Compra criptomonedas

Pagar con

USD

Compra y venta

HOT

Compra y vende criptomonedas a travésde Apple Pay, tarjetas, Google Pay, transferencias bancarias y más

P2P

0 Fees

¡Cero tarifas, más de 400 opciones de pago y compra y venta de criptomonedas sin complicaciones!

Gate Card

Tarjeta de pago con criptomonedas que permite efectuar transacciones internacionales fácilmente

Operar

Básico

Spot

Opera con criptomonedas libremente

Margen

Multiplica tus beneficios con el apalancamiento

Conversión y trading en bloques

0 Fees

Opera cualquier volumen sin tarifas ni deslizamiento

ETF

Obtén exposición a posiciones apalancadas de forma sencilla

Premercado

Opera con nuevos tokens antes de que selisten oficialmente

Avanzado

DEX

Opera on-chain con Gate Wallet

Alpha

Puntos

Consigue tokens prometedores en operaciones on-chain simplificadas

Bots

Trading con un solo clic y estrategias inteligentes autoejecutables

Copiar

Haz crecer tu riqueza siguiendo a los traders top

Trading CrossEx

Beta

Un solo saldo de margen compartido entre plataformas

Futuros

Futuros

Cientos de contratos liquidados en USDT o BTC

Opciones

HOT

Opera con opciones estándar al estilo europeo

Cuenta unificada

Maximiza la eficacia de tu capital

Trading de prueba

Comienzo del trading de futuros

Prepárate para operar con futuros

Eventos de futuros

Participa en eventos para ganar generosas recompensas

Trading de prueba

Usa fondos virtuales para probar el trading sin asumir riesgos

Earn

Lanzamiento

CandyDrop

Acumula golosinas para ganar airdrops

Launchpool

Staking rápido, ¡gana nuevos tokens con potencial!

HODLer Airdrop

Holdea GT y consigue airdrops enormes gratis

Launchpad

Anticípate a los demás en el próximo gran proyecto de tokens

Puntos Alpha

NEW

¡Opera con activos on-chain y recibe recompensas por airdrop!

Puntos de futuros

NEW

Gana puntos de futuros y reclama recompensas de airdrop

Inversión

Simple Earn

Genera intereses con los tokens inactivos

Inversión automática

Invierte automáticamente de forma regular

Inversión dual

Compra a la baja y vende al alza para aprovechar las fluctuaciones de los precios

Staking flexible

Gana recompensas con el staking flexible

Préstamo de criptomonedas

0 Fees

Usa tu cripto como garantía y pide otra en préstamo

Centro de préstamos

Centro de préstamos integral

Centro de patrimonio VIP

La gestión patrimonial personalizada potencia el crecimiento de tus activos

Gestión patrimonial privada

Gestión de activos personalizada para hacer crecer sus activos digitales

Quant Fund

El mejor equipo de gestión de activos te ayuda a obtener beneficios sin complicaciones

Staking

Haz staking de criptomonedas para ganar en productos PoS

Apalancamiento inteligente

NEW

Sin liquidación forzosa antes del vencimiento, ganancias apalancadas sin preocupaciones

Acuñación de GUSD

Usa USDT/USDC para acuñar GUSD y obtener rendimientos a nivel tesorería

Más

Promociones

Centro de actividades

Participa en las actividades y gana grandes premios de dinero y merchandising exclusivo

Referido

20 USDT

Gana un 40•% de comisión o hasta 500•USDT en recompensas

Anuncio

Anuncios de nuevos listados, actividades, actualizaciones, etc.

Blog de Gate

Artículos del sector de las criptomonedas

Servicios VIP

Grandes descuentos en tarifas

Prueba de Reservas

Gate garantiza el 100 % de prueba de reservas

Afiliados

¡Consigue comisiones exclusivas y gana una alta rentabilidad!

Gestión de activos

NEW

Solución integral para la gestión de activos

Institucional

NEW

Soluciones profesionales de activos digitales para instituciones

Transferencia bancaria OTC

Deposita y retira fiat

Programa de bróker

Reembolsos generosos mediante API

Gate Vault

Mantén tus activos seguros

La cena de Trump aviva a TRUMP, ¿habrá oportunidades de operación en el futuro?

