Previsão de Preço da INJ em 2025: Análise Completa das Tendências de Mercado e das Perspectivas de Crescimento do Injective Protocol

Introdução: Posição de Mercado e Valor de Investimento do INJ

Injective (INJ) é uma blockchain Layer 1 ultrarrápida e interoperável, projetada para aplicações financeiras Web3 de alto nível, e tem apresentado avanços expressivos desde seu lançamento em 2020. Em 2025, o INJ alcançou um valor de mercado de US$ 1.390.000.000, com oferta circulante de cerca de 97.727.220 tokens e cotação em torno de US$ 14,226. Reconhecido como “potência do DeFi”, o INJ desempenha papel central nas finanças descentralizadas e aplicações Web3.

Este artigo traz uma análise abrangente sobre a tendência dos preços da Injective entre 2025 e 2030, considerando padrões históricos, oferta e demanda, desenvolvimento do ecossistema e fatores macroeconômicos, para fornecer ao investidor previsões profissionais e estratégias práticas de investimento.

I. Histórico de Preços do INJ e Situação Atual do Mercado

Evolução dos Preços do INJ

- 2020: Lançamento do INJ a US$ 0,657401, marcando entrada no mercado cripto

- 2021: Alta de mercado, INJ atingiu máxima histórica de US$ 52,62 em 14 de março de 2024

- 2025: Consolidação, preço variando entre US$ 13,851 e US$ 14,41 nas últimas 24 horas

Situação Atual do Mercado INJ

Em 12 de setembro de 2025, INJ negocia a US$ 14,226, com volume negociado de US$ 3.066.738,94 nas últimas 24 horas, registrando aumento de 0,38% no período. Seu valor de mercado soma US$ 1.390.267.436, ocupando a 92ª posição no ranking global de criptomoedas.

O preço atual marca forte recuperação em relação ao mínimo histórico, mas segue 72,96% abaixo do topo. Na última semana, o INJ valorizou 13,07%, indicando bom momento de curto prazo, mas acumula queda de 5,04% em 30 dias e de 24,12% em um ano, confirmando volatilidade em horizontes maiores.

A oferta circulante soma 97.727.220,33 tokens, representando 97,73% do total de 100.000.000. O valor de mercado diluído é de US$ 1.422.600.000, praticamente igual ao valor atual, evidenciando alta liquidez dos tokens.

O sentimento no mercado do INJ é de otimismo cauteloso: a alta recente e bom desempenho semanal atraem investidores, porém a desvalorização ao longo do ano demanda atenção a tendências e fundamentos.

Clique para conferir o preço atual do INJ

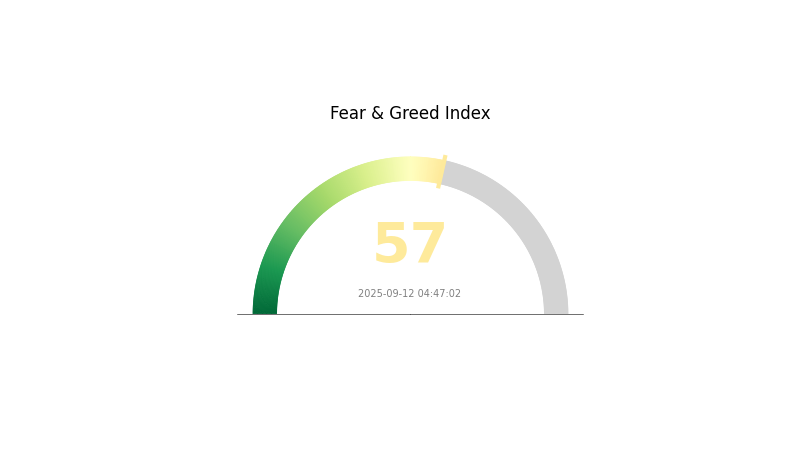

Indicador de Sentimento de Mercado INJ

12/09/2025 – Índice Fear and Greed: 57 (ganancioso)

Clique para ver o Fear & Greed Index atual

O mercado de criptomoedas está em modo ganancioso, com Fear and Greed Index em 57, indicando otimismo crescente entre investidores. Porém, é fundamental cautela, pois altos níveis de ganância costumam antecipar correções. Diversifique seu portfólio e utilize ordens de stop-loss para mitigar riscos. Pesquise e analise antes de investir, e respeite seu perfil e objetivos.

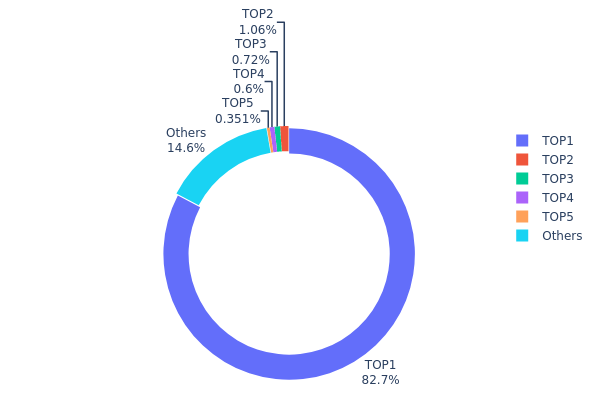

Distribuição das Posições INJ

O levantamento de distribuição dos endereços INJ mostra concentração extrema: o maior endereço detém 82,70% dos tokens, totalizando 82.700,24K INJ. Esse padrão alerta para riscos de centralização e manipulação de mercado.

