2025 BIGTIME Price Prediction: Analysis of Growth Potential and Market Factors Influencing the Gaming Token's Future Value

Introduction: BIGTIME's Market Position and Investment Value

Big Time (BIGTIME), as a multiplayer online role-playing game token, has achieved significant milestones since its inception. As of 2025, BIGTIME's market capitalization has reached $88,714,312, with a circulating supply of approximately 1,908,245,059 tokens, and a price hovering around $0.04649. This asset, known as the "Web3 gaming pioneer," is playing an increasingly crucial role in the blockchain gaming industry.

This article will comprehensively analyze BIGTIME's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. BIGTIME Price History Review and Current Market Status

BIGTIME Historical Price Evolution

- 2023: ATH reached, price peaked at $500 on October 12

- 2025: Market downturn, price hit ATL of $0.04086 on March 11

BIGTIME Current Market Situation

As of September 26, 2025, BIGTIME is trading at $0.04649. The token has experienced significant volatility in the past year, with a 64.07% decrease in value. In the last 24 hours, BIGTIME has seen a 2.92% decline, while the 7-day and 30-day trends show losses of 15.5% and 13.51% respectively.

The current market capitalization of BIGTIME stands at $88,714,312.83, ranking it 472nd in the global cryptocurrency market. With a circulating supply of 1,908,245,059.79 BIGTIME tokens out of a total supply of 5,000,000,000, the circulating ratio is approximately 38.16%.

The 24-hour trading volume for BIGTIME is $387,121.31, indicating moderate market activity. The token's fully diluted valuation is $232,450,000, suggesting potential for growth if the entire supply were to be circulated.

Despite the recent downward trend, BIGTIME maintains a market dominance of 0.0058%, reflecting its niche position in the broader cryptocurrency ecosystem.

Click to view the current BIGTIME market price

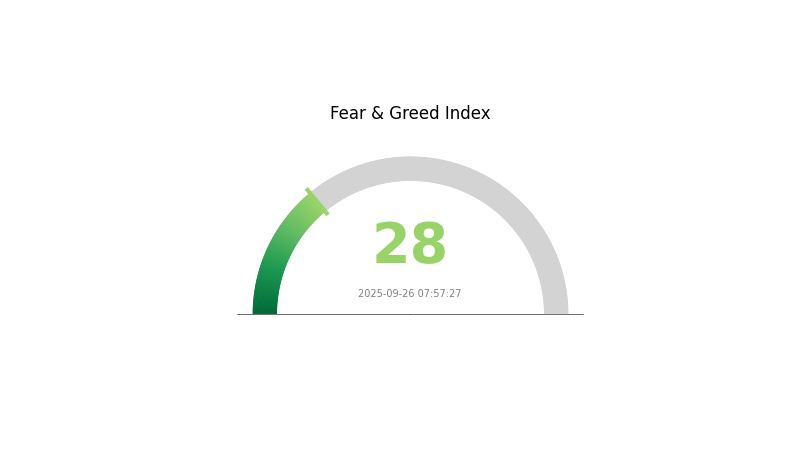

BIGTIME Market Sentiment Indicator

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index standing at 28. This suggests investors are cautious and uncertain about market conditions. During such periods, some traders view it as a potential buying opportunity, following the contrarian approach of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in this volatile market.

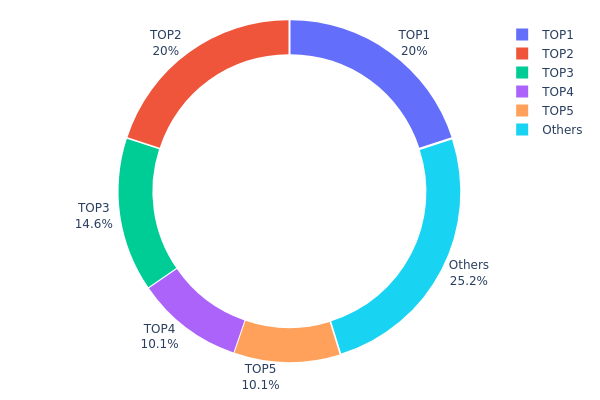

BIGTIME Holdings Distribution

The address holdings distribution chart provides a snapshot of BIGTIME token concentration among top holders. Analysis of this data reveals a highly concentrated ownership structure, with the top 5 addresses controlling 74.77% of the total supply. The leading address holds 20% of tokens, followed closely by the second with 19.98%, indicating potential centralization concerns.

This concentration level suggests a significant influence on market dynamics by a small number of large holders. Such a structure may lead to increased price volatility and susceptibility to market manipulation. The substantial holdings of top addresses could impact liquidity and create sudden price movements if large transactions occur.

Overall, the current distribution reflects a relatively centralized on-chain structure for BIGTIME. This concentration may pose challenges to market stability and decentralization efforts, potentially affecting investor confidence and long-term project sustainability.

