Gate Research: 米国の関税政策が世界市場に混乱を引き起こし、Bitcoinが$80,000を下回る

Gate Research Daily Report: 4月7日、Bitcoinは5.22%減の$78,236に下落し、Ethereumは12.13%減の$1,601に落ちました。 AaveのEthereumにおける累積借入金利は10億ドルを超えました。Solanaの総ロックバリュー(TVL)は5380万SOLに達し、2023年以来の最高値を記録しました。3月には、ほとんどの主要なDeFiプロトコルが急激な収益減少を経験しましたが、Skyは著しい成長を遂げました。一方、新たに発表された米国の関税政策がグローバル市場を揺るがし、従来の市場と暗号通貨市場の両方で売りが加速しました。Lens Chainは公式にメインネットを開始し、分散型ソーシャルアプリケーションの拡張可能でモジュラーな基盤を提供しています。SECはまた、バイデン政権下で導入されたデジタル資産政策の見直しを開始し、より緩和的な規制に向けた動きを示唆しています。抽象

- ビットコインの価格は5.22%下落し、78,236ドルに達しました。一方、イーサリアムの価格は12.13%下落し、1,601ドルに落ち着きました。

- イーサリアム上のAaveの借入金利は10億ドルを超えました。

- SolanaのTVL(Total Value Locked)は、2023年以来の新記録となる53.8万SOLに達しました。

- 3月、主要なDeFiプロトコルは収益が大幅に減少しましたが、Sky Protocolは成長を見せました。

- 関税政策は世界市場を揺るがし、世界株式市場と暗号通貨市場の双方で急速な下落を加速させています。

- Lens Protocolのメインネット、Lens Chainが正式にローンチされました。

- SECは、規制緩和の道を開く可能性がある、バイデン政権のデジタル資産政策を審査しています。

市場分析

- BTC—— ビットコインは過去24時間で5.22%下落し、現在7万8,236ドルで取引されています。全体的なトレンドはベアリッシュで、明確な下方圧力があります。今朝、BTCは取引量の増加により急落し、一時的に7万7,151ドルのサポートゾーンまで下落しました。わずかな反発が続き、このレベルがまだ一時的なサポートを提供していることを示しています。短期移動平均線はベアリッシュな状況のままですが、MACDインジケーターはブルッシュクローソーバーに近づいており、短期的な反発の可能性を示唆しています。価格と出来高が上昇の勢いを維持できるかどうかを注視してください。[1]

- ETHイーサリアムは過去24時間で12.13%下落し、現在1,601ドルで取引されています。範囲内での調整の後、ETHは今朝強いボリュームで1,750ドルのサポートレベルを下抜け、一時的なサポートを1,530ドル付近で見つけました。短期的な底が形成されつつある初期の兆候があります。[2]

- ETF—— SoSoValueによると、4月4日、米国の現物ビットコインETFは6,488万ドルの流出を記録し、一方、米国の現物イーサリアムETFは206万ドルの流入を記録しました。データは4月7日11時(UTC+8)時点です。

- オルトコイン— ほかのオルトコイン市場は弱いままで、大きな上昇は見られませんでした。[5]

- 米国株指数4月4日、S&P 500は5.97%、ダウ平均株価は5.50%、ナスダックは5.82%下落しました。[6]

- スポットゴールド- スポットゴールドは1.76%下落し、1オンスあたり2,980.49ドルとなりました。 4月7日10:00(UTC+8)時点のデータです。[7]

- Fear & Greed Index現在、指数は23で、市場は極度の恐怖感を示しています。[8]

