2025 LIGHT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of LIGHT

Bitlight Labs (LIGHT) is a Bitcoin and Lightning Network infrastructure token that serves as a key utility asset for the ecosystem. As a major contributor to the RGB protocol, LIGHT has established itself in the infrastructure sector since its launch. As of December 2025, LIGHT has reached a market capitalization of approximately $576.996 million USD, with a circulating supply of 43,056,972 tokens trading at around $1.3738 USD. This innovative infrastructure token is playing an increasingly critical role in enabling scalable, sovereign asset solutions on Bitcoin and the Lightning Network.

This article will comprehensively analyze LIGHT's price trajectory through 2030, incorporating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies. Whether you are evaluating long-term infrastructure plays or seeking to understand LIGHT's role in the evolving Bitcoin ecosystem, this analysis will offer data-driven insights to guide your investment decisions.

I. LIGHT Price History Review and Market Status

LIGHT Historical Price Movement Trajectory

Based on available data as of December 18, 2025:

- September 27, 2025: All-time low of $0.19 recorded

- October 21, 2025: All-time high of $2.8558 reached, representing a significant rally of approximately 1,403% from the low point

- December 18, 2025: Current price at $1.3738, reflecting a 52% decline from the all-time high

LIGHT Current Market Situation

As of December 18, 2025, LIGHT is trading at $1.3738 with a 24-hour trading volume of $2,578,054.94. The token has experienced a sharp pullback over the past day, declining 13.31% from the previous close, with an intraday range between $1.3472 and $1.6859.

Over the longer-term horizon, LIGHT demonstrates strong performance with a 7-day gain of 55.44% and a 1-year return of 155.92%, though the 30-day period shows a notable 25.21% decline from recent highs. The hourly movement reflects minor weakness at negative 1.26%.

The fully diluted market capitalization stands at $576,996,000, with a circulating market cap of $59,151,668.14 based on 43,056,972 circulating tokens out of a total supply of 420,000,000 tokens. The token maintains a circulating supply ratio of 10.25%, indicating significant room for token inflation as additional tokens enter circulation. The token is currently ranked 457th by market capitalization with a market dominance of 0.018%.

Liquidity appears adequate with trading activity distributed across 12 exchange platforms. The token maintains 19,754 unique holders on the BSC network, where it operates under the BEP-20 standard contract at address 0x477c2c0459004e3354ba427fa285d7c053203c0e.

Click to view current LIGHT market price

LIGHT Market Sentiment Index

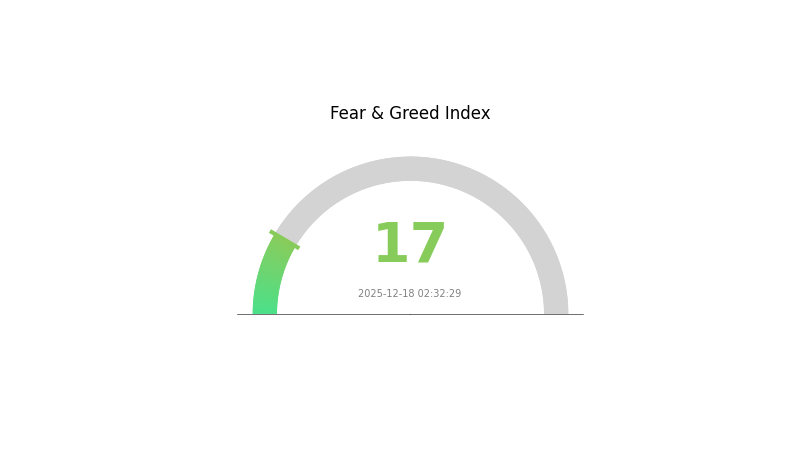

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 17. This significantly depressed sentiment indicates widespread panic among investors, creating substantial selling pressure across digital assets. Such extreme fear levels historically present contrarian opportunities, as markets often reach oversold conditions during peak pessimism. Risk-averse investors should exercise caution, while those with strong conviction may view current prices as entry points. Monitor key support levels closely and consider dollar-cost averaging to manage volatility exposure during this period of heightened market anxiety.

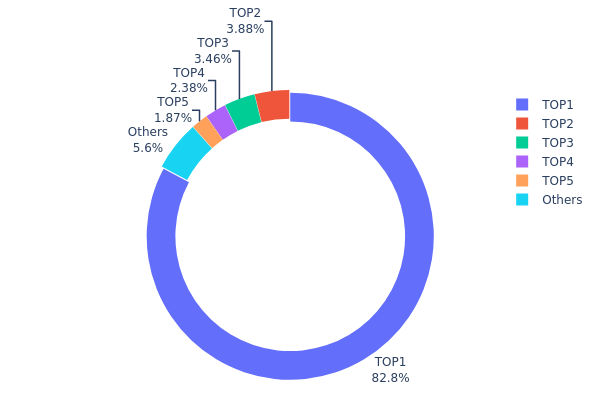

LIGHT Holdings Distribution

Address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical indicator of market structure decentralization and potential systemic risks. By analyzing the top holders and their respective percentages, investors and analysts can assess the degree of token concentration, evaluate vulnerability to price manipulation, and understand the overall health of the token's ecosystem.

