Prediksi Harga CFX 2025: Analisis Potensi Pertumbuhan dan Faktor-Faktor Pasar untuk Token Conflux Network

Pendahuluan: Posisi Pasar dan Nilai Investasi CFX

Conflux (CFX) merupakan jaringan blockchain terdesentralisasi yang mampu diskalakan dan telah meraih pencapaian signifikan sejak pertama kali diperkenalkan pada 2019. Hingga 2025, kapitalisasi pasar Conflux berada di angka USD 907.622.956, dengan jumlah token beredar sekitar 5.135.937.959 dan harga terbaru berkisar USD 0,17672. Dijuluki sebagai “high-throughput blockchain”, aset ini kini memegang peran sangat penting dalam pengembangan ekosistem dan aplikasi terdesentralisasi.

Artikel ini membahas secara komprehensif tren harga Conflux pada periode 2025–2030, dengan mengintegrasikan data historis, dinamika penawaran dan permintaan pasar, perkembangan ekosistem, serta analisis makroekonomi. Tujuannya adalah memberikan prediksi harga profesional dan strategi investasi yang dapat diterapkan oleh investor.

I. Tinjauan Sejarah Harga CFX dan Kondisi Pasar Terkini

Evolusi Harga Historis CFX

- 2020: CFX diluncurkan dengan harga awal sekitar USD 0,12

- 2021: bull market, CFX mencatatkan harga tertinggi sepanjang masa di USD 1,70 (27 Maret)

- 2022: bear market, harga jatuh ke titik terendah sepanjang masa di USD 0,022 (30 Desember)

Kondisi Pasar CFX Saat Ini

Per 16 September 2025, CFX diperdagangkan pada harga USD 0,17672 dan berada di peringkat 115 menurut kapitalisasi pasar. Volume perdagangan 24 jamnya sebesar USD 8.450.225,89. Dalam 24 jam terakhir, harga CFX turun tipis 1,59% dengan rentang harga USD 0,17219 hingga USD 0,18393. Sepanjang satu tahun terakhir, harga naik 31,48%, meski dalam 30 hari terakhir terdapat penurunan sebesar 1,48%. Kapitalisasi pasar saat ini USD 907.622.956,27, jumlah token beredar 5.135.937.959,86 CFX, serta fully diluted market cap mencapai USD 1.008.875.589,13.

Klik untuk melihat harga pasar CFX terkini

Indikator Sentimen Pasar CFX

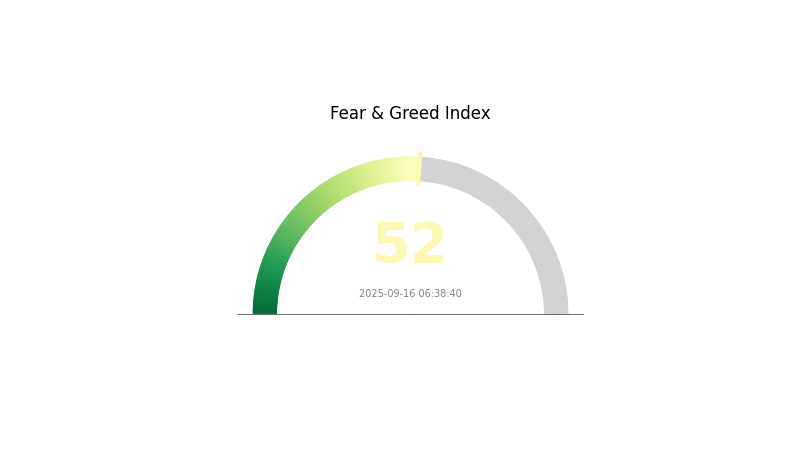

Indeks Fear and Greed 16 September 2025: 52 (Netral)

Klik untuk melihat Indeks Fear & Greed terkini

Sentimen pasar kripto saat ini berada di posisi netral, dengan Indeks Fear and Greed di angka 52. Hal ini menandakan bahwa pelaku pasar tidak berada dalam kondisi pesimis atau optimis berlebihan. Meski tetap perlu berhati-hati, sentimen netral bisa membuka peluang baik bagi pembeli maupun penjual. Selalu lakukan analisis dan pertimbangkan risiko sebelum berinvestasi di pasar kripto yang volatil.