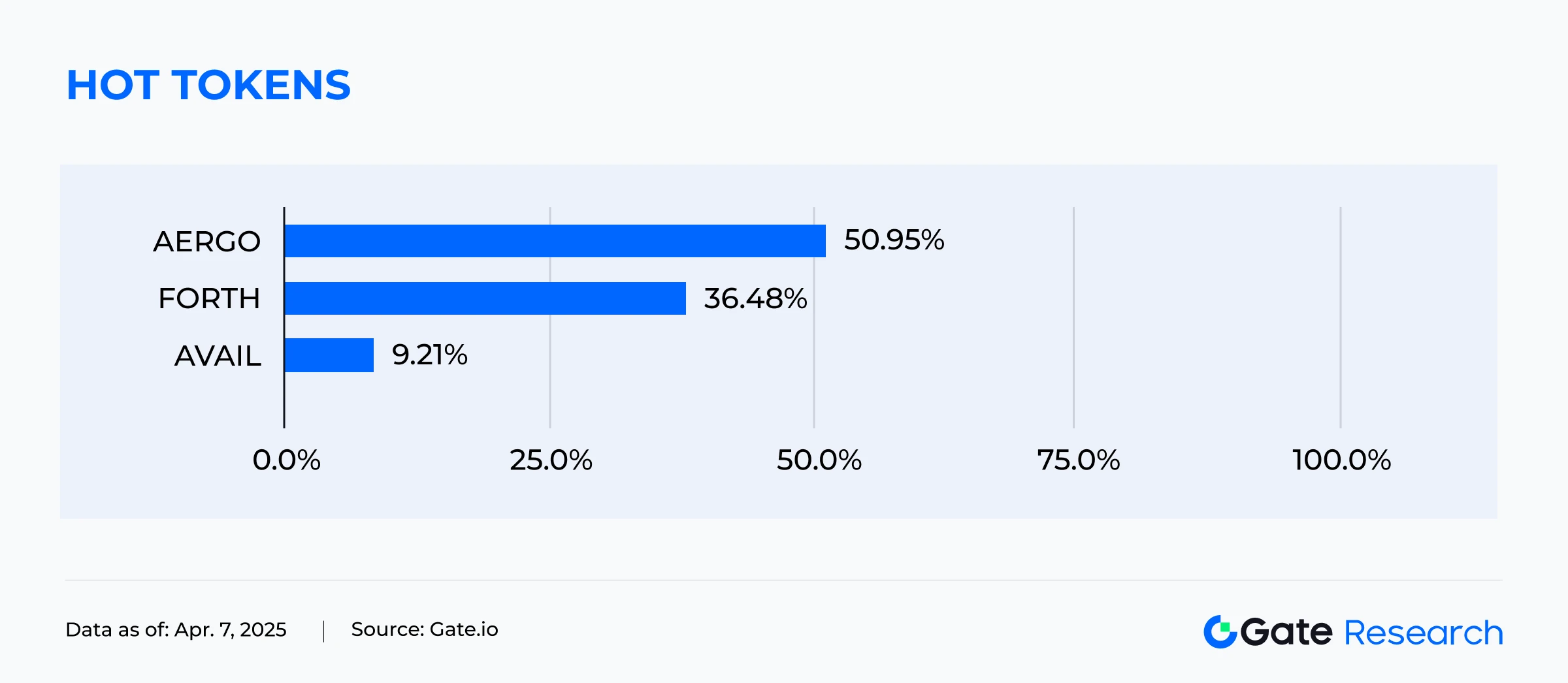

トップパフォーマー

Gate.comの市場データ[9]によると、過去24時間で取引高と価格変動に基づくと、最もパフォーマンスの良いオルトコインは次のとおりです:

AERGO (Aergo)- 約50.95%の日次増加率で、流通市場規模は3745万ドルです。 Aergoは、許可されたおよび許可されていないブロックチェーンアーキテクチャをサポートするために設計されたオープンソースのエンタープライズブロックチェーンプラットフォームであり、ハイブリッド展開モデルを可能にします。 プラットフォームの主要な特徴の1つは、SQLサポートの統合であり、これによりデータ管理が簡素化され、スマートコントラクト開発のための馴染みのある環境が提供されます。 [10]

AERGOトークン価格の最近の急上昇は、主にAIP-21提案の投票とそれに関連するインセンティブスキームによって推進されています。チームは、投票者に対して総供給量の1%にあたる1700万HPPトークンのエアドロップを発表し、投票権の重みに基づいて分配します。これにより、コミュニティの参加が大幅に増加し、多くのユーザーが事前にサポートされているウォレットにAERGOトークンを移動させ、市場需要が直接的に増加しました。

AIP-21提案では、HPPトークンの76%がエアドロップ、開発者への助成金、エコシステムの成長などコミュニティインセンティブ用に割り当てられるトークノミクスモデルも概説されています。投票者に報酬を提供する期間限定の「コミュニティパワースプリント」イベントと組み合わせることで、このキャンペーンは投機的な買い注文を引き付けました。

