2025 MGO Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: MGO's Market Position and Investment Value

Mango Network (MGO) is a Layer 1 multi-VM omnichain infrastructure designed to address fragmented user experiences and liquidity challenges in Web3 applications and DeFi protocols. Since its launch in December 2024, the project has established itself as a significant player in the blockchain infrastructure space. As of December 2025, MGO's market capitalization stands at approximately $31.83 million, with a circulating supply of 1.59 billion tokens and a current price hovering around $0.02002. This innovative asset, recognized for its multi-virtual machine interoperability supporting MoveVM, EVM, and SVM, is playing an increasingly important role in enabling secure, modular, and high-performance Web3 infrastructure.

This article will provide a comprehensive analysis of MGO's price trajectory from 2025 through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

Mango Network (MGO) Market Analysis Report

I. MGO Price History Review and Current Market Status

MGO Historical Price Evolution Trajectory

Based on available data from the reference materials, Mango Network (MGO) has demonstrated significant price volatility since its market debut:

- June 24, 2025: All-Time Low (ATL) reached at $0.005, marking the lowest point in the token's trading history.

- July 19, 2025: All-Time High (ATH) achieved at $0.08158, representing an appreciation of approximately 1,531.6% from the ATL, indicating strong market interest in the project's early stages.

- Current Period (December 19, 2025): Token trading at $0.02002, reflecting a significant correction of approximately 75.5% from the ATH, though maintaining substantial gains above the ATL.

MGO Current Market Posture

As of December 19, 2025, MGO exhibits the following market characteristics:

Price Performance:

- Current Price: $0.02002

- 24-Hour Change: -1.13%

- 7-Day Change: -1.28%

- 30-Day Change: -6.89%

- 1-Hour Change: -0.2%

Market Capitalization Metrics:

- Market Cap (based on circulating supply): $31,831,800

- Fully Diluted Valuation (FDV): $200,200,000

- Market Cap to FDV Ratio: 15.9%

- Market Dominance: 0.0063%

Supply Dynamics:

- Circulating Supply: 1,590,000,000 MGO (15.9% of total supply)

- Total Supply: 10,000,000,000 MGO

- Max Supply: 10,000,000,000 MGO

Trading Activity:

- 24-Hour Trading Volume: $554,245.42

- Market Ranking: 671st by market cap

- Trading Range (24H): $0.02 - $0.02031

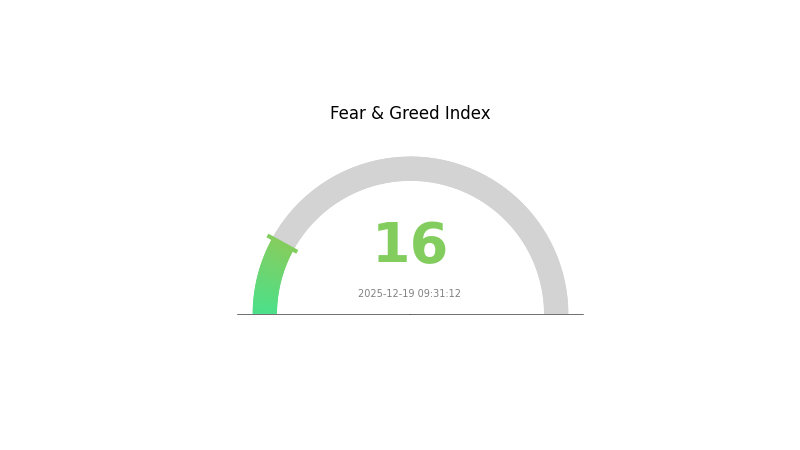

Market Sentiment: The current market environment reflects extreme fear conditions (VIX: 16), which may be contributing to recent downward price pressure across the broader market.

Click to view current MGO market price

MGO Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 16. This exceptionally low score indicates severe market pessimism and heightened investor anxiety. During such periods, market volatility tends to increase significantly, and risk-averse investors may consider reducing exposure. However, contrarian traders often view extreme fear as a potential buying opportunity, as markets historically tend to rebound from such depressed sentiment levels. It is essential to conduct thorough research and risk assessment before making investment decisions in this volatile environment.

