The Next Battle for Stablecoins: The Giants’ War in the Stablecoin Network

In the second half of 2025, the stablecoin industry will enter a new era.

For years, companies such as Tether and Circle have been central players in the stablecoin space. However, their function has been limited to issuing tokens, while the underlying network architecture and operations have depended on public blockchains like Ethereum, Tron, and Solana. Despite the ever-increasing volume of stablecoin issuance, users have always needed to rely on external systems to transact.

Recently, this dynamic has started to change. Circle introduced Arc, Tether rolled out Plasma and Stable almost simultaneously, while Stripe partnered with Paradigm to launch Tempo. The rapid emergence of these three payment and settlement-focused stablecoin blockchains signals a shift—issuers are no longer content to simply issue tokens. They want to control the infrastructure itself.

This coordinated movement is hardly coincidental.

Why Are Stablecoin Issuers Building Their Own Blockchains?

Initially, nearly all stablecoins relied on public blockchains such as Ethereum, Tron, and Solana. Now, more issuers are building their own dedicated chains, gaining control over both issuance and settlement.

The most direct driver is value capture. The transaction fees absorbed by these underlying networks are far larger than most realize.

Tether processes over $1 trillion in transactions each month, but most transaction fees are absorbed by the underlying blockchains. On Tron, each USDT transfer incurs a fee of roughly 13–27 TRX, or about $3–$6 at current prices. With USDT’s enormous volume on Tron, this represents enormous revenue. Considering that Tron processes billions of dollars in USDT daily, transaction fees alone generate hundreds of millions in annual revenue for the Tron network.

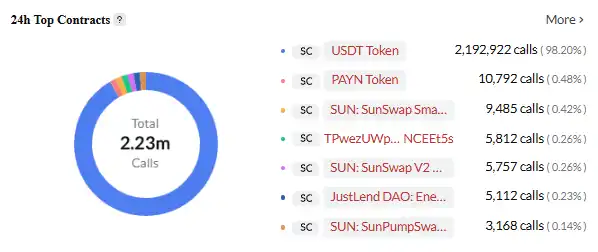

USDT is the most active smart contract on the TRON network. Source: Cryptopolitan

Although Tether itself boasts extraordinary profits, these mainly come from the spread and investment income—unrelated to USDT’s transaction volume. Each USDT transaction brings Tether zero direct revenue; every transaction fee goes to the public blockchain.

Circle faces a similar dilemma. Every USDC transfer on Ethereum consumes ETH as gas. At today’s Ethereum transaction fee rates, if USDC saw the same transaction scale as USDT, Ethereum would capture billions annually just from fees. As USDC’s issuer, Circle receives none of these fees.

Even more frustrating, the greater the transaction volume, the bigger the missed revenue. USDT’s monthly trading volume grew from several hundred billion in 2023 to over $1 trillion, but Tether’s revenue from transfers remains zero.

This “see but can’t touch” situation is the core reason these companies are now building their own blockchains.

There are other factors as well. Technical limitations of existing public chains are compounding: Ethereum has high fees and slow speeds, making micropayments impractical; Tron’s low cost is offset by concerns over decentralization and security; Solana is fast, but not always stable. For always-on payment services, these are critical drawbacks.

User experience is also an obstacle. Ordinary users must switch between different chains, hold various native tokens, and manage different wallets. Cross-chain transfers are even more complex, costly, and risk-prone. From a compliance perspective, current public chains rely heavily on external solutions for transaction monitoring and anti-money laundering, with only limited effectiveness. Competitive differentiation is now essential: Circle aims to provide faster settlement and integrated smart contract modules via Arc, while Stripe intends to achieve programmable and automated payments with Tempo.

With value capture, technical limitations, user experience, compliance, and competitive pressures converging, building proprietary blockchains has become the inevitable path forward.

How Major Players Are Responding

Faced with these challenges and opportunities, each company has chosen distinct technologies and business strategies.