技術的観点から見ると、提案のHPPレイヤー2ネットワークをOPスタックを使用して構築し、Superchainとの互換性を確保する計画は、Aergoの既存のレイヤー1エンタープライズサービスとのシナジーを生み出すことが期待されています。このデュアルレイヤーアーキテクチャは、市場がプロジェクトに対する長期的な信頼を強化します。ガバナンスインセンティブと技術革新の組み合わせが、現在の価格急騰を最終的に牽引しています。

FORTH (Ampleforth)- 約36.48%の日次増加率で、時価総額は約2,925万ドルです。

Ampleforthは、主に貸出しのために設計された、需要に応じてそのネイティブトークンの供給を調整する革新的なメカニズムを導入し、分散型および弾力性のある供給安定資産を提供する、イーサリアムベースのブロックチェーンプラットフォームです。[11]

FORTHの価格の最近の上昇は、革新的なデザインで市場の注目を集めている新しいデュアルアセットシステム(AMPL + SPOT)の導入によるものです。このシステムの中核には、AMPL(弾力的供給資産)とSPOT(低ボラティリティ資産)との相互作用が必要です。“トランチング”メカニズムを使用して、プロトコルは非USDペッグの通貨システムを作成し、長期的な購買力を維持しながら資本効率を最適化することを目指しています。AMPLは基準資産として機能し、供給の弾力性を通じてシステムの安定性を維持します。一方、SPOTは低ボラティリティでイールドを向上させた投資オプションを提供します。SPOT-stAMPLなどのメカニズムを通じて可能になる両者の動的なバランスは、ボラティリティを生産性に変え、DeFiプロトコルや機関投資家の両方から関心を集めています。この革新はリスク管理やポートフォリオ構築のための新しいツールを提供し、プロトコルのガバナンストークンであるFORTHへの需要を増加させ、そのエコシステム全体の成長に貢献しています。

AVAIL (Avail)- デイリー増加率は約9.21%で、流通市場時価総額は$57.80百万ドルです。

Availは、Web3エコシステムにおけるデータの利用可能性と相互運用性の課題を解決することに焦点を当てたモジュラーベースレイヤーブロックチェーンプロジェクトです。信頼性のあるデータの利用可能性を確保するためにKZG多項式コミットメントを使用し、スケーリングソリューションが安全に成長し、クロスエコシステムの相互作用を可能にしながら、Web3の統一インフラストラクチャとして機能します。[12]

AVAILの最近の価格上昇は、Lens Chainの発売が成功したことと、データ可用性(DA)レイヤーとしてAvailを採用したことが主な要因です。650,000人以上のユーザーを抱える大規模なSocialFiプラットフォームであるLens Chainの統合は、Availの技術的信頼性と実用的価値を実証し、AVAILトークンの需要を直接押し上げます。さらに、アベイルが新たに発表した技術ロードマップは、市場の信頼を強めています。ロードマップでは、ブロック生成の改善、データ可用性サンプリング(DAS)、SNARKベースのトランザクション圧縮などの最適化により、ブロックサイズを4MBから10GBに増やし、ブロック時間を20秒から600ミリ秒に短縮し、ネットワークスループットを大幅に向上させる3段階の計画を概説しています。投資家の楽観的な見方は、zkSyncやQuickNodeとのパートナーシップや、10GBインフィニティブロックなどのテストイニシアチブなど、継続的なエコシステムのコラボレーションによってさらに裏付けられています。Lens Chainによる積極的な採用、野心的な技術アップグレード、強力なエコシステムの支援が相まって、今回の価格高騰を後押ししています。

