2025 BMT Price Prediction: Analyzing Future Market Trends and Investment Potential

Introduction: BMT's Market Position and Investment Value

Bubblemaps (BMT), as the first supply auditing tool for DeFi tokens and NFTs, has established itself as a unique player in the cryptocurrency market. As of 2025, Bubblemaps has achieved a market capitalization of $15,473,326.36, with a circulating supply of approximately 256,180,900 tokens, and a price hovering around $0.0604. This asset, often referred to as the "DeFi and NFT Auditor," is playing an increasingly crucial role in the field of blockchain supply transparency and security.

This article will provide a comprehensive analysis of Bubblemaps' price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BMT Price History Review and Current Market Status

BMT Historical Price Evolution

- 2025 March 18: BMT reached its all-time high of $0.3262

- 2025 September 30: BMT hit its all-time low of $0.05479

BMT Current Market Situation

As of October 6, 2025, BMT is trading at $0.0604, with a 24-hour trading volume of $1,054,171.69. The token has shown a slight positive movement in the last 24 hours, with a 0.26% increase. BMT's market cap currently stands at $15,473,326.36, ranking it at 1214 in the cryptocurrency market.

The token's price has experienced mixed performance across different timeframes. In the past hour, BMT has seen a 0.38% increase, while the 7-day change shows a more significant rise of 1.82%. However, looking at the longer term, BMT has experienced a decline of 1.69% over the past 30 days and a substantial decrease of 36.026% over the past year.

BMT's current price is significantly lower than its all-time high of $0.3262, recorded on March 18, 2025. The token is trading closer to its all-time low of $0.05479, which was reached on September 30, 2025. This suggests that BMT has been in a downtrend for most of 2025.

The current circulating supply of BMT is 256,180,900 tokens, which represents 25.7% of the total supply of 1,000,000,000 BMT. The fully diluted market cap stands at $60,400,000.

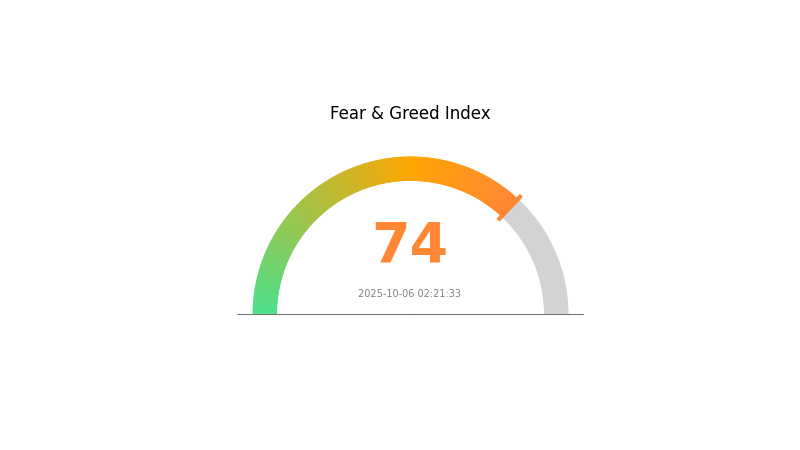

Despite the recent price decline, the market sentiment for cryptocurrencies overall appears to be positive, with the Fear and Greed Index indicating "Greed" at a value of 74.

Click to view the current BMT market price

BMT Market Sentiment Indicator

2025-10-06 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 74. This suggests investors are becoming overly optimistic, potentially leading to overbought conditions. While the bullish sentiment may continue to drive prices higher in the short term, it's crucial for traders to exercise caution. Consider taking profits or implementing risk management strategies to protect your investments. Remember, extreme greed often precedes market corrections. Stay vigilant and avoid making impulsive decisions based solely on market euphoria.

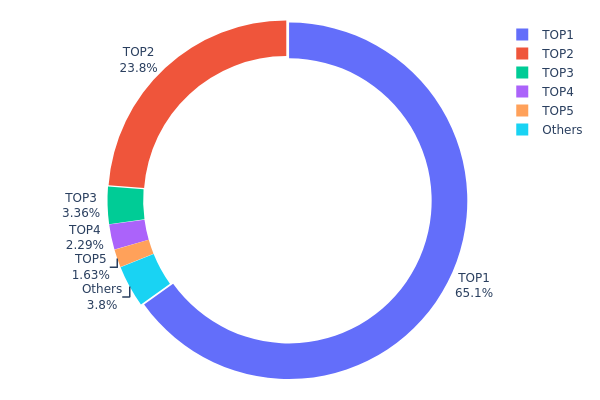

BMT Holdings Distribution

The address holdings distribution data for BMT reveals a highly concentrated ownership structure. The top address holds a staggering 65.12% of the total supply, while the second-largest holder possesses 23.79%. This indicates that nearly 89% of BMT tokens are controlled by just two addresses, signaling an extremely centralized distribution.

Such a high concentration of holdings raises concerns about market stability and potential price manipulation. With so much control in the hands of a few entities, there is a risk of significant price volatility if large holders decide to sell or move their tokens. Furthermore, this concentration could potentially undermine the project's claims of decentralization and may impact investor confidence in the long term.

The current distribution structure suggests that BMT's on-chain stability could be precarious. While a small number of large holders might provide some price support, it also means that the token's value is heavily dependent on the actions of these few addresses. This situation warrants close monitoring by investors and may require strategic efforts from the project team to encourage a more diverse distribution of tokens over time.

