2025 KAIA Price Prediction: Expected Market Trends and Investment Outlook for the Innovative Digital Asset

Introduction: KAIA's Market Position and Investment Value

KAIA (KAIA), as a Layer 1 blockchain based on EVM, has made significant strides since its inception. As of 2025, KAIA's market capitalization has reached $909,653,596, with a circulating supply of approximately 5,856,641,747 tokens, and a price hovering around $0.15532. This asset, known for its focus on "scalability, convenience, and reliability," is playing an increasingly crucial role in empowering Web 3.0 technology, business, and individuals.

This article will comprehensively analyze KAIA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. KAIA Price History Review and Current Market Status

KAIA Historical Price Evolution

- 2024: All-time high reached, price peaked at $0.406698 on December 3rd

- 2025: Market correction, price dropped to all-time low of $0.090737 on April 7th

- 2025: Recovery phase, price rebounded to current $0.15532 as of September 16th

KAIA Current Market Situation

KAIA is currently trading at $0.15532, with a 24-hour trading volume of $1,107,664.54. The token has experienced a slight decline of 1.45% in the past 24 hours. KAIA's market capitalization stands at $909,653,596, ranking it 114th in the global cryptocurrency market. The circulating supply is 5,856,641,747 KAIA tokens, which is very close to its total supply of 5,856,641,936 KAIA. The token's price is currently 61.78% below its all-time high of $0.406698, but has shown significant recovery, being 71.18% above its all-time low of $0.090737. In the past year, KAIA has demonstrated strong performance with a 20.16% price increase.

Click to view the current KAIA market price

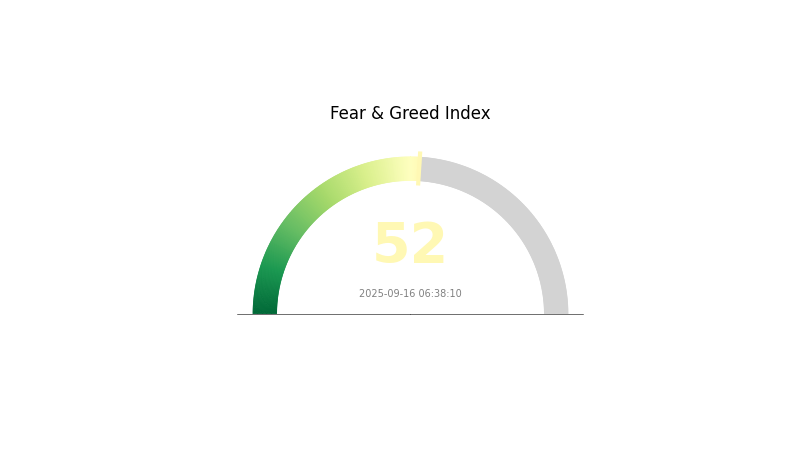

KAIA Market Sentiment Indicator

2025-09-16 Fear and Greed Index: 52 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index registering a neutral reading of 52. This indicates a stable market environment, where neither extreme fear nor excessive greed is dominating investor behavior. Traders and investors should maintain a cautious approach, carefully analyzing market trends and conducting thorough research before making any decisions. As always, it's crucial to diversify your portfolio and manage risk effectively in the ever-changing crypto landscape.

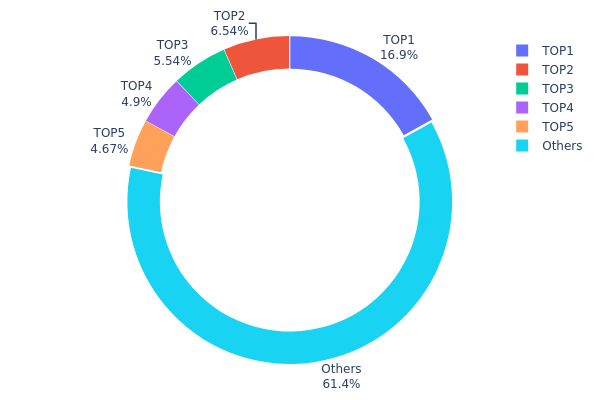

KAIA Holdings Distribution

The address holdings distribution data reveals significant concentration among top KAIA holders. The top address holds 16.90% of the total supply, with the top 5 addresses collectively controlling 38.55% of KAIA tokens. This level of concentration suggests a relatively centralized ownership structure, which could potentially impact market dynamics.

Such concentration may lead to increased volatility and susceptibility to large price movements if major holders decide to buy or sell significant portions of their holdings. It also raises concerns about potential market manipulation risks. However, with 61.45% of tokens distributed among other addresses, there is still a considerable degree of broader market participation.

This distribution pattern indicates a moderate level of decentralization for KAIA, though improvements in wider distribution would enhance market stability and reduce manipulation risks. Monitoring changes in this distribution over time will be crucial for assessing the token's evolving market structure and decentralization efforts.

Click to view the current KAIA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7f59...88f4c7 | 1034445.67K | 16.90% |

| 2 | 0xf208...02ae10 | 400000.01K | 6.54% |

| 3 | 0xdc41...d833c6 | 339173.00K | 5.54% |

| 4 | 0xd443...4a6f1f | 300169.66K | 4.90% |

| 5 | 0xdada...b94281 | 285714.29K | 4.67% |

| - | Others | 3760304.83K | 61.45% |

II. Key Factors Influencing KAIA's Future Price

Supply Mechanism

- Total Supply: The current total supply of KAIA is 6,120,093,101.761591 tokens.