データのハイライト

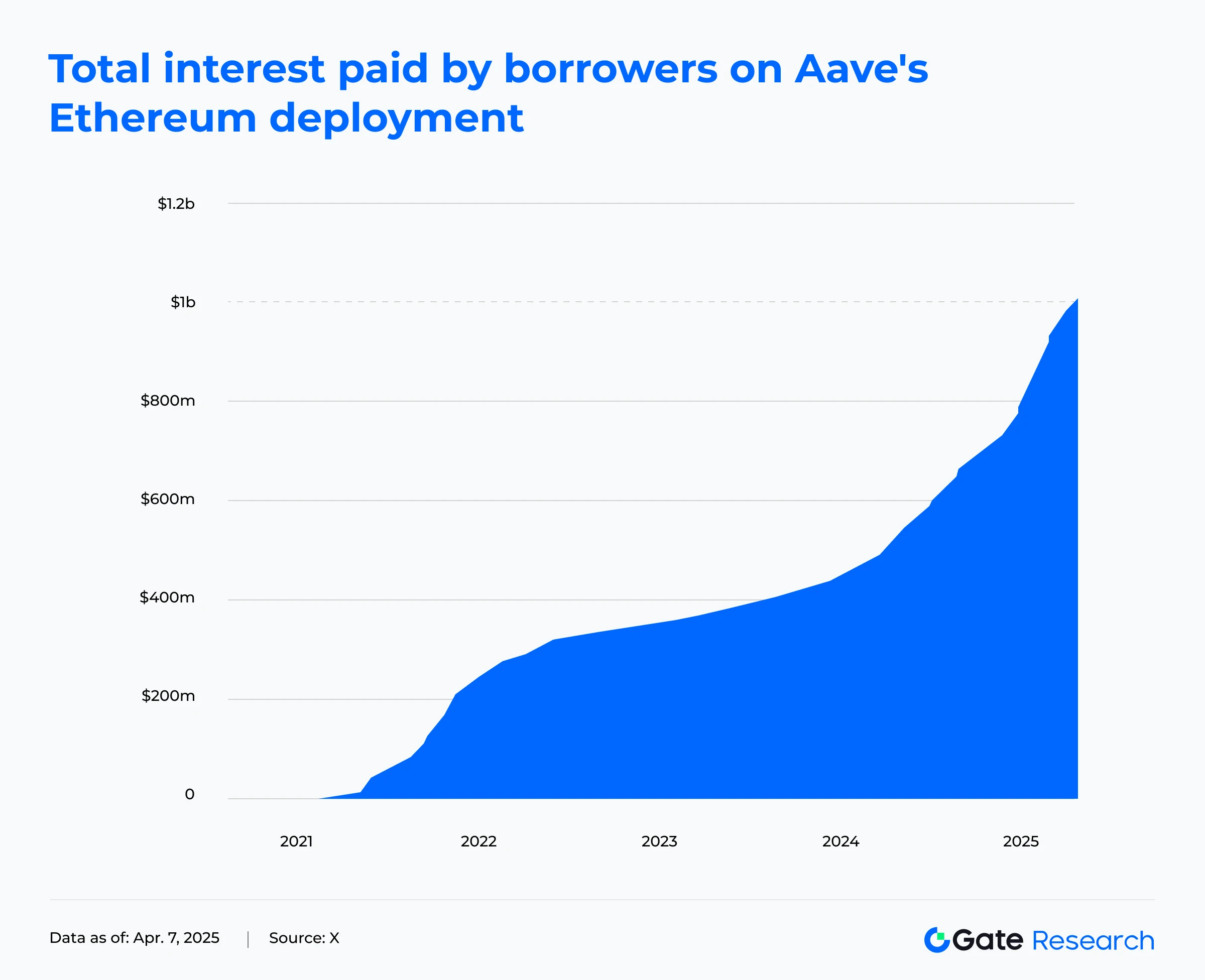

Aaveのイーサリアムにおける借入金利が10億ドルを超える

イーサリアムネットワーク上で展開されたAaveプロトコルによる借り手が支払った合計利息が10億ドルを超えました。チャートに示されているように、この数字は加速するペースで成長し、2024年から2025年の間に顕著な上向き曲線が現れました。2022年から2023年まで、Aaveの借り手によってイーサリアム上で生み出された総利息は3億ドルから約5億ドルに着実に増加しました。しかし、2024年後半には成長が急速に加速し、2025年初頭に10億ドルのマイルストーンを突破しました。

Aaveは、ユーザーが提供する流動性プールから資産を引き出した後に可変金利を支払う借り手から利子を生み出します。プロトコルは、各資産に対してリザーブファクターを設定し、利子が流動性提供者とプロトコル自体の間でどのように分配されるかを決定します。近年、Aaveは年間数億ドルの収益を安定して生み出しており、総ロックアップ価値(TVL)の増加は借入金利の蓄積をさらに後押ししています。