Click to view the current BMT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xeaed...6a6b8d | 331071.78K | 65.12% |

| 2 | 0xf977...41acec | 120965.70K | 23.79% |

| 3 | 0x5d36...f67bf0 | 17093.21K | 3.36% |

| 4 | 0x09f9...917fc5 | 11623.39K | 2.28% |

| 5 | 0x0d07...b492fe | 8311.88K | 1.63% |

| - | Others | 19317.87K | 3.82% |

II. Key Factors Affecting BMT's Future Price

Supply Mechanism

- Airdrop Distribution: Some early supporters are claiming airdrops, which may create selling pressure on the price.

- Current Impact: Short-term volatility is mainly influenced by airdrop claims and market sentiment.

Institutional and Whale Dynamics

- Token Concentration: Some large holders possess significant amounts of BMT, posing potential sell-off risks.

Macroeconomic Environment

- Regulatory Factors: Global regulatory changes may impact BMT's trading environment.

Technical Development and Ecosystem Building

- Cross-chain Liquidity: The actual utility of the token and cross-chain liquidity help maintain stable trading volume.

- Ecosystem Applications: BubbleMaps is a key application in the BMT ecosystem.

The price prediction for BMT tokens in 2025 shows a bullish trend. Investment strategies for BMT tokens should consider various factors, including market trends, technological developments, and regulatory environment.

III. BMT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0495 - $0.06037

- Neutral prediction: $0.06037 - $0.07

- Optimistic prediction: $0.07 - $0.07969 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.06275 - $0.1153

- 2028: $0.05037 - $0.12011

- Key catalysts: Broader crypto market trends, project developments, and adoption rates

2029-2030 Long-term Outlook

- Base scenario: $0.10849 - $0.11337 (assuming steady market growth)

- Optimistic scenario: $0.11825 - $0.16099 (with favorable market conditions and increased adoption)

- Transformative scenario: $0.16099 - $0.18 (with breakthrough technology implementation and mass adoption)

- 2030-12-31: BMT $0.11337 (potential stabilization point after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07969 | 0.06037 | 0.0495 | 0 |

| 2026 | 0.08684 | 0.07003 | 0.05042 | 15 |

| 2027 | 0.1153 | 0.07843 | 0.06275 | 29 |

| 2028 | 0.12011 | 0.09686 | 0.05037 | 60 |

| 2029 | 0.11825 | 0.10849 | 0.08896 | 79 |

| 2030 | 0.16099 | 0.11337 | 0.10997 | 87 |

IV. BMT Professional Investment Strategies and Risk Management

BMT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a high risk tolerance

- Operation suggestions:

- Accumulate BMT during market dips

- Set price targets for partial profit-taking

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to Bubblemaps

- Set stop-loss orders to manage downside risk

BMT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BMT

BMT Market Risks

- High volatility: BMT price may experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

BMT Regulatory Risks

- Uncertain regulations: Potential for new crypto regulations affecting BMT

- Cross-border restrictions: Possible limitations on BMT trading in certain jurisdictions

- Compliance requirements: Increased KYC/AML measures may impact adoption

BMT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Scalability issues on Solana or BSC could affect transactions

- Interoperability challenges: Difficulties in cross-chain functionality

VI. Conclusion and Action Recommendations

BMT Investment Value Assessment

BMT offers potential long-term value as a supply auditing tool for DeFi and NFTs, but faces short-term risks due to market volatility and regulatory uncertainties.

BMT Investment Recommendations

✅ Beginners: Consider small, gradual investments to learn about the project ✅ Experienced investors: Implement a dollar-cost averaging strategy with set profit targets ✅ Institutional investors: Conduct thorough due diligence and consider BMT as part of a diversified crypto portfolio

BMT Trading Participation Methods

- Spot trading: Buy and sell BMT on Gate.com's spot market

- Limit orders: Set specific buy or sell prices to execute trades automatically

- Staking: Participate in BMT staking programs if available on Gate.com

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for BNS 2025?

The price prediction for BNS in 2025 is $86, based on analyst consensus as of 2025-10-06.

What is BMT in crypto?

BMT is the native token of Bubblemaps, a platform for blockchain data visualization. It's used for accessing premium features and operates on Solana, promoting transparency in the crypto ecosystem.

What is the stock price prediction for beta bionics in 2025?

Based on market trends, Beta Bionics stock is predicted to trade between $17.82 and $20.37 in 2025, with an average price around $19.09.

What is the value of BMT?

As of October 6, 2025, BMT's value is $0.05963, showing a 3.35% decrease in the last 24 hours.

2025 SUPERPrice Prediction: Analyzing Market Trends and Future Valuation of SUPER Token in the Evolving Blockchain Ecosystem

What is K21: The Revolutionary AI System Transforming Healthcare Diagnostics

2025 K21 Price Prediction: Analyzing Market Trends and Potential Growth Factors

DON vs CHZ: A Battle of Blockchain Giants in the Sports and Entertainment Arena

2025 NFTFI Price Prediction: Navigating the Future of NFT-Backed Financial Instruments

BUSY vs THETA: The Battle of Productivity Apps in the Digital Age

Dropee Daily Combo December 12, 2025

Tomarket Daily Combo December 12, 2025

Guide to Participating and Claiming SEI Airdrop Rewards

Effective Strategies for Algorithmic Trading in Cryptocurrency

Understanding Bitcoin Valuation with the Stock-to-Flow Model