Distribusi Kepemilikan CFX

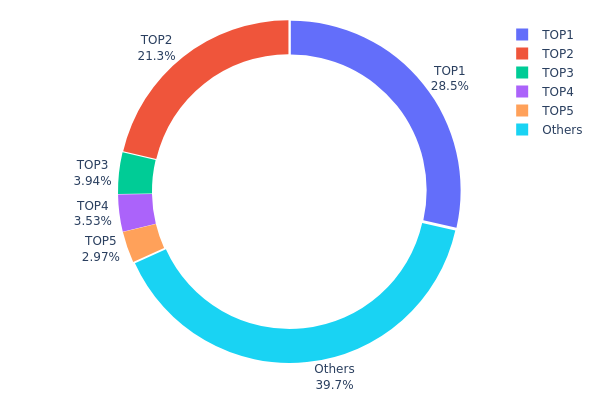

Distribusi kepemilikan alamat CFX menunjukkan konsentrasi tinggi token di beberapa alamat utama. Alamat teratas memegang 28,52% suplai, sedangkan alamat kedua menguasai 21,31%. Secara total, lima alamat teratas mengendalikan sekitar 60,26% suplai CFX, yang mengindikasikan tingkat sentralisasi cukup tinggi.

Konsentrasi tinggi ini berpotensi menimbulkan risiko manipulasi harga dan volatilitas pasar. Jika salah satu pemegang utama melakukan aksi jual besar-besaran, dampaknya terhadap harga dan likuiditas CFX bisa signifikan. Selain itu, sentralisasi kepemilikan dapat mengurangi klaim desentralisasi proyek serta berpengaruh terhadap tata kelola jika berbasis token holding.

Namun, suplai sebesar 39,74% tetap didistribusikan ke alamat lain, memberi peluang partisipasi pasar lebih merata. Walau belum ideal untuk ekosistem yang sepenuhnya terdesentralisasi, komposisi ini tetap menjadi penyeimbang dan mengurangi risiko dari konsentrasi ekstrem.

Klik untuk melihat distribusi kepemilikan CFX terkini

| Top | Alamat | Jumlah (x1.000) | Kepemilikan (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 307.343,85 | 28,52% |

| 2 | 0x5a52...70efcb | 229.617,08 | 21,31% |

| 3 | 0xc9c2...3cea06 | 42.500,00 | 3,94% |

| 4 | 0xa371...fa3879 | 38.087,11 | 3,53% |

| 5 | 0xc882...84f071 | 31.990,89 | 2,96% |

| - | Lainnya | 427.900,99 | 39,74% |

2. Faktor Kunci yang Mempengaruhi Harga CFX di Masa Depan

Mekanisme Suplai

- Mining dan Distribusi: Token CFX diperoleh melalui mekanisme Proof-of-Work dengan tingkat penerbitan yang menurun secara bertahap.

- Pola Historis: Perubahan suplai sebelumnya terbukti memengaruhi harga, khususnya pada peristiwa halving.

- Dampak Terkini: Dinamika suplai saat ini diprediksi akan menjaga tekanan inflasi harga CFX tetap seimbang.

Aktivitas Institusi dan Whale

- Kepemilikan Institusional: Minat perusahaan investasi blockchain besar terhadap CFX menunjukkan potensi adopsi institusi yang berkembang.

- Adopsi Korporasi: Conflux Network bermitra dengan China Telecom untuk pengembangan SIM card blockchain, membuktikan aplikasi nyata teknologi.

- Kebijakan Nasional: Dukungan pemerintah Tiongkok terhadap teknologi blockchain, terutama Conflux sebagai public chain sesuai regulasi, sangat berpengaruh pada potensi CFX.

Lingkungan Makroekonomi

- Dampak Kebijakan Moneter: Kebijakan bank sentral global, terutama dari negara besar, terus mempengaruhi sentimen pasar kripto dan harga CFX.

- Potensi Lindung Nilai Inflasi: CFX mulai menunjukkan fungsi sebagai hedge inflasi, meski belum setara dengan kripto utama.

