什麼是 Paradigm?

Paradigm 是一個去中心化金融(DeFi)平台,提供先進的流動性解決方案和全新的交易工具。其目標是通過提供如統一市場(Unified Markets)和 RFQ(報價請求,Request for Quote)等工具,整合來自多個去中心化交易所和區塊鏈的流動性,從而彌合各類流動性來源之間的差距。Paradigm 通過優化訂單路由、減少滑點並確保輕鬆訪問深度流動性,提升了交易體驗。該平台通過提供對各種數字資產的訪問權限,使交易者、機構和開發者受益,進而提升 DeFi 生態系統的效率與透明度。

什麼是 Paradigm?

Paradigm 是一個專爲加密衍生品交易者打造的流動性網絡,可通過中心化金融(CeFi)和去中心化金融(DeFi)平台,提供對多資產、多協議流動性的訪問,打造一致且非托管的交易體驗。Paradigm 在 CeFi 和 DeFi 生態系統中運營着一個面向機構的加密衍生品流動性網絡。該平台爲交易者和加密協議統一提供按需獲取多資產、多協議流動性的通道,同時不犧牲執行偏好、成本或速度。該公司旨在打造一個平台,讓用戶可以與任何人交易任何資產,並在任何地方完成結算。Paradigm 致力於深入了解用戶需求,並準確表達其所要解決的問題。

Paradigm 的目標是通過整合交易平台、協議和代理,作爲獲取多平台流動性的樞紐,運作成爲一個多種資產流動性的網絡,並促進用戶之間的交換。Paradigm 的計劃包括在 DeFi 中設立用戶帳戶和衍生品的扣款機制。這是構建完整金融體系並將其納入加密生態系統的重要一步。Paradigm 擁有加密貨幣領域最大的機構交易對手網絡,目前已有超過 700 家機構客戶,每月交易額超過 100 億美元,其中包括對沖基金、場外交易(OTC)臺、借貸方、結構性產品發行人、做市商以及知名家族辦公室。

Paradigm 的背景

Paradigm 成立於 2016 年,由 Anand Gomes 和 Michal Koonin 共同創辦,總部位於新加坡。Anand Gomes 是 Paradigm 的聯合創始人兼首席執行官(CEO),而 Michal Koonin 則是聯合創始人兼運營高級副總裁(SVP of Operations)。Anand Gomes 畢業於凱斯西儲大學(Case Western Reserve University)的 Weatherhead 管理學院,Michal Koonin 畢業於 DePaul University。Gomes 和 Koonin 均爲傳統金融領域的資深人士,曾在 KeyBanc Capital Markets 和 Wolverine Trading 的交易部門工作。

2019 年 12 月,Paradigm 宣布完成 3,500 萬美元的 A 輪融資。本輪融資由 Jump Capital 和 Alameda Ventures 領投,公司估值達 4 億美元。A 輪融資共有超過 25 家投資方參與,包括 Genesis Trading、QCP Capital、Nexo、Optiver US、IMC、GSR、Akuna Capital、Babel Finance、MGNR、Avon Ventures、CMT Digital、Goldentree Asset Management 的高管團隊,以及 Amber Group。此前的種子輪投資者包括 Dragonfly Capital、Digital Currency Group、Vectr Fintech Partners、Mirana Ventures、Bybit 和 BitDAO Venture Partners。

Paradigm 的投資者包括 Jump Capital、Dragonfly Capital、Digital Currency Group、Genesis Trading、QCP Capital、Nexo、Optiver US、IMC、GSR Markets、Akuna Capital、MGNR、Avon Ventures、CMT Digital、Pattern Research、Vectr Fintech、Amber Group,以及一些場外交易(OTC)市場最具影響力的私人投資者。

Paradigm 的特色功能

Paradex

Paradex 是一個基於 Paradigm 流動性網絡的去中心化交易所(DEX)。它的創建旨在緩解去中心化金融(DeFi)中流動性碎片化的問題,支持高效的跨鏈交易。Paradex 匯聚多個去中心化交易所(DEX)的流動性,形成一個聚合流動性池,以實現更高效的交易。用戶可直接通過自己的錢包進行交易,無需依賴中心化交易所,從而提供一個真正去中心化的數字資產交易選項。Paradex 通過將訂單路由至多個流動性來源來優化交易執行,同時最小化滑點。Paradex Chain 是一個通用型智能合約平台,基於 CairoVM 驅動。它與 Paradex 交易所共享狀態,使鏈上應用可以與深度流動性基礎設施順暢交互,打造一個可組合、高吞吐的執行環境。