The LIGHT token demonstrates significant concentration risk, with the top holder commanding 82.80% of total supply—an exceptionally elevated level that substantially exceeds healthy decentralization benchmarks. The top five addresses collectively control 94.39% of circulating tokens, while the remaining addresses account for merely 5.61%. This extreme concentration pattern indicates that decision-making power and price action are disproportionately influenced by a small number of stakeholders, creating a highly asymmetrical market structure where the actions of the largest holder could materially impact token valuation and liquidity conditions.

The pronounced holdings concentration poses considerable risks to market stability and price discovery mechanisms. With over four-fifths of the token supply held by a single address, the potential for coordinated selling pressure, market manipulation, or sudden liquidation events is substantially elevated. The marginal holdings of the second through fifth largest addresses (ranging from 3.88% to 1.87%) provide insufficient counterbalance to mitigate single-entity influence. This distribution pattern suggests limited genuine decentralization, restricted retail participation, and elevated execution risk for market participants seeking meaningful position sizing without triggering adverse price movements.

Click to view current LIGHT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2cde...48f00c | 347765.22K | 82.80% |

| 2 | 0xecce...7ccd70 | 16298.00K | 3.88% |

| 3 | 0x233f...570708 | 14541.15K | 3.46% |

| 4 | 0x73d8...4946db | 10000.92K | 2.38% |

| 5 | 0x4040...d97bfc | 7865.33K | 1.87% |

| - | Others | 23529.39K | 5.61% |

II. Core Factors Influencing LIGHT's Future Price

Supply Mechanism

- Total Token Supply: LIGHT has a total supply of 420 million tokens, which directly impacts price and investment value.

- Historical Precedent: Historical data shows that supply changes have previously driven LIGHT price appreciation.

- Investment Significance: Scarcity serves as the core support for long-term value.

Macroeconomic Environment

- Bitcoin Market Correlation: LIGHT's future price is significantly influenced by Bitcoin's performance. The upcoming Bitcoin halving event is expected to indirectly impact LIGHT's price through broad market movements.

- Market Sentiment: Market trends and investor sentiment play key roles in determining price trajectories.

Regulatory Environment

- Policy Changes: LIGHT's price is sensitive to regulatory developments in the cryptocurrency sector. Positive regulatory measures can stimulate market confidence, while tightening restrictions may exert downward pressure on prices.

Three, 2025-2030 LIGHT Price Forecast

2025 Outlook

- Conservative Forecast: $1.25-$1.49

- Neutral Forecast: $1.37

- Optimistic Forecast: $2.00 (requires sustained market interest and ecosystem development)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Growth and consolidation phase with gradual adoption expansion

- Price Range Forecast:

- 2026: $1.44-$2.38 (22% potential appreciation)

- 2027: $1.46-$2.60 (48% potential appreciation)

- Key Catalysts: Increased utility adoption, ecosystem partnerships, market sentiment improvement, and technical milestone achievements

2028-2030 Long-term Outlook

- Base Case Scenario: $1.58-$2.44 (68% appreciation by 2028, assuming stable market conditions and moderate ecosystem growth)

- Optimistic Scenario: $1.97-$2.83 (73% appreciation by 2029, assuming accelerated adoption and positive market cycles)

- Transformation Scenario: $1.56-$3.85 (89% appreciation by 2030, assuming breakthrough developments, major institutional adoption, and favorable macroeconomic conditions)

- Dec 18, 2025: LIGHT trading at consolidation levels (establishing foundation for medium-term growth trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.00429 | 1.3728 | 1.24925 | 0 |

| 2026 | 2.38085 | 1.68854 | 1.43526 | 22 |

| 2027 | 2.60441 | 2.0347 | 1.46498 | 48 |

| 2028 | 2.43553 | 2.31955 | 1.5773 | 68 |

| 2029 | 2.82927 | 2.37754 | 1.97336 | 73 |

| 2030 | 3.85304 | 2.60341 | 1.56204 | 89 |

LIGHT Token Investment Strategy and Risk Management Report

I. Executive Summary

Bitlight Labs (LIGHT) is a Bitcoin and Lightning Network infrastructure company and major contributor to the RGB protocol. As of December 18, 2025, LIGHT is trading at $1.3738 with a market capitalization of approximately $59.15 million and a fully diluted valuation of $576.99 million. The token has demonstrated significant volatility, with a 1-year gain of 155.92% but a 30-day decline of -25.21%.