このマイルストーンは、AaveがDeFiスペースの主要な貸出プラットフォームとしての地位を強調するだけでなく、過去4年間にわたる分散型ファイナンスセクター、特に貸出セグメントの広範な成長を反映しています。継続的な上昇トレンドは、より多くのユーザーが借入のために分散型金融ソリューションに頼る傾向を示しており、金融業界におけるブロックチェーン技術の成長する実用性をさらに裏付けています。[13]

Solana TVLが2023年以来の新記録を達成、DEX市場シェアは強いままです

最近、Solanaは強力なオンチェーンのパフォーマンスを維持しています。 3月31日以降、SOLの価格が約19%下落したにもかかわらず、ネットワーク内の総ロックバリュー(TVL)は53.8百万SOLに達し、約65億ドルに相当する2022年半ば以来の新記録を樹立しました。これはBNB Chainをほぼ7.8億ドルも上回る金額です。分散型取引所(DEX)の市場シェアも24%に上昇し、市場で2番目の位置を堅持しています。Jito、Jupiter、Kaminoなどの主要なDAppsは非常に優れたパフォーマンスを発揮し、ネットワークに資金を引き付け続けています。

ただし、ソラナのオンチェーンデータが活発であるにもかかわらず、SOLの価格はそれに見合った強化を見せていません。4月4日には、約179万SOLがアンロックされ、2億ドル以上の売り圧力が生じました。初期ステーカーの利益確定の意向と相まって、これが価格を下押ししました。同時に、ソラナ上のミームコインの人気が低下しており、WIF、POPcat、BOMEなどのコインは1週間で20%以上の一般的な下落を経験しており、これが短期的なユーザーアクティビティを抑制しています。

さらに、最近、主要な資産が下落し、リスク選好が低下する中、全体的な仮想通貨市場は不振であり、これによりSOLを取り巻くネガティブな感情が高まっています。それでも、Solanaのインフラ、ユーザーエクスペリエンス、および開発者活動の進展は市場に認められています。MEV(最大抽出可能価値)メカニズムに関する論争が続いているにもかかわらず、コミュニティは最適化ソリューションを推進し続けています。全体として、SolanaはDeFiエコシステム内で競争力のあるプラットフォームとしての地位が強く、今後のパフォーマンスは引き続き注目に値するものとなっています。[14]

3月に主要なDeFiプロトコルの収益が急落、Sky(旧MakerDAO)はトレンドに逆らって成長

3月には、Solana、Ethereum、BNB Chainのほとんどの主要なDeFiプロトコルの収益が50%以上減少しました。Pump.fun、Jito、RaydiumなどのSolana上の主要なDeFiプロトコルは、3月に約4200万ドルの総収益を上げ、前月比55%減少しました。BNB Chainでは、PancakeSwapの3月の収益はわずか2100万ドルで、前月比54%減少しました。同様に、Ethereum上のDeFiプロトコルであるEthena、Lido、Aaveも同様の傾向を示し、3月の総収益はわずか2450万ドルで、2月から52%減少しました。ただし、Sky(以前のMakerDAO)は、3月に49%の月次成長を記録し、収益が1350万ドルに達し、収益が増加した唯一のプロトコルとなりました。その収入は主にステーブルコインの安定料金と清算料金から得られ、持続可能なビジネスモデルの重要性を強調しています。

主要なDeFiプロトコルの収益減少は、オンチェーンの活動や取引量の一般的な減少、およびユーザーの活動の低下によるものと考えられます。これは、分散型ファイナンスの需要の減少を反映しており、取引量と貸出活動が減少しています。DeFiプロトコルの数が増えるにつれて、市場競争が激化し、主要なDeFiプロトコルの収益に影響を与えています。さらに、一部のプロトコルは利益モデルに持続可能性の問題を抱えているかもしれません。多くのプロトコルは、トークンインフレーションに依存してユーザーに流動性を提供するようインセンティブを与えており、取引手数料や借入金利などの実際の収入を生み出すのではなく、このモデルは熊市で維持するのが難しいです。持続不能な高収益設計や過剰なレバレッジは、ユーザーによるパニック引き出しを招き、"デススパイラル"を作り出しています。

