Dự báo giá BTRST năm 2025: Phân tích xu hướng thị trường và tiềm năng phát triển trong tương lai của token Braintrust

Giới thiệu: Vị thế thị trường và giá trị đầu tư của BTRST

Braintrust (BTRST) là token mạng lưới nhân sự phi tập trung, đã kết nối freelancer với tổ chức từ năm 2021. Đến năm 2025, vốn hóa thị trường BTRST đạt 40.474.023 USD, nguồn cung lưu hành khoảng 241.347.782 token, giá duy trì quanh 0,1677 USD. Được mệnh danh “LinkedIn phi tập trung”, BTRST ngày càng đóng vai trò thiết yếu trong nền kinh tế gig và quản trị nguồn nhân lực.

Bài viết này phân tích toàn diện xu hướng giá BTRST từ 2025 đến 2030, dựa trên dữ liệu lịch sử, cung-cầu thị trường, phát triển hệ sinh thái và yếu tố vĩ mô, nhằm đưa ra dự báo giá chuyên nghiệp cùng chiến lược đầu tư thực tế cho các nhà đầu tư.

I. Tổng quan lịch sử giá và tình hình thị trường hiện tại của BTRST

Diễn biến giá lịch sử BTRST

- 2021: Ra mắt, giá đạt đỉnh 46,82 USD ngày 16 tháng 9

- 2021: Điều chỉnh thị trường, giá xuống thấp nhất 0,16 USD ngày 19 tháng 10

- 2025: Chu kỳ thị trường tiếp diễn, giá dao động quanh các mức cao và thấp lịch sử

Tình hình thị trường hiện tại của BTRST

Đến 01 tháng 10 năm 2025, BTRST giao dịch ở 0,1677 USD. Token này tăng 0,96% trong 24 giờ qua, khối lượng giao dịch đạt 21.366,02 USD. Vốn hóa thị trường ở mức 40.474.023 USD, xếp hạng 779 toàn thị trường tiền mã hóa. Nguồn cung lưu hành là 241.347.782 BTRST, chiếm 96,54% tổng cung 250.000.000 token.

Tuần qua, BTRST giảm 9,36%, trong 30 ngày giảm 15,31%. Hiệu suất từ đầu năm giảm mạnh 55,82%, phản ánh xu hướng thị trường chung và các thách thức riêng của dự án.

Giá hiện tại thấp hơn rất nhiều so với đỉnh lịch sử 46,82 USD ngày 16 tháng 9 năm 2021, tức giảm 99,64% so với đỉnh. Đây là minh chứng cho tính biến động cao và rủi ro đặc thù của thị trường tiền mã hóa.

Bấm để xem giá thị trường BTRST hiện tại

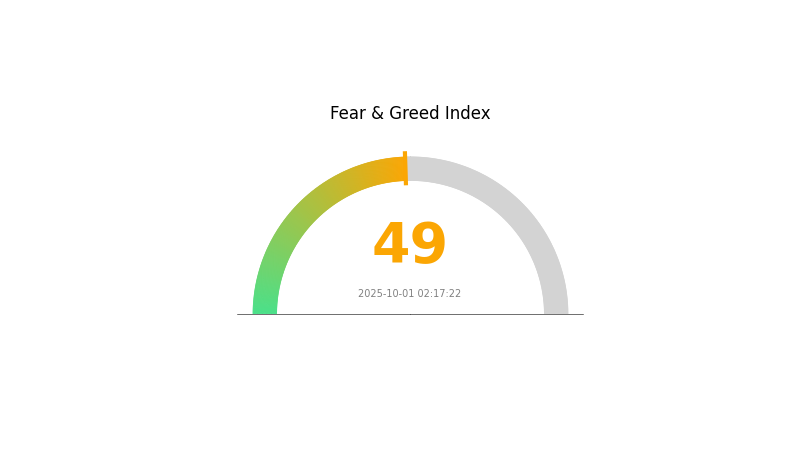

Chỉ số tâm lý thị trường BTRST

2025-10-01 Chỉ số Sợ hãi & Tham lam: 49 (Trung tính)

Bấm để xem Chỉ số Sợ hãi & Tham lam hiện tại

Tâm lý thị trường với BTRST đang cân bằng, chỉ số Sợ hãi & Tham lam ở mức 49, phản ánh vị thế trung tính. Nhà đầu tư không quá lo ngại cũng không quá kỳ vọng, duy trì quan điểm thận trọng lạc quan. Nhà giao dịch nên cảnh giác, đa dạng hóa danh mục để giảm thiểu rủi ro. Nghiên cứu kỹ lưỡng và thận trọng luôn cần thiết khi đầu tư tiền mã hóa.

