$PING Rebounds 50% — A Quick Look at c402.market, the Launchpad Built on $PING

x402 captured the crypto narrative spotlight for about two weeks, but few truly new assets have emerged from the hype.

The main reason is that x402 is designed for payments between AI agents, which doesn’t match crypto’s typical “create new assets” playbook.

Most x402-related crypto projects focus on infrastructure, benefiting more from technical narrative enthusiasm than immediate product breakthroughs.

Ironically, the first asset created with x402—$PING, a meme token—was the first to make waves.

On November 10 (UTC), the official PING Twitter, @pingobserver, announced the launch of the c402.market token launchpad based on x402, scheduled to go live November 11.

Following the announcement, PING’s price quickly rebounded from its daily low, surging almost 50% within 24 hours.

In short, the core mechanism of c402.market is that every new token issued on the platform is automatically paired for trading with $PING.

Put another way, PING isn’t just a meme token for the x402 narrative anymore—it’s become the “base currency” for the entire c402 ecosystem. If you want to join a new project on the platform, you need PING.

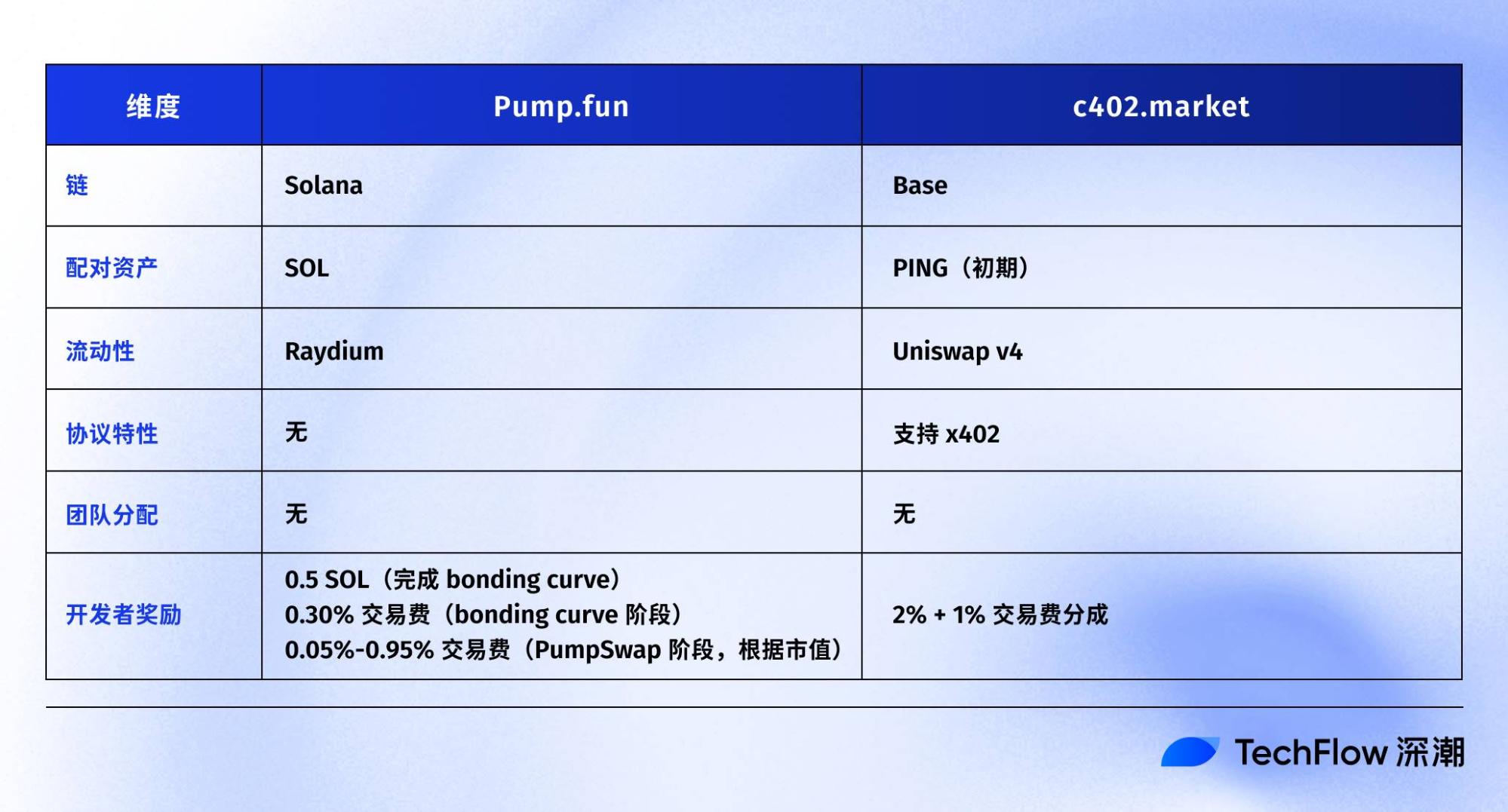

This approach is tried and true. Pump.fun in the Solana ecosystem made SOL essential for meme launches; launchpads on Base chain gave ETH new utility.

Now, c402.market is positioning PING to play a similar foundational role in the x402 ecosystem.

Currently, the market is at a bull-bear crossroads. Some believe it’s still a bear market, with no new narratives and little optimism for new assets; others think altcoin season is arriving in an unexpected way, bringing localized opportunities.

As x402 protocol trading activity has eased, launching a platform focused on trading and asset creation around x402 could present a niche opportunity in today’s environment.

But can PING successfully transition from meme coin to ecosystem currency? For everyday investors, where are the opportunities—and the risks?

Quick Review: x402 and PING

If you’re new to x402, here’s a quick summary:

x402 is an open payment protocol launched by Coinbase in May 2025. It enables websites, APIs, and AI agents to make direct payments using stablecoins (mainly USDC), with no need for accounts, passwords, or API keys.

The core mechanism is straightforward: When you access a paid service, the server returns HTTP 402—a “payment required” status code that has existed in internet protocols but was never used—telling you the payment amount.

You send an on-chain payment from your wallet, then re-request access. After the server verifies payment, you gain access via X402. The whole process takes about two seconds and charges zero fees.

x402’s popularity is tightly linked to $PING, which delivered a real wealth effect.

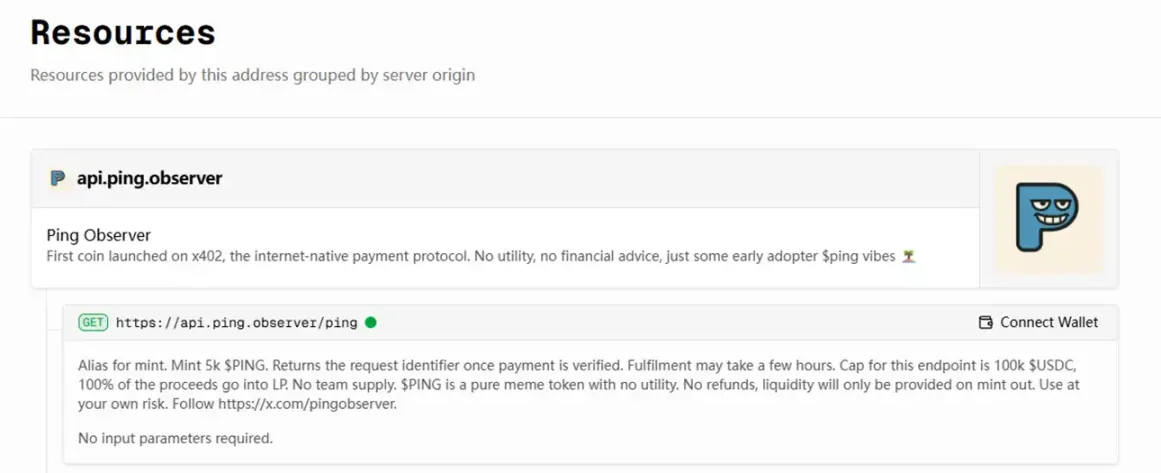

$PING was the first token issued under the x402 protocol. Users don’t need to sign up for an account—just visit a URL, see a “402 Payment Required” message, pay a small amount of USDC, and receive PING tokens upon retry.

The token itself has little utility and is really a meme, but its status as the first token created via x402 gave it a unique halo—much like recent inscription tokens. This drove intense speculation, with the price increasing thirtyfold after launch and its market cap exceeding $60 million.

Yet, after PING boomed, the x402 ecosystem hit an awkward patch:

The protocol is innovative, the technical narrative is compelling, and the backing is strong. But aside from PING, there are few assets for broader participation. x402 is more payment infrastructure than a token creation tool.

Most related projects focus on AI Agent services or API marketplaces—B2B businesses that don’t satisfy retail investors’ appetite for token speculation.

The market needs a venue that can consistently produce new assets and let retail investors join early-stage projects. That’s the context for c402.market’s arrival.

You might not like this model, but dismissing it as mere hype is also an overreaction.

c402.market: The Pump.fun for x402?

On the c402.market homepage, a bold slogan greets you:

“The mintpad for internet capital markets”

It’s the familiar ICP (Internet Capital Markets) narrative—pairing “internet” and “capital markets” to give a token launchpad a revolutionary veneer.

Simply put, c402.market is a token launchpad built on the x402 protocol. Anyone can quickly issue tokens, which are automatically paired for trading with $PING.

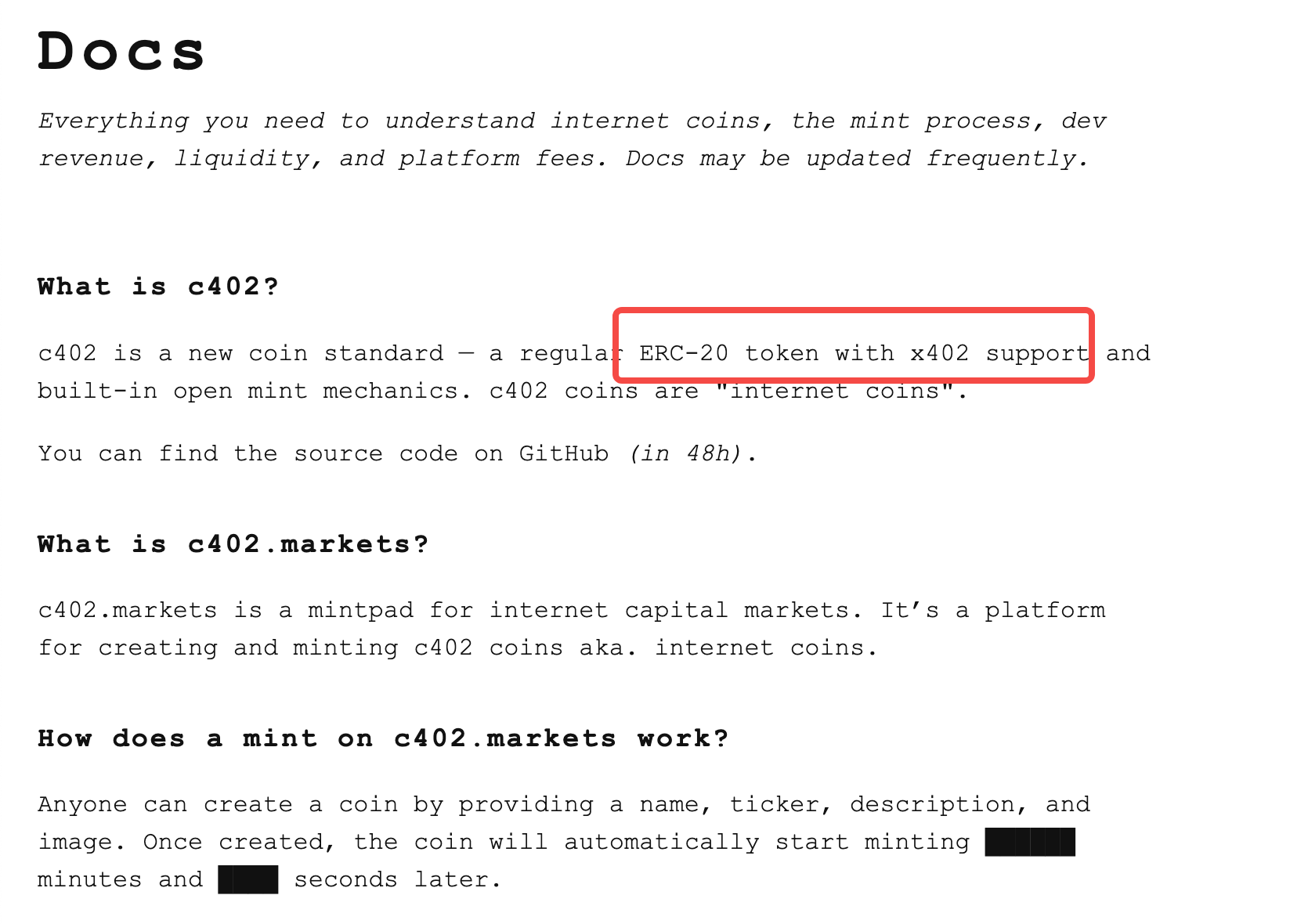

Before explaining the launch mechanism, let’s define “c402 token.” c402 is a custom token standard—a variant of ERC-20 that supports the x402 protocol and features public minting. The official term: “internet coins.”

Tokens issued on c402.market aren’t just standard ERC-20—they natively support x402 payments.

Theoretically, these tokens can be used for AI Agent payments or any app triggered by HTTP 402. In reality, most people care about speculation, not technical features.

c402.market’s launch mechanism borrows heavily from Pump.fun’s “Bonding Curve” model, with certain adaptations. Every token has a fixed supply of 1 billion—no team allocation, no reserved shares.

Per official docs, token distribution works like this:

- 49% via public minting, with each mint costing 1 USDC

- 49% used to add liquidity

- 2% as developer rewards

Minting process:

- Create the token: Anyone can create a token by providing a name, code, description, and image. This costs a 1 USDC creation fee (to prevent spam).

- Wait for minting to open: After creation, minting opens after a set period (the official docs do not disclose the exact time—could be minutes to tens of minutes; actual timing will be revealed at launch).

- Minting phase: Users pay 1 USDC to mint tokens. Minting slots are limited.

- Automatic listing: Once all minting slots are filled, the collected USDC is processed automatically.

How PING Pairing Works: USDC → PING → Liquidity Pool

This is the core mechanism—and the logic behind PING’s benefit.

Per the project’s Github, once a c402 token finishes minting, all USDC raised is used to buy the paired token (currently only PING). The purchased PING plus the remaining 49% of tokens form a liquidity pool, which is locked.

For example: Someone creates $COIN and selects $PING as the pairing asset. If 10,000 mints occur, that’s 10,000 USDC.

- Minting: Users pay USDC; 10,000 USDC is collected.

- Auto-swap: The 10,000 USDC is swapped for $PING on Uniswap.

- Liquidity added: The acquired PING and 490 million $COIN (49% supply) are added to Uniswap v4’s liquidity pool and permanently locked.

- Developer reward: The creator receives 20 million $COIN (2%).

What does this mean for PING?

Each successful new token launch on c402.market creates forced USDC → PING buying pressure. If the platform hosts 10 projects a day, each raising 10,000 USDC, that’s $100,000 in daily PING buy orders.

This likely explains why PING surged 50% after the c402.market announcement—the market is pricing in anticipated buy pressure and ecosystem growth.

Who Profits?

c402.market’s fee structure:

For minters:

- Each mint costs 1 USDC

- 2% goes to the platform (0.02 USDC)

- Gas fees (minimal on Base chain, but still required)

For token creators:

- 1 USDC creation fee (to prevent spam) to create a token c402

- 2% of the token supply as a reward

- 1% of trading fees from the liquidity pool (partially paid in tokens) c402

Docs note that you can set up your own frontend and make yourself the referrer to collect the 2% platform fee—effectively minting with zero platform fees.

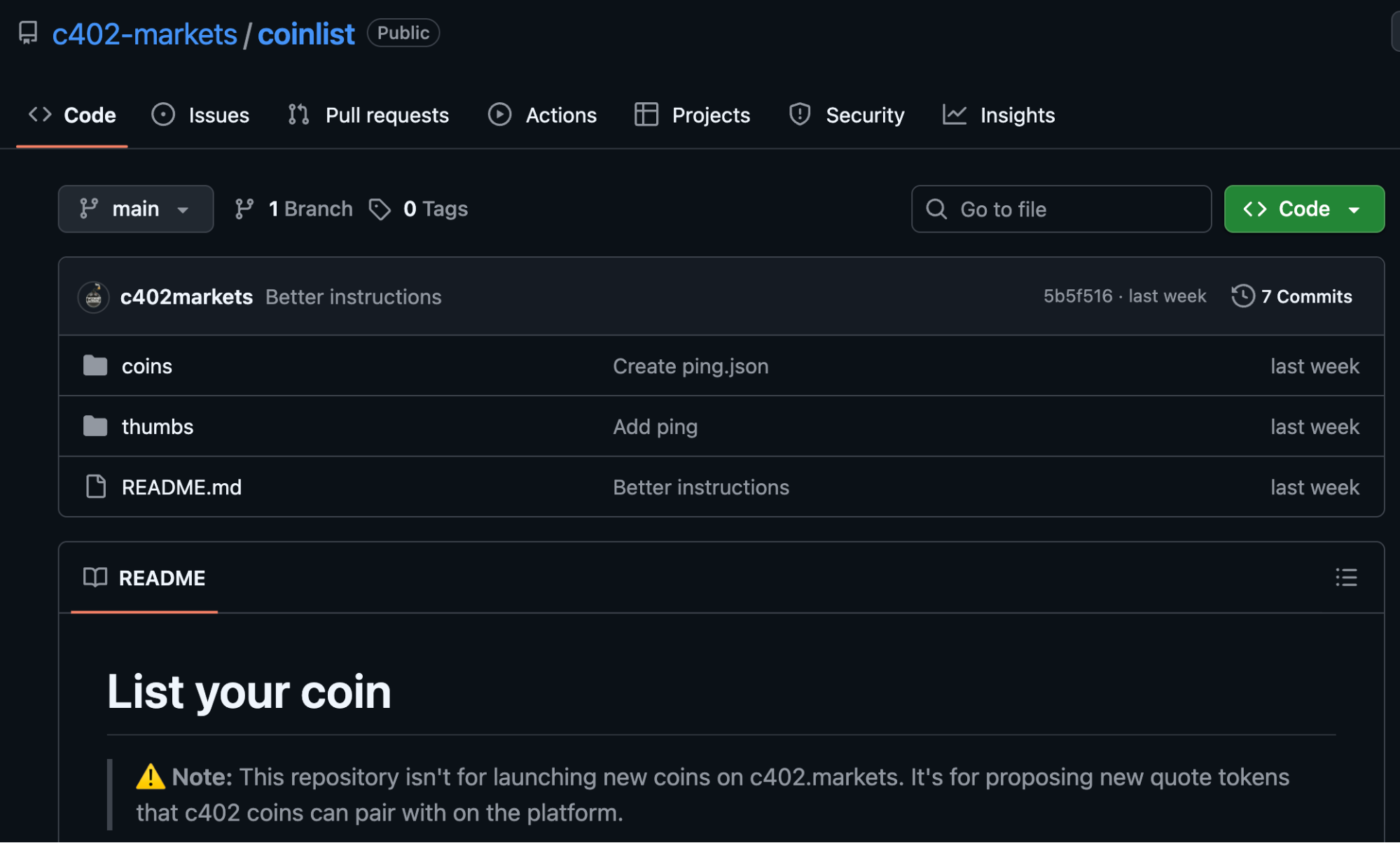

Though PING is the only pairing asset at launch, c402.market’s GitHub already allows paired token whitelist submissions github. Any project can submit a PR for pairing, as long as it has sufficient locked liquidity on Uniswap v3/v4 and meets JSON/image specs. After approval, the token is manually whitelisted on-chain.

This means c402.market could support USDC, ETH, or other tokens for pairing in the future—not just PING. For now, PING is the sole option.

It’s clear c402.market’s design incentivizes token creators, not just minters and traders. Anyone familiar with the industry knows this could flood the platform with low-quality projects, since creators have financial incentives to keep launching new tokens.

As of publication, c402.market just announced its launch (November 10, 14:00 UTC). Many details—including mint count, time windows, and “bribery” mechanisms—remain omitted in the official docs.

This could be to prevent bots from gaming the system, or because the team hasn’t finalized the details.

The true test comes when the first projects launch, liquidity forms, and traders start competing. Only then will the mechanism’s real-world performance be clear.

Ultimately, asset creation and new token launches are perennial crypto themes—they’ve just shifted to the x402 concept. With few fresh narratives today, cautious participation may be the most practical approach.

Statement:

- This article is reprinted from [TechFlow]; copyright belongs to the original author [David, TechFlow]. If you have concerns about republication, contact the Gate Learn team, who will address your concerns promptly following established procedures.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by Gate Learn. Do not copy, distribute, or plagiarize translated articles without mentioning Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?