Paradex 的誕生,是由於中心化金融(CeFi)的風險引擎缺乏統一的框架,難以對一個資產組合中的風險進行可靠評估。這意味着,大多數交易所的保證金要求可能無法準確反映用戶的真實投資組合風險,從而導致用戶需承擔更高的資本需求。此外,大多數 DeFi 交易所也普遍存在“真實”用戶流動性不足的問題,其流動性與交易量仍落後於 CeFi 平台。

Paradex 的優勢

- Paradex 聚合多個區塊鏈的流動性,使您可以在多個去中心化平台和生態系統間自由交易。

- Paradex 使用智能訂單路由算法,能在多個 DEX 之間找到最佳價格,降低滑點、提升交易執行效率。

- Paradex 是完全去中心化的平台,在交易過程中,用戶對私鑰和資產始終擁有完整控制權。

- 該平台專注於提升跨鏈交易的流暢性,用戶可無需切換多個界面,即可創建復雜交易策略。

- Paradex 的去中心化特性通常意味着費用更低於中心化交易所,同時提供更安全的交易環境。

Paradex 是 Paradigm 更廣泛流動性網絡的核心組成部分。通過跨多個平台整合流動性,它有助於構建一個更爲緊密的 DeFi 生態系統,使去中心化金融對交易者和流動性提供者而言更加可訪問、更加高效。

Paradigm RFQ(報價請求)

Paradigm RFQ(Request for Quote,報價請求)是 Paradigm 平台中的一項功能,允許用戶在去中心化金融(DeFi)生態系統中,爲大額或復雜交易請求並提供報價,尤其適用於那些難以交易或流動性較差的資產。RFQ(報價請求)是一種電子通信方式,向特定的交易對手方(即報價方 / maker)發出,以獲取某個特定期權或期貨策略的價格報價。RFQ 可明確指定清算場所、產品與工具類型、交易方案,以及帳戶或子帳戶信息。它既可以是一項多腿套利策略,也可以是單一工具的交易請求。

交易者可通過 Paradigm 向流動性提供者(LP)發送請求,詳細說明其希望交易的資產及其特殊交易需求。作爲回應,流動性提供者(如機構做市商)會根據其可用流動性與所請求交易規模,發出相應報價。RFQ 模式使交易者能夠就某一資產或交易規模進行議價,從而確定最優價格,尤其適用於流動性較低的市場,或在執行可能影響傳統 DEX 報價的大額交易時更爲有效。當交易者收到滿意的報價後,即可選擇接受該報價,並與流動性提供者直接完成交易,從而規避了去中心化交易所常見的滑點和訂單簿相關問題。

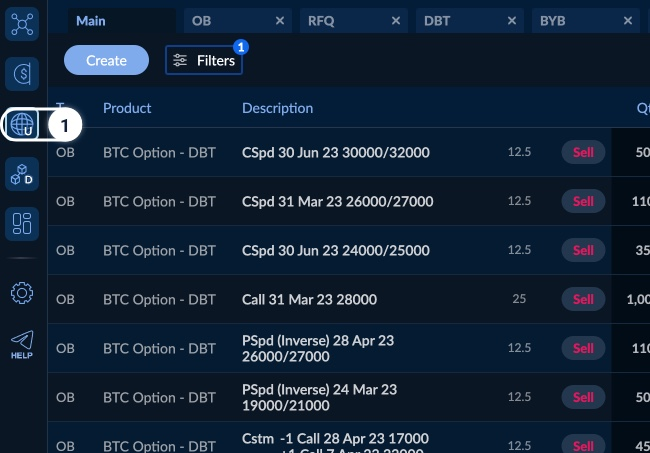

復雜訂單簿 (Order Book, OB)

