Bit_Bull

Верить во что-то

Bit_Bull

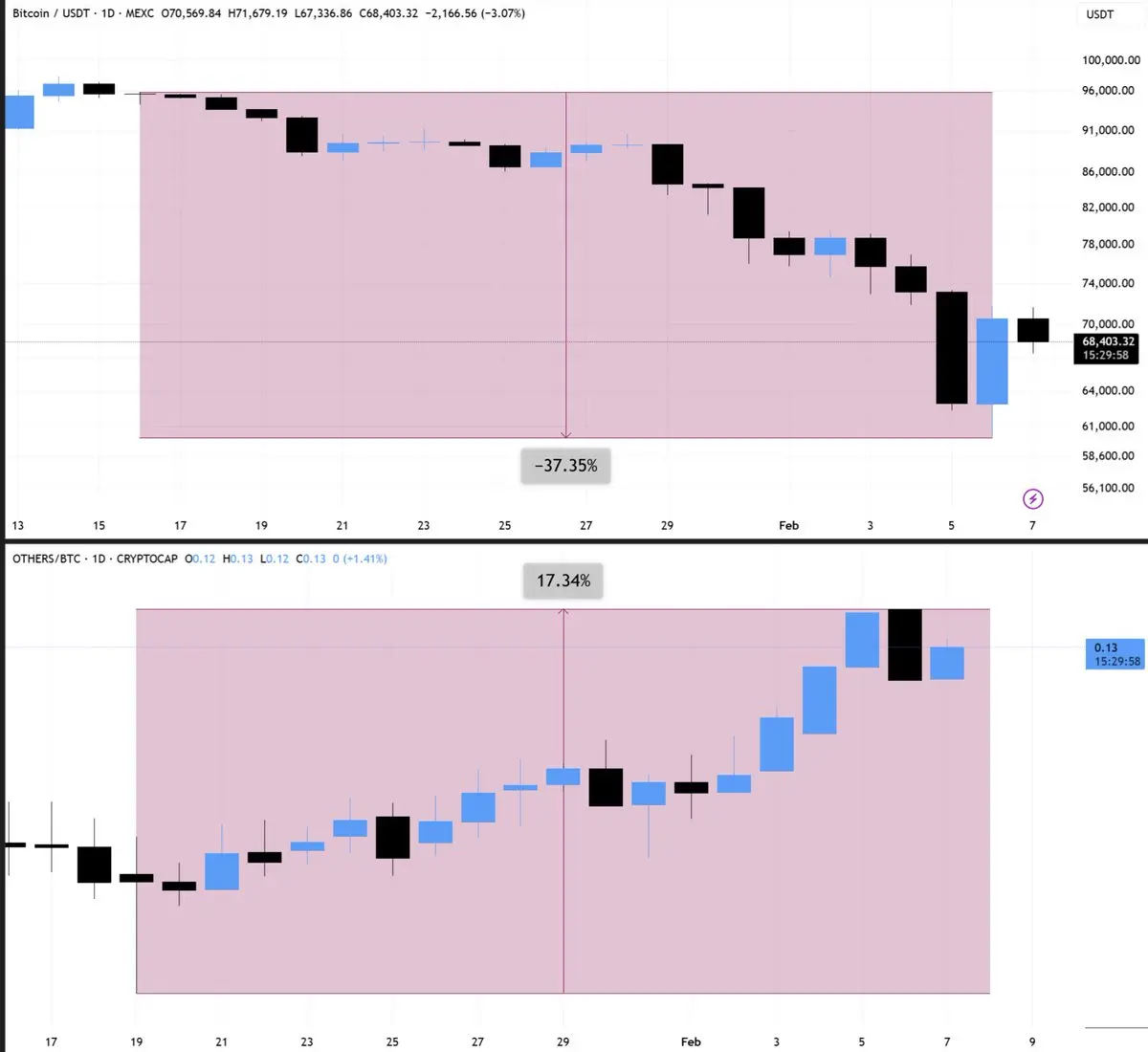

Большинство людей пропустили продажу на дне.

Большинство людей пропустит покупку на дне.

На мой взгляд, Bitcoin достигнет дна примерно на уровне $45K-$50K в этом цикле.

Многие покупатели будут ждать $30K или ниже, как они ждали $10K в 2022 году.

Большинство людей пропустит покупку на дне.