Stripe Tempo: A Neutral Platform Approach

Tempo, jointly incubated by Stripe and Paradigm, is a dedicated payments blockchain. Its biggest distinction from traditional public chains is that it does not issue a native token—instead, it accepts major stablecoins like USDC and USDT directly as gas. This choice is both a statement and a show of ambition.

Source: X

While the design appears simple, the technical challenges are considerable. Traditional blockchains use a single native token for transaction fees, making system design relatively straightforward. Tempo must support multiple stablecoins as gas, necessitating sophisticated token management and exchange rate mechanisms at the protocol level.

Tempo’s architecture is optimized for payments. Its enhanced consensus protocol enables sub-second confirmations with ultra-low costs, and it includes native payment primitives that developers can use to build advanced applications—such as conditional payments, scheduled payments, and multi-party payments.

Tempo has assembled a robust ecosystem alliance. Its initial partners span artificial intelligence (Anthropic, OpenAI), e-commerce (Shopify, Coupang, DoorDash), and financial services (Deutsche Bank, Standard Chartered, Visa, Revolut), among other critical fields. The breadth of this list signals that Stripe aims to make Tempo a foundational, cross-industry infrastructure.

Circle Arc: Vertically Integrated Customization

In August 2025, Circle launched Arc, a public blockchain designed specifically for stablecoin finance. In contrast to Stripe’s neutral posture, Arc embodies a strategy of complete vertical integration.

Source: Circle

Arc uses USDC as its native gas token. All transactions on Arc require USDC to pay fees, driving USDC demand and utility. This design allows Circle to extract value from every on-chain transaction, creating a fully closed loop value chain.

Arc also integrates an institution-grade spot FX engine, delivering rapid swaps between stablecoins of different currencies and aiming for sub-second transaction finality. These features address real-world institutional needs, reflecting Circle’s deep market insight.

By owning its own blockchain, Circle gives USDC a more efficient and controlled operating environment. More importantly, it enables Circle to build a closed financial ecosystem around USDC, locking value inside its own system.

Tether’s Dual-Chain Strategy: Aggressive, All-In Verticalization

As the largest stablecoin issuer globally, Tether launched both Plasma and Stable in 2025, demonstrating a more aggressive approach to vertical integration than its rivals.

Source: Bankless

Plasma, backed by Tether’s sister company Bitfinex, is a Layer 1 blockchain built for stablecoin transactions. Its standout feature is zero-fee USDT transfers, posing a direct challenge to Tron’s dominance in USDT circulation. Plasma’s July 2025 token sale raised $373 million, underscoring robust market demand.

Stable’s ambition is even broader. Tether bills it as “USDT’s exclusive home,” leveraging a dual-chain parallel architecture. One main chain handles core settlements, while Plasma serves as a parallel chain to process high-throughput, low-value transactions and micropayments, periodically settling on the main chain. In this system, USDT operates as both the transaction medium and fee token, eliminating the need for users to hold other gas tokens and substantially lowering entry barriers.

For greater flexibility, Stable has introduced several USDT variants: The standard USDT for everyday use, USDT0 specifically for cross-chain bridging, and gasUSDT for network fees. All three maintain a 1:1 peg and can be freely exchanged at zero cost, providing seamless experiences across use cases.

Stable employs a custom consensus protocol, StableBFT, built atop the CometBFT engine (an enhanced Tendermint version) and uses delegated proof of stake. By separating transaction propagation from consensus propagation, StableBFT mitigates congestion during periods of heavy traffic to offer a stable environment for large-scale payments.

By combining Plasma and Stable, Tether is not only addressing existing networks’ fee and stability limitations, but also building a closed ecosystem encompassing USDT transactions, fees, and cross-chain capabilities.

Big Tech’s Infrastructure Ambitions

Google is also making moves. With Google Cloud Unified Ledger (GCUL), Google targets the stablecoin infrastructure layer. GCUL is an enterprise-grade blockchain platform for banks and financial institutions to issue, manage, and transact stablecoins.