Paradigm 的復雜訂單簿(Complex Order Book, OB)是一個公開可見的集合,展示了特定加密衍生品結構的所有買單與賣單。交易者可利用該訂單簿了解市場的供需情況,以及其他人願意買入或賣出的價格區間。該訂單簿支持部分成交機制,即系統可以將某一交易者的訂單部分地與訂單簿對側的一個或多個可用訂單匹配,從而實現與多個交易對手方的分段執行。大宗訂單可作爲限價單掛在訂單簿上,等待執行。例如,當用戶希望進行價格發現而又不想暴露實際訂單規模時,OB 可幫助其大致了解市場對於其結構的定價。如果報價水平合理,用戶既可以直接在訂單簿上執行交易,也可以啓動一個 RFQ(報價請求)流程。

Paradex Chain

Paradex Chain 是一個基於 Starknet Appchain 的去中心化永續合約交易所(DEX),支持自托管交易及鏈上風險引擎,旨在實現資金效率最優化。StarkEx 的開發團隊 Starkware 是該項目的重要合作夥伴和關鍵技術提供方。Starknet 是一個使用零知識證明(Zero-Knowledge Proofs, ZK-Proofs)的 Rollup 鏈,它通過發布二層(L2)狀態變更的證明,由一層(L1)智能合約使用二層業務邏輯進行驗證,以確保其準確性。Paradex Chain 是一個通用型智能合約平台,由 CairoVM 驅動。它與 Paradex Exchange 共享狀態,提供一個可組合、高吞吐量的執行環境,使鏈上應用可以與構建出的深度流動性基礎設施順暢交互。CairoVM 是專爲有效性證明系統(ZK-Rollups)打造的專用虛擬機,不受基於 EVM 的設計限制。

Cairo 是一種類似 Rust 的語言,用於編寫智能合約,以提升基於 STARK 證明的計算效率,從而支持以太坊的擴展。Starknet 的 Cairo 開發者採用固定精度的 8 位小數,即將所有數字乘以 10^8 轉換爲整數。例如,ETH-USD-PERP 的價格爲 $3,309.33 時,將其乘以 10^8 得到 330,933,000,000,從而使系統能夠用整數而非小數進行操作。該系統使用這些整數來確保在生成訂單籤名時的準確性與一致性。協議要求所有交互均以整數形式進行,不包括 API 層的值。Paradex 帳戶具備一個所有者密鑰與一個監護人密鑰,以增強安全性。用戶還可通過添加“監護人(Guardian)”和“備用監護人(Backup Guardian)”,並使用多籤機制來控制交易,從而進一步保護 Paradex CLI 帳戶。

Paradex Chain 採用一種基於資產證明的共識機制(Proof of Asset-Based Consensus,PoBCH),結合了權益證明(PoS)與權威證明(PoA)的特點,以驗證交易並保護其網絡。驗證者需質押代幣以參與區塊生產,系統將選出質押額度最高的候選者來生成區塊。該機制提升了區塊鏈的安全性、穩定性與最終性。Paradex Chain 並非完全採用 PoS,而是融合了 PoS 與 PoA,打造出獨特且安全的混合共識模型。在性能參數方面,Paradex Chain 的吞吐量達每秒 10,000 筆交易(TPS),延遲約爲 1 秒。正是由於 PoBCH 共識機制,使得該平台實現了更短的區塊時間與更低的交易費用。Paradex 還採用多項安全措施保障資金管理,包括阻止來自 L1 的直接存款,以及對 L1 與 L2 的提取進行限制。驗證者通過在 Paradex Chain 上質押代幣參與區塊生成,系統從中挑選質押最多的候選者參與出塊,形成一種結合質押與權威驗證的混合式共識機制。

Paradigm 的產品

Unified Markets(統一市場)

Paradigm Unified Markets 是 Paradigm 推出的一項產品,旨在連接去中心化金融(DeFi)生態系統中的多個流動性池與交易平台,打造一個統一、無縫的交易體驗。該產品通過整合來自不同來源的流動性,允許用戶通過一個統一界面,在多個協議和平台之間進行交易,從而提升了數字資產市場的可訪問性、效率與流動性。Paradigm Unified Markets 支持基於 RFQ(報價請求)機制的按需拍賣,並可應用於任何工具或策略的復雜訂單簿。這一解決方案使用戶能夠快速從流動性提供者處獲得雙邊報價,適用於大額、復雜、多腿的策略型交易,無論是公開還是匿名執行。此外,用戶還可以按需創建任意策略的復雜訂單簿。將限價單掛在訂單簿上,可支持對買盤出價(hit the bid)、對賣盤成交(lift the offer)或提高出價水平。