O segundo maior detentor tem apenas 1,05% e os demais porcentagens ainda menores. Juntos, os cinco principais endereços concentram 85,41% dos tokens, com os demais representando 14,59%. Tal disparidade pode amplificar volatilidade e permitir mudanças bruscas no preço caso os maiores detentores se movimentem.

Essa estrutura pode prejudicar eficiência e descentralização do projeto, afetar a integridade de mercado e limitar a adoção por receio do controle centralizado. Investidores e stakeholders devem monitorar variações nesta distribuição, pois mudanças nas grandes posições podem impactar fortemente o mercado e a saúde do ecossistema INJ.

Clique para conferir a distribuição atual dos tokens INJ

| Top | Endereço | Tokens | % |

|---|---|---|---|

| 1 | 0xf955...bad6f3 | 82.700,24K | 82,70% |

| 2 | 0xf89d...5eaa40 | 1.059,54K | 1,05% |

| 3 | 0x5ff1...89634b | 719,73K | 0,71% |

| 4 | 0xafcd...45c5da | 600,00K | 0,60% |

| 5 | 0x77fb...94df0e | 350,54K | 0,35% |

| - | Outros | 14.569,95K | 14,59% |

II. Principais Fatores que Influenciam o Preço Futuro do INJ

Mecanismos de Oferta

- Queima de tokens: Leilões semanais promovem mecanismo deflacionário para INJ

- Padrões históricos: Reduções na oferta historicamente favoreceram a valorização

- Efeito atual: Queimas de tokens devem continuar pressionando o preço para cima

Dinâmica Institucional e Grandes Detentores

- Interesse institucional: Crescente participação de investidores institucionais no INJ enquanto infraestrutura DeFi

- Adoção corporativa: Número crescente de projetos construindo sobre o Injective Protocol, elevando a demanda por INJ

Ambiente Macroeconômico

- Política monetária: Decisões de bancos centrais e taxas de juros influenciam o apetite por risco em criptoativos como INJ

- Proteção inflacionária: INJ pode atrair investidores em busca de proteção contra inflação em momentos de incerteza econômica

Aprimoramento Técnico e Crescimento do Ecossistema

- Interoperabilidade cross-chain: Expansão da integração com outras blockchains amplia o alcance do Injective

- Melhorias de desempenho: Otimizações contínuas em velocidade de transação e escalabilidade mantêm a vantagem competitiva

- Aplicações no ecossistema: Número crescente de DApps, DEXs e protocolos DeFi sobre Injective aumenta utilidade e demanda pelo INJ

III. Previsão de Preço do INJ de 2025 a 2030

Projeção para 2025

- Estimativa conservadora: US$ 12,50 - US$ 14,20

- Estimativa neutra: US$ 14,20 - US$ 15,20

- Estimativa otimista: US$ 15,20 - US$ 16,20 (dependendo do ímpeto de mercado)

Projeções para 2027-2028

- Expectativa de fase de alta: Possível continuidade do ciclo otimista

- Faixa prevista:

- 2027: US$ 15,33 - US$ 24,12

- 2028: US$ 19,91 - US$ 22,91

- Catalisadores: Adoção crescente do INJ em DeFi, expansão do ecossistema

Projeção de Longo Prazo para 2030

- Cenário base: US$ 22,15 - US$ 24,04 (crescimento sustentado)

- Cenário otimista: US$ 24,04 - US$ 25,73 (com adoção geral do blockchain)

- Cenário transformador: US$ 25,73+ (INJ se consolidando como plataforma líder de DeFi)

- Em 31/12/2030, o INJ está projetado em US$ 24,04, representando um crescimento de 69% em relação a 2025

| Ano | Máxima projetada | Média projetada | Mínima projetada | Variação (%) |

|---|---|---|---|---|

| 2025 | 16,19712 | 14,208 | 12,50304 | 0 |

| 2026 | 22,19574 | 15,20256 | 13,0742 | 6 |

| 2027 | 24,1219 | 18,69915 | 15,3333 | 31 |

| 2028 | 22,90926 | 21,41053 | 19,91179 | 50 |

| 2029 | 25,92708 | 22,15989 | 19,72231 | 55 |

| 2030 | 25,72653 | 24,04348 | 17,79218 | 69 |

IV. Estratégias Profissionais de Investimento em INJ e Gestão de Riscos

Metodologia de Investimento INJ

(1) Estratégia de Longo Prazo

- Perfil: Investidores de longo prazo com alta tolerância a risco

- Diretrizes:

- Comprar INJ em correções de mercado

- Realizar staking para gerar renda passiva

- Armazenar em carteira física segura

(2) Estratégia Ativa

- Ferramentas técnicas:

- Médias móveis: Monitorar tendências de curto e longo prazo

- RSI (Índice de Força Relativa): Identificar sobrecompra e sobrevenda

- Pontos chave para operações de swing trade:

- Definir stop-loss para limitar perdas

- Realizar lucros em níveis previamente definidos

Estrutura de Gestão de Riscos INJ

(1) Princípios de Alocação

- Conservador: 1-3% do portfólio

- Agressivo: 5-10% do portfólio

- Profissional: até 15% do portfólio

(2) Estratégias de proteção

- Diversificação: Investir em diferentes criptomoedas

- Stop-loss: Limitar perdas em operações

(3) Soluções de Armazenamento Seguro

- Hot wallet recomendada: Gate Web3 wallet

- Armazenamento frio: carteira física para longo prazo

- Medidas de segurança: autenticação em dois fatores e senha forte

V. Riscos e Desafios Potenciais para INJ

Riscos de Mercado INJ

- Volatilidade elevada: grandes oscilações podem resultar em perdas expressivas

- Concorrência: outras blockchains Layer 1 podem ganhar participação no mercado

- Sentimento: notícias negativas afetam o preço do INJ

Riscos Regulatórios INJ

- Incerteza regulatória: alterações podem limitar adoção e uso do INJ

- Requisitos de conformidade: aumento de custos e escrutínio regulatório

- Barreiras internacionais: regras diferentes por jurisdição podem limitar alcance global

Riscos Técnicos INJ

- Falhas em smart contracts: possibilidade de exploração de vulnerabilidades

- Congestionamento de rede: alto número de transações pode causar lentidão

- Desafios de escalabilidade: limitações no processamento de atividade crescente

VI. Conclusão e Recomendações de Ação

Avaliação do Valor de Investimento INJ

Injective (INJ) oferece perspectiva promissora de valor no longo prazo como blockchain Layer 1 interoperável de ponta para o universo DeFi, mas sua volatilidade e riscos regulatórios no curto prazo exigem cautela.

Recomendações de Investimento INJ

✅ Iniciantes: Realize investimentos menores e recorrentes para obter exposição

✅ Investidores experientes: Equilibre o hold de longo prazo com operações ativas

✅ Institucionais: Realize diligência prévia aprofundada e considere INJ em portfólio diversificado

Como Participar do Mercado INJ

- Negociação à vista: Comprar e vender INJ em exchanges reconhecidas como Gate.com

- Staking: Participe do staking de INJ para gerar renda passiva

- Aplicações DeFi: Explore os protocolos descentralizados do ecossistema Injective

Investir em criptomoedas é altamente arriscado. Este conteúdo não constitui conselho financeiro. Decida com cautela de acordo com seu perfil de risco e consulte especialistas. Nunca invista mais do que pode perder.

FAQ

INJ tem futuro?

O INJ tem grande potencial como token líder do DeFi, infraestrutura institucional robusta e adoção prática. Conta com projeções de crescimento de até 100 vezes, segundo especialistas.

Injective pode chegar a US$ 100?

Sim, o Injective pode chegar a US$ 100 em 2025 caso o cenário de mercado seja favorável, especialmente após as eleições nos Estados Unidos. A previsão depende de dinâmicas positivas do mercado.

Qual a previsão para o preço da Injective em 2025?

Segundo tendências atuais, a Injective deve oscilar entre US$ 15,19 e US$ 17,17 em dezembro de 2025.

Injective é boa para investimento de longo prazo?

Sim, a Injective tem potencial relevante no horizonte de longo prazo. Sua infraestrutura robusta e adoção crescente indicam valorização sustentável. Especialistas projetam crescimento expressivo, com expectativa de até 100 vezes se capturar pequena fatia do mercado global de derivativos.

Previsão de preço MNT para 2025: análise de mercado e fatores potenciais de crescimento do token Mantle Network

Previsão de Preço do NEAR em 2025: análise detalhada dos principais fatores que devem impulsionar o próximo ciclo de valorização no ecossistema NEAR Protocol

Previsão de preço da AURORA em 2025: análise das tendências futuras e do potencial de mercado para a solução Layer-2

Previsão de preço CELR para 2025: análise do potencial de crescimento e dos fatores de mercado do token Celer Network

Celestia (TIA) é um bom investimento?: Avaliação do potencial e dos riscos deste projeto de blockchain layer-1

Aptos (APT) é um bom investimento?: Uma análise do potencial e dos riscos desta plataforma blockchain em ascensão

Compreendendo as Chaves Privadas: Orientações para Proteger Seus Ativos em Criptomoedas

Explorando Soluções Layer 2 para Potencializar a Escalabilidade do Ethereum

Entenda como funcionam os nodes em Blockchain: Guia introdutório

Principais carteiras seguras de Bitcoin com suporte à tecnologia Taproot

Entenda os Custos de Transação do Ethereum e Como Otimizá-los