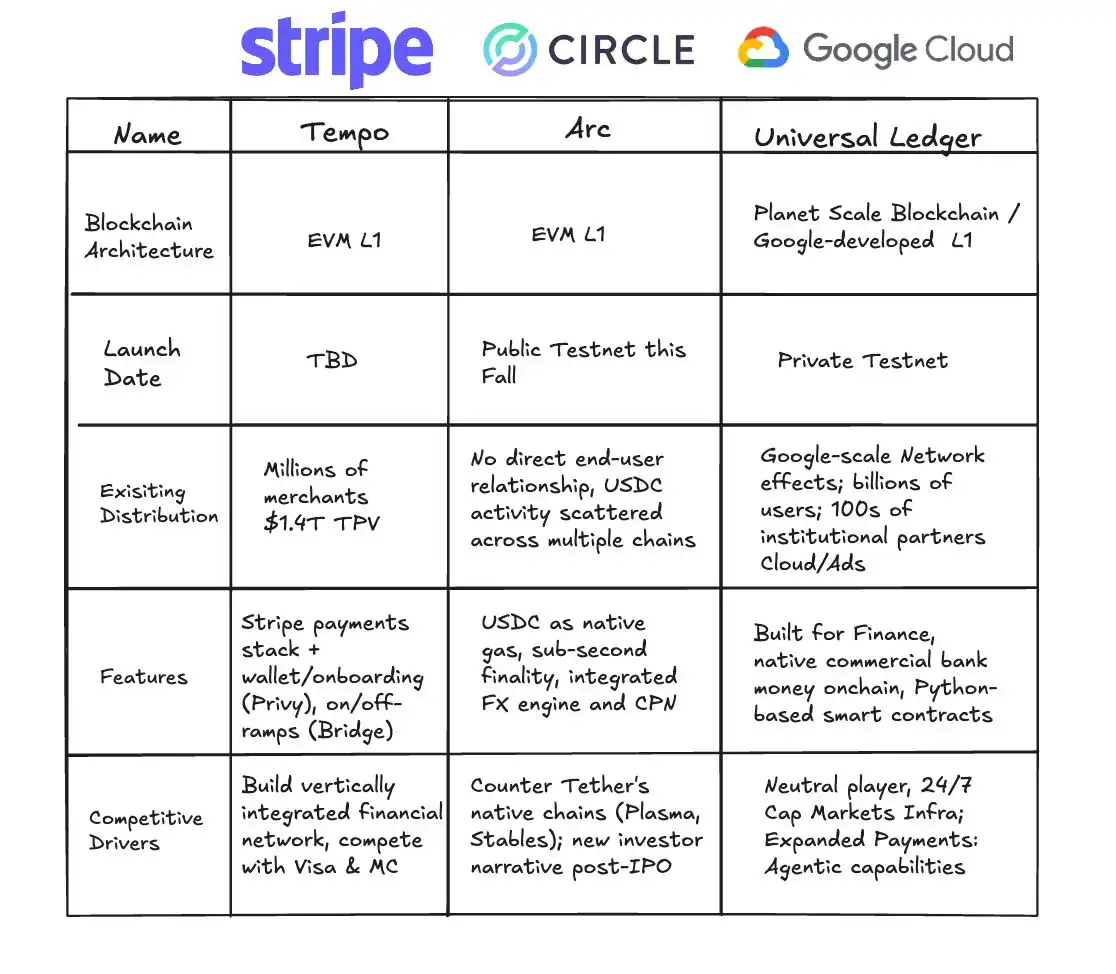

GCUL versus Tempo and Arc. Source: Fintech America

Its primary advantage: deep integration with existing Google Cloud enterprise services. Financial institutions can quickly launch stablecoin products on GCUL without the burden of building new infrastructure. For banks already using Google’s cloud, it offers a near-seamless digital asset solution.

Google’s strategy is notably restrained: it does not directly issue stablecoins or compete in the payments arena. Instead, it establishes itself as the “pick-and-shovel” provider, furnishing foundational technology for all industry players. No matter who wins the stablecoin race, Google stands to benefit.

