Crypto Summit Trump: Amerika Serikat Memimpin Masa Depan Aset Digital

1. Latar Belakang dan Signifikansi Crypto Summit Trump

The term “Trump Crypto Summit” became a trending topic following the Digital Asset Summit (DAS) held in New York on March 20. President Donald Trump delivered a video speech, becoming the first sitting U.S. president to formally address the cryptocurrency industry.

Sumber:Akun resmi BlockWorks X

1.1 Asal Usul Kripto Summit Trump

- Waktu: Kripto Summit Trump bertepatan dengan BlockWorks Digital Asset Summit (DAS) di New York pada 20 Maret.

- Lokasi: DAS diadakan di Kota New York, sementara Crypto Summit Trump dilakukan dalam format online dan offline hibrida.

- Peserta: Pertemuan ini diselenggarakan oleh BlockWorks, sebuah media kripto terkemuka di AS. Co-founder Jason Yanowitz (dikenal secara online sebagai Yano) menggambarkan acara ini sebagai "moment bersejarah bagi industri kripto." Presiden Trump menyampaikan pidato video, didampingi oleh para co-founder BlockWorks dan pemimpin industri lainnya.

Sumber:Tweet Jason Yanowitz

Puncak Kripto Trump mencerminkan perubahan sikap pemerintah AS terhadap aset digital. Sejak kembalinya Trump ke Gedung Putih (setelah kemenangannya yang diprediksi dalam pemilihan 2024 dan pengangkatannya kembali pada awal 2025), keterlibatannya dengan industri kripto telah meningkat. Puncak ini berfungsi sebagai pernyataan kebijakan dan demonstrasi komitmen pemerintah AS untuk memfasilitasi lingkungan pendukung bagi ekosistem kripto.

1.2 Signifikansi dari Kripto Summit Trump

Presiden yang Duduk Pertama kali di Konferensi Kripto: Partisipasi Trump menandai momen bersejarah, menandakan bahwa aset digital sekarang menjadi prioritas dalam agenda politik AS.

Arah Regulasi Aset Digital dan Cadangan AS: Penyebutan Trump tentang 'cadangan strategis aset digital' dan 'cadangan Bitcoin' menunjukkan bahwa pemerintah AS mungkin akan memperlakukan aset digital sebagai komponen penting dari cadangan keuangannya.

Pengembangan dan Regulasi Industri yang Dipercepat: KTT ini diharapkan dapat memajukan upaya legislatif, dengan Trump mendesak Kongres untuk meloloskan "undang-undang stablecoin dan struktur pasar," yang dapat memberikan kerangka peraturan yang jelas untuk industri.

2. Poin Penting dari Pidato Trump dan Implikasi Kebijakan

Pidato video Trump, disampaikan pada pukul 11:00 malam waktu Beijing pada tanggal 20 Maret, menguraikan beberapa poin kunci:

2.1 Panggilan untuk Regulasi Stablecoin dan Struktur Pasar

Trump menekankan perlunya Kongres untuk meloloskan regulasi inti bagi stablecoin dan struktur pasar pertukaran, menciptakan lingkungan regulasi yang “sederhana dan masuk akal.” Ia yakin hal ini akan memungkinkan lembaga-lembaga dari berbagai ukuran untuk berinvestasi, berinovasi, dan berpartisipasi dalam revolusi teknologi keuangan. Pemanggilan untuk Undang-Undang Stablecoin dan Struktur Pasar

2.2 Akhir dari "Operasi Chokepoint 2.0"

Trump mengkritik “Operasi Chokepoint 2.0” pemerintahan sebelumnya, menyebutnya sebagai penyalahgunaan wewenang regulasi dan bentuk “pengweaponan pemerintah.” Dia berjanji untuk mengakhiri kebijakan ini setelah peresmiannya kembali pada 20 Januari 2025, menjanjikan lingkungan yang lebih adil bagi industri kripto.

Strategi Cadangan Bitcoin dan Aset Digital AS 2.3

Trump mengumumkan rencana untuk membentuk “cadangan aset digital” dan “cadangan strategis Bitcoin” untuk memaksimalkan nilai aset jangka panjang. Dia mengkritik pemerintahan Biden karena menjual Bitcoin yang dipegang pemerintah dengan harga rendah, bersumpah untuk menghindari kesalahan serupa.

2.4 Memperkuat Dominasi Dolar Melalui Stablecoin

Trump menyoroti peran stablecoin yang didukung dolar dalam memperkuat kepemimpinan global dolar AS, dengan menyatakan, "Dolar akan terus memimpin selama bertahun-tahun, dan ini adalah posisi yang ingin kita pertahankan dalam jangka panjang."