Click to view the current BIGTIME Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0a1b...1f5030 | 1000000.05K | 20.00% |

| 2 | 0x533f...c2c098 | 999333.96K | 19.98% |

| 3 | 0x3691...b29967 | 730000.05K | 14.60% |

| 4 | 0x549a...5ac1f5 | 507395.85K | 10.14% |

| 5 | 0x4695...fd7d37 | 502887.11K | 10.05% |

| - | Others | 1260382.98K | 25.23% |

II. Key Factors Affecting BIGTIME's Future Price

Supply Mechanism

- NFT Price Threshold: The price threshold for Time Guardians and Hourglass NFTs controls the influx of new players.

- Asset Distribution Rate: Reducing the rate of asset distribution has a positive impact on token price.

Institutional and Whale Dynamics

- Corporate Adoption: BIGTIME has attracted attention from traditional game players and development studios due to its over 20-fold price increase and intense yield farming effects.

Technical Development and Ecosystem Building

- Game Economics Model: Changes in the core team, particularly the departure of the product director and game economics model design director, may have impacted game development and delivery.

- Ecosystem Applications: BIGTIME is a GameFi project, which influences its price dynamics and market positioning.

III. BIGTIME Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03678 - $0.04656

- Neutral prediction: $0.04656 - $0.05285

- Optimistic prediction: $0.05285 - $0.05913 (requires favorable market conditions)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.04175 - $0.0724

- 2027: $0.04947 - $0.06888

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.06979 - $0.07346 (assuming steady market growth)

- Optimistic scenario: $0.07346 - $0.08448 (assuming strong market performance)

- Transformative scenario: $0.08448+ (assuming exceptional project developments and market conditions)

- 2030-12-31: BIGTIME $0.08448 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05913 | 0.04656 | 0.03678 | 0 |

| 2026 | 0.0724 | 0.05285 | 0.04175 | 13 |

| 2027 | 0.06888 | 0.06262 | 0.04947 | 34 |

| 2028 | 0.06904 | 0.06575 | 0.03682 | 41 |

| 2029 | 0.07953 | 0.0674 | 0.04179 | 44 |

| 2030 | 0.08448 | 0.07346 | 0.06979 | 58 |

IV. BIGTIME Professional Investment Strategies and Risk Management

BIGTIME Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate BIGTIME tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predefined resistance levels

BIGTIME Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Options contracts: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. BIGTIME Potential Risks and Challenges

BIGTIME Market Risks

- High volatility: Gaming tokens can experience extreme price swings

- Competition: Increasing number of blockchain gaming projects

- User adoption: Uncertainty in long-term player retention

BIGTIME Regulatory Risks

- Unclear regulations: Potential for unfavorable regulatory changes

- Token classification: Risk of being classified as a security

- Cross-border restrictions: Possible limitations on global accessibility

BIGTIME Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Challenges in handling increased user load

- Interoperability: Difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

BIGTIME Investment Value Assessment

BIGTIME presents a high-risk, high-reward opportunity in the blockchain gaming sector. While it offers potential for significant growth, investors should be prepared for extreme volatility and regulatory uncertainties.

BIGTIME Investment Recommendations

✅ Beginners: Allocate a small portion (1-2%) of crypto portfolio, focus on learning ✅ Experienced investors: Consider a 5-10% allocation, actively manage positions ✅ Institutional investors: Explore strategic partnerships with the BIGTIME ecosystem

BIGTIME Trading Participation Methods

- Spot trading: Buy and hold BIGTIME tokens on Gate.com

- Staking: Participate in staking programs if available

- In-game purchases: Acquire BIGTIME tokens for use within the game ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is bigtime crypto price prediction?

BIGTIME price is expected to range between $0.40 and $0.55 by 2030, based on player engagement and game monetization. Current trends suggest moderate volatility.

Will BigTime go up?

Yes, BigTime is expected to go up. Predictions suggest it could reach $0.07332 in the near term and potentially climb to $0.1372 in the future.

Is BigTime worth?

Yes, BigTime shows potential with a net worth of $64,900 and 42 uploaded videos, indicating growing popularity and value in the Web3 space.

What meme coin will explode in 2025 price prediction?

BONK is expected to explode in price in 2025, driven by strong community support and viral trends. Other potential high performers include Dogwifhat and FARTCOIN, based on social media hype.

2025 GAME2Price Prediction: Analyzing Market Trends and Future Valuation Potential for the Gaming Token

2025 MAVIA Price Prediction: Future Growth Analysis and Potential ROI for Investors

2025 FORESTPrice Prediction: Analyzing Market Trends and Environmental Factors Shaping the Future of Sustainable Forestry

2025 WOD Price Prediction: Analyzing Market Trends and Expert Forecasts for World of Demons Tokens

2025 LOE Price Prediction: Navigating the Future of Cryptocurrency Investments

Is Ember Sword (EMBER) a good investment?: Analyzing the potential and risks of this blockchain-based MMORPG token

Khám Phá Cơ Hội Token hóa Tài Sản Thực Tế Trong Thế Giới Web3

Discover Exclusive Yacht-Inspired NFT Collectibles for Luxury Enthusiasts

Top Tools for Efficient Crypto Faucet Management

Understanding the Functionality of Wrapped Bitcoin

Top Bitcoin Mining Pools for Beginners Seeking Optimization