[TL;DR]:

El 23 de abril, el sitio web oficial de TRUMP meme coin anunció que los usuarios que posean en promedio TRUMP en las posiciones 220 más altas serán invitados a la “CENA TRUMP”. Esta buena noticia provocó un aumento temporal del 80% en el token TRUMP.

Según los datos de Nansen y Chainalysis, en los siete días que finalizaron el 25 de abril, los flujos netos de salida del token TRUMP alcanzaron los 869 millones de dólares, mientras que las entradas fueron solo de 96 millones de dólares, lo que muestra que muchos tenedores optaron por vender en los máximos.

El futuro del token TRUMP depende de la influencia continua de Trump, la capacidad de ejecución del equipo del proyecto y el regreso a la racionalidad del mercado.

Introducción

Después de tres meses de caída continua, el token TRUMP ha vuelto a ser objeto de especulación en el mercado recientemente debido a la “CENA TRUMP”, con el precio del token subiendo de 8 dólares a alrededor de 16 dólares en su punto más alto. Este artículo detalla el evento del aumento de TRUMP impulsado por la cena de Trump y revela la lógica detrás de la volatilidad del mercado.

Cena de Trump, impulsa el aumento de TRUMP tras la caída.

Desde que el token TRUMP alcanzó su máximo histórico el 19 de enero de este año, ha estado en una tendencia de caída durante 3 meses. Especialmente el 18 de abril, TRUMP experimentó un desbloqueo del 4% de los tokens, lo que se convirtió en la pista principal para que el mercado continuara vendiendo y presionando el precio del token.

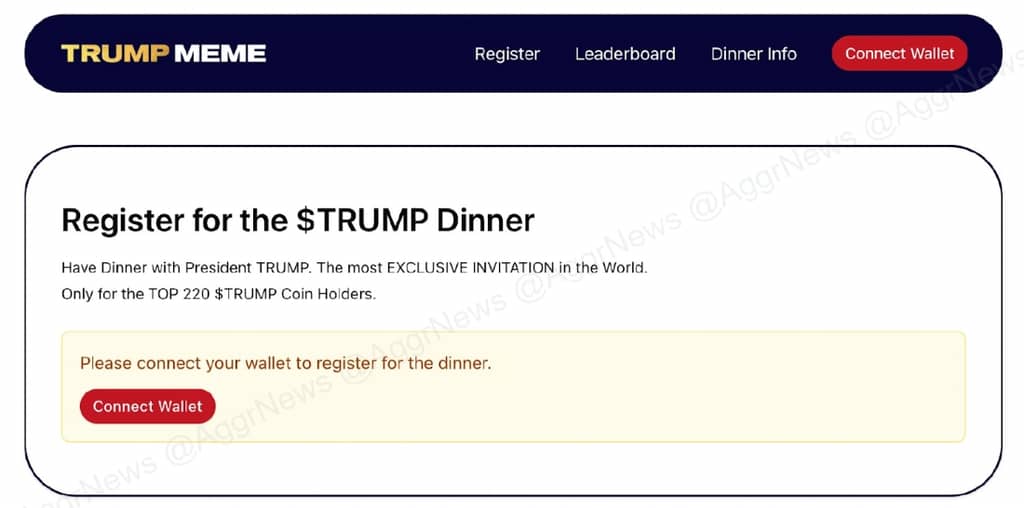

Sin embargo, apenas dos días después, comenzaron a circular en la comunidad noticias de que Trump planeaba organizar una cena para los poseedores de tokens TRUMP. Para el 23 de abril, el sitio web oficial de la moneda meme TRUMP confirmó la noticia, y el anuncio publicado afirmaba que los usuarios con un promedio de tenencia en las primeras 220 posiciones serían invitados a esta cena. Figura 1 Fuente: TRUMP MEME