На мой взгляд, Bitcoin достигнет дна примерно на уровне $45K-$50K в этом цикле.

Многие покупатели будут ждать $30K или ниже, как они ждали $10K в 2022 году.

BTC-3,24%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

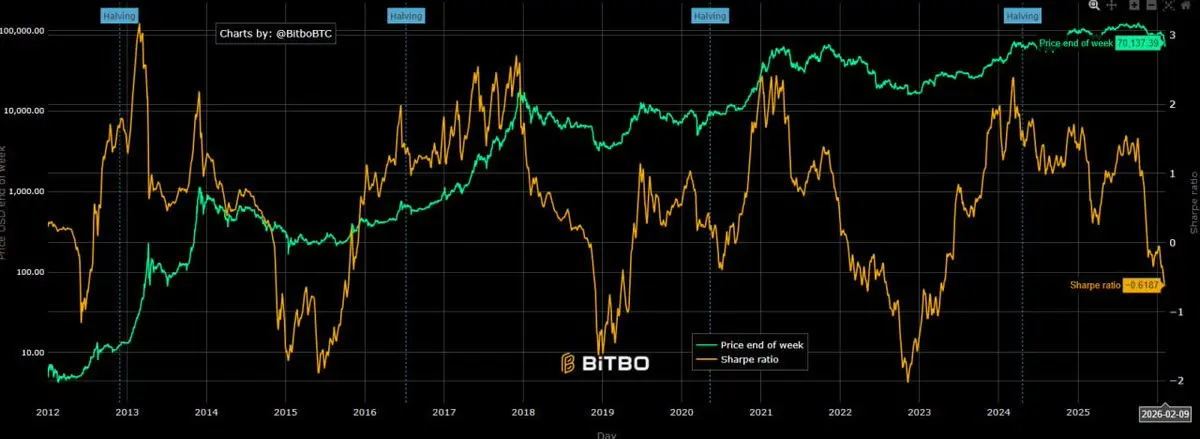

Коэффициент Шарпа Bitcoin снизился до трехлетнего минимума.

Низкий коэффициент Шарпа означает, что инвесторы берут на себя больше рисков, но получают меньшую прибыль.

Исторически сложилось так, что BTC достигает дна, когда коэффициент Шарпа опускается ниже -1.5

Низкий коэффициент Шарпа означает, что инвесторы берут на себя больше рисков, но получают меньшую прибыль.

Исторически сложилось так, что BTC достигает дна, когда коэффициент Шарпа опускается ниже -1.5

BTC-3,24%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

Большинство людей считают, что $60k был дном.

Большинство людей считают, что $30K будет дном.

На мой взгляд, настоящее дно будет около $48K-$50K , но это займет несколько месяцев.

Вам придется пережить как временную, так и ценовую капитуляцию перед разворотом.

Посмотреть ОригиналБольшинство людей считают, что $30K будет дном.

На мой взгляд, настоящее дно будет около $48K-$50K , но это займет несколько месяцев.

Вам придется пережить как временную, так и ценовую капитуляцию перед разворотом.

- Награда

- лайк

- комментарий

- Репост

- Поделиться

Большинство блокчейнов были созданы для быстрого роста и краткосрочного внимания.

Это работает для спекуляций, но ломается, когда институты действительно пытаются их использовать.

@hedera была создана для другой аудитории.

С 2018 года она сосредоточена на корпоративных и государственных сценариях использования, где важнее доверие, управление и надежность, чем хайп.

Вот почему Hedera управляется советом из до 39 глобальных организаций, таких как Google, IBM, Dell, LG, Repsol и Chainlink Labs, компаний, которые запускают узлы, участвуют в управлении и создают реальные системы в сети.

Hedera не и

Посмотреть ОригиналЭто работает для спекуляций, но ломается, когда институты действительно пытаются их использовать.

@hedera была создана для другой аудитории.

С 2018 года она сосредоточена на корпоративных и государственных сценариях использования, где важнее доверие, управление и надежность, чем хайп.

Вот почему Hedera управляется советом из до 39 глобальных организаций, таких как Google, IBM, Dell, LG, Repsol и Chainlink Labs, компаний, которые запускают узлы, участвуют в управлении и создают реальные системы в сети.

