2025 MP Price Prediction: Analyzing Market Trends and Forecasting Future Values

Introduction: MP's Market Position and Investment Value

MerlinSwap (MP), as the leading decentralized exchange in the Bitcoin ecosystem, has established itself as a key player since its inception. As of 2025, MerlinSwap's market cap stands at $709,065, with a circulating supply of approximately 3,150,000,000 tokens and a price hovering around $0.0002251. This asset, dubbed the "liquidity hub for Bitcoin layer2," is playing an increasingly crucial role in facilitating transactions and providing liquidity for BTC and Bitcoin eco-assets.

This article will provide a comprehensive analysis of MerlinSwap's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MP Price History Review and Current Market Status

MP Historical Price Evolution

- 2024: Initial launch, price peaked at $0.009488 on April 8th

- 2025: Market downturn, price dropped to an all-time low of $0.0002225 on November 21st

MP Current Market Situation

As of November 26, 2025, MP is trading at $0.0002251, with a 24-hour trading volume of $8,520.82. The token has experienced a slight decline of 0.88% in the past 24 hours. MP's market cap currently stands at $709,065, ranking it at 2937th position in the overall cryptocurrency market.

The token is showing negative price trends across various timeframes:

- 1 hour: -0.04%

- 24 hours: -0.88%

- 7 days: -4.7%

- 30 days: -24.79%

- 1 year: -79.62%

These figures indicate a consistent downward trend for MP, with significant losses over the past year. The current price is substantially lower than its all-time high of $0.009488, representing a 97.63% decrease from its peak.

The circulating supply of MP is 3,150,000,000 tokens, which is 15% of its maximum supply of 21,000,000,000. The fully diluted market cap is $4,727,100.

Click to view the current MP market price

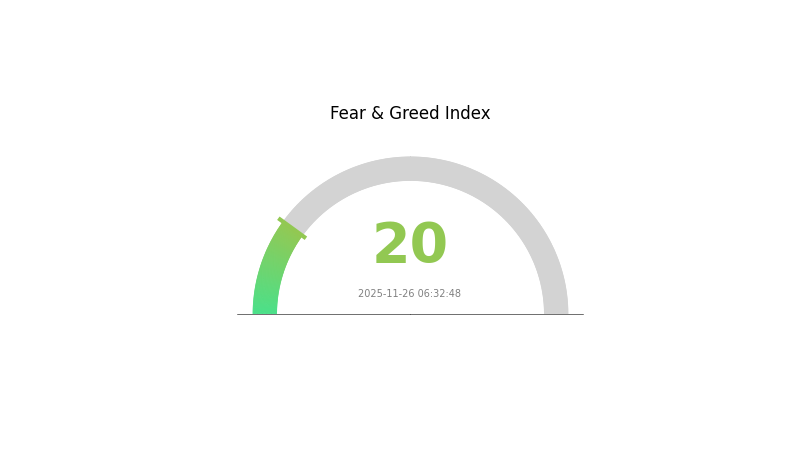

MP Market Sentiment Index

2025-11-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 20. This reflects widespread uncertainty and pessimism among investors. Such low levels often indicate a potential buying opportunity for contrarian traders, as markets may be oversold. However, caution is advised as further downside could still occur. Traders should carefully assess their risk tolerance and consider dollar-cost averaging strategies in this fearful climate. As always, thorough research and risk management are crucial before making any investment decisions.

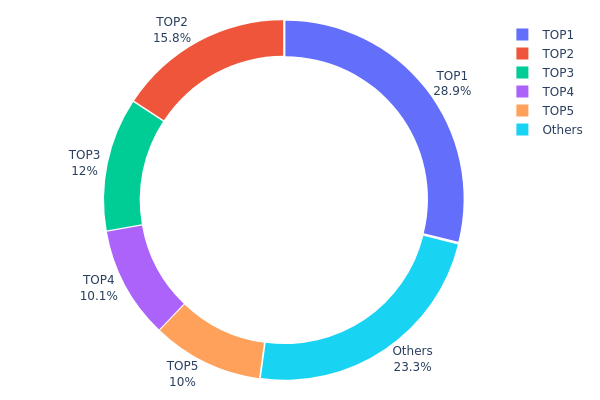

MP Holdings Distribution

The address holdings distribution data for MP reveals a highly concentrated ownership structure. The top address holds a significant 28.88% of the total supply, followed by four other addresses each holding between 10% and 15.77%. Collectively, the top five addresses control 76.72% of MP tokens, leaving only 23.28% distributed among other holders.

This level of concentration raises concerns about market centralization and potential price manipulation. With such a large portion of tokens in few hands, there's an increased risk of market volatility should any of these major holders decide to sell. Furthermore, this concentration could potentially impact governance decisions if MP utilizes a token-based voting system.

The presence of a 'dead' address (0x0000...00dead) holding 15.77% of tokens suggests a portion of the supply has been permanently removed from circulation, which could affect the token's scarcity and long-term value proposition. Overall, this distribution pattern indicates a relatively low level of decentralization and potentially fragile on-chain structural stability for MP.

Click to view the current MP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb198...35e9c0 | 6063750.00K | 28.88% |

| 2 | 0x0000...00dead | 3311076.14K | 15.77% |

| 3 | 0x92d0...c07a49 | 2520000.00K | 12.00% |

| 4 | 0x0f78...48dc5a | 2114585.43K | 10.07% |

| 5 | 0xcd25...12c044 | 2100000.00K | 10.00% |

| - | Others | 4890588.43K | 23.28% |

II. Key Factors Affecting MP's Future Price

Supply Mechanism

- Halving: The halving mechanism reduces the block reward by half every four years, limiting the supply of new MP entering the market.

