2025 CFX Price Prediction: Analyzing Market Trends and Potential Growth Factors for Conflux Network

Introduction: CFX's Market Position and Investment Value

Conflux (CFX), as a scalable decentralized blockchain network, has achieved significant milestones since its inception in 2020. As of 2025, Conflux's market capitalization has reached $560,074,972, with a circulating supply of approximately 5,145,383,306 tokens, and a price hovering around $0.10885. This asset, dubbed the "tree-graph consensus pioneer," is playing an increasingly crucial role in high-throughput blockchain applications and decentralized finance.

This article will comprehensively analyze Conflux's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. CFX Price History Review and Current Market Status

CFX Historical Price Evolution

- 2021: CFX reached its all-time high of $1.7 on March 27, marking a significant milestone in its price history.

- 2022: The cryptocurrency market experienced a downturn, with CFX price dropping to its all-time low of $0.02199898 on December 30.

- 2025: CFX price has shown recovery, currently trading at $0.10885, representing a 394% increase from its all-time low.

CFX Current Market Situation

As of October 17, 2025, CFX is trading at $0.10885, with a market capitalization of $560,074,972.87. The token has experienced a 4.5% decrease in the last 24 hours, with a trading volume of $5,188,895.45. CFX currently ranks 135th in the cryptocurrency market, holding a market share of 0.015%. The circulating supply stands at 5,145,383,306 CFX, which represents 89.98% of the total supply. The fully diluted valuation of CFX is $622,441,756.39. Over the past week, CFX has seen a significant decline of 21.64%, and a more substantial decrease of 39.93% over the last 30 days, indicating a bearish trend in the short to medium term.

Click to view the current CFX market price

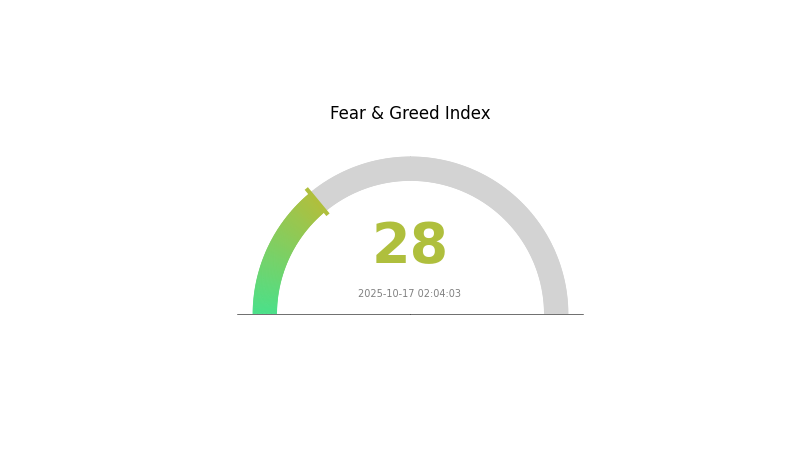

CFX Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can signal a good time to invest, it's crucial to conduct thorough research and consider your risk tolerance. Remember, market sentiment can shift rapidly, so stay informed and consider diversifying your portfolio. Gate.com offers various tools and resources to help you navigate these market conditions effectively.

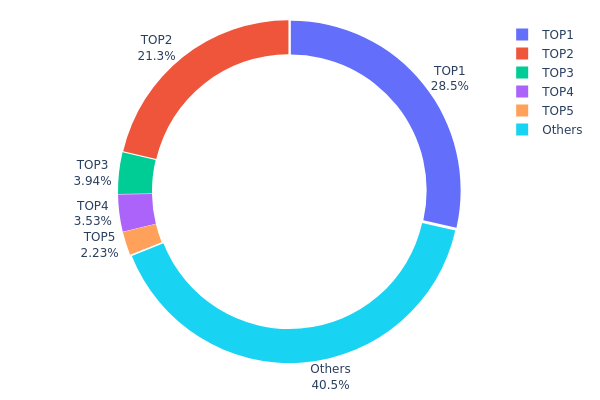

CFX Holdings Distribution

The address holdings distribution data for CFX reveals a significant concentration of tokens among the top holders. The top address controls 28.52% of the total supply, while the second-largest holder possesses 21.31%. Together, these two addresses account for nearly 50% of all CFX tokens. The top five addresses collectively hold 59.52% of the total supply, indicating a high degree of centralization.

This concentration of holdings raises concerns about market stability and potential price manipulation. With such a large portion of tokens in few hands, there's an increased risk of market volatility if these major holders decide to sell or move their assets. Additionally, this level of concentration could potentially impact the network's decentralization ethos, as it may give these large holders disproportionate influence over governance decisions or network operations.

However, it's worth noting that 40.48% of the tokens are distributed among other addresses, which suggests some level of wider distribution. This fragmentation among smaller holders could provide a counterbalance to the top holders' influence, potentially contributing to long-term market stability and more diverse participation in the CFX ecosystem.