Figura 1 Fuente: TRUMP MEME

Tras el anuncio, el precio del token TRUMP se disparó, con un aumento de la capitalización de mercado de más de 100 millones de dólares y un aumento máximo diario de más del 80%. Sin embargo, cabe mencionar que, posteriormente, un anuncio oficial indicó que los 4 principales poseedores que asistan a la cena de TRUMP podrán obtener un reloj Trump Tourbillon de edición limitada, lo que provocó que la moneda no pudiera mantener su impulso y experimentara una leve caída. Figura 2 Fuente: Gate.io

Figura 2 Fuente: Gate.io

Además, el oficial de TRUMP Meme también ha declarado en dos ocasiones que no se desbloquearán tokens durante el evento de clasificación de la cena, y que el desbloqueo del lote inicial y los siguientes se extenderán 90 días.

La reducción de la presión de venta a corto plazo en el mercado, así como el potencial empoderamiento de los tokens, desencadenó más de USD 2.4 mil millones en transferencias de tokens en la cadena, el mayor volumen diario de operaciones de CEX desde mediados de febrero, e impulsó otros tokens relacionados con la familia Trump como MELANIA, demostrando plenamente la energía gritona de Trump en el mercado de criptomonedas.

Sin embargo, la cena para los poseedores de monedas también ha atraído muchas críticas. Los senadores demócratas Jon Ossoff, Adam Schiff y Elizabeth Warren han criticado públicamente el uso de la presidencia por parte de Trump para beneficio personal, diciendo que la medida podría violar las reglas federales de ética y pidiendo a la Oficina de Ética del Gobierno de Estados Unidos que investigue. Sin embargo, en una administración controlada por los republicanos, estas voces pueden tener dificultades para tener un impacto real. Aún así, la sombra de la controversia sin duda ha arrojado una capa de incertidumbre sobre el futuro del token TRUMP.

Los datos en cadena revelan los movimientos de las ballenas antes y después de la cena de TRUMP

A pesar de que el evento de la cena ha impulsado a TRUMP a subir durante varios días, todavía hay muchos grandes ballenas que están vendiendo en los altos precios. Según los datos en la cadena, en los siete días que terminaron el 25 de abril, la salida neta de tokens TRUMP alcanzó los 869 millones de dólares, mientras que la entrada fue de solo 96 millones de dólares, lo que muestra que muchos poseedores han optado por vender en los niveles altos.