- Historical Pattern: Previous halvings have historically led to significant price increases in the months following the event.

- Current Impact: The upcoming halving is expected to create upward pressure on MP's price due to reduced supply inflation.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and corporations have been increasing their MP holdings as a store of value and inflation hedge.

- Corporate Adoption: Several Fortune 500 companies have added MP to their balance sheets, signaling growing mainstream acceptance.

- National Policies: Some countries have begun to recognize MP as legal tender, while others are developing regulatory frameworks for cryptocurrencies.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' continued quantitative easing and low interest rates may drive investors towards MP as an alternative asset.

- Inflation Hedge Properties: MP has shown potential as a hedge against inflation, attracting investors during periods of high inflation expectations.

- Geopolitical Factors: Global economic uncertainty and geopolitical tensions may increase MP's appeal as a borderless, decentralized asset.

Technical Development and Ecosystem Building

- Layer 2 Solutions: The implementation of Layer 2 scaling solutions is improving MP's transaction speed and reducing fees.

- Lightning Network Expansion: The growth of the Lightning Network is enhancing MP's usability for small, everyday transactions.

- Ecosystem Applications: The MP ecosystem is expanding with DeFi protocols, NFT platforms, and Web3 applications built on MP-based networks.

III. MP Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00012 - $0.00018

- Neutral prediction: $0.00018 - $0.00023

- Optimistic prediction: $0.00023 - $0.00025 (requires sustained market recovery)

2026-2028 Outlook

- Market phase expectation: Gradual growth and stabilization

- Price range forecast:

- 2026: $0.00022 - $0.00028

- 2027: $0.00014 - $0.00027

- 2028: $0.00023 - $0.00034

- Key catalysts: Increased adoption, technological advancements, market maturity

2029-2030 Long-term Outlook

- Base scenario: $0.00030 - $0.00036 (assuming steady market growth)

- Optimistic scenario: $0.00036 - $0.00042 (with favorable market conditions)

- Transformative scenario: $0.00042 - $0.00050 (with breakthrough innovations and mass adoption)

- 2030-12-31: MP $0.00039 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00023 | 0.00023 | 0.00012 | 0 |

| 2026 | 0.00028 | 0.00023 | 0.00022 | 1 |

| 2027 | 0.00027 | 0.00025 | 0.00014 | 12 |

| 2028 | 0.00034 | 0.00026 | 0.00023 | 15 |

| 2029 | 0.00042 | 0.0003 | 0.00016 | 33 |

| 2030 | 0.00039 | 0.00036 | 0.00032 | 60 |

IV. MP Professional Investment Strategies and Risk Management

MP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Bitcoin ecosystem enthusiasts and long-term crypto investors

- Operation suggestions:

- Accumulate MP tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

MP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Bitcoin ecosystem projects

- Stop-loss orders: Implement to limit potential losses during market volatility

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. MP Potential Risks and Challenges

MP Market Risks

- High volatility: MP price may experience significant fluctuations

- Liquidity risk: Limited trading volume may impact entry and exit positions

- Competition: Other Bitcoin ecosystem DEXs may emerge and capture market share

MP Regulatory Risks

- Uncertain regulatory landscape: Potential changes in crypto regulations may impact MP's operations

- Cross-border compliance: Varying regulations across jurisdictions may limit global adoption

- Tax implications: Evolving tax laws may affect MP token holders

MP Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying code

- Scalability challenges: Increased adoption may strain the network's capacity

- Interoperability issues: Potential difficulties in connecting with other blockchain networks

VI. Conclusion and Action Recommendations

MP Investment Value Assessment

MP shows potential as a leading DEX in the Bitcoin ecosystem, but faces significant short-term risks due to market volatility and regulatory uncertainties. Long-term value proposition depends on continued adoption and ecosystem growth.

MP Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about Bitcoin ecosystem and DEX operations ✅ Experienced investors: Consider allocating a portion of Bitcoin ecosystem investments to MP, actively manage positions ✅ Institutional investors: Conduct thorough due diligence, potentially include MP in diversified crypto portfolios

MP Trading Participation Methods

- Spot trading: Buy and sell MP tokens on Gate.com

- Staking: Participate in liquidity provision on MerlinSwap to earn rewards

- DeFi integration: Explore yield farming opportunities within the Bitcoin ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will MP stock go?

MP stock could potentially reach $50-60 by 2026, driven by growing demand for rare earth elements in tech and green energy sectors.

Is MP a good investment?

MP shows potential for growth in the Web3 space. Its innovative features and increasing adoption suggest it could be a promising investment opportunity.

What is the price target for MP in 2025?

Based on market analysis and current trends, the price target for MP in 2025 is projected to reach $15 to $20, reflecting potential growth in the Web3 and cryptocurrency sectors.

Does MP Materials have a good future?

MP Materials has a promising future in the rare earth industry, with potential for growth and innovation in sustainable mining practices.

Introducing $LIGHT:Bitlight Labs' Token & Its Role in Bitcoin's Ecosystem

Bitcoin Operating System ($BOS) Project Overview: Transforming Bitcoin into a Programmability platform.

2025 STX Price Prediction: Bullish Trends and Potential Catalysts for Stacks' Native Token

Exploring Mezo: Enhancing DeFi with Bitcoin's Layer 2 Technology

Top Innovative Projects in the Bitcoin DeFi Space

Exploring the Bitcoin DeFi Landscape: Opportunities and Innovations

Exploring Top International Token Investment Platforms for Beginners

Understanding NFT Minting: A Comprehensive Guide on How to Mint Your Own NFTs

Understanding ZK Rollups: In-Depth Exploration of Zero-Knowledge Technology in Web3

Discover the Top NFT Artists

The Definitive Guide to Privacy Protection in Cryptocurrency Mixing