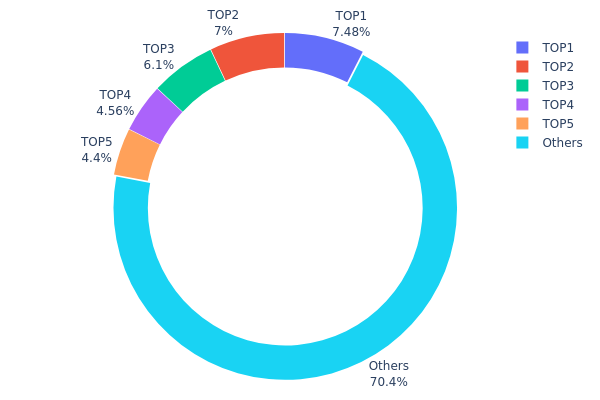

Phân bổ sở hữu BTRST

Dữ liệu phân bổ địa chỉ sở hữu BTRST thể hiện mức độ tập trung vừa phải ở top nhà đầu tư. 5 địa chỉ lớn nhất chiếm 29,53% nguồn cung, mỗi địa chỉ nắm giữ từ 4,40% đến 7,48%. Kết cấu này giúp cân bằng quyền sở hữu, không địa chỉ nào kiểm soát đa số token.

Tuy vậy, một số địa chỉ lớn vẫn có thể ảnh hưởng đến thị trường nếu thực hiện giao dịch lớn. Địa chỉ lớn nhất kiểm soát 7,48% có thể tác động đến giá. Tuy nhiên, 70,47% token phân bổ cho các địa chỉ khác giúp BTRST duy trì tính phi tập trung, góp phần ổn định thị trường và giảm nguy cơ thao túng giá.

Mô hình phân bổ này phản ánh cấu trúc thị trường đang trưởng thành, cân bằng giữa nhóm đầu tư lớn và nhà đầu tư nhỏ lẻ. Dù chưa loại trừ hoàn toàn ảnh hưởng của cá mập, hiện tại cấu trúc on-chain của BTRST đủ vững chắc để hỗ trợ ổn định dài hạn và xác lập giá tự nhiên.

Bấm để xem phân bổ sở hữu BTRST hiện tại

| Top | Địa chỉ | Số lượng nắm giữ | Tỷ lệ (%) |

|---|---|---|---|

| 1 | 0xb6f1...33990b | 18.712,45K | 7,48% |

| 2 | 0xe754...87600a | 17.499,99K | 6,99% |

| 3 | 0x0768...b88627 | 15.250,00K | 6,10% |

| 4 | 0xd20d...b0dd6e | 11.411,81K | 4,56% |

| 5 | 0x3154...0f2c35 | 11.010,79K | 4,40% |

| - | Khác | 176.114,97K | 70,47% |

II. Các yếu tố chính ảnh hưởng tới giá BTRST trong tương lai

Cơ chế cung ứng

- Dữ liệu lịch sử: Giá BTRST gần 30 USD vào tháng 9/2021, đến tháng 9/2022 giảm còn 2,40 USD.

Động lực tổ chức và cá mập

- Ứng dụng doanh nghiệp: Braintrust thu hút nhiều doanh nghiệp, token BTRST thúc đẩy tăng trưởng nền tảng.

Môi trường kinh tế vĩ mô

- Chống lạm phát: BTRST tách biệt với thị trường tiền mã hóa chung, có thể giảm biến động giá khi lạm phát tăng.

- Yếu tố địa chính trị: Nguy cơ suy thoái kinh tế có thể gây áp lực giảm giá lên BTRST.

Phát triển kỹ thuật và hệ sinh thái

- Ứng dụng hệ sinh thái: Braintrust là mạng lưới nhân sự phi tập trung, kết nối freelancer và doanh nghiệp qua nền tảng.

- Cơ chế nền tảng: Thanh toán giữa freelancer và doanh nghiệp bằng tiền pháp định, hạn chế biến động thu nhập do giá token. Nền tảng thu hoa hồng tiền mặt 10%, dùng BTRST thay cho chi phí thu hút khách hàng.