MGO Holdings Distribution

Click to view current MGO holdings distribution

The address holdings distribution chart provides a comprehensive view of how MGO tokens are distributed across different wallet addresses on the blockchain. This metric serves as a crucial indicator for assessing token concentration risk, market structure health, and the degree of decentralization within the MGO ecosystem. By analyzing the top holders and their respective percentages of total supply, investors and analysts can evaluate whether token ownership is distributed across a diverse base of participants or concentrated in the hands of a limited number of entities.

Given that the current holdings distribution data shows minimal or no significant concentration among top addresses, MGO demonstrates a relatively healthy decentralization profile. The absence of dominant whale wallets holding disproportionate percentages of the token supply suggests that the network is not excessively exposed to the price manipulation risks typically associated with highly concentrated token distributions. This distributed ownership structure generally supports more stable and organic price discovery mechanisms, as no single entity possesses sufficient holdings to unilaterally influence market movements through large liquidations or coordinated trading activities.

The current address distribution pattern reflects a market structure characterized by reasonable decentralization and distributed stakeholder participation. This composition typically supports greater market resilience and reduces systematic risks emanating from concentrated selloff pressure. However, ongoing monitoring of holder concentration remains essential, as shifts in distribution dynamics can significantly impact market volatility and long-term price stability within the MGO ecosystem.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing MGO's Future Price

Supply Mechanism

- Token Economic Model: MGO has a total supply of 10 billion tokens. The allocation strategy balances long-term ecosystem development with short-term incentives, directly influencing the token's scarcity and value dynamics.

Technology Development and Ecosystem Building

-

Narwhal-Bullshark Consensus: The platform implements advanced consensus technology that provides technical value support for MGO, enhancing network security and transaction efficiency.

-

Web3 Infrastructure Revolution in 2025: MGO token serves as the core of the Mango Network ecosystem, playing crucial roles in network governance, security, and utility. The network's ability to support high-value operations is a key factor in token price prediction and market demand. As 2025 unfolds with transformations in Web3 infrastructure, MGO is positioned as a potential beneficiary of these industry-wide developments.

Market Sentiment and User Adoption

- Market Dynamics: MGO's price is influenced by multiple key factors including overall market sentiment, trading volume, technological development, and user adoption trends. These factors collectively shape short-term price movements and long-term value realization.

III. MGO Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.01261 - $0.01631

- Neutral Forecast: $0.01631 - $0.02001

- Optimistic Forecast: $0.02001 - $0.02601 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing adoption and market recognition

- Price Range Forecast:

- 2026: $0.01404 - $0.02623 (14% potential upside)

- 2027: $0.02068 - $0.02807 (22% potential upside)

- Key Catalysts: Enhanced tokenomics implementation, ecosystem expansion, strategic partnerships, and increased institutional interest in emerging digital assets

2028-2030 Long-term Outlook

- Base Case: $0.02503 - $0.03399 (31% upside potential by 2028, assumes continued organic growth and market stabilization)

- Optimistic Case: $0.02866 - $0.03620 (50% upside potential by 2029, assumes accelerated adoption and positive regulatory environment)

- Transformative Case: $0.02588 - $0.03949 (65% upside potential by 2030, assumes breakthrough utility implementation and mainstream market penetration)

Note: All price forecasts are based on historical trend analysis and should be verified on Gate.com or other reputable data sources before making investment decisions. Past performance does not guarantee future results.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02601 | 0.02001 | 0.01261 | 0 |

| 2026 | 0.02623 | 0.02301 | 0.01404 | 14 |

| 2027 | 0.02807 | 0.02462 | 0.02068 | 22 |

| 2028 | 0.03399 | 0.02635 | 0.02503 | 31 |

| 2029 | 0.0362 | 0.03017 | 0.02866 | 50 |

| 2030 | 0.03949 | 0.03318 | 0.02588 | 65 |

Mango Network (MGO) Professional Investment Strategy & Risk Management Report

IV. MGO Professional Investment Strategy and Risk Management

MGO Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Institutional investors, long-term believers in multi-VM infrastructure, and diversified portfolio builders seeking exposure to Layer 1 blockchain innovation

