What is Dolomite (DOLO)?

What is Dolomite?

(Source:@Dolomite_io)

Dolomite is a next-generation decentralized money market protocol and decentralized exchange, providing extensive token support and capital efficiency. Through its unique virtual liquidity system, Dolomite achieves high capital utilization. By combining the advantages of decentralized exchanges and lending protocols, Dolomite creates the most capital-efficient and modular protocol in the DeFi field, offering over-collateralized loans, leveraged trading, spot trading, and other financial instruments. With its extensive token support, capital efficiency, and no-rental model, Dolomite enables users to hedge their portfolios more easily, amplify capital operations, or release potential idle funds. Dolomite aims to become the center of DeFi activities, enabling other protocols, yield aggregators, decentralized autonomous organizations (DAOs), market makers, hedge funds, and others to easily manage assets and execute on-chain strategies.

Architecture features of Dolomite

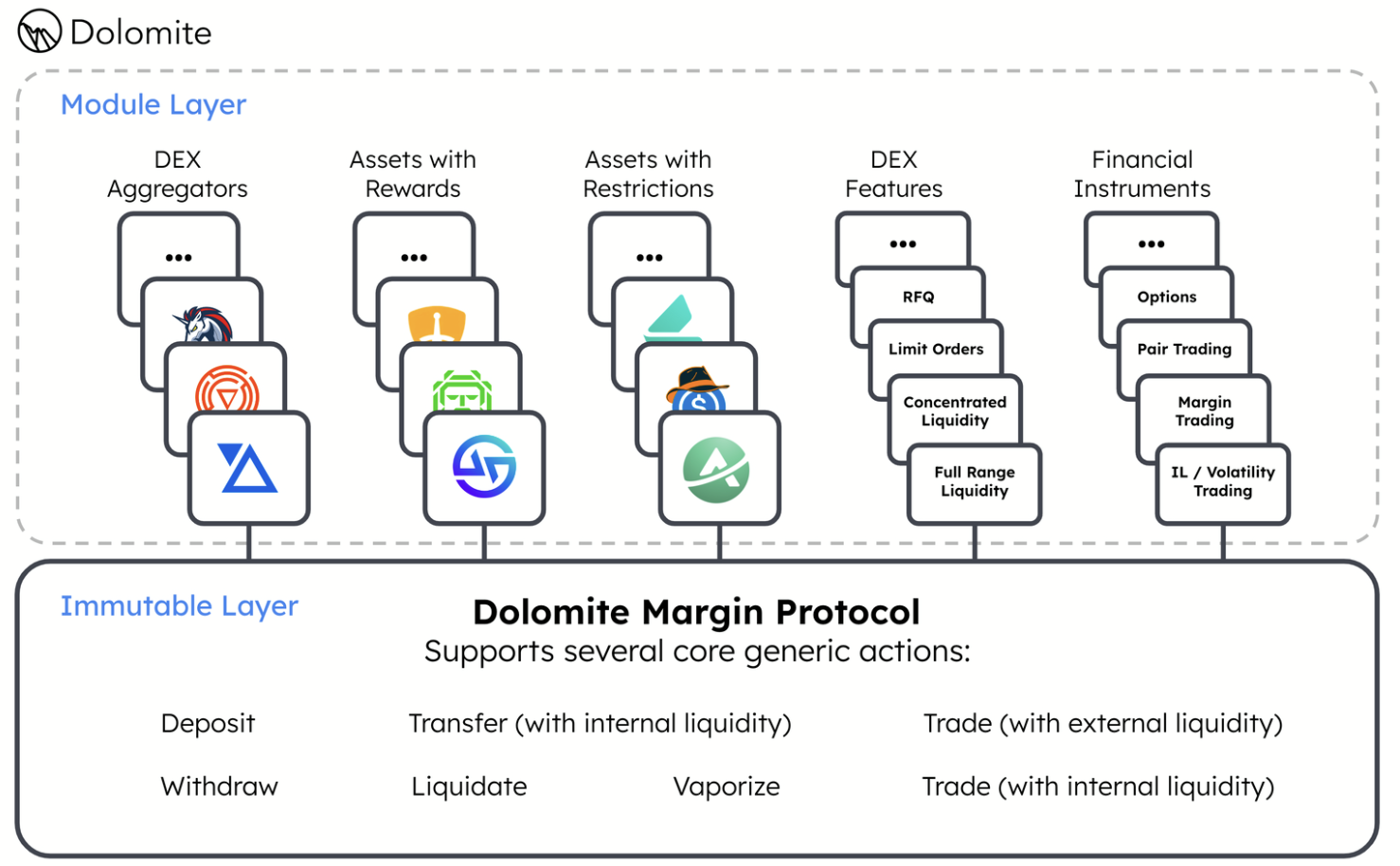

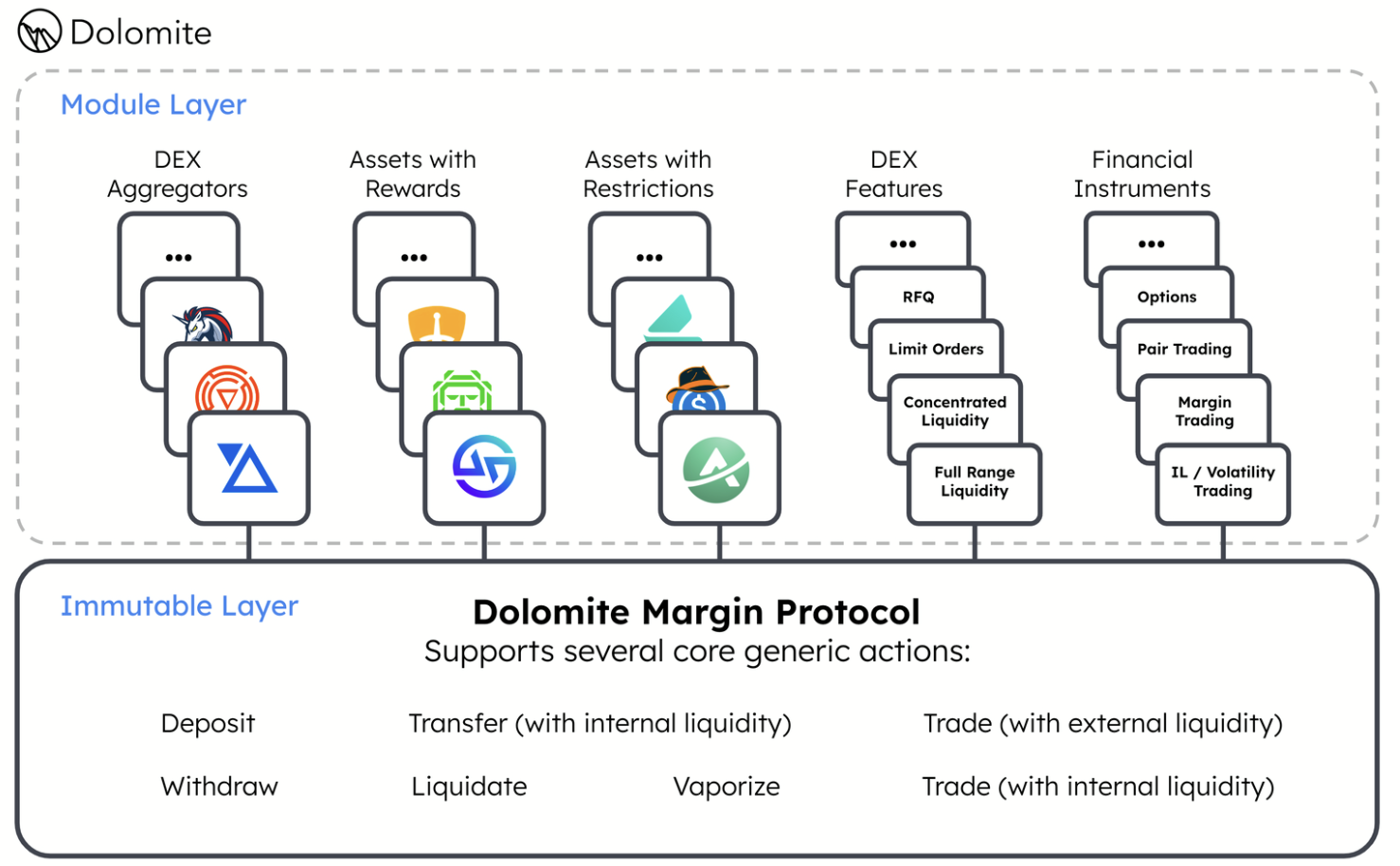

Dolomite has a highly modular architecture, mainly divided into two levels: the core (Immutable) layer and the module (Mutable) layer.

1. Core Layer:

- The core layer is an immutable infrastructure that only allows modifications to certain specific configuration parameters.

- This layer ensures the security and stability of the protocol, unaffected by external operations.

2. Module Layer:

- The module layer is highly flexible, able to adapt to market changes and introduce new functional modules.

- Users can run various Actions by sending Operations to the core layer, and these Actions can be operations such as transfer, trade, and lending.

