🎉 Gate.io Growth Points Lucky Draw Round 🔟 is Officially Live!

Draw Now 👉 https://www.gate.io/activities/creditprize?now_period=10

🌟 How to Earn Growth Points for the Draw?

1️⃣ Enter 'Post', and tap the points icon next to your avatar to enter 'Community Center'.

2️⃣ Complete tasks like post, comment, and like to earn Growth Points.

🎁 Every 300 Growth Points to draw 1 chance, win MacBook Air, Gate x Inter Milan Football, Futures Voucher, Points, and more amazing prizes!

⏰ Ends on May 4, 16:00 PM (UTC)

Details: https://www.gate.io/announcements/article/44619

#GrowthPoints#

Will Solana's Rise Continue? Here are the Critical Levels and Expectations!

Solana (SOL) gained about 20% value last week, attracting investors' attention. However, this rapid rise also raises some questions. Although technical indicators show that SOL has gained strong momentum, the sustainability of this trend is not yet clear. It is uncertain whether the rise occurred due to general market conditions and the influence of Bitcoin, or due to Solana's own dynamics.

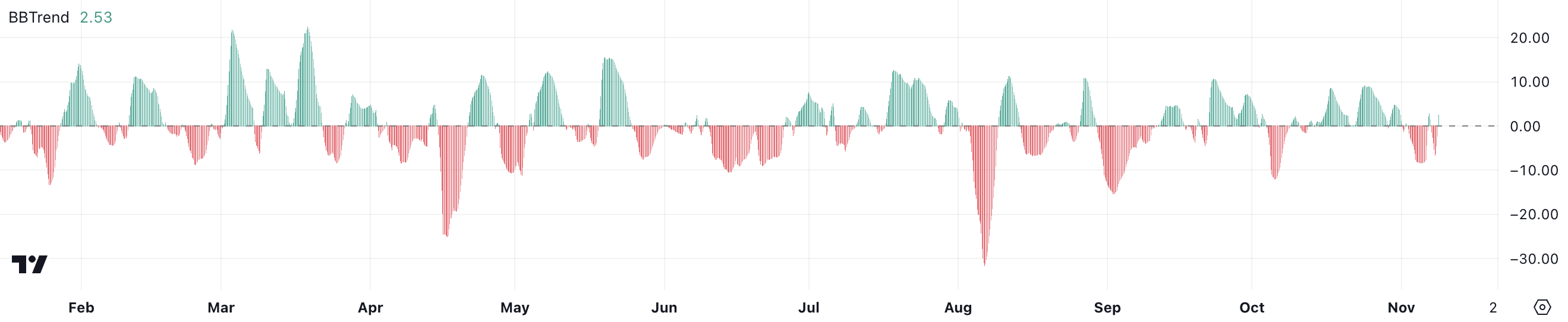

Evaluation of BBTrend and Solana's Momentum

Solana's (SOL) BBTrend indicator is currently at 2.53. This value had dropped to -10 levels in the last few days. However, it is showing a recovery right after. This recovery indicates a renewed buyer interest. However, BBTrend's still being at low levels suggests that Solana's rise is more fueled by overall market movements.

BBTrend measures the relationship between Bollinger Bands and momentum. Positive values indicate strength in price, while negative values indicate weakness. BBTrend at 2.53 suggests that Solana has gained some momentum, but it does not indicate a strong bullish signal. Amid Bitcoin's push for new highs, Solana (SOL) is benefiting from overall market trends.

Solana's Strong Bullish Trend

The DMI chart shows a significant increase in the trend strength of Solana (SOL). The ADX, which was nearly at 10 just a week ago, has now risen to 47.3. This increase clearly demonstrates how quickly Solana's trend is strengthening. The rising ADX value indicates that the current trend is based on a solid foundation.

Will it Break the Level 210 on the Left?

The EMA (Exponential Moving Average) lines of Solana (SOL) give a very positive outlook. The price is trading above all EMA lines. Additionally, the short-term EMAs are positioned above the long-term EMAs. This indicates a strong upward momentum and a clear trend direction.

If this trend continues, it is expected that Solana will test the 210 resistance. This will be the highest level seen since March. However, the BBTrend indicator shows that this momentum is largely fueled by the overall market. If market conditions weaken, Solana will test the 179 or 165 support levels. Maintaining the trend will depend on the overall momentum of the market. As kriptokoin.com also reported, cryptocurrencies are risky assets. Therefore, it is important to do your own analysis before investing.

To stay up to date with the latest developments, follow us on Twitter, Facebook, and Instagram, and join our Telegram and YouTube channels!