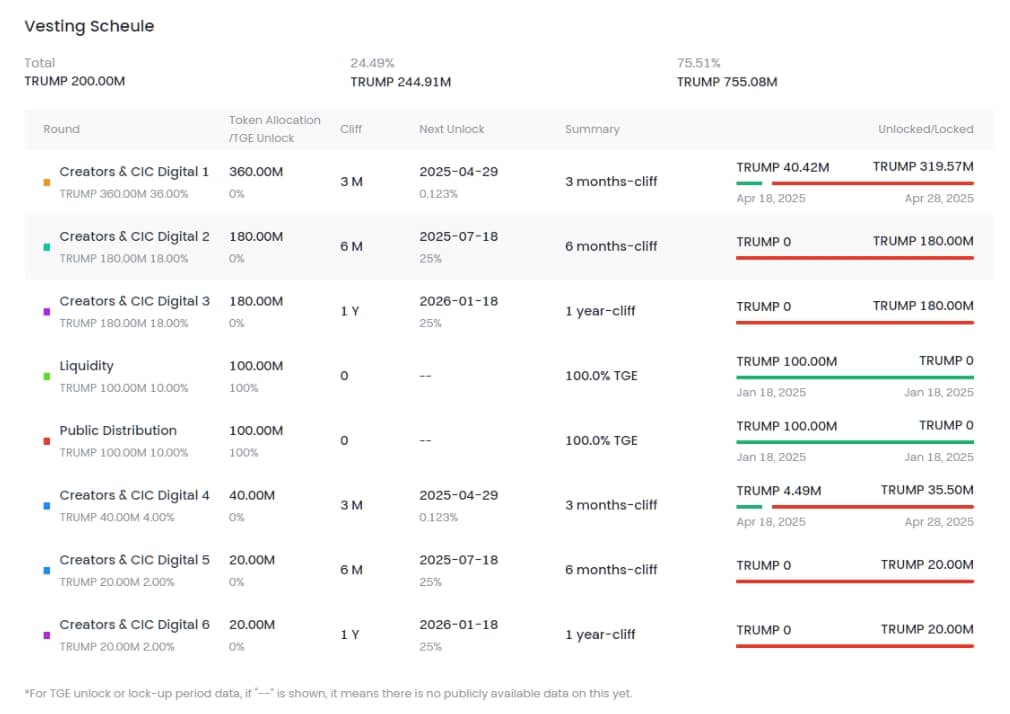

De hecho, las 10 direcciones principales que controlan los tokens de TRUMP tienen el 82% de la oferta circulante, y el equipo del proyecto posee el 80% del suministro total. Aunque actualmente está bloqueado, la presión de venta futura tras el desbloqueo sigue siendo alta. Según el libro blanco, el token TRUMP inició una fase de distribución a largo plazo el 18 de abril de este año, que se espera que continúe hasta mediados de 2028, y en julio de este año se espera el próximo desbloqueo. Si añadimos que la primera fase se retrasó 90 días, entonces la presión de venta dual en julio será indudablemente muy pesada. Los lectores que no son ajenos a la economía de tokens probablemente también sepan que los tokens con una alta concentración similar a menudo enfrentan el riesgo de “venta por parte del equipo”, por lo que los inversores deben tener especial cuidado. Figura 3 Fuente: Gate.io

Figura 3 Fuente: Gate.io

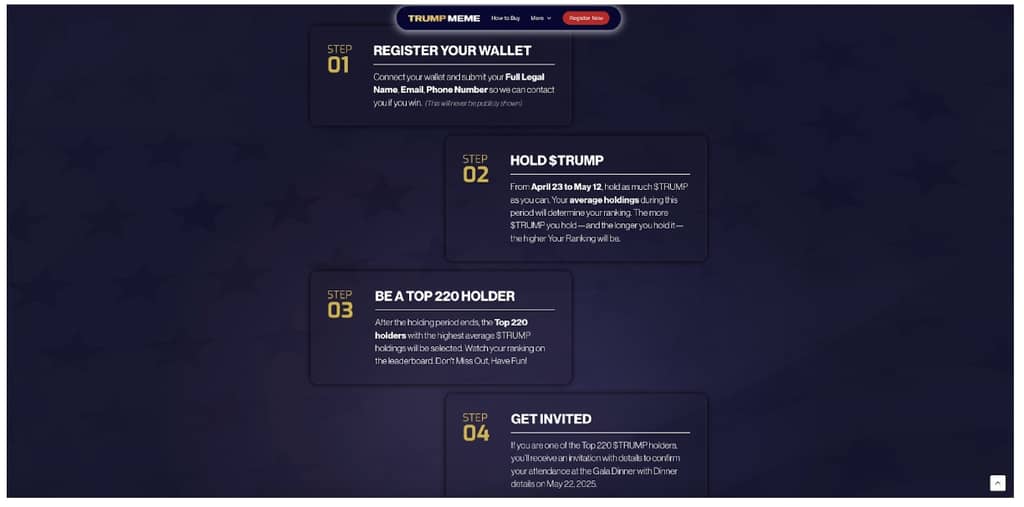

Además, hemos visto que el primer poseedor de tokens es una dirección anónima llamada “Sun” que posee 1.176.800 tokens (por un valor aproximado de 16 millones de dólares), lo que ha suscitado especulaciones sobre si el fundador de Tron, Justin Sun, está involucrado. Además, más ballenas han optado por retirar sus criptomonedas de los intercambios o acumular en la cadena después de que la noticia se difundiera, y solo dos poseedores utilizaron direcciones tempranas, lo que sugiere que no faltan especuladores que entran temporalmente en este “juego de la cena”. Figura 4 Fuente: TRUMP MEME

