2025 JELLYJELLY Price Prediction: Comprehensive Analysis and Market Forecast for Crypto Enthusiasts

Introduction: JELLYJELLY's Market Position and Investment Value

JellyJelly (JELLYJELLY), positioned as a fast video chat clip sharing platform, has made significant strides since its inception. As of 2025, JellyJelly's market capitalization has reached $48,432,956, with a circulating supply of approximately 999,999,099 tokens, and a price hovering around $0.048433. This asset, often referred to as the "social video sharing innovator," is playing an increasingly crucial role in the realm of digital communication and content sharing.

This article will provide a comprehensive analysis of JellyJelly's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. JELLYJELLY Price History Review and Current Market Status

JELLYJELLY Historical Price Evolution

- 2025 January: JELLYJELLY reached its all-time high of $0.2451

- 2025 March: The price hit its all-time low of $0.003674

- 2025 September: JELLYJELLY experienced significant growth, with a 191.84% increase over the past 30 days

JELLYJELLY Current Market Situation

As of September 30, 2025, JELLYJELLY is trading at $0.048433. The token has shown positive momentum in the past 24 hours with a 1.56% increase. Its market capitalization stands at $48,432,956, ranking 687th in the cryptocurrency market. The 24-hour trading volume is $202,689, indicating moderate market activity. JELLYJELLY has a circulating supply of 999,999,099.34 tokens, which is 100% of its total supply. The token has demonstrated strong performance over the past month and year, with gains of 191.84% and 163.073% respectively. However, it's worth noting that the price is still significantly below its all-time high of $0.2451 set in January 2025.

Click to view the current JELLYJELLY market price

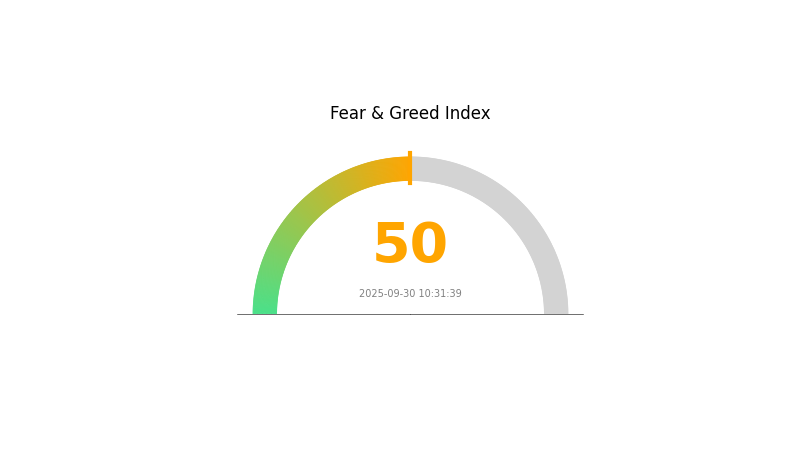

JELLYJELLY Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 50, indicating a neutral stance. This equilibrium suggests that investors are neither overly fearful nor excessively greedy. While the market lacks strong directional bias, it presents opportunities for both cautious and optimistic traders. As always, it's crucial to conduct thorough research and manage risks wisely when making investment decisions in the volatile crypto space.

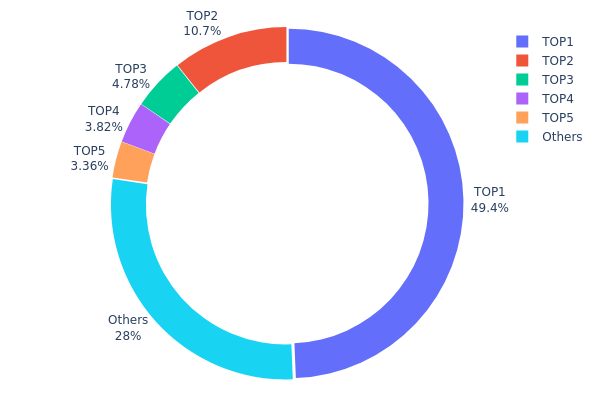

JELLYJELLY Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of JELLYJELLY tokens. The top address holds a significant 49.35% of the total supply, indicating a high level of centralization. The subsequent four largest addresses collectively control an additional 22.65%, bringing the total held by the top 5 addresses to 72% of the supply.

This concentration pattern raises concerns about potential market manipulation and price volatility. With nearly half of the tokens in a single wallet, there's a risk of large-scale selling pressure if this entity decides to liquidate its position. Moreover, the high concentration in few hands could lead to reduced liquidity and increased price swings based on the actions of these major holders.

From a market structure perspective, this distribution suggests a relatively low level of decentralization for JELLYJELLY. The on-chain stability might be compromised due to the outsized influence of a small number of addresses. Potential investors should be aware of these factors when considering JELLYJELLY, as they may impact the token's long-term sustainability and market behavior.

Click to view the current JELLYJELLY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 493505.60K | 49.35% |

| 2 | 7TWnq4...ueuVuh | 107004.58K | 10.70% |

| 3 | 5Q544f...pge4j1 | 47808.33K | 4.78% |

| 4 | 9KY9Tu...iKr4T2 | 38176.85K | 3.81% |

| 5 | EiiAnQ...GP11xw | 33601.83K | 3.36% |

| - | Others | 279871.65K | 28% |

II. Key Factors Influencing JELLYJELLY's Future Price

Supply Mechanism

- Market Performance: Historical data shows JELLYJELLY's market value rapidly increased from millions to hundreds of millions of dollars shortly after its release. Although there has been some decline, it still maintains a relatively high market valuation.