スポットライト分析

関税政策が世界市場に衝撃を与え、株式市場や仮想通貨市場の減少を加速

2025年4月2日、トランプ大統領は、中国、カナダ、メキシコを含む複数の国からの輸入品に新たな関税を発表し、米国の内需産業を保護し、貿易赤字を減らすことを目指しています。しかし、この政策はすぐに市場を混乱させました。4月3日、S&P500指数はほぼ5%暴落し、2020年以来の最悪の一日のパフォーマンスとなりました。この指数は4月4日にも下落を続け、2日間で5兆ドル以上の市場価値を消し去り、史上最大の下落となりました。日本の株式市場も同様に影響を受け、ニッケイ225とTOPIX指数は週間でそれぞれ約9%と10%下落し、その政策の影響が世界の市場にも波及していることを示しています。2025年4月7日現在、世界の金融市場は4月2日にトランプ政権が発表した大規模な関税措置の影響を引き続き吸収しており、市場にパニックが広がっています。S&P500先物はさらに5%下落し、ビットコインの価格は一時75000ドルまで下落しました。

これらの関税措置は、市場や経済にさまざまな影響を与えています。米国は国内製造業を強化しようとしていますが、関税は輸入コストを上昇させ、消費者に圧力をかけ、インフレをもたらす可能性もあります。さらに、他の国が報復措置を取れば、米国の輸出に影響する可能性があります。VIX(ボラティリティ指数)は4月4日に40を超える急騰を見せ、市場のリスク回避が明らかでした。資本市場の不確実性は、KlarnaやCircleなどの企業がIPOを延期すると発表した企業の行動に反映され、投資家や企業が市場の信頼が明らかに揺らいでいることを示しています。暗号市場も免れませんでした。ビットコイン(BTC)は先週3.7%下落しましたが、週末には反発し、ある程度の強靱さと安定性を示しました。ただし、連邦準備制度理事会のパウエル議長の最近の発言により、市場の緩和的な政策への期待が損なわれ、リスク資産に下方圧力がかかりました。ビットコインは日曜日の夜に再び下落し、指数先物の下落とともに、その価格はさらに75000ドルまで下落し、その広範な市場の下方圧力から完全に分離していないことを示しています。[17]

Lens Protocol Mainnet“Lens Chain”が正式にローンチされました

Lens Protocolは4月4日、公式にメインネットLens Chainをローンチしました。Availのデータ可用性レイヤーとzkSyncテクノロジーを使用して構築されたLens Chainは、ネットワーク全体でスケーラビリティとセキュリティを向上させるよう設計されています。また、GHOステーブルコインをガスとして利用し、スケーラブルで高速かつガス不要のトランザクションを実現しています。分散型ソーシャルアプリケーションの開発をサポートするために、Lensメインネットはいくつかのコアインフラコンポーネントを統合しています。まず、Social Protocolはアカウント、投稿、グループなどの事前構築されたソーシャルプリミティブを提供しています。これらのモジュールは柔軟で簡単に統合でき、開発者は既存のアプリ内でスタンドアロンの機能として埋め込むことができます。次に、ユーザーがコンテンツとデータセキュリティを管理できるオンチェーンの権限付きストレージシステムであるGroveがあります。さらに、開発者ダッシュボードは、開発者が迅速にソーシャルモジュールを統合できる直感的なインターフェースを提供しています。プロのプログラミングスキルがなくても、簡単に始めることができます。

メインネットのローンチは、Lensプラットフォームの大規模なアップグレードを象徴し、そのSocialFiインフラストラクチャのパフォーマンスと機能性を大幅に向上させます。zkSyncのハイパーチェーン技術とAvailのデータ可用性レイヤーのスケーラビリティを活用することで、Lens Chainは安全で効率的なオンチェーン取引を実現し、永続的なコンテンツストレージと柔軟な削除の両方をサポートします。これにより、ユースケース全体で多様なデータ管理ニーズに対応し、大規模な分散型ソーシャルアプリケーションの成長のための強固な基盤を提供します。

一方、Farcasterのような競合他社はまだ初期段階にあり、現在はユーザーデータをチェーン上にアンカーにするだけで、まだ完全なメインネットは立ち上がっていません。この文脈において、Lensのメインネットのデビューは、セキュリティ、スケーラビリティ、機能の完全性の観点から明確な優位性を持っています。この利点は、将来のSocialFi市場の景観を変える可能性があります。