Figura 4 Fuente: TRUMP MEME

Detrás de este carnaval de precios, la operación de las ballenas gigantes es aún más intrigante. Según el seguimiento on-chain, se estableció una dirección por adelantado a través del mecanismo de ponderación de “tenencias de monedas × tiempo de tenencia”, aumentó su posición antes del anuncio de la cena y luego se vendió en lotes cuando el precio de la moneda subió, con una ganancia única de USD 2.3 millones. Otros están sumidos en el atolladero: un inversor que compró 1.11 millones de tokens a un precio promedio de USD 41 en un máximo en enero perdió USD 33.66 millones, una pérdida del 73%, a pesar de aumentar su posición. Esta situación de hielo y fuego solo muestra que en un mercado dominado por el tráfico y la narrativa, la mala información y las ventajas financieras a menudo aplastan el juicio de los inversores comunes. Figura 5 Fuente: @cryptothedoggy

Figura 5 Fuente: @cryptothedoggy

En resumen, la volatilidad extrema del token TRUMP refleja las contradicciones estructurales de todo el sector de las monedas MEME. Por un lado, su volumen de comercio en 24 horas puede situarse entre los 50 principales activos criptográficos, lo que demuestra el fervor del mercado por la “economía de la atención”; por otro lado, su tendencia de precios está altamente vinculada a la vida política de Trump, y cuando se inicia la investigación del Senado, el precio del token cae un 17%. Esta enorme incertidumbre hace que MEME sea un objetivo preferido para los traders de corto plazo con alto apalancamiento.

El análisis técnico falla, la moneda TRUMP depende de mensajes para fluctuar drásticamente

En opinión del autor, la volatilidad de los tokens de celebridades como TRUMP se debe en gran medida a la especulación del mercado y al efecto de las celebridades. El efecto de celebridad de Trump como presidente de los Estados Unidos es ampliamente aprovechado por el mercado, y por supuesto, esta atención a menudo carece de una base racional, lo que puede provocar fluctuaciones de precios drásticas.

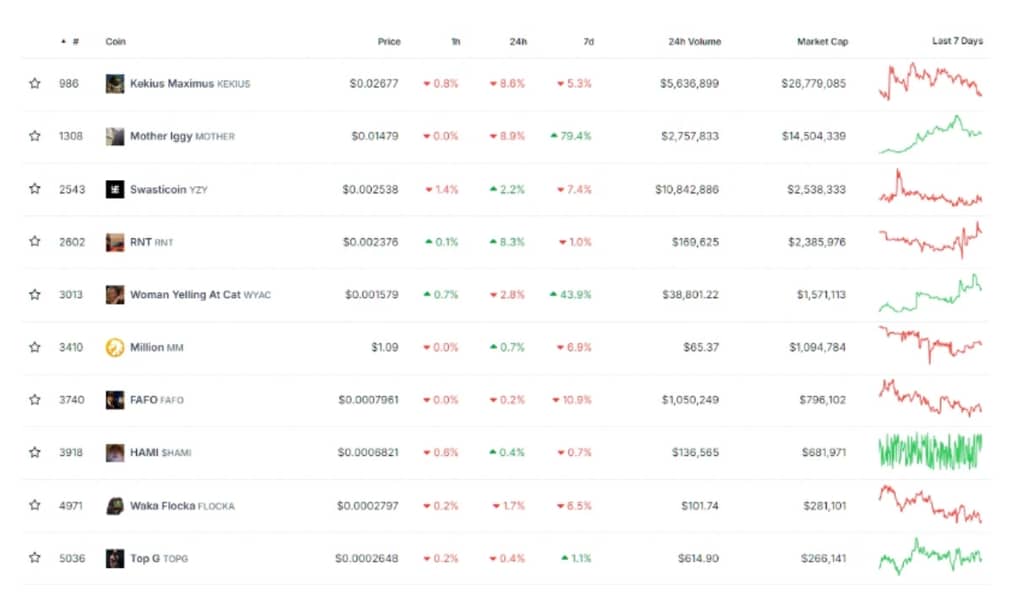

Al ampliar la perspectiva, el token TRUMP es solo un reflejo de las monedas de celebridades en el mercado de criptomonedas. Este tipo de tokens se fundamenta en el respaldo de celebridades para atraer rápidamente fondos a corto plazo, pero el valor a largo plazo suele ser difícil de mantener, como ocurrió el año pasado con JENNER, MOTHER, entre otros. La cena de Trump nos proporciona un excelente caso para observar el auge y la caída de las monedas de celebridades, y nos permite vislumbrar su futuro en el mercado de criptomonedas. Figura 6 Fuente: coingecko