Dolomite’s modular design allows for future upgrades and expansions without affecting existing functionality, enabling cross-platform liquidity interoperability, trade aggregation, and a variety of financial instruments through internal liquidity and trading operations, such as:

- Pair Trading

- Impermanent loss hedging

- Trade using multiple decentralized trading models while earning lending profits

- Trade with external liquidity through an aggregator or native DEX adapter

- Pledge and borrow against a variety of assets to continue receiving platform rewards, such as GLP, plvGLP, and Camelot’s Nitro Pools.

(Source: docs.dolomite)

Dolomite Token Economics

Dolomite’s governance token is DOLO, and a multi-level token economic model is designed to drive ecological development, including DOLO, veDOLO, and oDOLO, each playing its role in the ecosystem.

1.DOLO

- Total Supply: 1,000,000,000

- As the foundation of the Dolomite protocol, it provides liquidity, governance participation, and trading medium.

- Supports cross-chain operation, initially on the Berachain mainnet and cross-chain interoperability through Chainlink’s CCIP protocol.

2.veDOLO

- Users can stake DOLO to obtain veDOLO, participate in governance, and receive trading fee dividends

- veDOLO exists in the form of NFT and can be transferred or merged

- The longest lock-up period can be up to two years, and the longer the lock-up time, the higher the voting weight and profit-sharing ratio obtained.

3.oDOLO

- oDOLO is an innovative liquidity incentive mechanism that involves periodic distribution and requires 1:1 pairing of DOLO to convert to veDOLO

- After completing the pairing, you can get veDOLO with market discount.

- The discount rate is determined by the length of the lock-up period, with a maximum lock-up of two years entitling to a 50% discount.

Token Distribution

The total token supply of Dolomite (DOLO) is 1,000,000,000 DOLO, and its token distribution is designed to support the long-term development of the ecosystem, protocol growth, and community participation. The specific distribution ratios are as follows:

Future Liquidity Mining: 20%

In the future, liquidity mining will receive 20% of the token allocation, which will be used to incentivize liquidity providers to ensure stable trading depth and liquidity within the protocol.Airdrop(空投): 20%

Reserve 20% of the tokens for airdrop activities, including rewards for early users, supporters, and specific community contributors, to encourage broader community participation.Core Team: 20.20%

The core team will receive 20.20% of the tokens for long-term incentives for team members’ development and protocol maintenance. This portion of tokens typically has a long-term release schedule to ensure synchronization with ecosystem growth.

Investors: 16.20%

Allocate 16.20% of the tokens to early investors, these funds will be used to support the initial development, promotion, and market expansion of the project.Foundation: 9.65%

The foundation holds 9.65% of the tokens, mainly for the long-term development of the protocol, global expansion, and the establishment of strategic partnerships.Future Partner Rewards: 5.75%

Reserve 5.75% of the tokens for future partner relationships, which will be used to support the expansion of the ecosystem and the establishment of strategic alliances.Boyco Incentives: 3%

3% of the tokens will be specifically allocated to the Boyco incentive plan for specific activities within the ecosystem, community promotion, and partner support.Service Providers: 3%

This portion of the tokens will be used to reward service providers within the protocol, including developers, node operators, and infrastructure supporters, to ensure the stable operation of the ecosystem.Protocol Owned Liquidity: 2%

The protocol will hold 2% of the tokens as its own liquidity to ensure market stability and better trading depth.

Dolomite’s token economic design emphasizes long-term stable development and community participation, ensuring the competitiveness and resilience of the entire ecosystem in the decentralized financial market through reasonable token allocation and liquidity incentives.

(Source: docs.dolomite)

Start trading DOLO spot now:https://www.gate.io/trade/DOLO_USDT

Summary

Dolomite is leading the DeFi world towards greater freedom and interoperability through innovative structures of modular design and capital efficiency. Whether it’s leveraged trading, lending, spot trading, or liquidity mining, users can experience ultimate trading experience and capital efficiency in the Dolomite protocol. In the future, the Dolomite ecosystem will continue to expand, becoming the core hub of decentralized financial activities.

What is Dolomite (DOLO)?

What is Dolomite?

(Source:@Dolomite_io)

Dolomite is a next-generation decentralized money market protocol and decentralized exchange, providing extensive token support and capital efficiency. Through its unique virtual liquidity system, Dolomite achieves high capital utilization. By combining the advantages of decentralized exchanges and lending protocols, Dolomite creates the most capital-efficient and modular protocol in the DeFi field, offering over-collateralized loans, leveraged trading, spot trading, and other financial instruments. With its extensive token support, capital efficiency, and no-rental model, Dolomite enables users to hedge their portfolios more easily, amplify capital operations, or release potential idle funds. Dolomite aims to become the center of DeFi activities, enabling other protocols, yield aggregators, decentralized autonomous organizations (DAOs), market makers, hedge funds, and others to easily manage assets and execute on-chain strategies.

