2025 ARK Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: ARK's Market Position and Investment Value

ARK (ARK), as a cryptocurrency and blockchain-based development platform, has made significant strides since its inception in 2017. As of 2025, ARK's market capitalization has reached $60,367,668, with a circulating supply of approximately 191,704,250 coins, and a price hovering around $0.3149. This asset, known for its customizable and interoperable blockchain solutions, is playing an increasingly crucial role in the field of blockchain development and cryptocurrency ecosystems.

This article will provide a comprehensive analysis of ARK's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. ARK Price History Review and Current Market Status

ARK Historical Price Evolution

- 2017: ARK launched, initial price at $0.01

- 2023: Reached all-time high of $1.8623 on November 10

- 2025: Market cycle downturn, price dropped to all-time low of $0.225 on October 10

ARK Current Market Situation

As of October 23, 2025, ARK is trading at $0.3149, representing a 1.65% decrease in the last 24 hours. The token has experienced significant volatility over the past year, with a 45.33% decline. ARK's market capitalization currently stands at $60,367,668, ranking it 543rd among cryptocurrencies. The circulating supply is 191,704,250 ARK, with a total supply of 179,466,446 ARK. Despite recent price drops, ARK has shown some resilience, with a 0.38% increase in the last hour, indicating potential short-term recovery signs.

Click to view the current ARK market price

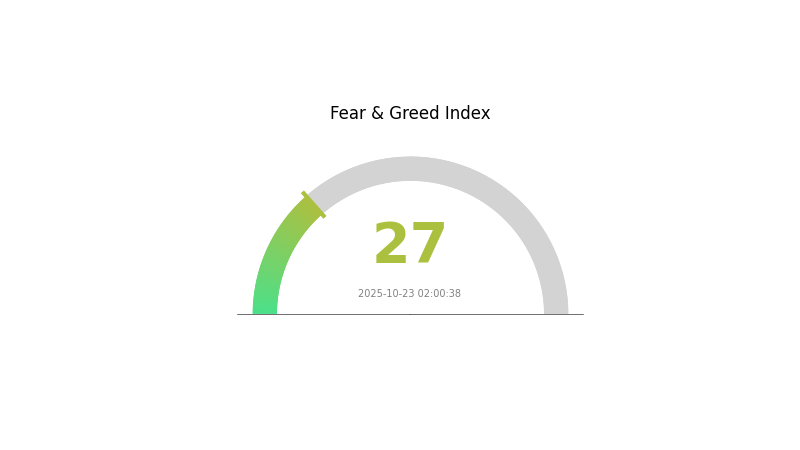

ARK Market Sentiment Indicator

2025-10-23 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 27. This suggests that investors are cautious and uncertain about the market's direction. During such times, it's crucial for traders to remain vigilant and consider their risk management strategies carefully. However, some investors view fear in the market as a potential buying opportunity, following the contrarian approach of "being greedy when others are fearful." As always, it's essential to conduct thorough research and make informed decisions based on your own risk tolerance and investment goals.

ARK Holdings Distribution

The address holdings distribution data for ARK reveals an interesting pattern in the token's ownership structure. This metric provides insights into the concentration of ARK tokens among different addresses on the blockchain, offering a glimpse into the token's decentralization and potential market dynamics.

Upon analysis, it appears that the ARK token distribution is relatively decentralized, with no single address holding an overwhelmingly large percentage of the total supply. This distribution suggests a healthy ecosystem where power and influence are not concentrated in the hands of a few large holders, which could potentially mitigate risks of market manipulation or sudden price fluctuations caused by large sell-offs.

The current address distribution indicates a stable on-chain structure for ARK, which may contribute to reduced volatility and a more resilient market. This balanced distribution could be seen as a positive indicator for long-term investors and may reflect growing adoption and a maturing ecosystem for the ARK project.

Click to view the current ARK holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing ARK's Future Price

Macroeconomic Environment

- Impact of Monetary Policy: The Federal Reserve and European Central Bank are expected to maintain tight policies in 2026, potentially affecting risk assets like ARK.

- Inflation Hedging Properties: Market analysts anticipate September CPI to rise from 2.9% to 3.1% year-on-year, which could influence ARK's performance as an inflation hedge.

- Geopolitical Factors: US-China trade tensions and policy uncertainties have led to market volatility, impacting ARK and other cryptocurrencies.