Hedera не и

- Награда

- 1

- комментарий

- Репост

- Поделиться

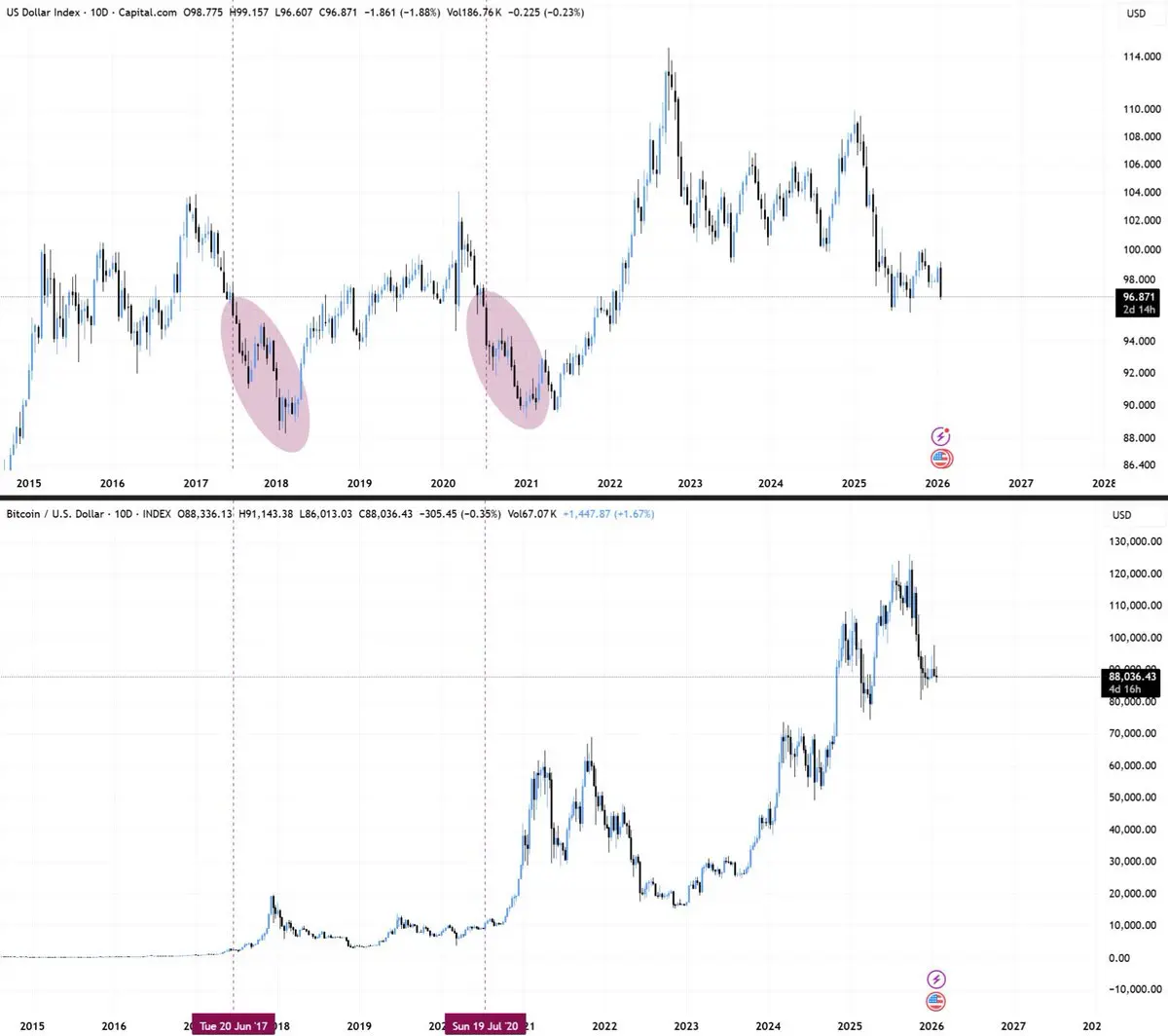

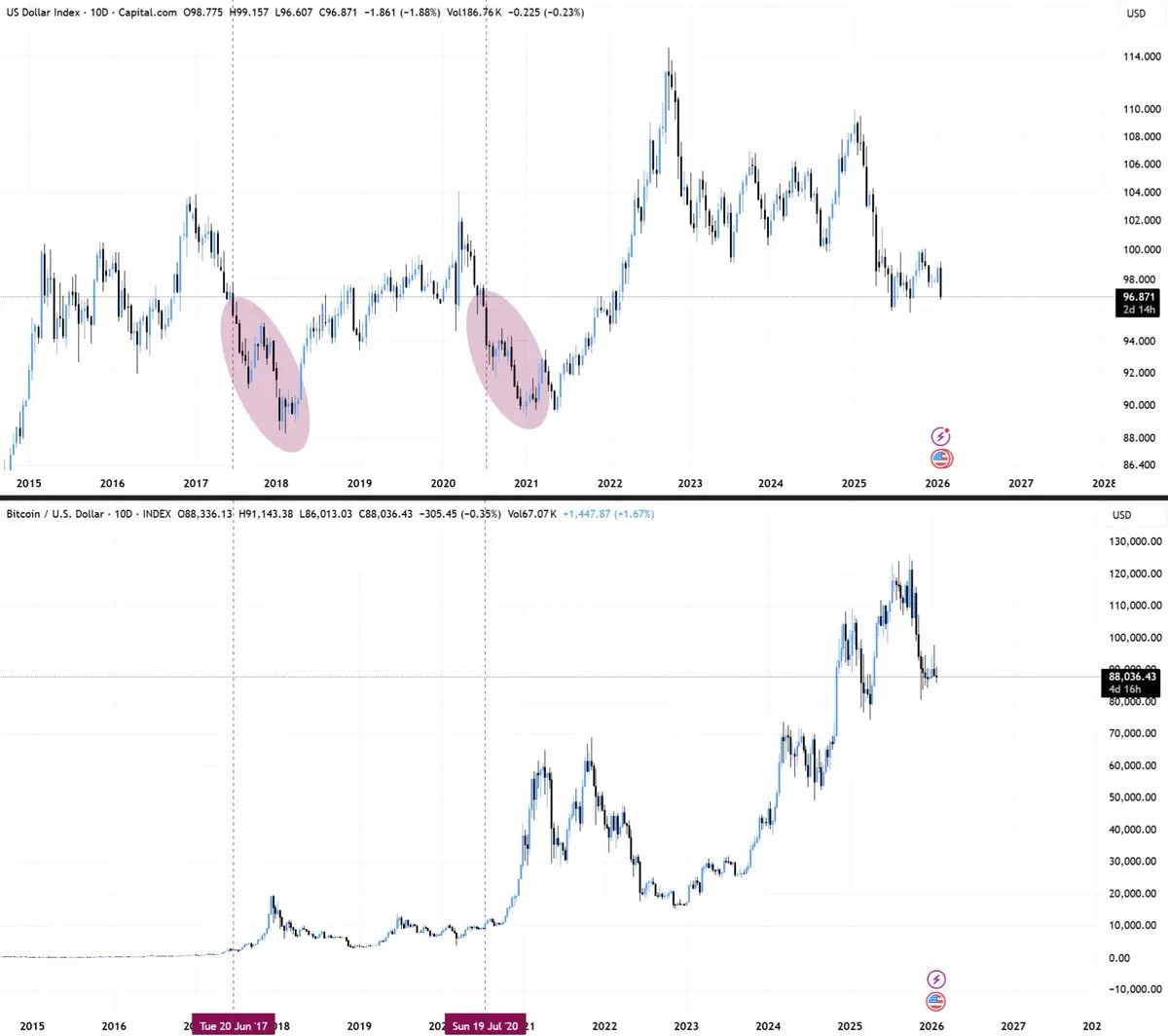

Давление на ФРС усиливается со всех сторон.

Рынки закладывают снижение ставок.

Данные Truflation быстро охлаждаются.

Президент хочет снижения.

Даже следующий председатель ФРС + Минфин намекают на смягчение.

На данном этапе…

Речь идет не о том, произойдет ли снижение ставок. А о том, как быстро их заставят двигаться.

Что, по вашему мнению, произойдет дальше?

Посмотреть ОригиналРынки закладывают снижение ставок.

Данные Truflation быстро охлаждаются.

Президент хочет снижения.

Даже следующий председатель ФРС + Минфин намекают на смягчение.

На данном этапе…

Речь идет не о том, произойдет ли снижение ставок. А о том, как быстро их заставят двигаться.

Что, по вашему мнению, произойдет дальше?