These dedicated blockchains are more than mere clones of existing chains—they leap forward in several key areas. Stablecoins have already eliminated banks as intermediaries; now, they’re breaking free from dependency on blockchains like Ethereum or Tron, truly bringing the transaction rails under their own control.

They unlock far greater programmability. Stablecoins are, at heart, programmable contracts. As Stripe CEO Patrick Collison has observed, programmable payments can spawn entirely new business models—such as agent payments for AI agents. On these new chains, developers can use built-in payment primitives to assemble sophisticated applications like conditional payments, scheduled payments, and multi-party settlements.

Settlement times are nearly instantaneous. Public chains like Arc target sub-second confirmation. For high-frequency trading, supply chain finance, or microtransactions within messaging apps, this “instant settlement” speed is transformative.

Crucially, these networks are natively designed for interoperability. Cross-chain bridges and atomic swaps are now core system features, not add-ons. Stablecoins can flow freely across chains, akin to seamless connectivity in the global banking system.

The First Year of Stablecoin Public Blockchains

The creation of stablecoin-dedicated blockchains is fundamentally rewriting the value chain. In traditional payments, banks, card schemes, and clearinghouses carved up profits; now, new players capture these flows.

By issuing stablecoins, Circle and Tether have built enormous pools of interest-free capital, investing these funds in safe assets like U.S. Treasuries and generating billions in annual interest. In Q2 2024, Tether’s profits reached $4.9 billion—almost entirely from “seigniorage.”

With proprietary blockchains, value capture is now more diverse. Transaction fees are just the tip of the iceberg. The real upside lies in value-added services: Tempo can offer custom payment solutions to enterprise clients, while Arc delivers institutional-grade compliance and FX settlement. These premium services generate far more value than individual transactions alone.

The application layer unlocks even greater potential. Programmable payments enable new business models: automated payroll, conditional disbursements, supply chain finance—driving efficiency gains and creating brand-new value.

But for traditional financial institutions, stablecoins are shaking the status quo. Payment intermediation represents a major revenue stream for banks, which could fade as stablecoins gain traction. Short-term effects may be limited, but over the long term, banks will need to redefine their role.

This value reshuffling is about more than business—it carries geopolitical weight. The global circulation of USD stablecoins extends dollar dominance into the digital realm. Countries are already responding, and the battles to come will be fought not only between blockchains and corporations, but among national and currency systems.

The stablecoin surge is not simply a technological or business-model upgrade—it marks the most profound reconstruction of global financial infrastructure since the invention of double-entry accounting and the modern banking system.

Zooming out, stablecoins may trigger the most sweeping overhaul of financial infrastructure since double-entry bookkeeping and modern banking.

Each wave of foundational reform has propelled business forward: Venetian bills of exchange enabled intercity trade, the Rothschilds’ banking network accelerated global capital flows, and systems like Visa and SWIFT made payments nearly instantaneous.

Such revolutions have slashed costs, expanded markets, and sparked new growth. Stablecoins are the latest chapter in this ongoing story.

Their impact will be felt across multiple levels for years to come.

Financial inclusion will be dramatically amplified: anyone with a smartphone can access global networks without a bank account. Cross-border settlement will become near-instant, significantly improving capital turnover in supply chains and trade flows.

Perhaps the most profound transformation will be the rise of digital-native business models. Payments will evolve from simple fund transfers to programmable, composable building blocks—propelling the boundaries of innovation ever outward.

By 2025, as stablecoin public chains roll out one after another, stablecoins are stepping beyond crypto and onto the main stage of global finance and commerce. We are at the crossroads, witnessing the birth of a more open and efficient global payment network.

Notice:

- This article is reprinted from [BlockBeats], with copyright held by the original author [BlockBeats]. For any concerns regarding this republication, please contact the Gate Learn team to resolve them promptly.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Unless Gate is expressly credited, unauthorized copying, reproduction, or use of translated content is strictly prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.