Architecture features of Dolomite

Dolomite has a highly modular architecture, mainly divided into two levels: the core (Immutable) layer and the module (Mutable) layer.

1. Core Layer:

- The core layer is an immutable infrastructure that only allows modifications to certain specific configuration parameters.

- This layer ensures the security and stability of the protocol, unaffected by external operations.

2. Module Layer:

- The module layer is highly flexible, able to adapt to market changes and introduce new functional modules.

- Users can run various Actions by sending Operations to the core layer, and these Actions can be operations such as transfer, trade, and lending.

Dolomite’s modular design allows for future upgrades and expansions without affecting existing functionality, enabling cross-platform liquidity interoperability, trade aggregation, and a variety of financial instruments through internal liquidity and trading operations, such as:

- Pair Trading

- Impermanent loss hedging

- Trade using multiple decentralized trading models while earning lending profits

- Trade with external liquidity through an aggregator or native DEX adapter

- Pledge and borrow against a variety of assets to continue receiving platform rewards, such as GLP, plvGLP, and Camelot’s Nitro Pools.

(Source: docs.dolomite)

Dolomite Token Economics

Dolomite’s governance token is DOLO, and a multi-level token economic model is designed to drive ecological development, including DOLO, veDOLO, and oDOLO, each playing its role in the ecosystem.

1.DOLO

- Total Supply: 1,000,000,000

- As the foundation of the Dolomite protocol, it provides liquidity, governance participation, and trading medium.

- Supports cross-chain operation, initially on the Berachain mainnet and cross-chain interoperability through Chainlink’s CCIP protocol.

2.veDOLO

- Users can stake DOLO to obtain veDOLO, participate in governance, and receive trading fee dividends

- veDOLO exists in the form of NFT and can be transferred or merged

- The longest lock-up period can be up to two years, and the longer the lock-up time, the higher the voting weight and profit-sharing ratio obtained.

3.oDOLO

- oDOLO is an innovative liquidity incentive mechanism that involves periodic distribution and requires 1:1 pairing of DOLO to convert to veDOLO

- After completing the pairing, you can get veDOLO with market discount.

- The discount rate is determined by the length of the lock-up period, with a maximum lock-up of two years entitling to a 50% discount.

Token Distribution

The total token supply of Dolomite (DOLO) is 1,000,000,000 DOLO, and its token distribution is designed to support the long-term development of the ecosystem, protocol growth, and community participation. The specific distribution ratios are as follows:

Future Liquidity Mining: 20%

In the future, liquidity mining will receive 20% of the token allocation, which will be used to incentivize liquidity providers to ensure stable trading depth and liquidity within the protocol.Airdrop(空投): 20%

Reserve 20% of the tokens for airdrop activities, including rewards for early users, supporters, and specific community contributors, to encourage broader community participation.Core Team: 20.20%

The core team will receive 20.20% of the tokens for long-term incentives for team members’ development and protocol maintenance. This portion of tokens typically has a long-term release schedule to ensure synchronization with ecosystem growth.

Investors: 16.20%

Allocate 16.20% of the tokens to early investors, these funds will be used to support the initial development, promotion, and market expansion of the project.Foundation: 9.65%

The foundation holds 9.65% of the tokens, mainly for the long-term development of the protocol, global expansion, and the establishment of strategic partnerships.Future Partner Rewards: 5.75%

Reserve 5.75% of the tokens for future partner relationships, which will be used to support the expansion of the ecosystem and the establishment of strategic alliances.Boyco Incentives: 3%

3% of the tokens will be specifically allocated to the Boyco incentive plan for specific activities within the ecosystem, community promotion, and partner support.Service Providers: 3%

This portion of the tokens will be used to reward service providers within the protocol, including developers, node operators, and infrastructure supporters, to ensure the stable operation of the ecosystem.Protocol Owned Liquidity: 2%

The protocol will hold 2% of the tokens as its own liquidity to ensure market stability and better trading depth.

Dolomite’s token economic design emphasizes long-term stable development and community participation, ensuring the competitiveness and resilience of the entire ecosystem in the decentralized financial market through reasonable token allocation and liquidity incentives.

(Source: docs.dolomite)

Start trading DOLO spot now:https://www.gate.io/trade/DOLO_USDT

Summary

Dolomite is leading the DeFi world towards greater freedom and interoperability through innovative structures of modular design and capital efficiency. Whether it’s leveraged trading, lending, spot trading, or liquidity mining, users can experience ultimate trading experience and capital efficiency in the Dolomite protocol. In the future, the Dolomite ecosystem will continue to expand, becoming the core hub of decentralized financial activities.