Predicción del precio de CRV en 2025: análisis de tendencias del mercado, métricas de adopción y factores principales que determinan la valoración de Curve DAO Token

Introducción: Posición de mercado y valor de inversión de CRV

Curve (CRV), como protocolo de exchange descentralizado especializado en el intercambio eficiente de stablecoins, ha logrado hitos destacados desde su lanzamiento en 2020. En 2025, la capitalización de mercado de Curve alcanza los 1 030 millones de dólares, con una oferta circulante aproximada de 1 400 millones de tokens y un precio en torno a los 0,7356 dólares. Este activo, conocido como la “potencia del trading de stablecoins”, tiene un papel cada vez más relevante dentro del ecosistema de finanzas descentralizadas (DeFi).

En este artículo encontrarás un análisis exhaustivo sobre la evolución del precio de Curve desde 2025 hasta 2030, considerando patrones históricos, la interacción entre oferta y demanda, el desarrollo del ecosistema y factores macroeconómicos, con el objetivo de ofrecerte predicciones profesionales de precios y estrategias prácticas de inversión.

I. Revisión de la evolución del precio de CRV y situación actual del mercado

Trayectoria histórica del precio de CRV

- 2020: Curve debuta en enero y alcanza su máximo histórico (ATH) de 15,37 dólares el 14 de agosto

- 2021: Ciclo alcista, con una volatilidad pronunciada en el precio de CRV

- 2022-2023: Criptoinvierno, el precio cae de los máximos a los mínimos

- 2024: El 5 de agosto, el precio marca su mínimo histórico (ATL) en 0,180354 dólares

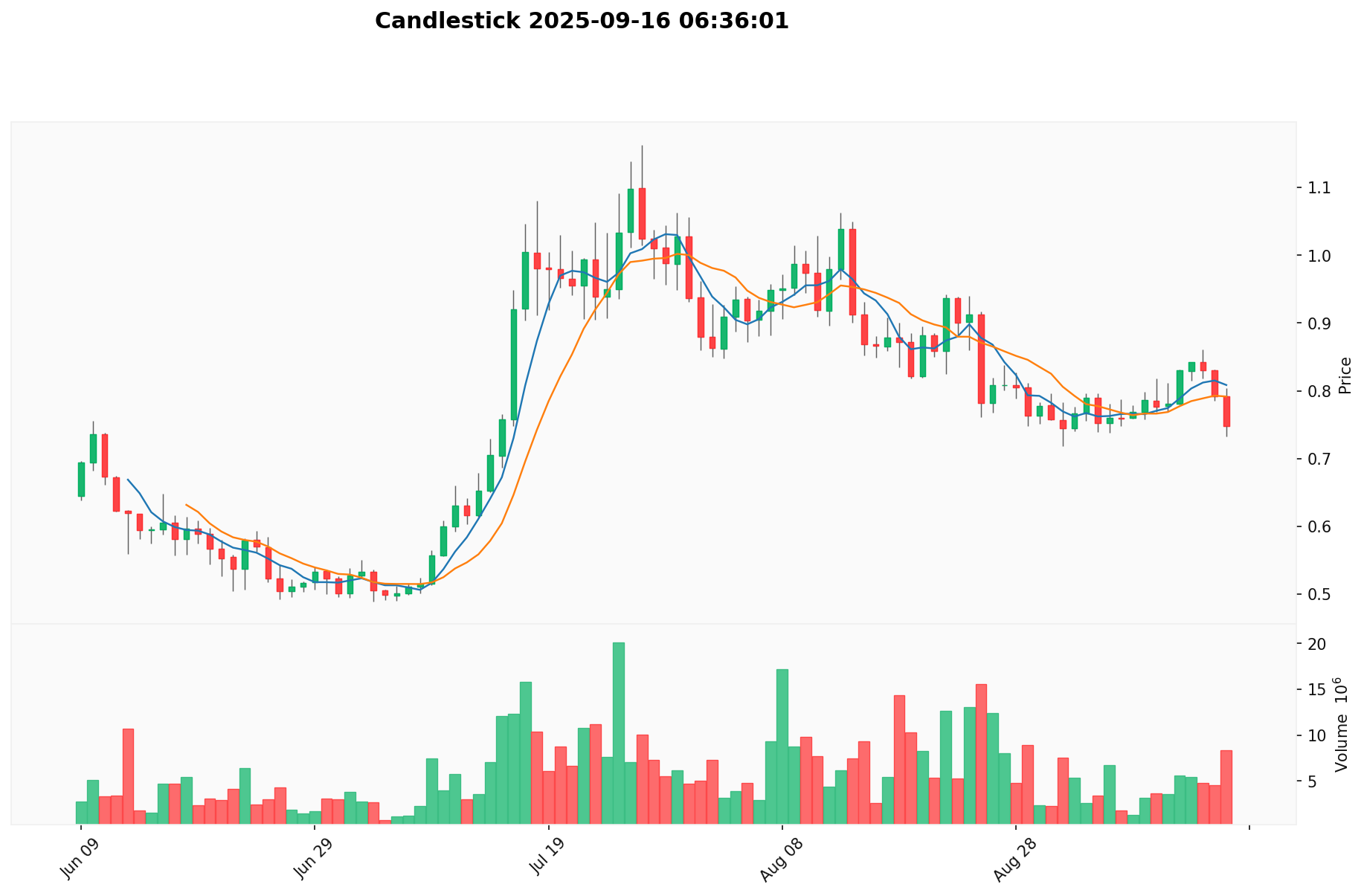

Situación actual de mercado de CRV

Al 16 de septiembre de 2025, CRV cotiza a 0,7356 dólares, con un volumen de negociación en 24 horas de 5 877 317 dólares. En las últimas 24 horas, el token ha experimentado una bajada del 7,82 %. Su capitalización de mercado es de 1 031 240 959 dólares, situándose en la posición 110 en el ranking global de criptomonedas. El suministro en circulación es de 1 401 904 512 CRV, con un suministro total de 2 304 788 327 y un máximo de 3 030 303 031 tokens.

CRV cotiza actualmente un 95,21 % por debajo de su máximo histórico de 15,37 dólares, pero ha subido un 307,87 % desde su mínimo histórico de 0,180354 dólares. Durante el último año ha registrado un fuerte rendimiento, con un aumento del 176,36 %, aunque ha experimentado tendencias bajistas a corto plazo: -14,87 % en los últimos 30 días y -7,39 % la última semana.

Consulta el precio de mercado actual de CRV

Indicador de sentimiento de mercado CRV

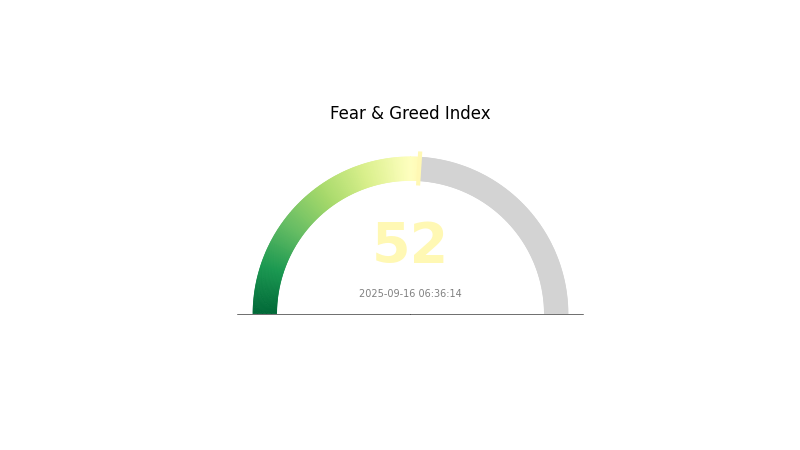

16-09-2025 Índice de Miedo y Avaricia: 52 (Neutral)

Consulta el Índice de Miedo y Avaricia actual

El sentimiento del mercado cripto permanece equilibrado, con el Índice de Miedo y Avaricia estable en 52, lo que refleja una actitud neutral. Esto indica que los inversores muestran un optimismo prudente, sin caer en el exceso de miedo ni de codicia. Si bien el mercado se mantiene sereno, conviene estar atentos ante posibles cambios de sentimiento. Como siempre, la investigación minuciosa y la gestión del riesgo son esenciales en el entorno cripto.

