Bitcoin Price Prediction: Gradual Rise to $1 Million by 2032

The Gradual Ascent of Bitcoin

Recently, cryptocurrency analyst PlanC presented a perspective on X that differs from mainstream market sentiment: the road to Bitcoin (BTC) reaching $1 million per coin may be much slower and steadier than most expect. PlanC suggests that, rather than experiencing extreme price swings, Bitcoin could follow a long-term, gradually upward trajectory to the right, featuring 10–30% corrections and periods of consolidation. He notes that Bitcoin is steadily gaining acceptance among traditional financial institutions and major players. During extended sideways trading, speculation often arises that the current cycle is ending. Many expect a steep correction is imminent so buyers can re-enter at lower levels. In practice, however, these dramatic pullbacks have not occurred.

Diverse Market Outlooks for Bitcoin’s Future

Although PlanC favors the “slow bull” scenario and predicts Bitcoin will reach $1 million by 2032, there are sharply contrasting views in the market. For instance, Jan3 founder Samson Mow expects Bitcoin might soon see the so-called “omega candle”—a single-day surge of $100,000. He asserts that $1 million is a matter of “when, not if,” and that it may happen as soon as this year or the next.

Coinbase CEO Brian Armstrong sets his seven-figure target for 2030, while Eric Trump has also declared that Bitcoin reaching $1 million in the coming years is “a certainty.” Conversely, Galaxy Digital CEO Mike Novogratz warns that if Bitcoin crosses $1 million too quickly, it signals severe distress in the U.S. economy.

Market Favors Mild Corrections

Analyst Pav Hundal notes that most market participants prefer Bitcoin to maintain a healthy trajectory characterized by modest pullbacks. Corporate treasuries, institutional desks, and even sovereign wealth funds now provide steady demand. In theory, this can temper excessive volatility. However, Hundal also warns the market remains in uncharted waters: “Even treasury buyers aren’t fully immune to traditional market shocks. If credit spreads widen and risk signals shift, even those seen as strong hands may quickly be forced to sell.” In short, Bitcoin’s price has solid support. It may still face structural pressures and market uncertainty ahead.

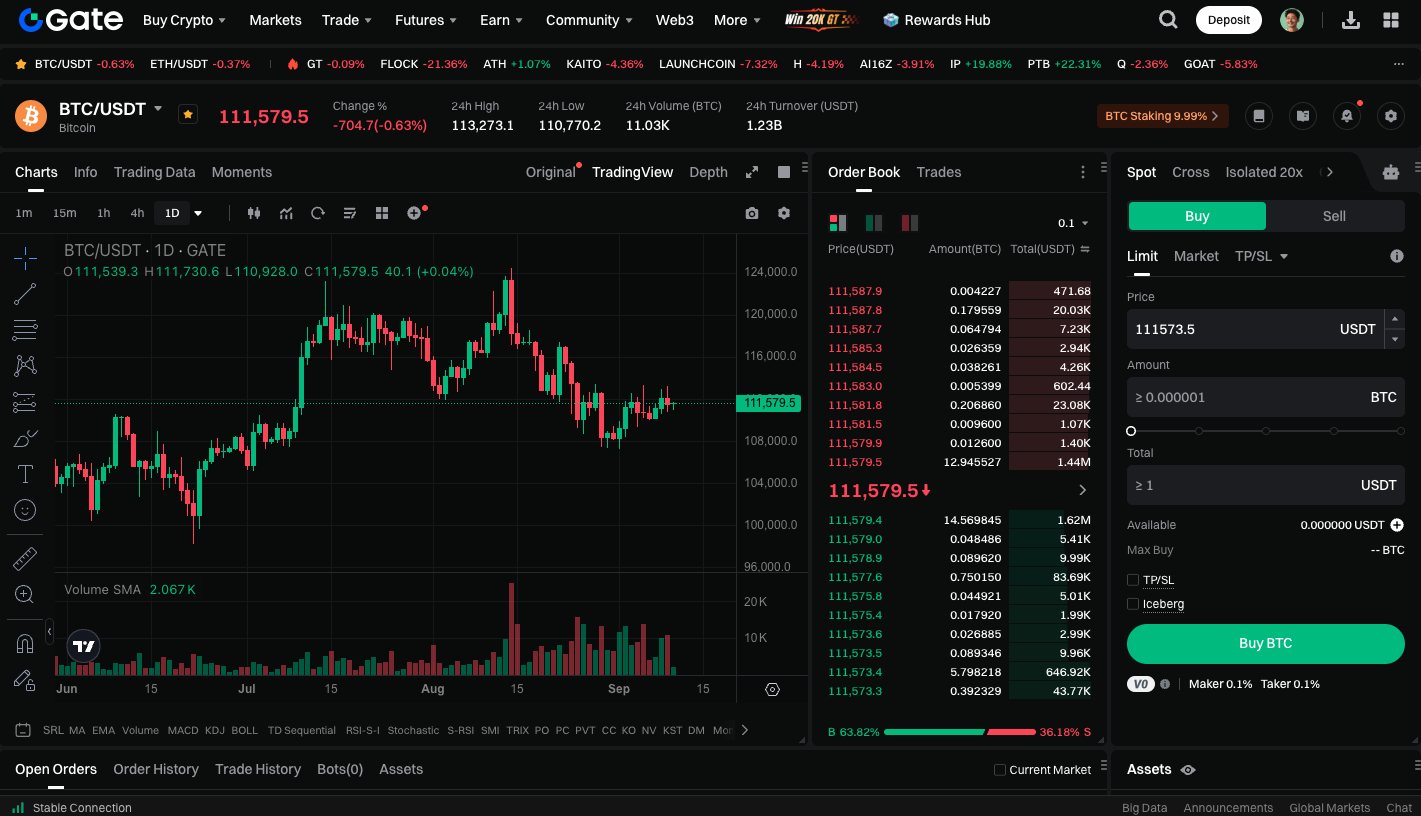

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

In conclusion, Bitcoin’s upward path is more likely to unfold as a steady, measured climb toward the $1 million milestone, rather than an explosive rally. Investors should continue monitoring market volatility and potential risks.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality