Understanding the Key Differences Between Ethereum, Solana, and Aptos in the Life Cycle of a Transaction

By analyzing the full transaction lifecycle—from creation and initiation to broadcast, sorting, execution, and status update—this article clarifies the design philosophy and technical trade-offs of public blockchains. It provides insight into the core narratives of different chains and explores how to build market-attracting applications on Aptos.This article focuses on Aptos, analyzing its unique design and comparing it with Ethereum and Solana.

When comparing the technical differences between Move language, Aptos, and other public blockchains, the analysis can sometimes become either too shallow or overly technical. A general overview tends to miss important nuances, while diving deep into code may obscure the larger picture. To effectively and accurately understand the differences between Aptos and other blockchains, it’s essential to choose the right focal point.

In the author’s view, the life cycle of a transaction offers the best entry point. By breaking down the complete steps of a transaction—starting from creation and initiation to broadcasting, sorting, execution, and finally state update—one can clearly understand the design philosophy and technical decisions behind each public chain. This approach not only helps grasp the core narratives of different blockchains but also provides a clear path for building market-attractive applications on Aptos.

As shown in the diagram below, all blockchain transactions revolve around these five key stages. This article will use Aptos as the focal point to analyze its unique design and highlight the critical differences compared to Ethereum and Solana.

Aptos: Optimistic Parallelism and High-Performance Design

Aptos is a high-performance public blockchain that shares similarities with Ethereum’s transaction life cycle but achieves significant improvements through its unique optimistic parallel execution and memory pool optimizations. The key steps in the transaction lifecycle on Aptos are as follows:

Create and Initiation

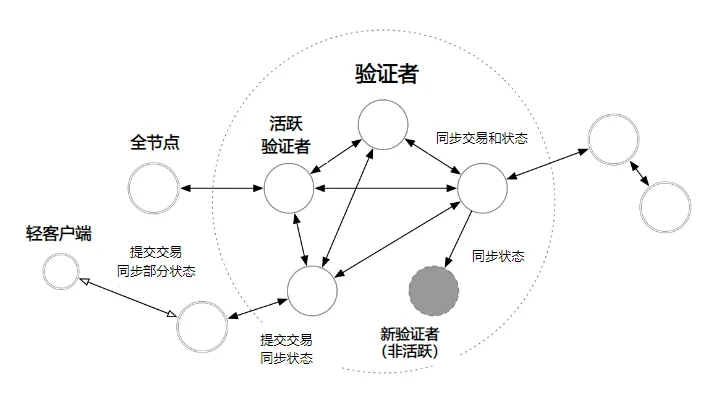

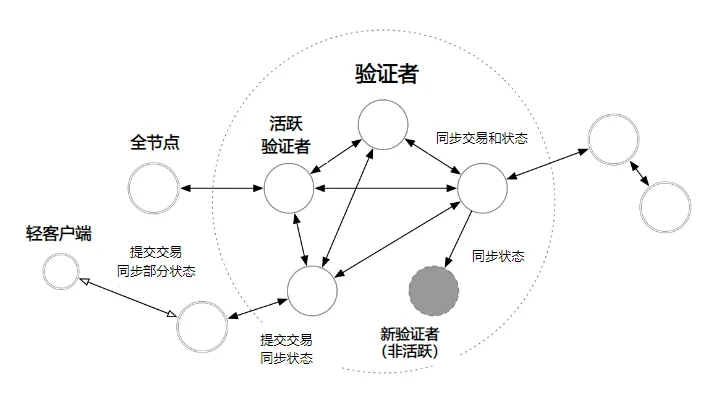

The Aptos network is composed of light nodes, full nodes, and validators. Users initiate transactions through light nodes (e.g., wallets or apps), which then forward the transactions to nearby full nodes. These full nodes subsequently synchronize with validators.

Broadcasting

Aptos retains a memory pool, but after QuorumStore, the pools are not shared. Unlike Ethereum, Aptos’ memory pool serves more than just as a transaction buffer. Once transactions enter the memory pool, the system pre-sorts them according to specific rules (e.g., FIFO or Gas fees), ensuring no conflicts during parallel execution. This approach avoids Solana’s high hardware requirements of declaring read/write sets in advance.

Sorting

Aptos uses the AptosBFT consensus protocol, where proposers cannot arbitrarily order transactions. The addition of AIP-68 allows proposers to include delayed transactions. Conflict avoidance is handled in advance through memory pool pre-sorting, with block generation depending more on validator collaboration than proposer control.

Execution

Aptos employs Block-STM technology for optimistic parallel execution. Transactions are processed concurrently, assuming no conflicts. If a conflict arises, the affected transaction is re-executed. This approach leverages multi-core processors to increase efficiency, with a theoretical TPS of up to 160,000.

Status Update

Validators synchronize the network state, and finality is confirmed through checkpoints, similar to Ethereum’s Epoch mechanism but with greater efficiency. Aptos’ core advantage lies in combining optimistic parallelism with memory pool pre-sorting. This design reduces node performance requirements while dramatically improving throughput. As illustrated in the diagram below, Aptos’ network architecture clearly supports this efficient and high-performance design:

Source: Aptos White Paper

Ethereum: The Benchmark for Serial Execution

As the pioneer of smart contracts, Ethereum serves as the foundation of public blockchain technology. Its transaction lifecycle provides the basic framework for understanding Aptos.

Ethereum Transaction Lifecycle:

Create and Initiate: Users initiate transactions via wallets, through relay gateways or RPC interfaces.

Broadcast: The transaction enters the public memory pool and waits to be packaged.

Sorting: After Ethereum’s PoS upgrade, block builders package transactions based on profit maximization principles. The relay layer bids and submits the transactions to the proposer.

Execution: The Ethereum Virtual Machine (EVM) processes transactions serially, updating the state in a single thread.

Status Update: Blocks must pass through two checkpoints to confirm finality.

Ethereum’s serial execution and memory pool design impose limitations on performance, with block times of 12 seconds per slot and a relatively low TPS. In comparison, Aptos achieves a significant leap in performance through parallel execution and memory pool optimization.

Solana: The Ultimate Optimization of Deterministic Parallelism

Solana is known for its high performance, and its transaction lifecycle differs significantly from Aptos, particularly in terms of the memory pool and execution method.

Solana Transaction Lifecycle:

Create and Initiate: Users initiate transactions through their wallets.

Broadcast: Solana does not use a public memory pool. Transactions are sent directly to the current proposer and the next two proposers.

Sorting: The proposer packs the block based on Proof of History (PoH), with block times as fast as 400 milliseconds.

Execution: The Sealevel virtual machine employs deterministic parallel execution. Read and write sets must be declared in advance to prevent conflicts.

Status Update: The BFT consensus quickly confirms the finality of the transaction.

Solana avoids using a memory pool because it could become a performance bottleneck. Without a memory pool and with PoH, nodes can quickly reach consensus on transaction order, which eliminates the need for transactions to queue in a memory pool. As a result, transactions are nearly instantaneous. However, during network overload, transactions may be dropped instead of waiting, and users will need to resubmit them.

In contrast, Aptos’s optimistic parallelism does not require the declaration of read-write sets, lowering the node threshold while achieving higher TPS.

Source: shoe research

Two Paths to Parallel Execution: Aptos vs Solana

The execution of a transaction represents the update of the block state, converting the transaction initiation into a final state. This process can be understood as follows: the node assumes the transaction is successful and calculates its impact on the network state. This calculation is called execution.

In blockchain, parallel execution refers to multi-core processors simultaneously calculating the network’s state. Currently, there are two primary methods for parallel execution: deterministic parallel execution and optimistic parallel execution. The difference between these two methods lies in how to ensure parallel transactions don’t conflict—whether there are dependencies between transactions.

In the transaction lifecycle, the timing of identifying parallel transaction dependency conflicts determines the differentiation between deterministic and optimistic parallel execution. Aptos and Solana have chosen different approaches:

Deterministic parallelism (Solana):Before broadcasting a transaction, the read-write set must be declared. The Sealevel engine processes transactions in parallel if no conflicts are declared; conflicting transactions are executed serially. The advantage is high efficiency, but the downside is higher hardware requirements.

Optimistic Parallelism (Aptos):Aptos assumes no conflicts in transactions and executes them in parallel using Block-STM. After execution, the transactions are verified, and conflicts are retried if found. Pre-sorting transactions in the memory pool reduces the risk of conflicts, lowering the node’s load.

For example: Account A has a balance of 100. Transaction 1 transfers 70 to B, and Transaction 2 transfers 50 to C. Solana confirms conflicts through declarations before execution, handling transactions in order. In contrast, Aptos executes transactions in parallel, and if it finds insufficient funds, it adjusts the transactions accordingly. Aptos’ flexibility makes it more scalable.

Optimistic Parallelism and Memory Pool:

The core idea behind optimistic parallelism is to assume no conflicts in parallel transactions, meaning no transaction declaration is needed before execution. If a conflict arises during post-execution verification, Block-STM will re-execute the affected transaction to ensure consistency.

However, if transaction dependencies aren’t confirmed in advance, numerous errors could occur during execution, potentially slowing down the public chain. Therefore, optimistic parallelism doesn’t merely assume no conflicts; it mitigates risks during the transaction broadcast stage.

On Aptos, transactions entering the public memory pool are pre-sorted according to rules (e.g., FIFO or Gas fees) to ensure no conflicts in parallel execution. As a result, Aptos proposers don’t have the ability to order transactions, and there are no block builders in the network. This pre-sorting mechanism is key to achieving optimistic parallelism. Unlike Solana, which requires transaction declarations, Aptos doesn’t need this, reducing node performance requirements.

The overhead in ensuring transactions don’t conflict in Aptos through the memory pool has a much smaller impact on TPS compared to the cost of Solana’s transaction declarations. As a result, Aptos can achieve a TPS of 160,000—more than twice that of Solana.However, the pre-sorting of transactions impacts the difficulty of capturing MEV (Maximal Extractable Value) on Aptos, which has both pros and cons for users.

Aptos’ Development Focus: A Security-Driven Narrative

RWA (Real-World Asset Tokenization): Aptos is actively advancing the tokenization of real-world assets and institutional financial solutions. Compared to Ethereum, Aptos’ Block-STM can handle multiple asset transfer transactions in parallel, avoiding delays in asset validation caused by network congestion. While Solana and Sui boast fast transaction speeds, the lack of a memory pool design may cause transactions to be discarded during network overload, affecting the stability of asset validation. Aptos’ memory pool pre-sorting ensures that transactions are executed in order, maintaining asset record reliability even during peak periods. RWA requires complex smart contract support, such as asset splitting, yield distribution, and compliance checks. The modular design and security of the Move language make it easier for developers to build reliable RWA applications. In contrast, Ethereum’s Solidity complexity and vulnerability risks increase development costs, and Solana’s Rust programming, though efficient, requires a steeper learning curve for developers. Aptos’ ecosystem friendliness is expected to attract more RWA projects, forming a positive cycle. The potential of Aptos in the RWA space lies in the combination of security and performance. In the future, it could focus on collaborating with traditional financial institutions to bring high-value assets such as bonds and stocks on-chain, using the Move language to create compliant tokenization standards. This “security + efficiency” narrative allows Aptos to stand out in the RWA market.

- In July 2024, Aptos announced the integration of Ondo Finance’s USDY into its ecosystem, which has been integrated into major DEXs and lending applications. By March 10, 2025, USDY’s market capitalization on Aptos was approximately $15 million, accounting for about 2.5% of USDY’s total market cap. In October 2024, Aptos announced that Franklin Templeton had launched the Franklin on-chain U.S. Government Money Fund (FOBXX) on the Aptos Network, and it also collaborated with Libre to advance security tokenization, bringing investment funds from Brevan Howard, BlackRock, and Hamilton Lane onto the chain, enhancing access for institutional investors.

Stablecoin Payments: Stablecoin payments require ensuring transaction finality and asset security. Aptos’ Move language uses a resource model to prevent double-spending, ensuring the accuracy of every stablecoin transfer. For example, when users pay with USDC on Aptos, the transaction state is rigorously protected, avoiding fund loss due to contract vulnerabilities. Additionally, Aptos’ low gas fees (thanks to high TPS spreading costs) make it highly competitive in small payment scenarios. Ethereum’s high gas fees limit its payment applications, and while Solana has low costs, transaction drop risks during network overloads can affect user experience. Aptos’ memory pool pre-sorting and Block-STM ensure the stability and low latency of payment transactions.

PayFi and stablecoin payments need to balance decentralization and regulatory compliance. AptosBFT’s decentralized consensus reduces centralization risks, and its modular architecture allows developers to integrate KYC/AML checks. For instance, a stablecoin issuer can deploy compliance contracts on Aptos, ensuring transactions meet local regulations without sacrificing network efficiency. This is superior to Ethereum’s centralized relay model and addresses the potential compliance gaps of Solana’s proposer-led approach. Aptos’ balanced design makes it more suitable for financial institutions.

Aptos’ Potential in PayFi and Stablecoin Payments: Aptos’ potential in the PayFi and stablecoin payment space lies in the trifecta of “security, efficiency, and compliance.” In the future, it will continue to drive the widespread adoption of stablecoins, building cross-border payment networks, or partnering with payment giants to develop on-chain settlement systems. High TPS and low costs will also support micropayment scenarios, such as real-time tips for content creators. Aptos’ narrative could focus on “next-generation payment infrastructure,” attracting both business and user traffic.

Aptos’ Security Advantages: Aptos’ security advantages—memory pool pre-sorting, Block-STM, AptosBFT, and the Move language—not only enhance its resistance to attacks but also lay a solid foundation for RWA and PayFi narratives. In the RWA space, its high security and throughput support asset tokenization and large-scale transactions. In PayFi and stablecoin payments, its low cost and efficiency drive real-world application adoption. Compared to Ethereum’s robust but inefficient approach and Solana’s fast but high-barrier model, Aptos creates a new path through its balanced approach. In the future, Aptos can leverage these advantages to shape the narrative of a “security-driven value network,” becoming the bridge between the traditional economy and blockchain.

Summary: Aptos’ Technical Differences and Future Narrative

Through the perspective of the transaction lifecycle, we can clearly compare the technical design differences between Aptos, Ethereum, Solana, and Sui, and reveal their respective core narratives. The table below summarizes the similarities and differences among the four in the broadcast, sequencing, and execution phases, highlighting the unique advantages of Aptos:

Aptos is designed to strike a clever balance between performance and security. Its memory pool pre-sorting, combined with Block-STM’s optimistic parallelism, not only lowers node requirements but also achieves a high throughput of 160,000 TPS, surpassing Solana’s deterministic parallelism and Sui’s object-level parallelism. Compared to Ethereum’s serial execution, Aptos’ parallelism represents a significant leap. Unlike Solana and Sui, which cut out memory pool optimizations, Aptos retains the pre-sorting mechanism, ensuring network stability under high loads. This “stable yet fast” approach, along with the resource model of the Move language, gives Aptos higher security—whether defending against DDoS attacks or preventing contract vulnerabilities—surpassing Ethereum’s traditional architecture and Solana’s heavy hardware dependence.

The divergence between Aptos and Sui is more enlightening. Sui, also based on the Move language, is object-centric, pursuing ultimate performance with DAG sorting and object-level parallelism, suitable for high-concurrency asset management scenarios. In contrast, Aptos is account-centric, relying on memory pools and optimistic parallelism, balancing versatility and ecosystem compatibility. This difference not only reflects distinct technical paths but also signals diverging application directions: Sui excels in complex asset operations, while Aptos is better in security-driven scenarios.

Thanks to the combination of security and performance, Aptos shows great potential in RWA and PayFi narratives. In the RWA space, Aptos’ high throughput supports large-scale asset tokenization, with initial collaborations with Ondo Finance (USDY market cap about $15 million), Franklin Templeton, and Libre. In PayFi and stablecoin payments, Aptos’ low cost, high efficiency, and compliance support micro-payments and cross-border settlements, making it a strong candidate for “next-generation payment infrastructure.”

In conclusion, Aptos integrates security and efficiency into each phase of the transaction lifecycle, distinguishing it from Ethereum’s stable but inefficient design, Solana’s high-performance and high-barrier approach, and Sui’s extreme optimization focused on objects. In the future, Aptos can leverage its “security-driven value network” narrative to connect traditional finance with the blockchain ecosystem, continue strengthening its position in RWA and PayFi, and establish a new public chain landscape that balances trust and scalability.

About Movemaker: Movemaker is the first official community organization authorized by the Aptos Foundation, jointly launched by Ankaa and BlockBooster. It focuses on the development of the Aptos ecosystem in Chinese-speaking regions. As Aptos’ official representative in the region, Movemaker is dedicated to creating a diverse, open, and prosperous ecosystem by connecting developers, users, capital, and various ecological partners.

Disclaimer:

- This article is reproduced from [TechFlow]. The copyright belongs to the original author [TechFlow]. If you have any objection to the reprint, please contact Gate Learn team, the team will handle it as soon as possible according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team and are not mentioned in Gate.io, the translated article may not be reproduced, distributed or plagiarized.

Understanding the Key Differences Between Ethereum, Solana, and Aptos in the Life Cycle of a Transaction

Aptos: Optimistic Parallelism and High-Performance Design

Ethereum: The Benchmark for Serial Execution

Solana: The Ultimate Optimization of Deterministic Parallelism

Two Paths to Parallel Execution: Aptos vs Solana

Summary: Aptos’ Technical Differences and Future Narrative

This article focuses on Aptos, analyzing its unique design and comparing it with Ethereum and Solana.

When comparing the technical differences between Move language, Aptos, and other public blockchains, the analysis can sometimes become either too shallow or overly technical. A general overview tends to miss important nuances, while diving deep into code may obscure the larger picture. To effectively and accurately understand the differences between Aptos and other blockchains, it’s essential to choose the right focal point.

In the author’s view, the life cycle of a transaction offers the best entry point. By breaking down the complete steps of a transaction—starting from creation and initiation to broadcasting, sorting, execution, and finally state update—one can clearly understand the design philosophy and technical decisions behind each public chain. This approach not only helps grasp the core narratives of different blockchains but also provides a clear path for building market-attractive applications on Aptos.

As shown in the diagram below, all blockchain transactions revolve around these five key stages. This article will use Aptos as the focal point to analyze its unique design and highlight the critical differences compared to Ethereum and Solana.

Aptos: Optimistic Parallelism and High-Performance Design

Aptos is a high-performance public blockchain that shares similarities with Ethereum’s transaction life cycle but achieves significant improvements through its unique optimistic parallel execution and memory pool optimizations. The key steps in the transaction lifecycle on Aptos are as follows:

Create and Initiation

The Aptos network is composed of light nodes, full nodes, and validators. Users initiate transactions through light nodes (e.g., wallets or apps), which then forward the transactions to nearby full nodes. These full nodes subsequently synchronize with validators.

Broadcasting

Aptos retains a memory pool, but after QuorumStore, the pools are not shared. Unlike Ethereum, Aptos’ memory pool serves more than just as a transaction buffer. Once transactions enter the memory pool, the system pre-sorts them according to specific rules (e.g., FIFO or Gas fees), ensuring no conflicts during parallel execution. This approach avoids Solana’s high hardware requirements of declaring read/write sets in advance.

Sorting

Aptos uses the AptosBFT consensus protocol, where proposers cannot arbitrarily order transactions. The addition of AIP-68 allows proposers to include delayed transactions. Conflict avoidance is handled in advance through memory pool pre-sorting, with block generation depending more on validator collaboration than proposer control.

Execution

Aptos employs Block-STM technology for optimistic parallel execution. Transactions are processed concurrently, assuming no conflicts. If a conflict arises, the affected transaction is re-executed. This approach leverages multi-core processors to increase efficiency, with a theoretical TPS of up to 160,000.

Status Update

Validators synchronize the network state, and finality is confirmed through checkpoints, similar to Ethereum’s Epoch mechanism but with greater efficiency. Aptos’ core advantage lies in combining optimistic parallelism with memory pool pre-sorting. This design reduces node performance requirements while dramatically improving throughput. As illustrated in the diagram below, Aptos’ network architecture clearly supports this efficient and high-performance design:

Source: Aptos White Paper

Ethereum: The Benchmark for Serial Execution

As the pioneer of smart contracts, Ethereum serves as the foundation of public blockchain technology. Its transaction lifecycle provides the basic framework for understanding Aptos.

Ethereum Transaction Lifecycle:

Create and Initiate: Users initiate transactions via wallets, through relay gateways or RPC interfaces.

Broadcast: The transaction enters the public memory pool and waits to be packaged.

Sorting: After Ethereum’s PoS upgrade, block builders package transactions based on profit maximization principles. The relay layer bids and submits the transactions to the proposer.

Execution: The Ethereum Virtual Machine (EVM) processes transactions serially, updating the state in a single thread.

Status Update: Blocks must pass through two checkpoints to confirm finality.

Ethereum’s serial execution and memory pool design impose limitations on performance, with block times of 12 seconds per slot and a relatively low TPS. In comparison, Aptos achieves a significant leap in performance through parallel execution and memory pool optimization.

Solana: The Ultimate Optimization of Deterministic Parallelism

Solana is known for its high performance, and its transaction lifecycle differs significantly from Aptos, particularly in terms of the memory pool and execution method.

Solana Transaction Lifecycle:

Create and Initiate: Users initiate transactions through their wallets.

Broadcast: Solana does not use a public memory pool. Transactions are sent directly to the current proposer and the next two proposers.

Sorting: The proposer packs the block based on Proof of History (PoH), with block times as fast as 400 milliseconds.

Execution: The Sealevel virtual machine employs deterministic parallel execution. Read and write sets must be declared in advance to prevent conflicts.

Status Update: The BFT consensus quickly confirms the finality of the transaction.

Solana avoids using a memory pool because it could become a performance bottleneck. Without a memory pool and with PoH, nodes can quickly reach consensus on transaction order, which eliminates the need for transactions to queue in a memory pool. As a result, transactions are nearly instantaneous. However, during network overload, transactions may be dropped instead of waiting, and users will need to resubmit them.

In contrast, Aptos’s optimistic parallelism does not require the declaration of read-write sets, lowering the node threshold while achieving higher TPS.

Source: shoe research

Two Paths to Parallel Execution: Aptos vs Solana

The execution of a transaction represents the update of the block state, converting the transaction initiation into a final state. This process can be understood as follows: the node assumes the transaction is successful and calculates its impact on the network state. This calculation is called execution.

In blockchain, parallel execution refers to multi-core processors simultaneously calculating the network’s state. Currently, there are two primary methods for parallel execution: deterministic parallel execution and optimistic parallel execution. The difference between these two methods lies in how to ensure parallel transactions don’t conflict—whether there are dependencies between transactions.

In the transaction lifecycle, the timing of identifying parallel transaction dependency conflicts determines the differentiation between deterministic and optimistic parallel execution. Aptos and Solana have chosen different approaches:

Deterministic parallelism (Solana):Before broadcasting a transaction, the read-write set must be declared. The Sealevel engine processes transactions in parallel if no conflicts are declared; conflicting transactions are executed serially. The advantage is high efficiency, but the downside is higher hardware requirements.

Optimistic Parallelism (Aptos):Aptos assumes no conflicts in transactions and executes them in parallel using Block-STM. After execution, the transactions are verified, and conflicts are retried if found. Pre-sorting transactions in the memory pool reduces the risk of conflicts, lowering the node’s load.

For example: Account A has a balance of 100. Transaction 1 transfers 70 to B, and Transaction 2 transfers 50 to C. Solana confirms conflicts through declarations before execution, handling transactions in order. In contrast, Aptos executes transactions in parallel, and if it finds insufficient funds, it adjusts the transactions accordingly. Aptos’ flexibility makes it more scalable.

Optimistic Parallelism and Memory Pool:

The core idea behind optimistic parallelism is to assume no conflicts in parallel transactions, meaning no transaction declaration is needed before execution. If a conflict arises during post-execution verification, Block-STM will re-execute the affected transaction to ensure consistency.

However, if transaction dependencies aren’t confirmed in advance, numerous errors could occur during execution, potentially slowing down the public chain. Therefore, optimistic parallelism doesn’t merely assume no conflicts; it mitigates risks during the transaction broadcast stage.

On Aptos, transactions entering the public memory pool are pre-sorted according to rules (e.g., FIFO or Gas fees) to ensure no conflicts in parallel execution. As a result, Aptos proposers don’t have the ability to order transactions, and there are no block builders in the network. This pre-sorting mechanism is key to achieving optimistic parallelism. Unlike Solana, which requires transaction declarations, Aptos doesn’t need this, reducing node performance requirements.

The overhead in ensuring transactions don’t conflict in Aptos through the memory pool has a much smaller impact on TPS compared to the cost of Solana’s transaction declarations. As a result, Aptos can achieve a TPS of 160,000—more than twice that of Solana.However, the pre-sorting of transactions impacts the difficulty of capturing MEV (Maximal Extractable Value) on Aptos, which has both pros and cons for users.

Aptos’ Development Focus: A Security-Driven Narrative

RWA (Real-World Asset Tokenization): Aptos is actively advancing the tokenization of real-world assets and institutional financial solutions. Compared to Ethereum, Aptos’ Block-STM can handle multiple asset transfer transactions in parallel, avoiding delays in asset validation caused by network congestion. While Solana and Sui boast fast transaction speeds, the lack of a memory pool design may cause transactions to be discarded during network overload, affecting the stability of asset validation. Aptos’ memory pool pre-sorting ensures that transactions are executed in order, maintaining asset record reliability even during peak periods. RWA requires complex smart contract support, such as asset splitting, yield distribution, and compliance checks. The modular design and security of the Move language make it easier for developers to build reliable RWA applications. In contrast, Ethereum’s Solidity complexity and vulnerability risks increase development costs, and Solana’s Rust programming, though efficient, requires a steeper learning curve for developers. Aptos’ ecosystem friendliness is expected to attract more RWA projects, forming a positive cycle. The potential of Aptos in the RWA space lies in the combination of security and performance. In the future, it could focus on collaborating with traditional financial institutions to bring high-value assets such as bonds and stocks on-chain, using the Move language to create compliant tokenization standards. This “security + efficiency” narrative allows Aptos to stand out in the RWA market.

- In July 2024, Aptos announced the integration of Ondo Finance’s USDY into its ecosystem, which has been integrated into major DEXs and lending applications. By March 10, 2025, USDY’s market capitalization on Aptos was approximately $15 million, accounting for about 2.5% of USDY’s total market cap. In October 2024, Aptos announced that Franklin Templeton had launched the Franklin on-chain U.S. Government Money Fund (FOBXX) on the Aptos Network, and it also collaborated with Libre to advance security tokenization, bringing investment funds from Brevan Howard, BlackRock, and Hamilton Lane onto the chain, enhancing access for institutional investors.

Stablecoin Payments: Stablecoin payments require ensuring transaction finality and asset security. Aptos’ Move language uses a resource model to prevent double-spending, ensuring the accuracy of every stablecoin transfer. For example, when users pay with USDC on Aptos, the transaction state is rigorously protected, avoiding fund loss due to contract vulnerabilities. Additionally, Aptos’ low gas fees (thanks to high TPS spreading costs) make it highly competitive in small payment scenarios. Ethereum’s high gas fees limit its payment applications, and while Solana has low costs, transaction drop risks during network overloads can affect user experience. Aptos’ memory pool pre-sorting and Block-STM ensure the stability and low latency of payment transactions.

PayFi and stablecoin payments need to balance decentralization and regulatory compliance. AptosBFT’s decentralized consensus reduces centralization risks, and its modular architecture allows developers to integrate KYC/AML checks. For instance, a stablecoin issuer can deploy compliance contracts on Aptos, ensuring transactions meet local regulations without sacrificing network efficiency. This is superior to Ethereum’s centralized relay model and addresses the potential compliance gaps of Solana’s proposer-led approach. Aptos’ balanced design makes it more suitable for financial institutions.

Aptos’ Potential in PayFi and Stablecoin Payments: Aptos’ potential in the PayFi and stablecoin payment space lies in the trifecta of “security, efficiency, and compliance.” In the future, it will continue to drive the widespread adoption of stablecoins, building cross-border payment networks, or partnering with payment giants to develop on-chain settlement systems. High TPS and low costs will also support micropayment scenarios, such as real-time tips for content creators. Aptos’ narrative could focus on “next-generation payment infrastructure,” attracting both business and user traffic.

Aptos’ Security Advantages: Aptos’ security advantages—memory pool pre-sorting, Block-STM, AptosBFT, and the Move language—not only enhance its resistance to attacks but also lay a solid foundation for RWA and PayFi narratives. In the RWA space, its high security and throughput support asset tokenization and large-scale transactions. In PayFi and stablecoin payments, its low cost and efficiency drive real-world application adoption. Compared to Ethereum’s robust but inefficient approach and Solana’s fast but high-barrier model, Aptos creates a new path through its balanced approach. In the future, Aptos can leverage these advantages to shape the narrative of a “security-driven value network,” becoming the bridge between the traditional economy and blockchain.

Summary: Aptos’ Technical Differences and Future Narrative

Through the perspective of the transaction lifecycle, we can clearly compare the technical design differences between Aptos, Ethereum, Solana, and Sui, and reveal their respective core narratives. The table below summarizes the similarities and differences among the four in the broadcast, sequencing, and execution phases, highlighting the unique advantages of Aptos:

Aptos is designed to strike a clever balance between performance and security. Its memory pool pre-sorting, combined with Block-STM’s optimistic parallelism, not only lowers node requirements but also achieves a high throughput of 160,000 TPS, surpassing Solana’s deterministic parallelism and Sui’s object-level parallelism. Compared to Ethereum’s serial execution, Aptos’ parallelism represents a significant leap. Unlike Solana and Sui, which cut out memory pool optimizations, Aptos retains the pre-sorting mechanism, ensuring network stability under high loads. This “stable yet fast” approach, along with the resource model of the Move language, gives Aptos higher security—whether defending against DDoS attacks or preventing contract vulnerabilities—surpassing Ethereum’s traditional architecture and Solana’s heavy hardware dependence.

The divergence between Aptos and Sui is more enlightening. Sui, also based on the Move language, is object-centric, pursuing ultimate performance with DAG sorting and object-level parallelism, suitable for high-concurrency asset management scenarios. In contrast, Aptos is account-centric, relying on memory pools and optimistic parallelism, balancing versatility and ecosystem compatibility. This difference not only reflects distinct technical paths but also signals diverging application directions: Sui excels in complex asset operations, while Aptos is better in security-driven scenarios.

Thanks to the combination of security and performance, Aptos shows great potential in RWA and PayFi narratives. In the RWA space, Aptos’ high throughput supports large-scale asset tokenization, with initial collaborations with Ondo Finance (USDY market cap about $15 million), Franklin Templeton, and Libre. In PayFi and stablecoin payments, Aptos’ low cost, high efficiency, and compliance support micro-payments and cross-border settlements, making it a strong candidate for “next-generation payment infrastructure.”

In conclusion, Aptos integrates security and efficiency into each phase of the transaction lifecycle, distinguishing it from Ethereum’s stable but inefficient design, Solana’s high-performance and high-barrier approach, and Sui’s extreme optimization focused on objects. In the future, Aptos can leverage its “security-driven value network” narrative to connect traditional finance with the blockchain ecosystem, continue strengthening its position in RWA and PayFi, and establish a new public chain landscape that balances trust and scalability.

About Movemaker: Movemaker is the first official community organization authorized by the Aptos Foundation, jointly launched by Ankaa and BlockBooster. It focuses on the development of the Aptos ecosystem in Chinese-speaking regions. As Aptos’ official representative in the region, Movemaker is dedicated to creating a diverse, open, and prosperous ecosystem by connecting developers, users, capital, and various ecological partners.

Disclaimer:

- This article is reproduced from [TechFlow]. The copyright belongs to the original author [TechFlow]. If you have any objection to the reprint, please contact Gate Learn team, the team will handle it as soon as possible according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team and are not mentioned in Gate.io, the translated article may not be reproduced, distributed or plagiarized.