- Current Impact: The token's volatility remains a significant factor in its price movements, with recent data showing a 24-hour increase of 30.25%.

Institutional and Whale Dynamics

- Institutional Adoption: The project's founders include Venmo co-founder Iqram Magdon-Ismail and early investor Sam Lessin, providing strong credibility and market recognition in the cryptocurrency community.

Macroeconomic Environment

- Geopolitical Factors: The overall cryptocurrency market conditions and global economic trends can significantly impact JELLYJELLY's price.

Technological Development and Ecosystem Building

- Solana Blockchain Integration: JELLYJELLY is based on the Solana blockchain, known for its high performance. This integration potentially provides competitive advantages in transaction efficiency and costs.

- Alpenglow Upgrade: Solana's recent Alpenglow upgrade, which significantly improves network performance and efficiency, may indirectly affect JELLYJELLY's ecosystem and price.

- Ecosystem Applications: The JellyJelly video chat application allows users to extract clips from video chats and automatically generate titles, captions, and summaries using AI for quick sharing on various social media platforms. This feature provides convenience, especially for content creators.

III. JELLYJELLY Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.04688 - $0.04833

- Neutral forecast: $0.04833 - $0.06000

- Optimistic forecast: $0.06000 - $0.07056 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.05386 - $0.08802

- 2028: $0.04457 - $0.11221

- Key catalysts: Market adoption, technological advancements, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.08791 - $0.10020 (assuming steady market growth)

- Optimistic scenario: $0.10587 - $0.13227 (with strong adoption and favorable market conditions)

- Transformative scenario: $0.13227 - $0.15000 (with breakthrough use cases and widespread acceptance)

- 2030-12-31: JELLYJELLY $0.13227 (potential peak, subject to market dynamics)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07056 | 0.04833 | 0.04688 | 0 |

| 2026 | 0.07193 | 0.05944 | 0.04815 | 22 |

| 2027 | 0.08802 | 0.06569 | 0.05386 | 35 |

| 2028 | 0.11221 | 0.07685 | 0.04457 | 58 |

| 2029 | 0.10587 | 0.09453 | 0.08791 | 95 |

| 2030 | 0.13227 | 0.1002 | 0.07114 | 106 |

IV. JELLYJELLY Professional Investment Strategies and Risk Management

JELLYJELLY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Growth-oriented investors with high risk tolerance

- Operation suggestions:

- Accumulate JELLYJELLY tokens during market dips

- Set a target holding period of at least 1-2 years

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor social media sentiment and project developments

JELLYJELLY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Portfolio diversification: Spread investments across different crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for JELLYJELLY

JELLYJELLY Market Risks

- High volatility: Extreme price fluctuations common in crypto markets

- Competition: Other social video sharing platforms may emerge

- Market sentiment: Susceptible to rapid shifts in investor sentiment

JELLYJELLY Regulatory Risks

- Uncertain regulations: Potential for stricter crypto regulations globally

- Legal challenges: Possible issues related to content sharing and copyright

- Cross-border restrictions: Varying regulations across different jurisdictions

JELLYJELLY Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues with growing user base

- Blockchain network congestion: Could affect transaction speeds and costs

VI. Conclusion and Action Recommendations

JELLYJELLY Investment Value Assessment

JELLYJELLY offers potential long-term value in the social video sharing space but faces short-term risks due to market volatility and regulatory uncertainties.

JELLYJELLY Investment Recommendations

✅ Beginners: Start with small investments, focus on learning about the project ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider larger positions if aligned with risk profile

JELLYJELLY Trading Participation Methods

- Spot trading: Buy and hold JELLYJELLY tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance options involving JELLYJELLY tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is jelly jelly meme coin worth?

As of 2025-09-30, Jelly-My-Jelly (JELLYJELLY) is worth $0.04929, with a 24-hour trading volume of $4,165,526.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction for 2025, followed closely by Ethereum. These predictions are based on current market trends and expert analysis.

Which AI can predict crypto prices?

Incite AI is a leading tool for predicting crypto prices. It uses advanced algorithms to analyze market trends and deliver accurate forecasts with a user-friendly interface.

What is jelly jelly crypto?

JELLY is a memecoin on Solana blockchain, created by Venmo co-founder Iqram Magdon-Ismail in January 2025. It aims for social crypto engagement and gained attention due to a trading controversy.

How does Fartcoin compare to other Solana meme coins in market performance?

2025 AIMONICA Price Prediction: Analyzing Growth Potential and Market Trends for the Innovative AI Platform

How Do Derivatives Market Signals Predict BONK's Future Price Movement?

How Do Crypto Holdings and Fund Flows Impact Market Dynamics?

What Is Slippage ?

Moo Deng (MOODENG): Complete Analysis of the $140M Solana Hippo Token

Understanding the Core Principles of Decentralized Blockchain Technology

Understanding Gas Fees in Ethereum: A Comprehensive Guide

Exploring the Bored Ape NFT Collection: A Comprehensive Guide

A Beginner's Guide to Simulated Cryptocurrency Trading

Understanding Blockchain Oracles: Functionality and Importance