III. Dự báo giá BTRST giai đoạn 2025–2030

Triển vọng 2025

- Dự báo thận trọng: 0,10397 – 0,1677 USD

- Dự báo trung tính: 0,1677 – 0,20627 USD

- Dự báo lạc quan: 0,20627 – 0,24 USD (cần điều kiện thị trường thuận lợi và chấp nhận tăng)

Triển vọng 2027–2028

- Kỳ vọng giai đoạn thị trường: Tăng trưởng tiềm năng kèm biến động mạnh

- Dự báo biên độ giá:

- 2027: 0,1765 – 0,24483 USD

- 2028: 0,11083 – 0,24121 USD

- Yếu tố thúc đẩy: Tiến bộ công nghệ, mở rộng hợp tác ngành và khả năng phục hồi thị trường

Triển vọng dài hạn 2030

- Kịch bản cơ sở: 0,23832 – 0,2648 USD (giả định tăng trưởng và chấp nhận ổn định)

- Kịch bản lạc quan: 0,2648 – 0,37601 USD (giả định thị trường tăng mạnh và ứng dụng rộng)

- Kịch bản đột phá: 0,37601 – 0,45 USD (giả định đổi mới công nghệ và chấp nhận đại trà)

- 31 tháng 12 năm 2030: BTRST đạt 0,37601 USD (đỉnh tiềm năng theo dự báo lạc quan)

| Năm | Giá cao nhất dự báo | Giá trung bình dự báo | Giá thấp nhất dự báo | Tỷ lệ biến động |

|---|---|---|---|---|

| 2025 | 0,20627 | 0,1677 | 0,10397 | 0 |

| 2026 | 0,1926 | 0,18699 | 0,14585 | 11 |

| 2027 | 0,24483 | 0,18979 | 0,1765 | 13 |

| 2028 | 0,24121 | 0,21731 | 0,11083 | 29 |

| 2029 | 0,30033 | 0,22926 | 0,14673 | 36 |

| 2030 | 0,37601 | 0,2648 | 0,23832 | 57 |

IV. Chiến lược đầu tư chuyên nghiệp và quản trị rủi ro BTRST

Phương pháp đầu tư BTRST

(1) Chiến lược nắm giữ dài hạn

- Phù hợp cho: Nhà đầu tư chấp nhận rủi ro cao, tin vào mạng lưới nhân sự phi tập trung

- Khuyến nghị vận hành:

- Tích lũy BTRST khi thị trường giảm

- Nắm giữ tối thiểu 2–3 năm để vượt biến động

- Lưu trữ token bằng ví phần cứng bảo mật

(2) Chiến lược giao dịch chủ động

- Công cụ phân tích kỹ thuật:

- Trung bình động: Nhận diện xu hướng và điểm đảo chiều

- RSI: Đánh giá trạng thái quá mua/quá bán

- Lưu ý khi giao dịch xoay vòng:

- Theo dõi khối lượng giao dịch để nhận diện đột phá

- Đặt lệnh dừng lỗ để kiểm soát rủi ro giảm giá

Khung quản trị rủi ro BTRST

(1) Nguyên tắc phân bổ tài sản

- Nhà đầu tư thận trọng: 1–3% danh mục tiền mã hóa

- Nhà đầu tư tích cực: 5–8% danh mục tiền mã hóa

- Nhà đầu tư chuyên nghiệp: 10–15% danh mục tiền mã hóa

(2) Giải pháp phòng ngừa rủi ro

- Đa dạng hóa: Đầu tư vào nhiều loại tài sản mã hóa khác nhau

- Lệnh dừng lỗ: Giới hạn mức thua lỗ tiềm năng

(3) Giải pháp lưu trữ an toàn

- Khuyến nghị ví nóng: Gate Web3 wallet

- Lưu trữ lạnh: Ví phần cứng cho khoản nắm giữ dài hạn

- Bảo mật: Kích hoạt xác thực hai lớp, dùng mật khẩu mạnh

V. Rủi ro và thách thức tiềm ẩn với BTRST

Rủi ro thị trường BTRST

- Biến động lớn: Giá BTRST có thể dao động mạnh

- Thanh khoản thấp: Khối lượng giao dịch thấp dễ gây trượt giá

- Cạnh tranh: Nhiều nền tảng nhân sự phi tập trung mới có thể xuất hiện

Rủi ro pháp lý BTRST

- Môi trường pháp lý chưa rõ ràng: Quy định mới có thể ảnh hưởng đến công năng token