Key Metrics:

- Current Price: $1.3738

- 24-Hour Change: -13.31%

- 7-Day Change: +55.44%

- Market Cap Rank: #457

- Circulating Supply: 43,056,972 LIGHT

- Total Supply: 420,000,000 LIGHT

II. Market Overview and Performance Analysis

LIGHT Price Performance

| Timeframe | Change % | Change Amount |

|---|---|---|

| 1 Hour | -1.26% | -$0.0175 |

| 24 Hours | -13.31% | -$0.2109 |

| 7 Days | +55.44% | +$0.4900 |

| 30 Days | -25.21% | -$0.4631 |

| 1 Year | +155.92% | +$0.8370 |

Historical Price Milestones

- All-Time High: $2.8558 (October 21, 2025)

- All-Time Low: $0.19 (September 27, 2025)

- 24-Hour High: $1.6859

- 24-Hour Low: $1.3472

Market Position

- Current Market Cap: $59,151,668

- Fully Diluted Valuation: $576,996,000

- Market Dominance: 0.018%

- 24-Hour Trading Volume: $2,578,054.94

- Total Holders: 19,754

- Listed on 12 exchanges

III. Project Fundamentals and Ecosystem Analysis

Project Overview

Bitlight Labs is dedicated to enabling native smart contracts and stablecoin transactions on Bitcoin and the Lightning Network. The company develops core code for the Lightning Network and the RGB protocol, along with developer tools and applications, aiming to provide scalable, sovereign asset solutions on the world's most secure decentralized network.

Technology Stack

Token Specifications:

- Token Standard: BEP-20 (Binance Smart Chain)

- Contract Address: 0x477c2c0459004e3354ba427fa285d7c053203c0e

- Circulating Supply Ratio: 10.25%

Ecosystem Focus Areas

- Bitcoin Infrastructure: Development of Lightning Network core components

- RGB Protocol Contribution: Major development work on RGB smart contracts

- Developer Tools: Creation of accessible development frameworks

- Stablecoin Solutions: Implementation of stable assets on Bitcoin

IV. LIGHT Professional Investment Strategy and Risk Management

LIGHT Investment Methodology

(1) Long-Term Hold Strategy

Target Investors: Long-term believers in Bitcoin scaling solutions and decentralized financial infrastructure

Operation Guidelines:

- Dollar-Cost Averaging (DCA): Implement regular LIGHT purchases over extended periods to reduce timing risk and average entry costs across market cycles

- Accumulation During Downturns: Use market weakness (such as the recent -25.21% monthly decline) as strategic accumulation opportunities for believers in the project's long-term viability

- Storage Solution: Utilize Gate.com's Web3 wallet for secure, non-custodial asset management with integration to trading platforms for immediate execution when needed

(2) Active Trading Strategy

Technical Analysis Tools:

- Moving Averages: Apply 20-day, 50-day, and 200-day MAs to identify trend direction; consider buying when price trades above key MAs and selling on breaks below support levels

- Relative Strength Index (RSI): Monitor RSI levels (14-period); oversold conditions (below 30) may present buying opportunities while overbought conditions (above 70) suggest caution; the recent -13.31% daily decline may indicate temporary oversold conditions

Wave Trading Key Points:

- Volatility Management: The 7-day +55.44% surge demonstrates significant swing trading potential; establish clear profit-taking targets (15-25% gains) and stop-loss levels (8-12% losses)

- Volume Analysis: Monitor trading volume relative to 24-hour averages; increased volume on directional moves confirms trend strength and provides higher confidence signals

LIGHT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation, focusing on long-term thesis with minimal rebalancing

- Aggressive Investors: 5-10% portfolio allocation, allowing for active trading and tactical positions within the crypto infrastructure sector

- Professional Investors: 10-15% allocation within diversified crypto infrastructure strategies, with dynamic rebalancing based on technical and fundamental triggers

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 30-40% of allocated capital in stablecoins to enable rapid position adjustments during extreme volatility; this approach proved valuable during the -25.21% monthly decline

- Position Sizing: Limit individual trade size to 2-3% of total portfolio to contain downside impact while allowing for compounding gains through multiple successful trades

(3) Secure Storage Solutions

- Hot Wallet: Gate.com Web3 wallet for active trading and frequent transactions with enhanced security features

- Security Best Practices: Enable two-factor authentication (2FA), use strong passwords, regularly backup wallet recovery phrases, and never share private keys or seed phrases with any third parties

V. LIGHT Potential Risks and Challenges

LIGHT Market Risk

- High Volatility Exposure: The token's range from $0.19 to $2.8558 (all-time) and the -25.21% monthly decline indicate extreme price fluctuations that can result in substantial capital loss; retail investors may face significant liquidation risk

