比特幣交易:初學者指南,策略,風險和機會

圖片來源:如何在Gate.com上覆制加密貨幣交易

比特幣交易是什麼?

比特幣交易是指購買和出售比特幣(BTC)以從價格波動中獲利的做法。與長期投資不同,長期投資者購買比特幣並持有數年,而交易者的目標是利用短期市場波動。

比特幣交易是如何運作的:一步一步指南

- 選擇一個可靠的交易所 - 像Gate.com這樣的平臺Gate.com為比特幣交易提供安全環境。

- 資金入賬-使用法定貨幣或加密貨幣將資金存入您的交易賬戶。

- 選擇交易策略 - 決定是要進行日內交易、波段交易還是持有比特幣。

- 分析市場-使用技術和基本分析做出明智決策。

- 下訂單-使用限價、市價和止損訂單執行交易。

- 監控您的投資組合-跟蹤您的交易並根據市場波動調整您的策略。

比特幣交易策略類型

日內交易

日內交易者在單日內開倉和平倉,從短期價格波動中獲利。

波段交易

搖擺交易者持有比特幣數天或數週,利用中期趨勢賺取利潤。

剝頭皮

剝頭皮涉及全天進行大量小額交易以積累利潤。

HODLing

HODL(Hold On for Dear Life)是一種長期策略,投資者購買比特幣並持有,儘管有短期價格波動。

影響比特幣價格波動的關鍵因素

- 市場需求和供應-比特幣的固定供應量(2100萬枚)影響其價格。

- 宏觀經濟趨勢 - 通貨膨脹、利率和經濟政策都可能影響比特幣的價值。

- 監管新聞-政府和金融監管機構的公告影響市場情緒。

- 比特幣減半事件 - 每隔約四年發生一次,減少挖礦獎勵,通常導致價格飆升。

- 機構採用-當大公司投資比特幣時,其價格可能顯著上升。

2025年比特幣交易的最佳平臺

一些最好的交易所比特幣交易包括:

- Gate.com- 一家擁有先進交易工具的領先加密貨幣交易所。

- 幣安 - 提供各種交易對和流動性。

- Coinbase – 一個適合初學者的用戶友好平臺。

- Kraken – 以其強大的安全功能而聞名。

如何閱讀比特幣圖表和市場趨勢

比特幣交易者依賴於:

- 蠟燭圖表 - 顯示不同時間段的價格走勢。

- 移動平均線-幫助識別趨勢和支撐/阻力水平。

- 相對強弱指數(RSI)- 表示比特幣是超買還是超賣。

- 斐波納契回撤-有助於識別潛在的反轉點。

比特幣交易者的風險管理技巧

- 設置止損和止盈訂單-保護您的資本免受重大損失。

- 分散投資組合-避免將所有資金投入單一資產。

- 保持情緒穩定 – 避免恐慌拋售和恐懼驅動的決策。

- 明智使用槓桿 – 高槓杆可以放大收益,但也會增加風險。

比特幣交易中要避免的常見錯誤

- 缺乏研究 - 在不瞭解比特幣基本原理的情況下交易。

- 忽視風險管理 - 未使用止損訂單。

- 過度交易 - 過度交易可能導致不必要的損失。

- 落入詐騙陷阱-始終使用像Gate.com這樣的信譽良好的交易所Gate.

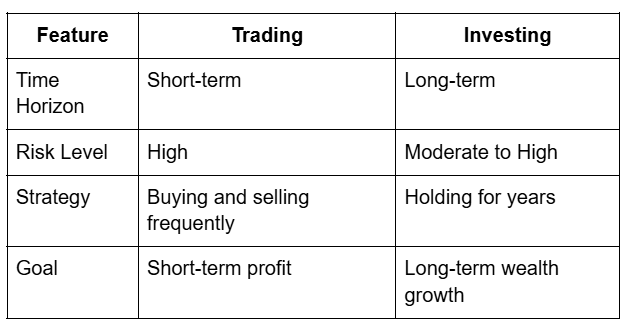

比特幣交易與投資:有何區別?

如何在Gate.com上開始比特幣交易

- 註冊Gate.com

- 完成KYC驗證

- 存入資金

- 選擇交易對(例如,BTC/USDT)

- 執行您的第一筆交易

- 使用高級交易工具制定更好的交易策略

結論:比特幣交易適合您嗎?

比特幣交易提供了巨大的機會,但也伴隨著風險。無論您是初學者還是經驗豐富的交易者,都可以使用像Gate.com這樣值得信賴的平臺。Gate遵循穩健的策略可以增強您的成功。從今天開始交易,但始終記得要負責任地交易並有效管理風險。

作者: Adewumi Arowolo

* 投資有風險,入市須謹慎。本文不作為 Gate 提供的投資理財建議或其他任何類型的建議。

* 在未提及 Gate 的情況下,複製、傳播或抄襲本文將違反《版權法》,Gate 有權追究其法律責任。

相關文章

新手

黃金價格走勢:市場焦點轉向鮑威爾演說

投資人態度謹慎,受美元走強及加密貨幣現貨市場需求減弱影響。此外,市場也密切關注美國聯邦準備理事會主席鮑威爾在 Jackson Hole 會議上的最新談話。

8-21-2025, 8:20:53 AM

新手

新手必讀:2025 年最新美債 ETF 推薦及策略

美國國債ETF是新手投資人進行穩健配置的最佳選擇。本文結合最新殖利率變化及主流ETF之推薦,介紹多種不同期限的美國國債ETF,協助投資人快速入門並有效優化投資組合。

8-12-2025, 7:24:10 AM

新手

Nasdaq 100 指數最新動態與投資策略

本文深入分析 Nasdaq 100 指數近期的市場動態。探討科技股引領的成長趨勢,並說明投資人如何善用 ETF 或個股把握機會,以達成穩健的投資目標。

9-15-2025, 5:50:31 AM

新手

2025 年房屋稅新制全方位解析—政策修訂重點及納稅人因應對策

2025 年房屋稅新制將於 2025 年全面實施,涵蓋稅率調整、試點範圍擴大及納稅人應對策略,以利全方位掌握最新稅務動向,以便有效規劃房產資產。

8-12-2025, 6:31:26 AM

新手

如何以快速且安全的方式,將資金自 Binance 平台提領出去?

本文將詳細說明如何從 Binance 提款至外部錢包及銀行帳戶的流程,內容涵蓋選擇正確的資產類型、設定收款地址、選擇網路、評估手續費,以及進行安全驗證。

7-24-2025, 9:41:12 AM