2025 NEWT Price Prediction: Analyzing Market Trends and Growth Potential for Newt Finance in the Evolving DeFi Landscape

Introduction: NEWT's Market Position and Investment Value

Newton (NEWT), as a decentralized infrastructure for verifiable on-chain automation and secure agent authorization, has been making significant strides since its inception. As of 2025, NEWT's market capitalization has reached $42,677,500, with a circulating supply of approximately 215,000,000 tokens, and a price hovering around $0.1985. This asset, often referred to as the "automation enabler," is playing an increasingly crucial role in empowering protocols, DAOs, and users to execute complex actions through verifiable agents.

This article will provide a comprehensive analysis of NEWT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. NEWT Price History Review and Current Market Status

NEWT Historical Price Evolution

- 2025 June: NEWT reached its all-time high of $0.8511, marking a significant milestone in its price history.

- 2025 September: The price experienced a sharp decline, reaching its all-time low of $0.1839.

- 2025 October: NEWT shows signs of recovery, with the price stabilizing around $0.1985.

NEWT Current Market Situation

As of October 1, 2025, NEWT is trading at $0.1985, showing a slight recovery of 0.81% in the past 24 hours. The token has experienced significant volatility in recent months, with a 24.74% decrease over the past 30 days and a substantial 61.34% decline over the past year. However, short-term indicators show some positive momentum, with a 3.01% increase in the last hour.

NEWT's market capitalization currently stands at $42,677,500, ranking it 756th in the global cryptocurrency market. The circulating supply is 215,000,000 NEWT, representing 21.5% of the total supply of 1,000,000,000 tokens. The fully diluted valuation of the project is $198,500,000.

Trading volume in the last 24 hours reached $693,577.81, indicating moderate market activity. The token is listed on 38 exchanges, providing ample liquidity for traders and investors.

Click to view the current NEWT market price

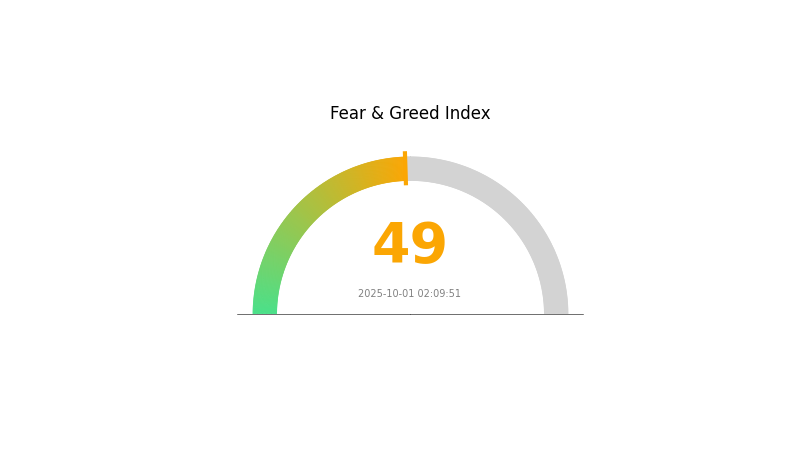

NEWT Market Sentiment Indicator

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of equilibrium, with the Fear and Greed Index standing at 49. This neutral reading suggests that investors are neither overly fearful nor excessively greedy. It's a time for cautious optimism, where rational decision-making should prevail. Traders and investors might consider this a balanced opportunity to reassess their strategies, conduct thorough research, and prepare for potential market movements in either direction. As always, it's crucial to stay informed and manage risks appropriately in the ever-evolving crypto landscape.

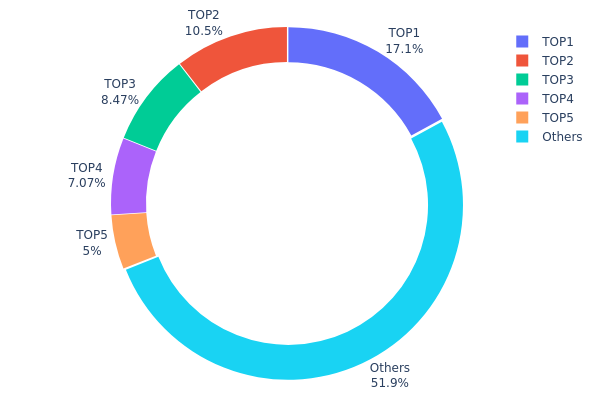

NEWT Holdings Distribution

The address holdings distribution chart provides insights into the concentration of NEWT tokens among different wallet addresses. Analysis of the data reveals a relatively high concentration among the top holders. The top address controls 17.09% of the total supply, with the top five addresses collectively holding 48.11% of all NEWT tokens.

This concentration level suggests a moderate degree of centralization in NEWT's distribution. While not extreme, it does indicate that a small number of addresses have significant influence over the token's supply. Such concentration could potentially impact market dynamics, as large holders may exert substantial pressure on price movements through their trading activities. Additionally, this distribution pattern may increase the risk of market manipulation or sudden price volatility if these major holders decide to move large quantities of tokens.

Despite the concentration among top holders, it's notable that 51.89% of NEWT tokens are distributed among other addresses. This broader distribution provides some level of decentralization and may contribute to overall market stability. However, the current holdings structure suggests that NEWT's on-chain governance and market behavior could be significantly influenced by decisions made by a relatively small number of large token holders.

Click to view the current NEWT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0068...c9c341 | 170983.34K | 17.09% |

| 2 | 0x8cc2...556c8e | 104881.41K | 10.48% |

| 3 | 0xbc8e...49aacc | 84733.75K | 8.47% |

| 4 | 0xc07c...a9bac3 | 70740.21K | 7.07% |

| 5 | 0x2f87...133aeb | 50000.00K | 5.00% |

| - | Others | 518661.22K | 51.89% |

II. Key Factors Affecting NEWT's Future Price

Supply Mechanism

- Halving: NEWT may implement a halving mechanism to reduce the rate of new coin creation over time.