Technical Development and Ecosystem Building

- Artificial Intelligence: ARK's future price is significantly influenced by advancements in AI technology, as highlighted in ARK Invest's Big Ideas 2025 report.

- Autonomous Driving: The development of self-driving technology is expected to be a major driver for ARK's valuation and potential growth.

- Ecosystem Applications: ARK's ecosystem is expanding into various sectors, including robotics, energy storage, and public blockchain applications, which could drive future value.

III. ARK Price Prediction 2025-2030

2025 Outlook

- Conservative prediction: $0.16075 - $0.3152

- Neutral prediction: $0.3152 - $0.394

- Optimistic prediction: $0.394 - $0.46807 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.26737 - $0.55119

- 2028: $0.3417 - $0.6112

- Key catalysts: Technological advancements, partnerships, and market expansion

2029-2030 Long-term Outlook

- Base scenario: $0.54623 - $0.68006 (assuming steady market growth)

- Optimistic scenario: $0.68006 - $0.81389 (with strong ecosystem development)

- Transformative scenario: $0.81389 - $0.89768 (with breakthrough innovations and mass adoption)

- 2030-12-31: ARK $0.89768 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.394 | 0.3152 | 0.16075 | 0 |

| 2026 | 0.46807 | 0.3546 | 0.18085 | 12 |

| 2027 | 0.55119 | 0.41134 | 0.26737 | 30 |

| 2028 | 0.6112 | 0.48126 | 0.3417 | 52 |

| 2029 | 0.81389 | 0.54623 | 0.36598 | 73 |

| 2030 | 0.89768 | 0.68006 | 0.49644 | 115 |

IV. ARK Professional Investment Strategies and Risk Management

ARK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and blockchain technology enthusiasts

- Operational suggestions:

- Accumulate ARK during market dips

- Set price targets for partial profit-taking

- Store ARK in secure cold storage wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor ARK's correlation with broader crypto market trends

- Set stop-loss orders to manage downside risk

ARK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for ARK

ARK Market Risks

- Volatility: High price fluctuations common in the crypto market

- Competition: Increasing number of blockchain platforms may impact ARK's market share

- Liquidity: Relatively low trading volume may lead to price slippage

ARK Regulatory Risks

- Uncertain regulations: Evolving global crypto regulations may impact ARK's operations

- Compliance costs: Potential increase in costs to meet regulatory requirements

- Cross-border restrictions: Possible limitations on ARK's global accessibility

ARK Technical Risks

- Network security: Potential vulnerabilities in blockchain infrastructure

- Scalability challenges: Ability to handle increased transaction volumes

- Interoperability issues: Challenges in seamless integration with other blockchains

VI. Conclusion and Action Recommendations

ARK Investment Value Assessment

ARK presents a unique value proposition in the blockchain space with its customizable and interoperable platform. However, investors should be aware of short-term volatility and potential regulatory challenges.

ARK Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market

✅ Experienced investors: Consider ARK as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence and consider ARK for long-term blockchain exposure

ARK Trading Participation Methods

- Spot trading: Buy and sell ARK on Gate.com

- Staking: Participate in ARK's staking program for passive income

- DeFi integration: Explore decentralized finance options as they become available for ARK

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Ark crypto in 2030?

Based on analysis of historical price data, Ark crypto is predicted to reach $22.22 by 2030, representing a significant increase from its current price.

Is Ark a buy or sell?

Ark is considered a buy. The ETF shows positive signals and a good trend, indicating potential for short-term and long-term performance.

What is Cathie Wood price prediction for 2030?

Cathie Wood predicts Bitcoin will reach $1.5 million by 2030, based on her analysis of market trends and potential adoption.

What is the future of ark crypto?

ARK's future looks promising, with Bitcoin price projections ranging from $300,000 to $1.5 million by 2030. These estimates are based on potential use cases and market conditions.

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Is Contentos (COS) a Good Investment?: Analyzing the Potential and Risks of This Blockchain Content Platform

Is Gems (GEMS) a good investment?: Analyzing the potential and risks of this crypto token

Is Aventus (AVT) a Good Investment? Analyzing Its Market Potential and Long-Term Value Proposition

What Is Mainnet?

Is Quantstamp (QSP) a good investment?: Analyzing the potential of this blockchain security token

2025 IDOL Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 BB Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Ultimate Guide to Decentralized Finance: Crypto Lending and Borrowing Explained

What is Aptos (APT) Market Overview: Price, Market Cap, and 24H Trading Volume

Is Ledger Available on the Stock Market?