-

Operation Recommendations:

- Accumulate during market downturns when MGO trades below $0.025, leveraging the current 30-day decline of -6.89% as a potential entry opportunity

- Establish a core position and hold through market cycles, recognizing MGO's positioning as infrastructure for addressing fragmented Web3 user experiences and liquidity pain points

- Set long-term price targets based on MGO's adoption metrics across MoveVM, EVM, and SVM ecosystems

-

Storage Solution:

- Store MGO on Gate.com for immediate trading flexibility and participation in staking opportunities

- Use Gate Web3 Wallet for self-custody with enhanced security features while maintaining accessibility for cross-chain interactions

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average (MA): Monitor the 7-day and 30-day moving averages to identify trend reversals; MGO's recent -1.28% 7-day decline suggests potential support levels near $0.02

- Relative Strength Index (RSI): Track overbought/oversold conditions; use RSI divergences to anticipate price reversals during volatile periods

-

Swing Trading Key Points:

- Capitalize on intraday volatility; the 1-hour change of -0.2% indicates active trading opportunities with tight stop-loss management

- Monitor volume trends against the 24-hour trading volume of $554,245; increased volume above this level signals potential breakout opportunities

MGO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation, limiting exposure given MGO's early-stage market position (ranked 671) and high volatility

- Active Investors: 3-5% of portfolio allocation, allowing meaningful exposure while maintaining diversification across multiple Layer 1 solutions

- Professional Investors: 5-10% of portfolio allocation, with hedging strategies and sophisticated entry/exit management

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 30-40% of intended MGO allocation in stablecoins on Gate.com to deploy opportunistically during price dips

- Diversified Layer 1 Exposure: Balance MGO holdings with exposure to established Layer 1 networks to reduce concentration risk in multi-VM infrastructure

(3) Secure Storage Solutions

- Custodial Wallet Strategy: Gate.com offers institutional-grade security with insurance coverage, suitable for active traders requiring frequent liquidity access

- Self-Custody Option: Gate Web3 Wallet provides non-custodial security for MGO holders prioritizing control, with support for multi-chain token management

- Security Considerations: Enable two-factor authentication on all exchange accounts; regularly verify wallet addresses before transactions; never share private keys or recovery phrases; keep seed phrases stored in secure offline locations

V. MGO Potential Risks and Challenges

MGO Market Risks

- Liquidity Risk: With only one exchange listing (Gate.com) and 24-hour volume of $554,245, MGO faces significant liquidity constraints that could result in slippage during large trades or rapid price movements

- Market Capitalization Volatility: MGO's relatively small market cap of $31.83 million and fully diluted valuation of $200.2 million make it susceptible to significant price swings from modest trading activity

- Circulation Supply Risk: With only 15.9% of the total 10 billion token supply currently in circulation, future token unlocks could create substantial selling pressure and downward price dynamics

MGO Regulatory Risks

- Classification Uncertainty: As a Layer 1 blockchain infrastructure project, MGO may face evolving regulatory classification across different jurisdictions, potentially affecting its operational status and token utility

- Compliance Exposure: Multi-VM architecture supporting MoveVM, EVM, and SVM creates complex regulatory compliance requirements across different blockchain standards and regional requirements

- Staking and Tokenomics Regulation: Future regulatory changes regarding staking mechanisms or token distribution could impact MGO's protocol economics and investor returns

MGO Technical Risks

- Multi-VM Integration Risk: The complexity of supporting three distinct virtual machines (MoveVM, EVM, SVM) simultaneously increases the potential for cross-chain compatibility issues or security vulnerabilities

- Cross-Chain Communication Risk: MGO's reliance on cross-chain communication protocols introduces bridge-related risks, including potential vulnerabilities in inter-blockchain message validation and atomic swap mechanisms

- Adoption Execution Risk: Successful market adoption depends on developer migration and ecosystem growth; failure to attract sufficient DeFi protocols and applications could undermine MGO's value proposition and competitive positioning

VI. Conclusion and Action Recommendations

MGO Investment Value Assessment

Mango Network presents a compelling infrastructure opportunity for investors seeking exposure to multi-VM blockchain innovation and solutions addressing Web3 fragmentation. The project's integration of Move, OPStack, and ZK Rollup technologies positions it as a potentially transformative Layer 1 solution. However, investors must recognize the significant execution risks inherent in supporting multiple virtual machines simultaneously and the current market challenges evidenced by the -6.89% 30-day decline. MGO's limited liquidity and concentrated exchange listing on Gate.com create both entry opportunities and exit challenges. The token's current valuation should be evaluated against the competitive Layer 1 landscape and the project's ability to achieve meaningful developer adoption across its multi-VM ecosystem.