- Historical pattern: Previous halvings in cryptocurrencies like Bitcoin have often led to price increases due to reduced supply.

- Current impact: The next halving, if implemented, could create upward pressure on NEWT's price as new supply decreases.

Institutional and Whale Dynamics

- Institutional holdings: Major financial institutions may begin accumulating NEWT as part of their crypto portfolios.

- Enterprise adoption: Tech companies could start using NEWT for payments or as a reserve asset.

- Government policies: Regulatory clarity from major economies may impact institutional involvement in NEWT.

Macroeconomic Environment

- Monetary policy impact: Central bank policies, especially from the Federal Reserve, will influence crypto markets including NEWT.

- Inflation hedging properties: NEWT may be viewed as a potential hedge against inflation, similar to Bitcoin.

- Geopolitical factors: Global economic tensions and currency devaluations could drive investors towards cryptocurrencies like NEWT.

Technical Development and Ecosystem Growth

- Scalability upgrades: Implementation of layer-2 solutions or sharding could improve NEWT's transaction capacity and speed.

- Smart contract functionality: Adding or enhancing smart contract capabilities could expand NEWT's use cases.

- Ecosystem applications: Development of DApps, DeFi protocols, and NFT platforms on NEWT could drive adoption and value.

III. NEWT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.10595 - $0.15

- Neutral prediction: $0.15 - $0.20

- Optimistic prediction: $0.20 - $0.26987 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by growth

- Price range forecast:

- 2027: $0.14758 - $0.24919

- 2028: $0.19645 - $0.3536

- Key catalysts: Project developments, market sentiment, and overall crypto adoption

2029-2030 Long-term Outlook

- Base scenario: $0.26483 - $0.35 (assuming steady market growth)

- Optimistic scenario: $0.35 - $0.43619 (assuming strong project performance)

- Transformative scenario: $0.45 - $0.50 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: NEWT $0.43619 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.26987 | 0.1999 | 0.10595 | 0 |

| 2026 | 0.24898 | 0.23488 | 0.21609 | 18 |

| 2027 | 0.24919 | 0.24193 | 0.14758 | 21 |

| 2028 | 0.3536 | 0.24556 | 0.19645 | 23 |

| 2029 | 0.32355 | 0.29958 | 0.17376 | 50 |

| 2030 | 0.43619 | 0.31156 | 0.26483 | 56 |

IV. NEWT Professional Investment Strategies and Risk Management

NEWT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in decentralized infrastructure

- Operation suggestions:

- Accumulate NEWT tokens during market dips

- Participate in Newton Protocol governance

- Store tokens securely in a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Newton Protocol updates and partnerships for potential price catalysts

NEWT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Newton Protocol wallet (if available)

- Security precautions: Use two-factor authentication, store private keys offline

V. Potential Risks and Challenges for NEWT

NEWT Market Risks

- High volatility: NEWT price may experience significant fluctuations

- Limited liquidity: Potential difficulties in executing large trades

- Competition: Other projects may develop similar decentralized infrastructure solutions

NEWT Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting decentralized protocols

- Cross-border compliance: Challenges in adhering to varying international regulations

- Token classification: Risk of NEWT being classified as a security in some jurisdictions

NEWT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability challenges: Possible limitations in handling increased network load

- Interoperability issues: Difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

NEWT Investment Value Assessment

Newton Protocol offers a promising solution for decentralized infrastructure and onchain automation. While it presents long-term potential in the evolving Web3 ecosystem, investors should be aware of short-term volatility and the project's early stage of development.

NEWT Investment Recommendations

✅ Beginners: Consider a small allocation as part of a diversified crypto portfolio ✅ Experienced investors: Explore active participation in the Newton ecosystem and governance ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships with the protocol

NEWT Trading Participation Methods

- Spot trading: Purchase NEWT tokens on Gate.com

- Staking: Participate in staking programs if offered by Newton Protocol

- Governance: Engage in protocol decision-making processes using NEWT tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Newt stock?

Newt stock is predicted to reach $8.49 in February and $4.60 in May 2025. The average price for 2027 is expected to be $6.34, with a potential decrease to $4.91 in the long term.

What is the XRP price prediction in 2025?

Based on current trends, XRP is predicted to experience a slight decrease of 1.99% by October 2, 2025. Technical analysis suggests a minor downward movement in price.

What is the value of Newt?

The value of Newt is $0.1878, with a 24-hour trading volume of $12,546,342. The price has decreased by 5.74% in the last day.

What crypto has the highest price prediction?

As of 2025, Bitcoin is predicted to have the highest price, followed by Ethereum. These two cryptocurrencies are expected to maintain their leading positions in terms of value and market dominance.

2025 COTI Price Prediction: Analyzing Market Trends and Future Potential in the Evolving Cryptocurrency Landscape

2025 ROSE Price Prediction: Analyzing Market Trends and Potential Growth for Oasis Network's Native Token

2025 CELO Price Prediction: Bull Run or Bear Market? Analyzing Key Factors for CELO's Future Value

2025 CERE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 RADAR Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 REACT Price Prediction: Analyzing Growth Potential in the Decentralized Finance Ecosystem

Guide to Bridging Assets to the Polygon PoS Network

Effortless Guide to Connecting with the Polygon Network

Exploring Tap Crypto: The Ultimate Beginner's Guide to Web3 Transactions

Understanding the Ethereum Name Service (ENS): A Simplified Guide

Exploring the Aptos Blockchain: A Comprehensive Guide