- Награда

- лайк

- комментарий

- Репост

- Поделиться

- Награда

- лайк

- комментарий

- Репост

- Поделиться

- Награда

- лайк

- комментарий

- Репост

- Поделиться

Доминирование USDT сейчас находится на очень важном уровне. Пробой этого уровня сопротивления означает, что все надежды на бычий тренд исчезнут на несколько месяцев. Отказ от этого уровня означает, что BTC и альткоины взорвутся в первом квартале 2026 года.

BTC-3,24%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

🚨 СРОЧНО: Трамп заявил, что падение на фондовом рынке — это пустяки, и рынок удвоится от текущего уровня.\n\nОн сказал, что США должны иметь самые низкие процентные ставки в мире, и позвонил Пауэллу очень поздно, добавив, что скоро появится новый председатель ФРС.\n\nЭто прямой сигнал о том, что агрессивные сокращения ставок снова на повестке дня.\n\nТрамп также подтвердил, что Конгресс работает над регулированием криптовалют, и законопроект может быть подписан в ближайшее время.\n\nОн назвал криптовалюту политически популярной и заявил, что США должны блокировать контроль Китая над ней.\n\nР

Посмотреть Оригинал

- Награда

- 1

- комментарий

- Репост

- Поделиться

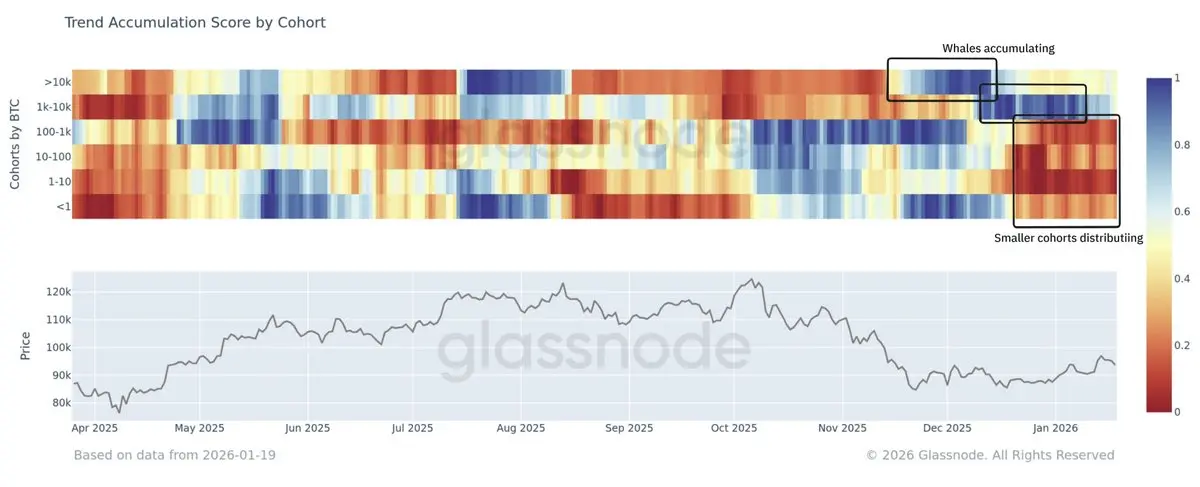

🚨КРУПНЫЕ ИГРОКИ ПОКУПАЛИ, В ТО ВРЕМЯ КАК МЕНЬШИЕ ДЕРЖАТЕЛИ ПРОДАВАЛИ

Во время фазы дна в ноябре-декабре Bitcoin показал явное разделение в поведении.

Крупные кошельки накапливали.

Маленькие кошельки распределяли.

Это означает, что сильные руки тихо накапливали позиции, в то время как слабые руки сдавались.

Так обычно выглядят настоящие дны.

Когда цена падала, а настроение было негативным, крупные держатели не паниковали. Они поглощали предложение.

В то же время часть этой активности также связана с перераспределением средств внутри биржевых кошельков. Монеты перемещались между внутренними кош

Во время фазы дна в ноябре-декабре Bitcoin показал явное разделение в поведении.

Крупные кошельки накапливали.

Маленькие кошельки распределяли.

Это означает, что сильные руки тихо накапливали позиции, в то время как слабые руки сдавались.

Так обычно выглядят настоящие дны.

Когда цена падала, а настроение было негативным, крупные держатели не паниковали. Они поглощали предложение.

В то же время часть этой активности также связана с перераспределением средств внутри биржевых кошельков. Монеты перемещались между внутренними кош

BTC-3,24%

- Награда

- лайк

- комментарий

- Репост

- Поделиться