Figura 6 Fuente: coingecko

De hecho, la transformación de Trump en el espacio de las criptomonedas es notable. Hace cuatro años, denunció a Bitcoin como una “estafa”; Hoy en día, es un firme defensor de la industria. Durante su campaña de 2024, se comprometió a convertir a Estados Unidos en una “capital de las criptomonedas” y cumplió esa promesa a través de varias políticas durante su segundo mandato en 2025. La Orden Ejecutiva 14178 del 23 de enero tiene como objetivo aumentar la competitividad de Estados Unidos en finanzas digitales; La orden del 6 de marzo establece una lista de reservas estratégicas de bitcoin y activos digitales. Estas políticas han infundido confianza en el mercado de las criptomonedas y también han proporcionado vientos de cola macro para el token TRUMP.

La estrategia comercial de la familia Trump también es notable. La plataforma World Liberty Financial (WLF) abarca servicios de negociación, custodia y préstamos, mientras que el nuevo stablecoin USD1 podría agregar valor ecológico al token TRUMP. Sin embargo, estas actividades también han suscitado controversias éticas. Como presidente en funciones, ¿constituyen los negocios de Trump un conflicto de intereses? ¿Está utilizando su cargo público para obtener beneficios personales? Estas preguntas generarán dudas entre los inversores sobre la legitimidad y sostenibilidad del token TRUMP. Figura 7 Fuente: TRUMP MEME

Figura 7 Fuente: TRUMP MEME

Desde este punto de vista, el ciclo de vida de las monedas de celebridades a menudo sigue un patrón: en la etapa inicial, dependen del respaldo de las celebridades para atraer fondos, y el precio se dispara; Posteriormente, el precio volvió a caer debido a la saturación del mercado o a la disminución de la atención. El token TRUMP se encuentra actualmente en la fase de recuperación del repunte, pero la historia muestra que el análisis técnico puede fallar ante muchas noticias positivas y negativas, pero las perspectivas a largo plazo de este tipo de token aún se ven afectadas por la atmósfera general del mercado de criptomonedas y la utilidad del token en sí. Un ejemplo que tomo a menudo es que durante el mercado alcista de las criptomonedas en 2021, Dogecoin se disparó varias veces debido a los tuits de Musk, pero finalmente no logró escapar del destino de los activos especulativos que cayeron con el giro general del mercado. Es probable que el token TRUMP se enfrente a una trayectoria similar, especialmente a medida que los pesos del mercado de las ventas de ballenas, los desbloqueos de equipos y las controversias éticas se hagan cargo.

En resumen, el auge de la moneda de celebridades refleja la cultura única del mercado de criptomonedas: la especulación y la innovación coexisten, y las oportunidades y los riesgos están presentes. El futuro del token TRUMP depende de la influencia continua de Trump, la capacidad de ejecución del equipo del proyecto y el regreso a la racionalidad del mercado. Los inversores deben mantenerse alerta, sopesar los beneficios a corto plazo y los riesgos a largo plazo, y evitar seguir ciegamente las tendencias.

Autor: Charle Y., investigador de Gate.io *Este artículo solo representa la opinión del autor y no constituye ningún consejo de inversión. La inversión conlleva riesgos, las decisiones deben tomarse con precaución. *El contenido de este artículo es original, y los derechos de autor pertenecen a Gate.io. Si necesita volver a publicar, indique el autor y la fuente; de lo contrario, se perseguirán responsabilidades legales.