Lensは現在、約650,000人のユーザープロファイルと28百万のソーシャルコネクションをホストしています。これらの数字はまだ伝統的なソーシャルプラットフォームに及びませんが、「ブロックチェーン上のソーシャルメディア」というビジョンは着実に現実のものとなっています。コミュニティはこのローンチに前向きな反応を示し、これがSocialFiセクターへの再投資関心を促し、広範な金融市場に新たな資本を呼び込む可能性があります。[18]

SECはバイデン政権時代のデジタル資産ポリシーを見直し、規制緩和の道を開く可能性がある

2025年4月6日、米国証券取引委員会(SEC)は、バイデン政権時代に制定されたデジタル資産規制政策の見直しを発表しました。レビューには、投資契約分析フレームワーク、ビットコイン先物市場に関するガイダンス、および暗号に関する開示書に関連するスタッフの声明が含まれています。このイニシアチブは、2025年1月にトランプ大統領が署名した大統領令14192「規制緩和による繁栄の解き放ち」に端を発しています。この大統領令は、連邦政府機関に対し、経済成長と技術革新を優先して、冗長な規制を特定して排除するよう指示しています。レビューの目的は、新政権のより暗号に優しく、イノベーション主導の政策スタンスに沿って、「修正または撤回すべきスタッフの声明を特定する」ことです。2023年から2024年の間に発行されたスタッフガイダンスは、トークンが証券を構成するかどうかの定義、暗号空間に参入する企業の開示要件、ビットコイン先物ファンド投資のリスクガイドラインなど、デジタル資産規制の重要な参考資料として機能しています。これらの枠組みは、今や弱体化または撤回される可能性がある。

この政策転換は、SECが新政権の方針に合わせて積極的に調整していることを示しています。トランプ大統領は、規制緩和の支持者であるポール・アトキンスをSEC委員長に指名し、SECと行政府との連携を強化しました。しかし、この動きにより、消費者保護の提唱者の間で懸念が高まっており、規制緩和が暗号市場投資家にリスクをもたらす可能性があると主張しています。SECは現在、立法上の責任と行政府のイノベーションと経済成長の促進目標とのバランスを取る課題に直面しています。このバランスは、機関の内部リソース配分と執行上の優先事項を形作ります。全体として、暗号業界はより緩和された規制環境から利益を得る可能性があり、イノベーションを促進し、より多くの投資を引き寄せるかもしれません。同時に、市場操作や詐欺に対抗し、投資家の信頼を維持することが不可欠です。[19]

資金調達ニュース

RootDataによると、過去72時間に、ブロックチェーン関連の4つのプロジェクトが公に資金調達ラウンドを発表し、合計2900万ドル以上を調達しました。これらのプロジェクトは、ブロックチェーンインフラストラクチャやAIなどの分野にまたがっています。以下に、各資金調達ラウンドの詳細があります:[20]

コーデックスCodexは、Dragonfly、Coinbase Venturesなどが参加したシードラウンドで1,580万ドルを調達しました。Codexはステーブルコイン用の専用ブロックチェーンを構築することに焦点を当てたスタートアップです。その目標は、一般的な用途のブロックチェーンに比べてステーブルコイン取引のためのより効率的なプラットフォームを作成するために、インフラを最適化することです。主な機能には、安定した取引手数料、ステーブルコインを法定通貨に換金するための組み込みのオフランプ、および潜在的にプライバシーを保護する取引が含まれます。新しい資金は、ステーブルコインに焦点を当てたブロックチェーンの開発を進めるために使用されます。

ウルトラ — Ultraは、NOIA Capital、MV Global、および他の著名な投資家による1200万ドルの資金調達を実施しました。Ultraは、開発者とプレイヤーの両方を強化することを目的とした次世代のブロックチェーンベースのPCゲーム配信プラットフォームです。カーボンニュートラルで高速かつ手数料がかからないレイヤー1ブロックチェーンを提供し、NFT規格とマーケットプレイスをサポートし、完全なブロックチェーンゲームソリューションを形成しています。その中核製品、ウルトラゲームス, Steamに競合を目指す自己出版プラットフォームであり、ゲーム配信の景観を再定義することを目指しています。[22]