- Faktor Geopolitik: Isu hubungan internasional dan kebijakan regulasi di pasar utama, seperti Tiongkok dan AS, mempengaruhi adopsi serta nilai global CFX.

Pengembangan Teknologi dan Ekosistem

- Tree-Graph Consensus: Sistem konsensus unik Conflux memungkinkan throughput tinggi dan skalabilitas, yang dapat meningkatkan adopsi dan nilai aset.

- Kompatibilitas EVM: Dukungan terhadap Ethereum Virtual Machine menarik minat pengembang dan memperluas ekosistem proyek.

- Ekosistem DApp: Pertumbuhan jumlah aplikasi terdesentralisasi di jaringan Conflux turut meningkatkan utilitas dan permintaan CFX.

III. Prediksi Harga CFX 2025–2030

Outlook 2025

- Perkiraan konservatif: USD 0,14583 – 0,17570

- Perkiraan netral: USD 0,17570 – 0,19854

- Perkiraan optimistis: USD 0,19854 – 0,22138 (dengan syarat kondisi pasar mendukung)

Outlook 2027–2028

- Fase pasar: Potensi fase pertumbuhan

- Perkiraan rentang harga:

- 2027: USD 0,1888 – 0,33347

- 2028: USD 0,21989 – 0,30091

- Pemicu utama: Peningkatan adopsi, kemajuan teknologi, sentimen pasar

Outlook Jangka Panjang 2029–2030

- Skenario dasar: USD 0,29512 – 0,34529 (asumsi pertumbuhan pasar stabil)

- Skenario optimistis: USD 0,34529 – 0,50758 (asumsi performa pasar kuat)

- Skenario transformasi: USD 0,50758 – 0,60000 (asumsi adopsi meluas dan kondisi pasar sangat positif)

- 31 Desember 2030: CFX USD 0,34529 (kenaikan 95% dari tahun 2025)

| Tahun | Prediksi Harga Tertinggi (USD) | Prediksi Harga Rata-rata (USD) | Prediksi Harga Terendah (USD) | Kenaikan (%) |

|---|---|---|---|---|

| 2025 | 0,22138 | 0,1757 | 0,14583 | 0 |

| 2026 | 0,29186 | 0,19854 | 0,10721 | 12 |

| 2027 | 0,33347 | 0,2452 | 0,1888 | 38 |

| 2028 | 0,30091 | 0,28933 | 0,21989 | 63 |

| 2029 | 0,39546 | 0,29512 | 0,17412 | 66 |

| 2030 | 0,50758 | 0,34529 | 0,27278 | 95 |

IV. Strategi Investasi Profesional & Manajemen Risiko CFX

Metodologi Investasi CFX

(1) Strategi Kepemilikan Jangka Panjang

- Cocok untuk: Investor jangka panjang dengan toleransi risiko tinggi

- Saran operasional:

- Akumulasi CFX saat harga turun

- Tetapkan target harga untuk ambil sebagian profit

- Simpan di dompet perangkat keras atau kustodian terpercaya

(2) Strategi Trading Aktif

- Alat analisis teknikal:

- Moving Average: identifikasi tren dan titik pembalikan potensial

- RSI (Relative Strength Index): pantau kondisi overbought/oversold

- Poin penting swing trading:

- Pantau korelasi harga CFX dengan aset kripto utama

- Cermati pembaruan jaringan dan kemitraan strategis

Kerangka Manajemen Risiko CFX

(1) Prinsip Alokasi Aset

- Investor konservatif: 1–3% dari portofolio aset kripto

- Investor agresif: 5–10% dari portofolio kripto

- Investor profesional: maksimal 15% dari portofolio kripto

(2) Solusi Hedging Risiko

- Diversifikasi: investasi di berbagai proyek blockchain

- Stop-loss: tetapkan titik keluar untuk membatasi kerugian

(3) Solusi Penyimpanan Aman

- Hot wallet yang direkomendasikan: Gate Web3 Wallet

- Solusi penyimpanan dingin: dompet perangkat keras untuk holding jangka panjang

- Keamanan: aktifkan autentikasi dua faktor dan gunakan kata sandi kuat

V. Risiko & Tantangan Potensial CFX

Risiko Pasar CFX

- Volatilitas tinggi: pergerakan harga CFX sangat fluktuatif

- Persaingan: proyek blockchain lain yang skalabel bisa mengambil pangsa pasar

- Sentimen: informasi negatif berpengaruh pada nilai CFX

Risiko Regulasi CFX

- Ketidakpastian regulasi: perubahan aturan kripto dapat memengaruhi CFX

- Kendala kepatuhan: tantangan dalam memenuhi persyaratan regulasi baru

- Pembatasan lintas-negara: regulasi internasional bisa membatasi adopsi CFX

Risiko Teknis CFX

- Keamanan jaringan: potensi celah pada jaringan Conflux

- Kendala skalabilitas: isu teknis tak terduga dalam mempertahankan throughput tinggi

- Risiko smart contract: bug atau eksploitasi pada dApp berbasis Conflux

VI. Kesimpulan & Rekomendasi Tindakan

Penilaian Nilai Investasi CFX

Conflux (CFX) memiliki prospek nilai jangka panjang yang menarik berkat teknologi blockchain high-throughput. Namun, risiko jangka pendek seperti volatilitas pasar dan ketidakpastian regulasi tetap perlu diperhatikan.

Rekomendasi Investasi CFX

✅ Pemula: Mulai dari posisi kecil dan prioritaskan pembelajaran teknologi Conflux

✅ Investor berpengalaman: Terapkan strategi seimbang antara holding jangka panjang dan trading aktif

✅ Investor institusional: Lakukan due diligence mendalam dan jadikan CFX bagian dari portofolio kripto terdiversifikasi

Metode Partisipasi Perdagangan CFX

- Spot trading: jual beli CFX di pasar spot Gate.com

- Staking: ikut program staking CFX untuk pendapatan pasif

- DeFi: eksplorasi aplikasi keuangan terdesentralisasi di jaringan Conflux

Investasi aset kripto memiliki risiko sangat tinggi. Artikel ini bukan merupakan nasihat investasi. Investor wajib mengambil keputusan dengan hati-hati sesuai toleransi risiko pribadi serta disarankan berkonsultasi dengan penasihat keuangan profesional. Disarankan untuk tidak berinvestasi melebihi kemampuan finansial masing-masing investor.

FAQ

Bagaimana prospek CFX ke depan?

CFX diperkirakan mencapai USD 0,1820 pada 2025, dengan rata-rata harga USD 0,1518. Kenaikan harga selanjutnya diproyeksikan terjadi di 2026, menunjukkan potensi pertumbuhan.

Berapa proyeksi harga CFX coin pada 2050?

Berdasarkan estimasi saat ini, harga CFX coin pada 2050 diperkirakan mencapai USD 0,606855.

Berapa harga tertinggi CFX sepanjang masa?

CFX pernah mencapai harga tertinggi USD 1,70 sebelum September 2025.

Apa alasan lonjakan harga CFX coin?

Lonjakan harga CFX didorong oleh regulasi yang mendukung, teknologi canggih, serta dukungan politik yang kuat, sehingga menarik minat investor dan meningkatkan keyakinan pasar.

Prediksi Harga GRT 2025: Analisis Trajektori Nilai Masa Depan dan Potensi Pasar Graph Protocol

Prediksi Harga XLM 2025: Potensi Lonjakan Stellar di Lanskap Kripto yang Terus Berkembang

Prediksi Harga SLC 2025: Analisis Tren Pasar dan Faktor Pertumbuhan Potensial

Prediksi Harga TLOS 2025: Analisis Pasar dan Potensi Pertumbuhan Telos Blockchain

Prediksi Harga SYS 2025: Analisis Tren Pasar, Faktor Teknis, serta Potensi Adopsi Institusional

Prediksi Harga REI 2025: Analisis Pasar dan Proyeksi Pertumbuhan untuk Ekonomi Token Real Estat

Panduan Pemula untuk Memahami White Paper Cryptocurrency

Menelusuri Model Stock-to-Flow Bitcoin: Panduan Penilaian yang Mendalam

Memahami Model Stock-to-Flow Bitcoin

Menguasai Perpetual Swaps: Panduan Trader

Menelusuri Linea Network: Panduan Utama bagi Anda mengenai Inovasi Layer 2 di Ethereum