Click to view the current CFX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 307343.85K | 28.52% |

| 2 | 0x5a52...70efcb | 229617.08K | 21.31% |

| 3 | 0xc9c2...3cea06 | 42500.00K | 3.94% |

| 4 | 0xa371...fa3879 | 38087.11K | 3.53% |

| 5 | 0x112a...547efd | 24000.13K | 2.22% |

| - | Others | 435893.03K | 40.48% |

II. Key Factors Affecting CFX's Future Price

Supply Mechanism

- Block Reward Halving: This mechanism reduces the rate of new CFX entering circulation, potentially impacting supply and demand dynamics.

- Historical Patterns: Previous halving events have often led to price increases due to reduced supply inflation.

- Current Impact: The next halving is expected to tighten supply, which could exert upward pressure on CFX's price.

Institutional and Whale Dynamics

- National Policies: China's regulatory stance on blockchain and cryptocurrencies significantly influences CFX's adoption and price.

Macroeconomic Environment

- Geopolitical Factors: International relations and policies, particularly those involving China and the "Belt and Road Initiative," can affect CFX's global adoption and value.

Technological Development and Ecosystem Building

- Tree-graph Technology: Conflux's unique consensus mechanism allows for parallel processing of transactions, enhancing scalability and potentially attracting more users and developers.

- Ecosystem Applications: Development of DeFi, NFT markets, and other DApps on the Conflux network could increase demand for CFX and support its value growth.

III. CFX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.08589 - $0.10000

- Neutral prediction: $0.10000 - $0.11000

- Optimistic prediction: $0.11000 - $0.13373 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.06585 - $0.18265

- 2028: $0.09821 - $0.22711

- Key catalysts: Technological advancements, wider adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.19028 - $0.22548 (assuming steady growth and adoption)

- Optimistic scenario: $0.22548 - $0.26069 (assuming strong market performance and project success)

- Transformative scenario: $0.26069 - $0.31342 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: CFX $0.31342 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13373 | 0.10872 | 0.08589 | 0 |

| 2026 | 0.12728 | 0.12122 | 0.10061 | 11 |

| 2027 | 0.18265 | 0.12425 | 0.06585 | 14 |

| 2028 | 0.22711 | 0.15345 | 0.09821 | 41 |

| 2029 | 0.26069 | 0.19028 | 0.14081 | 74 |

| 2030 | 0.31342 | 0.22548 | 0.12402 | 107 |

IV. CFX Professional Investment Strategies and Risk Management

CFX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Conflux technology

- Operational suggestions:

- Accumulate CFX during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for identifying trends and potential reversals

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set stop-loss orders to manage downside risk

CFX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-7% of crypto portfolio

- Aggressive investors: 7-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CFX

CFX Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Increasing competition in the blockchain scalability space

- Adoption: Slow adoption rate may impact long-term value

CFX Regulatory Risks

- Regulatory uncertainty: Changing global regulations may impact CFX

- Compliance issues: Potential challenges in meeting evolving compliance standards

- Legal status: Unclear legal status in some jurisdictions

CFX Technical Risks

- Network security: Potential vulnerabilities in the Conflux network

- Scalability challenges: Unforeseen issues in maintaining high throughput

- Smart contract risks: Bugs or exploits in smart contracts built on Conflux

VI. Conclusion and Action Recommendations

CFX Investment Value Assessment

CFX presents a unique value proposition with its high-throughput blockchain solution, but faces significant competition and regulatory uncertainties. Long-term potential exists, but short-term volatility and adoption challenges pose risks.

CFX Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the technology

✅ Experienced investors: Consider CFX as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence, monitor regulatory developments

CFX Trading Participation Methods

- Spot trading: Buy and sell CFX on Gate.com

- Staking: Participate in staking programs for passive income

- DeFi: Explore decentralized finance applications built on Conflux

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is CFX a good investment?

CFX shows strong potential for growth, with predictions of $1 by 2030 and $4 by 2040. Its unique position in China's blockchain ecosystem offers high reward potential, making it an attractive investment option for risk-tolerant investors.

Why is CFX pumping?

CFX is pumping due to favorable regulation, technological advancements, and political support. These factors align to boost its value.

Why is CFX going up?

CFX is rising due to increased adoption, network upgrades, and growing DeFi ecosystem on Conflux, driving demand and investor interest.

What are the risks of investing in conflux?

Investing in Conflux involves geopolitical and regulatory risks due to Chinese government influence, market volatility, and potential technological challenges.

2025 DEEP Price Prediction: Analyzing Future Market Trends and Growth Potential for Digital Economy Enhanced Protocols

2025 UMA Price Prediction: Analyzing Market Trends and Future Growth Potential in the DeFi Sector

2025 AUCTIONPrice Prediction: Analyzing Market Trends and Future Valuation Factors in the Global Auction Industry

2025 SPKPrice Prediction: Analysis of Market Trends and Future Valuation Prospects for SPK Token

2025 WNXM Price Prediction: Analyzing Growth Potential and Market Factors in the Decentralized Insurance Sector

2025 INJ Price Prediction: Bullish Trends and Key Factors Shaping Injective Protocol's Future Value

Understanding Flash Loans in DeFi: A Beginner's Guide

Introduction to GameFi: A Beginner's Guide to Blockchain Gaming

Guide to Using ENS Wallet for Web3 Integration

Guide to Purchasing Virtual Real Estate in the Metaverse

Beginner's Guide to Understanding Cryptocurrency White Papers