Sumber referensi:Akun resmi pribadi X milik Trump

3. Reaksi Pasar: BTC dan TRUMP

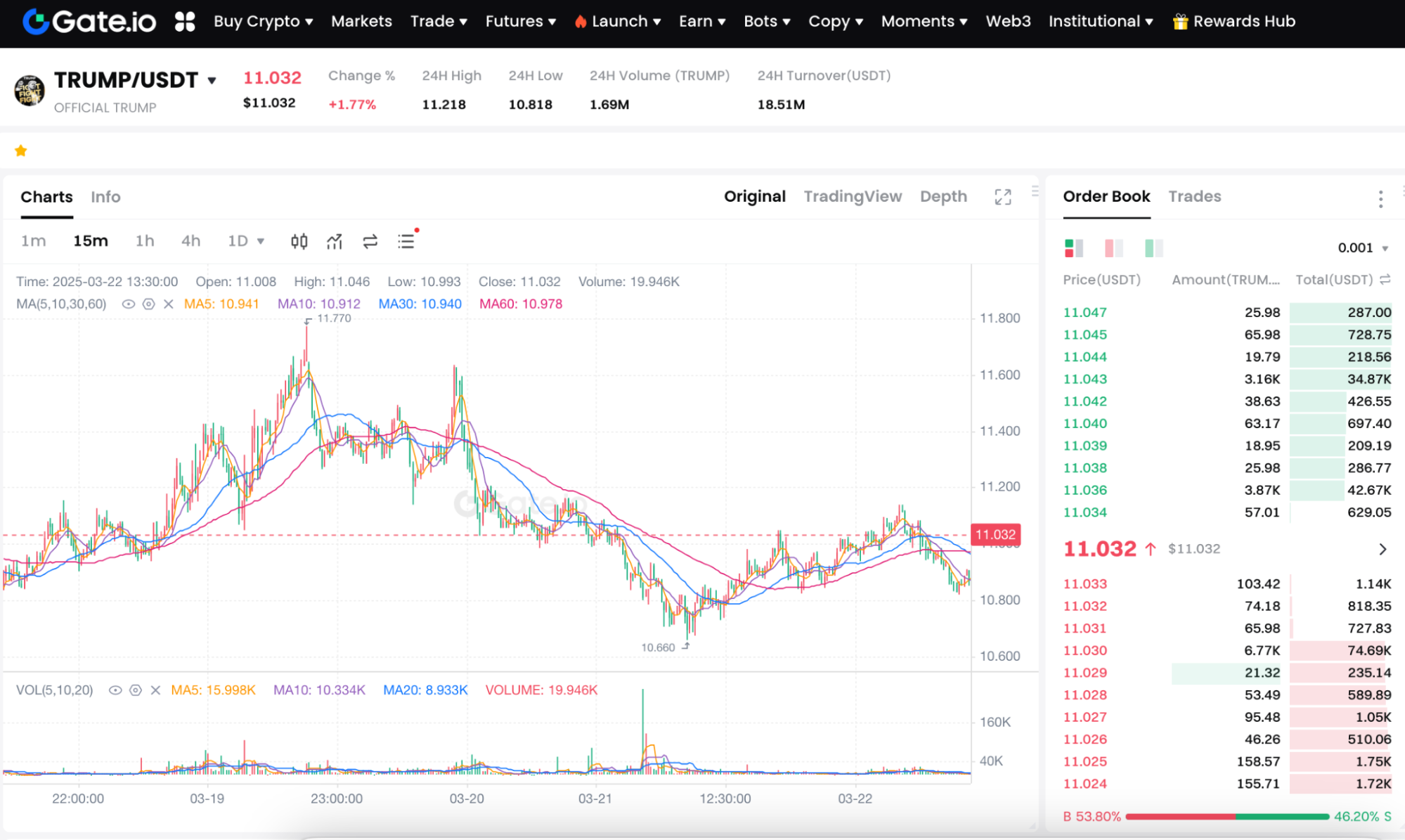

Analisis berikut didasarkan pada data pasar BTC/USDT dan TRUMP/USDT dari 19 Maret hingga 22 Maret 2025, di Gate.io, berfokus pada fluktuasi harga seputar Crypto Summit Trump.