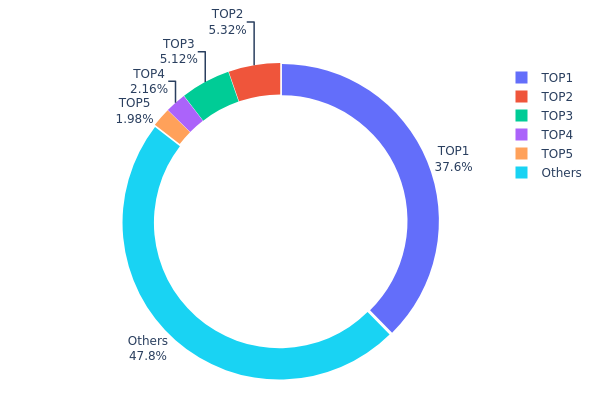

Distribución de tenencias de CRV

La distribución de tenencias de CRV refleja una fuerte concentración de tokens en pocas direcciones principales. La mayor dirección controla el 37,61 % de la oferta total, y el conjunto de las cinco primeras retiene el 52,15 % de todos los tokens CRV. Esta concentración genera inquietudes sobre posibles manipulaciones de mercado y riesgos de centralización.

Una distribución tan centralizada puede aumentar la volatilidad de precios y hacer el token susceptible a caídas bruscas en caso de ventas masivas por parte de los grandes tenedores. Además, esta estructura puede condicionar las decisiones de gobernanza dentro del ecosistema Curve, ya que quienes más tokens poseen podrían influir de manera desproporcionada en las actualizaciones y cambios del protocolo.

No obstante, es relevante señalar que el 47,85 % de los CRV están en manos de direcciones ajenas al top 5, lo que introduce un cierto grado de dispersión entre tenedores minoritarios. Esta parcial diversificación aporta algo de estabilidad y descentralización, aunque sigue limitada por la fuerte concentración en la parte alta.

Consulta la distribución de tenencias actual de CRV

| Top | Dirección | Cantidad en tenencia | Tenencia (%) |

|---|---|---|---|

| 1 | 0x5f3b...94e2a2 | 866 979,80K | 37,61 % |

| 2 | 0xf977...41acec | 122 609,42K | 5,31 % |

| 3 | 0x5a52...70efcb | 118 000,00K | 5,11 % |

| 4 | 0x8fa1...984d4a | 49 678,43K | 2,15 % |

| 5 | 0xc06f...0b3370 | 45 626,78K | 1,97 % |

| - | Otros | 1 101 858,07K | 47,85 % |

II. Factores clave que influyen en el futuro precio de CRV

Mecanismo de suministro

- Cronograma de emisión: CRV tiene un suministro máximo de 3 030 303 030,299 tokens y una oferta circulante actual de 1 389 745 746,69 tokens.

- Patrones históricos: La liberación gradual de tokens históricamente ha influido en el precio a medida que aumenta la oferta disponible.

- Impacto actual: Con cerca del 45,86 % del suministro máximo en circulación, las emisiones futuras pueden mantener la presión bajista sobre el precio.

Dinámica institucional y de grandes tenedores

- Tenencia institucional: Framework Ventures y Alameda Research figuran entre los principales inversores en CRV.

- Adopción empresarial: La plataforma Curve Finance es ampliamente utilizada en el universo DeFi, lo que impacta indirectamente en la demanda de CRV.

Entorno macroeconómico

- Capacidad de cobertura contra inflación: Como token DeFi, CRV puede considerarse un posible refugio frente a la inflación, en línea con otras criptomonedas.

Desarrollo tecnológico y consolidación del ecosistema

- Actualizaciones de la plataforma: Las mejoras continuas en Curve Finance pueden influir positivamente en el valor del token CRV.

- Aplicaciones en el ecosistema: Curve Finance es referencia en DeFi, especialmente en el intercambio de stablecoins y la provisión de liquidez.

III. Predicción de precio de CRV para 2025-2030

Pronóstico para 2025

- Estimación conservadora: 0,57631 - 0,65 dólares

- Estimación neutral: 0,65 - 0,75 dólares

- Estimación optimista: 0,75 - 0,80975 dólares (requiere condiciones de mercado favorables y una adopción DeFi más amplia)

Pronóstico para 2027-2028

- Fase de mercado prevista: posible ciclo de crecimiento con volatilidad acrecentada

- Rangos de precios estimados:

- 2027: 0,73422 - 0,87291 dólares

- 2028: 0,72614 - 1,19898 dólares

- Impulsores clave: expansión del ecosistema DeFi, escalabilidad mejorada y aumento de la adopción institucional

Perspectiva a largo plazo para 2030

- Escenario base: 0,90 - 1,20 dólares (suponiendo un crecimiento estable de DeFi y criptomercados)

- Escenario optimista: 1,20 - 1,50 dólares (con integración DeFi acelerada y clima regulatorio favorable)

- Escenario transformador: 1,50 - 1,68212 dólares (con innovaciones disruptivas en DeFi y adopción masiva)

- 31 de diciembre de 2030: CRV 1,12894 dólares (posible precio medio según proyecciones actuales)

| Año | Precio máximo estimado | Precio medio estimado | Precio mínimo estimado | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,80975 | 0,7295 | 0,57631 | 0 |

| 2026 | 0,86198 | 0,76962 | 0,67727 | 4 |

| 2027 | 0,87291 | 0,8158 | 0,73422 | 10 |

| 2028 | 1,19898 | 0,84435 | 0,72614 | 14 |

| 2029 | 1,23622 | 1,02167 | 0,56192 | 38 |

| 2030 | 1,68212 | 1,12894 | 0,67737 | 53 |

IV. Estrategias profesionales de inversión en CRV y gestión de riesgos

Metodologías de inversión en CRV

(1) Estrategia de tenencia a largo plazo

- Perfil: Inversores a largo plazo y entusiastas DeFi

- Sugerencias de operación:

- Acumula tokens CRV durante caídas del mercado

- Participa en la gobernanza de Curve para obtener recompensas adicionales

- Guarda los tokens en billeteras no custodias y con altos estándares de seguridad

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: Identifica tendencias y posibles puntos de giro

- RSI (Índice de Fuerza Relativa): Controla zonas de sobrecompra y sobreventa

- Aspectos clave para trading tipo swing:

- Sigue el TVL de Curve y las tendencias de volumen de negociación

- Mantente al día sobre actualizaciones del protocolo y nuevas alianzas

Marco de gestión de riesgos de CRV

(1) Principios de asignación de activos

- Inversor conservador: 1-3 % de su cartera en criptoactivos

- Inversor agresivo: 5-10 % de cartera cripto

- Inversor profesional: 10-15 % de cartera cripto

(2) Soluciones de cobertura de riesgos

- Diversificación: Reparte las inversiones entre distintos protocolos DeFi

- Estrategias con opciones: Utiliza opciones CRV para protegerte ante eventuales caídas

(3) Opciones seguras de almacenamiento

- Billetera caliente recomendada: Gate Web3 wallet

- Almacenamiento en frío: utiliza hardware wallets para tenencias a largo plazo

- Recomendaciones de seguridad: Activa 2FA, usa contraseñas robustas y realiza una copia de seguridad de tus claves privadas