- Liquidity Constraints: With 24-hour volume of $2.57M and market cap of $59M, liquidity may be insufficient during market stress events; large positions could experience significant slippage

- Early-Stage Market Development: As an infrastructure token in an emerging ecosystem, LIGHT lacks the maturity and adoption levels of established cryptocurrencies, creating higher uncertainty in valuation and demand

LIGHT Regulatory Risk

- Bitcoin Protocol Governance: Changes in Bitcoin consensus or regulatory treatment of Bitcoin-adjacent protocols could impact Lightning Network adoption and consequently LIGHT's utility value

- Jurisdictional Uncertainty: Regulatory frameworks for smart contracts and stablecoins on alternative protocols remain unclear in many jurisdictions, potentially creating barriers to institutional adoption

- Stablecoin Compliance: As Bitlight Labs works on stablecoin solutions, future regulatory requirements for stablecoin issuers could materially affect the company's roadmap and token economics

LIGHT Technical Risk

- RGB Protocol Maturity: While Bitlight Labs is a major RGB contributor, the protocol remains relatively nascent compared to established smart contract platforms; technical exploits or unforeseen limitations could undermine the value proposition

- Lightning Network Adoption Rate: The project's success depends significantly on Lightning Network adoption growth; slower-than-expected adoption could limit demand for infrastructure tools and tokens

- Cross-Layer Interoperability: Technical challenges in maintaining seamless interoperability between Bitcoin, Lightning Network, and RGB implementations could create operational risks and reduce competitiveness

VI. Conclusion and Action Recommendations

LIGHT Investment Value Assessment

Bitlight Labs represents a high-risk, high-potential-reward opportunity within the Bitcoin infrastructure sector. The project addresses genuine scalability challenges and contributes to important protocol development. However, the extreme volatility (155.92% annual gain offset by -25.21% monthly decline), early-stage ecosystem maturity, and regulatory uncertainty require sophisticated risk management and conviction in long-term vision. The token's relatively low circulating supply ratio (10.25%) and concentrated holder base present both dilution opportunities and potential volatility catalysts.

LIGHT Investment Recommendations

✅ Beginners: Start with micro-positions (1-2% of crypto portfolio) using Dollar-Cost Averaging strategy; use only capital you can afford to lose completely; prioritize learning about Bitcoin infrastructure and Lightning Network before investing

✅ Experienced Investors: Consider 5-10% allocation with active trading strategies based on technical signals; maintain stablecoin reserves for rebalancing; implement disciplined stop-loss orders at 10-12% below entry prices

✅ Institutional Investors: Evaluate 10-15% positions within diversified crypto infrastructure strategies; conduct thorough technical due diligence on RGB protocol maturity; establish relationships with Bitlight Labs team to assess roadmap execution and competitive positioning

LIGHT Trading Participation Methods

- Gate.com Spot Trading: Direct purchase and sale of LIGHT tokens with real-time market pricing; ideal for long-term holders and active traders seeking direct exposure

- Dollar-Cost Averaging Programs: Set up recurring LIGHT purchases on Gate.com to build positions systematically while reducing timing risk across market cycles

- Web3 Wallet Integration: Utilize Gate.com's Web3 wallet for secure self-custody, enabling both holding for long-term appreciation and rapid trading execution when market opportunities emerge

Disclaimer: Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance, investment objectives, and financial capacity before committing capital. Consult with qualified financial advisors before making investment decisions. Never invest more than you can afford to lose completely. Past performance does not guarantee future results.

FAQ

How much will 1 Litecoin be worth in 2025?

Based on Trading-Education.com analysis, Litecoin is predicted to reach approximately $1440 in 2025. However, cryptocurrency prices are highly volatile and actual values may differ significantly from predictions.

Will Litecoin reach $50,000?

Based on current market analysis, Litecoin reaching $50,000 is unlikely. While LTC may experience growth, such a significant price level would require extraordinary market conditions beyond current projections and trends.

Can Litecoin reach $1000?

Yes, Litecoin could reach $1000 with sustained 25-30% annual growth over a decade. Market conditions and adoption rates will be key factors determining whether this price target becomes achievable.

Will Litentry go back up?

Yes, Litentry is expected to increase in value in the coming months. Current market indicators predict a move towards the $0.505 price level over the next quarter. Based on recent trends, LIT is anticipated to climb higher in the near term.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

A straightforward guide for beginners to sell cryptocurrencies with ease

2025 GameFi In-Depth Overview: Current Landscape, Key Trends, and Investment Value Analysis

Understanding the MATIC to POL Migration: Insights for Crypto Investors

Future XRP Price Prediction 2025-2028: Investment Insights

Exploring BRICS and the Growth Potential of Central Bank Digital Currencies with XRP