3.1 Kripto/USDT Kinerja

Dari Gate.ioHalaman perdagangan BTC/USDTSeperti yang terlihat dalam tangkapan layar, Bitcoin menunjukkan tren naik dalam harga selama periode ini, diikuti oleh retracement kecil. Level harga kunci dan tren adalah sebagai berikut (nilai-nilai adalah rentang perkiraan):

Catatan: Dari 19/3 hingga 20/3, Bitcoin melonjak dari sekitar 81.200 hingga puncak 87.432,6, diikuti oleh penurunan dalam rentang 21/3 hingga 22/3 dan harga stabil di sekitar $84.000,

Performa TRUMP/USDT 3.2 dari 19-22 Maret

Dari Gate.ioHalaman perdagangan TRUMP/USDTSeperti yang terlihat dari tangkapan layar, Koin TRUMP telah mengalami fluktuasi yang lebih parah selama pertemuan, dan level harga kunci dan trennya adalah sebagai berikut (angka-angka tersebut adalah rentang perkiraan untuk referensi):

Catatan: TRUMP Coin melonjak hingga $12,20, mencerminkan permintaan yang kuat karena acara pada 20 Maret, dan kemudian Harga kembali ke kisaran 10-11 selama 21-22 Maret, menunjukkan volatilitas tinggi dan aktivitas spekulatif.

Selama 3.3 Trump Crypto Summit, dinamika pasar dan kesimpulan

1. BTC/USDT: pertama naik, kemudian stabil

- Menjelang puncak (19/3 - 20/3), BTC naik dengan cepat dari sekitar 81.000 USDT menjadi di atas 87.000 USDT, mencapai level tertinggi baru; setelah puncak (21/3 - 22/3), harga sedikit turun, stabil di sekitar 84.000 USDT.

2. TRUMP/USDT: Volatilitas yang lebih tinggi

- Pada 20 Maret, TRUMP Coin melonjak hingga sekitar 12,20 USDT, kemudian mundur untuk mengkonsolidasikan dalam kisaran 10~11 USDT, menunjukkan karakteristik yang dipicu acara dan volatilitas tinggi yang kuat.

3. Sentimen Pasar

- Pada 20 Maret, tanggal inti dari Kripto Summit Trump, volume perdagangan dan harga BTC dan Koin TRUMP melonjak secara signifikan, mencerminkan harapan investor yang kuat akan kebijakan yang menguntungkan dan aktivitas pasar yang meningkat selama acara tersebut. Namun, setelah pertemuan puncak, pasar secara bertahap kembali ke rasionalitas, dengan harga masuk ke fase konsolidasi tingkat tinggi atau fluktuasi ringan. Perubahan ini menunjukkan bahwa permintaan spekulatif jangka pendek telah mereda, dan investor kini menunggu implementasi kebijakan jangka panjang dan tindakan lanjutan.

Secara keseluruhan, pertemuan tidak hanya menarik perhatian dan kenaikan harga untuk aset kripto utama seperti Bitcoin tetapi juga menyebabkan lonjakan cepat dan penarikan mundur dalam token yang erat kaitannya dengan acara tersebut, seperti TRUMP Coin. Ke depannya, investor sebaiknya memantau perkembangan regulasi AS, arus dana pasar, dan kemajuan proyek nyata untuk lebih baik menilai potensi risiko dan peluang.

4. Kesimpulan dan Prospek

Pidato Trump di KTT Kripto Trump telah menyuntikkan momentum baru ke sektor aset digital AS. Usulannya—mengakhiri “Operasi Chokepoint 2.0,” mendirikan cadangan Bitcoin dan aset digital nasional, dan memajukan legislasi stablecoin—mengisyaratkan pendekatan regulasi kripto yang lebih progresif dan inklusif.

AS memiliki potensi untuk memperkokoh kepemimpinannya dalam ruang aset digital global, namun hal ini akan memerlukan upaya yang terkoordinasi dari Kongres, pemangku kepentingan industri, dan investor. Saat lembaga-lembaga tradisional dan perusahaan-perusahaan besar semakin memasuki ekosistem kripto, AS berada dalam posisi yang kuat untuk memperkuat peranannya dalam sistem keuangan global.

Artikel Terkait

Analisis Mendalam Kebijakan Tarif Trump 2025

Apa Itu ZEREBRO: Sistem Inovatif yang Menembus Batasan Pembuatan Konten AI

Fartcoin: Naiknya Seri AI Agent MEME Raja Baru

Prediksi Harga XRP: Analisis Tren Masa Depan dan Peluang Investasi

Analisis Trend dan Prospek Masa Depan Cardano (ADA)