- Circulating Supply: As of September 16, 2025, the circulating supply is 6,120,093,120.90232 KAIA tokens.

- Current Impact: KAIA has an infinite supply, which may affect its long-term price dynamics.

Institutional and Whale Dynamics

- Corporate Adoption: KAIA is the native cryptocurrency of the Kaia blockchain, which was formed by merging Klaytn and Finschia, developed by Kakao and LINE respectively.

Macroeconomic Environment

- Geopolitical Factors: Recent geopolitical tensions have impacted the crypto market, including KAIA. For instance, tensions in Iran caused a market-wide decline, affecting KAIA's price.

Technological Development and Ecosystem Building

- Blockchain Characteristics: Kaia blockchain is an EVM-compatible L1 blockchain with extremely low transaction latency, 1-second block time, and instant transaction finality.

- Ecosystem Applications: The Kaia blockchain provides a solid foundation and smooth user experience for applications requiring real-time responses.

III. KAIA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.09462 - $0.15511

- Neutral prediction: $0.15511 - $0.18691

- Optimistic prediction: $0.18691 - $0.21871 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.15734 - $0.28731

- 2028: $0.23706 - $0.26798

- Key catalysts: Technological advancements, expanded use cases, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.26282 - $0.32590 (assuming steady market growth and project development)

- Optimistic scenario: $0.32590 - $0.38898 (with favorable market conditions and significant project milestones)

- Transformative scenario: $0.37479 - $0.38898 (with exceptional project performance and bullish market sentiment)

- 2030-12-31: KAIA $0.37479 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.21871 | 0.15511 | 0.09462 | 0 |

| 2026 | 0.26915 | 0.18691 | 0.1327 | 20 |

| 2027 | 0.28731 | 0.22803 | 0.15734 | 46 |

| 2028 | 0.26798 | 0.25767 | 0.23706 | 65 |

| 2029 | 0.38898 | 0.26282 | 0.19975 | 69 |

| 2030 | 0.37479 | 0.3259 | 0.2151 | 109 |

IV. Professional Investment Strategies and Risk Management for KAIA

KAIA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operation suggestions:

- Accumulate KAIA tokens during market dips

- Set price targets and regularly review portfolio

- Store tokens in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor market sentiment and news that may impact KAIA's price

KAIA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Software wallet option: Official KAIA wallet (if available)

- Security precautions: Use two-factor authentication, keep private keys offline

V. Potential Risks and Challenges for KAIA

KAIA Market Risks

- Volatility: Cryptocurrency markets are known for high price fluctuations

- Competition: Other Layer 1 blockchains may outperform KAIA

- Liquidity: Limited trading volume may affect price stability

KAIA Regulatory Risks

- Uncertain regulations: Changing government policies may impact KAIA's adoption

- Compliance issues: Potential challenges in meeting future regulatory requirements

- Cross-border restrictions: International regulations may limit KAIA's global reach

KAIA Technical Risks

- Smart contract vulnerabilities: Potential bugs in the blockchain code

- Scalability challenges: Possible network congestion during high usage periods

- Technological obsolescence: Rapid advancements in blockchain technology may outpace KAIA

VI. Conclusion and Action Recommendations

KAIA Investment Value Assessment

KAIA shows promise as an EVM-compatible Layer 1 blockchain focusing on scalability and accessibility. However, investors should be aware of the high volatility and potential risks associated with early-stage blockchain projects.

KAIA Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the technology

✅ Experienced investors: Consider a balanced approach with regular DCA (Dollar-Cost Averaging)

✅ Institutional investors: Conduct thorough due diligence and consider KAIA as part of a diversified crypto portfolio

KAIA Trading Participation Methods

- Spot trading: Buy and sell KAIA tokens on Gate.com

- staking: Participate in KAIA's staking program for potential rewards

- DeFi involvement: Explore decentralized finance applications built on KAIA blockchain

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Kaia in 2025?

Based on current forecasts, Kaia's price is predicted to reach $0.3193 in 2025, representing a 101.52% increase from its current value.

How much is the Kaia coin worth today?

As of September 16, 2025, the Kaia coin is worth $0.158. Its price has increased by 0.76% in the last 24 hours, with a trading volume of $19,135,225.

What is the maximum supply of Kaia?

The maximum supply of Kaia is 5.86 billion coins, which is also the current circulating supply.

What is the XRP price prediction in 2025?

XRP is predicted to reach a maximum of $3.09 by September 2025, with a potential low of $2.94, based on current market analysis.

2025 ALT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Exploring DAG Technology in Blockchain Networks

Understanding Directed Acyclic Graphs in Blockchain Technology

Understanding Directed Acyclic Graph in Blockchain Technology

Exploring Directed Acyclic Graph in Blockchain Networks

Exploring Directed Acyclic Graphs in Blockchain Technology

Dropee Daily Combo December 12, 2025

Tomarket Daily Combo December 12, 2025

Guide to Participating and Claiming SEI Airdrop Rewards

Effective Strategies for Algorithmic Trading in Cryptocurrency

Understanding Bitcoin Valuation with the Stock-to-Flow Model