- Tuân thủ xuyên biên giới: Đáp ứng các quy định quốc tế phức tạp

- Ảnh hưởng thuế: Thay đổi về thuế có thể tác động đến nhà đầu tư BTRST

Rủi ro kỹ thuật BTRST

- Lỗ hổng hợp đồng thông minh: Có thể bị khai thác lỗ hổng mã nguồn

- Thách thức mở rộng: Tắc nghẽn mạng Ethereum ảnh hưởng giao dịch BTRST

- Phụ thuộc Ethereum: BTRST chịu tác động bởi nâng cấp và giới hạn kỹ thuật Ethereum

VI. Kết luận và khuyến nghị hành động

Đánh giá giá trị đầu tư BTRST

BTRST đem lại cơ hội tiếp cận thị trường mạng lưới nhân sự phi tập trung tăng trưởng, song phải đối mặt với biến động mạnh và thách thức về mức độ chấp nhận. Tiềm năng dài hạn phụ thuộc vào sự phát triển của Braintrust, còn rủi ro ngắn hạn vẫn ở mức cao.

Khuyến nghị đầu tư BTRST

✅ Người mới: Nên bắt đầu với vị thế nhỏ, hướng đến dài hạn

✅ Nhà đầu tư kinh nghiệm: Áp dụng chiến lược trung bình giá, kiểm soát rủi ro nghiêm ngặt

✅ Nhà đầu tư tổ chức: Thẩm định kỹ lưỡng, đa dạng hóa danh mục mã hóa

Phương thức tham gia BTRST

- Giao dịch giao ngay: Mua BTRST trên Gate.com

- Staking: Tham gia quản trị và nhận thưởng nếu có

- Tham gia mạng lưới: Sử dụng nền tảng Braintrust để trải nghiệm công dụng token

Đầu tư tiền mã hóa tiềm ẩn rủi ro rất cao, bài viết này không phải là khuyến nghị đầu tư. Nhà đầu tư cần cân nhắc kỹ theo khả năng chịu rủi ro cá nhân và nên tham khảo ý kiến chuyên gia tài chính. Không nên đầu tư vượt quá số tiền có thể mất.

FAQ

1 BTRST giá bao nhiêu?

Đến 01 tháng 10 năm 2025, 1 BTRST có giá 0,1939 USD. Mức giá này biến động theo thị trường.

BTRST coin là gì?

BTRST là token Ethereum của Braintrust, mạng lưới nhân sự phi tập trung. Token này vận hành nền tảng, kết nối freelancer và tổ chức.

Dự báo giá cổ phiếu BT năm 2030 là bao nhiêu?

Theo phân tích thị trường, cổ phiếu BT Group dự báo đạt giá trung bình 6,5658 USD năm 2030, mức cao tiềm năng 7,963 USD.

Tiền mã hóa nào có dự báo giá cao nhất?

Bitcoin dự báo dẫn đầu về giá năm 2025, tiếp theo là Ethereum. Hai đồng này dự kiến tiếp tục giữ vị thế dẫn đầu và tăng trưởng giá trị trên thị trường.

Khám Phá AICell: Logic White Paper & Các Trường Hợp Sử Dụng Cách Mạng

Dự báo giá AKT năm 2025: Đánh giá triển vọng tương lai của token Akash Network trong bối cảnh hệ sinh thái Web3 ngày càng hoàn thiện

GEOD là gì: Khám phá Cơ sở Dữ liệu Quan sát Môi trường Toàn cầu và ảnh hưởng của hệ thống này đối với nghiên cứu khí hậu

SAPIEN là gì: Hướng dẫn đầy đủ về môi trường mô phỏng vật lý phục vụ nghiên cứu robot

Nhà sáng lập Polymarket đùa về Token $POLY

OpenMind: Xây dựng Hệ điều hành Phi tập trung cho Robot, AI và Kinh tế Máy móc

Hướng dẫn cách tham gia và nhận thưởng từ SEI Airdrop

Chiến lược hiệu quả dành cho giao dịch thuật toán trong thị trường tiền mã hóa

Phân tích Định giá Bitcoin qua Mô hình Stock-to-Flow

Tìm hiểu tốc độ giao dịch tác động như thế nào đến hiệu suất của blockchain

Giải pháp quản lý danh tính Web3 bằng tên miền ENS