MGO Investment Recommendations

✅ Beginners: Start with 1-2% portfolio allocation through Gate.com; utilize dollar-cost averaging over 3-6 months to mitigate timing risk; store holdings on Gate Web3 Wallet for security; monitor project milestones and ecosystem development before increasing exposure

✅ Experienced Investors: Establish 3-5% core position; implement technical analysis strategies using moving averages and RSI indicators; use swing trading tactics during volatility spikes; maintain stablecoin reserves on Gate.com for opportunistic accumulation; actively monitor liquidity conditions and protocol upgrades

✅ Institutional Investors: Consider 5-10% allocation as alternative Layer 1 exposure; utilize Gate.com's custodial services with multi-signature security; develop hedging strategies through correlated Layer 1 positions; establish regular review protocols for technical and regulatory developments; consider participation in protocol governance as adoption increases

MGO Trading Participation Methods

- Exchange Trading: Trade MGO directly on Gate.com spot market; utilize limit orders to optimize entry and exit pricing during periods of limited liquidity

- Long-term Staking: Explore MGO staking opportunities to generate additional yield while maintaining long-term conviction in the project's infrastructure development

- Portfolio Rebalancing: Use MGO as a tactical allocation within Layer 1 infrastructure investments; rebalance quarterly based on performance metrics and fundamental developments

Cryptocurrency investment carries extreme risk and is highly speculative. This report does not constitute investment advice. All investors must conduct thorough due diligence and assess their individual risk tolerance before committing capital to MGO or any digital asset. Consider consulting with professional financial advisors. Never invest more capital than you can afford to lose completely. Past performance is not indicative of future results.

FAQ

Is MGO stock a good buy?

MGO shows mixed signals currently. While trading volume remains active, recent price analysis suggests cautious positioning. Consider your investment timeline and risk tolerance before making decisions. Monitor key resistance levels for potential entry points in upcoming market cycles.

What is MGO and what is its current price?

MGO is the native token of Mango Network, a decentralized protocol. Its current price is $0.020196 with a market cap of $32.09 million and 24-hour trading volume of $3.89 million.

What factors influence MGO price predictions?

MGO price predictions are influenced by global demand, production costs, government policies, market sentiment, trading volume, and supply chain dynamics. Macroeconomic conditions and geopolitical events also significantly impact price movements.

What is the historical price trend of MGO?

MGO reached an all-time high of $0.03417 in September 2025. The price has declined since then, currently trading around $0.02028 as of December 2025, with recent weekly range between $0.01999 and $0.02054.

What are the risks associated with MGO price volatility?

MGO price volatility poses risks including financial instability for shipping operators, unpredictable operational costs, and potential supply chain disruptions. Sudden price swings can impact budgeting accuracy and profit margins significantly.

2025 SPrice Prediction: Analyzing Future Market Trends and Investment Opportunities

How Does Sui's On-Chain Data Analysis Reveal Its Growth in 2025?

How Does On-Chain Data Analysis Reveal Sui's Performance in 2025?

2025 CLEAR Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

How Does On-Chain Data Analysis Reveal Aster's Whale Activity in 2025?

H vs APT: Unraveling the Complex Battle Between Human Intelligence and Advanced Persistent Threats

Guide to Purchasing Hamster Kombat (HMSTR) in India

Current Value of 1 Hamster Kombat Token (HMSTR) in Indian Rupees

Discover the Reduced Expenses of Launching Your Own Blockchain Node

What is QUICK: A Comprehensive Guide to Understanding the Revolutionary Payment System

What is LUMIA: A Comprehensive Guide to Understanding This Innovative Technology Platform