Paradigm Unified Markets 的特色功能

流動性聚合:Unified Markets 匯聚來自多個去中心化交易所(DEX)、流動性池,甚至中心化交易所的流動性,爲交易者在同一平台上提供更大的流動性池。它讓用戶無需在不同流動性來源之間手動切換,即可實現無縫交易,解決了傳統市場與 DeFi 市場中普遍存在的操作不便問題。

智能訂單路由:Unified Markets 產品採用智能訂單路由技術,可自動將交易者的訂單發送至最合適的流動性來源。這項技術不僅可減少滑點,還能確保以最佳價格成交。無論流動性來自 DEX、自動化做市商(AMM)或其他去中心化平台,該系統均能識別最優路徑。

跨鏈整合:Paradigm Unified Markets 能夠跨多個區塊鏈聚合流動性,允許用戶在不同生態系統之間自由交易資產,而無需手動跨鏈橋接或兌換。例如,某位交易者可能希望將一個基於以太坊的代幣兌換成幣安智能鏈(BSC)上的代幣,平台將自動處理兩條鏈上的流動性獲取與交易執行等復雜過程。

如何使用 Paradigm Unified Market

- 在 Paradigm 程序左側邊欄中選擇 Unified Market 圖標。

- 用戶需設置必要的權限,以便從交易平台讀取您的持倉信息。以 Deribit 爲例:需要爲您的 API 密鑰設置 Allow Trade: read-only 權限範圍。

- 請在管理員儀表盤中檢查所有權限是否配置正確。若配置無誤,您應能在對應的 API 密鑰旁看到一個綠色勾號標識。

- 此時,用戶應能在 Positions(持倉) 標籤頁中查看各平台的持倉信息,系統會自動刷新這些數據。持倉標籤頁右上角的計時器表示刷新時間間隔。

- RFQ 與 OB 按鈕可讓用戶直接從當前持倉中發起報價請求(RFQ)或創建復雜訂單簿(Complex Order Book)。

Delta-1 價差交易(Delta-1 Spreads)

Paradigm 的 Delta-1 Spreads 是流式訂單簿,允許交易者輕鬆進行 Delta-1 工具之間的價差交易,例如現貨、永續合約和期貨合約之間的組合。該功能支持相關合約的同時買入與賣出,從而實現套利、對沖等交易策略。Paradigm 的 Delta-1 Spreads 爲加密貨幣衍生品市場中的復雜交易策略提供了高效執行、較低成本和更高流動性。

通過 Delta-1 Spreads,交易者可執行永續資金費率交易策略(現貨對永續合約)、基差策略(現貨對期貨),以及無腿風險地滾動其對沖頭寸(永續對期貨)——所有操作均可在單一交易所內完成。此外,平台還支持所有 Delta-1 資產(現貨、永續合約或期貨)之間的價差交易,均通過流式訂單簿進行。

Paradigm 進一步擴展了與 Bybit 的合作,新增支持 USDT 保證金的 Delta-1 套利交易。此項合作使用戶可以一鍵交易涵蓋 25 種加密貨幣的 USDT 保證金現貨與永續合約之間的價差,無需影響 Bybit 的訂單簿,也不會產生腿部風險(leg risk)。此外,通過 Paradigm 平台發起並由 Bybit 結算的此類價差交易,其現貨部分將免除手續費。