P2P.meP2P.meはCoinbase VenturesとMulticoin Capitalの支援を受け、200万ドルのシードラウンドを完了しました。P2P.meは、主にUSDCを中心とした仮想通貨と法定通貨の素早い変換に焦点を当てた分散型のピア・ツー・ピア決済プラットフォームです。ユーザーは簡単にQRコードをスキャンすることで取引を完了できます。このプラットフォームでは、ゼロ知識証明技術を使用して本人確認を行い、プライバシーを向上させながら不正行為や凍結された銀行口座のリスクを低減しています。[23]

エアドロップの機会

CESSネットワーク

CESS Networkは、ユーザーに安全で透明性があり超高速なストレージソリューションを提供するよう設計された分散型データインフラストラクチャで、AI、DeSci、ゲーム産業におけるデータ所有権の再定義を目指しています。AI、科学研究、デジタル分野向けにカスタマイズされた分散型クラウドストレージ基盤を構築することで、CESSはユーザーにデータの完全な所有権と制御を提供します。

このプラットフォームは、高速なデータアクセスのためにCD²N(Content-Defined Decentralized Network)を使用し、安全なデータ共有のためにプロキシ再暗号化(PReT)技術を活用しています。これらの革新は、次世代の分散型ストレージソリューションの道を開いています。[24]

CESSは現在、CESS DeShare Airdropというポイントベースのキャンペーンを実施しています。ユーザーは簡単なソーシャルタスクを完了したり、友達を招待することでポイントを獲得でき、後で$CESSトークンと交換することができます。

参加方法:

- 公式のCESS DeShare Airdropウェブサイトを訪れて、アカウントを登録してください。

- 毎日チェックインしてクイズに参加してポイントを獲得してください。

- 友達を招待して追加ポイントを獲得する。

注意:

エアドロッププログラムと参加方法はいつでも更新される可能性があります。ユーザーは最新情報を入手するためにCESS Networkの公式チャンネルをフォローするように勧められています。いつも通り、注意して参加し、潜在的なリスクを認識し、参加する前に独自の調査を行ってください。Gate.comは将来のエアドロップ報酬を保証しません。

参考:

- Gatehttps://www.Gate.com/trade/BTC_USDT

- Gate.com,https://www.Gate.com/trade/ETH_USDT

- SoSoValue,https://sosovalue.xyz/assets/etf/us-btc-spot

- SoSoValue,https://sosovalue.xyz/assets/etf/us-eth-spot

- CoinGecko,https://www.coingecko.com/ja/categories

- 投資する,https://investing.com/indices/usa-indices

- 投資する,https://investing.com/currencies/xau-usd

- Gatehttps://www.Gate.com/bigdata

- Gate.com,https://www.Gate.com/price

- X,https://x.com/aergo_io/status/1908864516462649355

- X,https://x.com/AmpleforthOrg/status/1907531428692119708

- X,https://x.com/AvailProject/status/1908188086384906729

- X,https://x.com/tokenterminal/status/1908677424394494393

- Dfillama,https://defillama.com/chain/solana?groupBy=daily¤cy=SOL

- Theblock,https://www.theblock.co/data/decentralized-finance/protocol-revenue/monthly-defi-revenue

- Defillama,https://defillama.com/protocol/sky?tvl=false&revenue=true&groupBy=monthly

- Cointelegraph,https://cointelegraph.com/news/crypto-plunges-nasdaq-dow-stock-futures-fall-on-open

- レンズ,https://lens.xyz/news/build-socialfi-apps-faster-with-lens-now-on-mainnet?utm_source=chatgpt.com

- X,https://x.com/SECGov/status/1908546943686492633

- Rootdata,https://www.rootdata.com/zh/Fundraising

- X,https://x.com/codex_pbc

- X,https://x.com/ultra_io

- X,https://x.com/P2Pdotme

- CESS,https://cess.network/deshareairdrop/

Gate リサーチ

Gate Researchは、技術分析、ホットな情報、市況レビュー、業界調査、トレンド予測、マクロ経済政策分析など、読者に深い内容を提供する包括的なブロックチェーンおよび暗号研究プラットフォームです。

Click the リンクもっと学ぶ

免責事項

暗号通貨市場への投資には高いリスクが伴い、ユーザーは独自の調査を行い、投資決定を行う前に購入する資産や商品の性質を完全に理解することが推奨されています。Gate.comはそのような投資決定によって引き起こされた損失や損害について責任を負いません。

関連記事

ファンダメンタル分析とは何か

ETHを賭ける方法は?