V. Riesgos y desafíos potenciales para CRV

Riesgos de mercado de CRV

- Volatilidad: El precio de CRV puede registrar oscilaciones muy acusadas

- Competencia: Los nuevos DEX pueden desafiar la cuota de mercado de Curve

- Riesgo de liquidez: Retiradas bruscas de liquidez pueden impactar negativamente en el precio

Riesgos regulatorios de CRV

- Regulación incierta: Los protocolos DeFi pueden ser objeto de un control más exhaustivo

- Requerimientos de cumplimiento: Posible aplicación de KYC/AML

- Implicaciones fiscales: Normativa tributaria para DeFi en evolución

Riesgos técnicos de CRV

- Vulnerabilidades en smart contracts: Existen riesgos de exploits o ataques

- Problemas de escalabilidad: La congestión en Ethereum puede afectar a Curve

- Fallos en oráculos: Fuentes de precios inexactas pueden alterar la operativa del protocolo

VI. Conclusión y recomendaciones de acción

Valoración de la inversión en CRV

CRV presenta una propuesta de valor sólida a largo plazo como protocolo líder en DeFi, pero enfrenta riesgos a corto plazo derivados de la volatilidad de mercado y la incertidumbre regulatoria.

Recomendaciones de inversión en CRV

✅ Si te estás iniciando: Empieza por posiciones pequeñas y céntrate en comprender el funcionamiento de Curve

✅ Si ya tienes experiencia invirtiendo: Plantéate una participación activa en la gobernanza de Curve

✅ Si eres inversor institucional: Explora estrategias de yield farming y provisión de liquidez

Modalidades de participación en CRV

- Mantener tokens: Compra y mantén CRV para una potencial revalorización

- Aportar liquidez: Aporta liquidez a los pools de Curve y obtén comisiones y recompensas

- Participar en el staking de CRV: Haz staking de CRV para votar en propuestas clave del protocolo

Las inversiones en criptomonedas suponen riesgos extremadamente elevados. Este artículo no constituye una recomendación de inversión. Cada inversor debe tomar decisiones con cautela y siempre en función de su perfil de riesgo. Es recomendable consultar con un asesor financiero profesional. Nunca inviertas más de lo que puedas permitirte perder.

FAQ

¿Llegará CRV a 1 dólar?

Analistas prevén que CRV alcance 1 dólar en 2025 e incluso supere ese valor, con estimaciones que sitúan su máximo potencial en 1,20 dólares.

¿Es interesante invertir en CRV?

El atractivo de CRV depende de la evolución del mercado. Las previsiones actuales son inciertas, pero puede resultar interesante si los indicadores técnicos mejoran. Consulta siempre los datos más recientes antes de invertir.

¿Es CRV un buen token?

CRV es un token destacado en DeFi, con elevado potencial de crecimiento. Desempeña una función clave en los pools de liquidez y presenta buenas perspectivas a largo plazo.

¿Se recuperará CRV?

CRV podría recuperarse, aunque no hay certeza. Los datos de mercado y los registros on-chain apuntan a una posible recuperación, pero el plazo es incierto.

Predicción del precio de CRV en 2025: análisis de las tendencias del mercado y el potencial futuro de Curve DAO Token

Predicción del precio de LUNA en 2025: análisis de las tendencias del mercado y del potencial de crecimiento en la etapa posterior a la recuperación

¿Qué es WNXM: Comprende el token Wrapped Nexus Mutual y su función en el seguro DeFi?

¿Qué es TRWA: El algoritmo revolucionario de gestión de personal que está transformando las operaciones empresariales modernas?

Predicción del precio de RESOLV para 2025: análisis de las tendencias del mercado y del potencial de valoración futura

ENA vs CRO: análisis comparativo de dos repositorios líderes de datos genómicos

Guía para participar y reclamar recompensas del airdrop de SEI

Estrategias efectivas para el trading algorítmico en criptomonedas

Comprender la valoración de Bitcoin con el modelo Stock-to-Flow

Comprender cómo la velocidad de las transacciones influye en la eficiencia de la blockchain

Gestión de identidad Web3 con dominios ENS