Delta-1 Spread 的特色功能

- 專屬價差流動性:Paradigm 直接從其廣泛的機構網絡中引入流動性,確保具備針對價差交易的深度流動性,無需依賴交易所的訂單簿。

- 費用降低:通過與 Bybit 等交易所的合作,Paradigm 提供的價差交易在第二腿交易中免收手續費,相較傳統屏幕交易,交易費用最多可降低 50%。

- 原子執行:平台實現價差交易中雙腿訂單的原子性執行,顯著減少逐腿建倉(legging)所帶來的風險,提升交易效率與成交確定性。

Delta-1 Spread 如何運作

Delta-1 Spreads 表格

- 在 Paradigm 應用程序左側邊欄中選擇 Delta-1 Spreads 圖標。

- 在頁面頂部,通過 Asset(資產) 和 Venue(交易平台) 進行篩選。

- 表格以行與列的組合方式顯示各類價差交易。

- 所有 Delta-1 價差交易均處於激活狀態,交易者可對任一當前可用的 Delta-1 價差進行報價或執行交易

- 所有 Delta-1 價差交易均保持匿名,任何交易臺(desk)信息都不會傳輸給對手方。

掛出市價單(Market Order)

- 在 Delta-1 Spreads 界面中,點擊 Bid(買價) 或 Ask(賣價) 按鈕。

- 在右側菜單中,位於 Strategy Details(策略詳情) 下方,選擇 Market(市價) 類型。默認打開時爲限價單(Limit)。

- 輸入交易數量。

- 如需切換買賣方向,點擊 Swap(切換) 按鈕。

主做市商(Prime Dealers)

Paradigm 的 Prime Dealers(主做市商) 是該平台上唯一的市場做市方。作爲一個加密貨幣衍生品交易平台,Paradigm 爲加密交易者提供機構級流動性和深度期權流動性。主做市商提供目前加密市場中最廣泛的期權流動性。Paradex 的 Prime Dealer 是 Paradex 生態系統中的核心組成部分,旨在連接傳統金融與去中心化金融(DeFi)。Prime Dealer 通過 Paradex 網絡支持交易互通、流動性供給與交易執行。在去中心化金融網絡的基礎設施中,Prime Dealers 經常扮演關鍵角色,負責提供流動性、進行市場做市、以及實現快速交易執行。他們主要負責將機構交易者與高交易量參與者連接到去中心化平台。

主做市商提供當前加密貨幣市場中最具規模的流動性選項,使交易者可以以最小的價格影響完成大額交易。Paradigm 提供一個統一界面,幫助交易者查看、管理並執行包括 RFQ 與復雜訂單簿在內的各類交易。Paradigm 的目標是爲交易者提供機構級的流動性,使其能夠執行復雜策略並進入更深的市場。 雖然 Paradex Prime Dealer 的具體運作方式可能會隨着生態系統及平台的發展有所不同,但該角色始終是保障網絡具備高流動性、可訪問性和處理大規模交易能力的關鍵力量,同時確保高度的安全性與運營效率。

Paradex 的 Prime Dealer 擁有多項關鍵功能,旨在橋接傳統金融與去中心化金融(DeFi)之間的鴻溝,同時保持高流動性、高效交易與市場運營的安全性。Paradex Prime Dealers 向 Paradex 網絡提供流動性,確保大宗交易擁有充足的資本支持,並實現順暢的交易執行。他們通過擔任買方和賣方角色,有助於穩定市場,增強市場深度,並減少價格滑點。市場做市是 Prime Dealer 的核心職責,他們會在訂單簿的買入與賣出兩側同時掛單,確保市場始終處於活躍狀態。這一功能使客戶能夠在無需遭遇重大延遲或流動性限制的情況下進行資產交換。Paradex Prime Dealers 經常扮演連接機構交易者與去中心化平台的橋梁角色,使得那些在純 DeFi 環境下原本難以完成的大額交易成爲可能。

結論

Paradigm 是一個爲加密貨幣衍生品交易者打造的流動性網絡,服務於中心化金融(CeFi)與去中心化金融(DeFi)領域。Paradigm 致力於通過集成技術的發展,降低市場價差、提升整體流動性,從而構建一個更高效的交易網絡。因此,用戶參與加密市場可能變得更加容易,流動性價差也可能隨之縮小。 Paradigm 通過解決傳統場外交易(OTC)中存在的問題,爲從事期權或價差交易的機構投資者提供了一個交易市場。

相關文章

Sui:使用者如何利用其速度、安全性和可擴充性?

Arweave:用AO電腦捕捉市場機會

即將到來的AO代幣:可能是鏈上AI代理的終極解決方案

Solv協定:集中式去中心化金融趨勢下的資產管理新範式

什麼是漿果?您需要瞭解的有關BERRY的所有資訊