2025 PACK Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: PACK's Market Position and Investment Value

HashPack (PACK), as the leading retail wallet on Hedera Hashgraph, has established itself as a key player in the DeFi, NFT, and dApp ecosystems since its inception. As of 2025, PACK's market capitalization has reached $3,122,605, with a circulating supply of approximately 232,682,953 tokens, and a price hovering around $0.01342. This asset, often referred to as the "user experience champion" in the Hedera ecosystem, is playing an increasingly crucial role in providing seamless access to decentralized applications.

This article will provide a comprehensive analysis of PACK's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PACK Price History Review and Current Market Status

PACK Historical Price Evolution

- 2024: PACK reached its all-time high of $0.08778 on November 17, marking a significant milestone for the project

- 2025: The cryptocurrency market experienced a downturn, with PACK price declining to its all-time low of $0.00901 on October 10

PACK Current Market Situation

As of October 13, 2025, PACK is trading at $0.01342, showing a 10.63% increase in the last 24 hours. The token has a market capitalization of $3,122,605, ranking it at 2059 in the global cryptocurrency market. PACK's 24-hour trading volume stands at $17,999.49, indicating moderate market activity.

Despite the recent positive momentum, PACK has experienced significant price volatility over different time frames. While it has shown a slight 0.15% gain in the past hour, the token has seen substantial losses over longer periods. In the past week, PACK has declined by 16.22%, and over the last 30 days, it has dropped by 28.93%. The most dramatic decline is observed in the one-year timeframe, with PACK losing 61.75% of its value.

The current price of $0.01342 represents a 84.71% decrease from its all-time high and a 48.94% increase from its all-time low, suggesting that the token is in a recovery phase after a significant market correction.

Click to view the current PACK market price

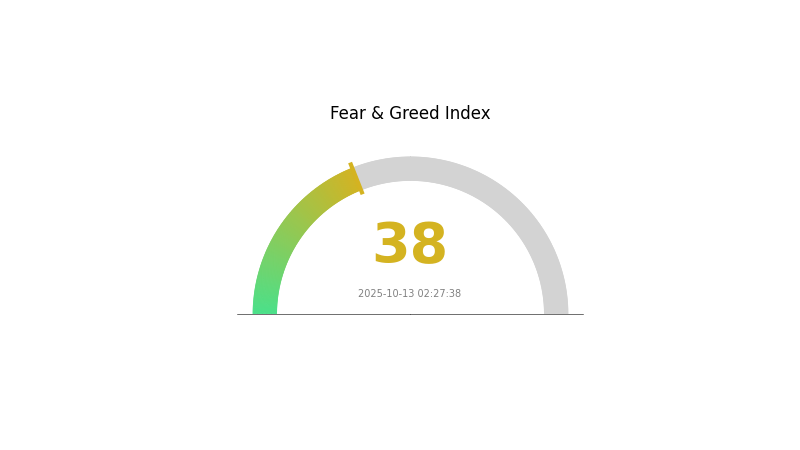

PACK Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 38, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. During such periods, it's crucial to conduct thorough research and consider dollar-cost averaging strategies. Remember, market cycles are normal, and periods of fear often precede significant recoveries. Stay informed and manage your risk wisely.

PACK Holdings Distribution

The address holdings distribution data for PACK reveals a highly decentralized ownership structure. With no individual addresses holding significant percentages of the total supply, the token appears to have a widely dispersed distribution among its holders.

This decentralized ownership pattern suggests a reduced risk of market manipulation or price volatility caused by large holders. It also indicates a healthy level of adoption and participation across a broad user base, which is generally considered a positive sign for the project's ecosystem stability and long-term sustainability.

The current distribution reflects a strong degree of decentralization in PACK's market structure, potentially contributing to more organic price discovery and reduced susceptibility to sudden large-scale sell-offs or accumulations. This distribution pattern may foster a more resilient and balanced market dynamic for PACK tokens.

Click to view the current PACK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing Future PACK Prices

Supply Mechanism

- Production Capacity: The expansion or contraction of production capacity for PACK (battery packs) can significantly impact supply and prices.

- Historical Patterns: Past supply changes have shown a direct correlation with price fluctuations in the PACK market.

- Current Impact: Expected supply changes due to new production lines or factory expansions may lead to increased supply and potential price stabilization.

Institutional and Large Holder Dynamics

- Corporate Adoption: Major automakers and energy storage companies adopting PACK technology can drive demand and influence prices.

- National Policies: Government initiatives promoting electric vehicles and energy storage solutions can significantly impact PACK demand and pricing.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly interest rates, can affect investment in PACK production and demand for electric vehicles.

- Inflation Hedging Properties: PACK prices may be influenced by their potential role in inflation-resistant technologies like electric vehicles and renewable energy storage.

- Geopolitical Factors: International trade relations and supply chain disruptions can impact raw material availability and PACK production costs.

Technological Development and Ecosystem Building

- Battery Technology Advancements: Improvements in energy density, charging speed, and longevity can enhance PACK value and market competitiveness.

- Manufacturing Innovations: Advancements in production processes, such as automation and new assembly techniques, can affect PACK costs and pricing.

- Ecosystem Applications: The growth of electric vehicle markets, grid-scale energy storage, and other PACK-dependent industries can drive demand and influence prices.

III. PACK Price Prediction 2025-2030

2025 Outlook

- Conservative prediction: $0.01275 - $0.01342

- Neutral prediction: $0.01342 - $0.01369

- Optimistic prediction: $0.01369 - $0.01396 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01494 - $0.01782

- 2028: $0.00992 - $0.02227

- Key catalysts: Increased adoption and market expansion

2030 Long-term Outlook

- Base scenario: $0.02222 - $0.02469 (assuming steady market growth)

- Optimistic scenario: $0.02469 - $0.03210 (assuming strong market performance)

- Transformative scenario: $0.03210+ (extreme favorable conditions)

- 2030-12-31: PACK $0.03210 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01396 | 0.01342 | 0.01275 | 0 |

| 2026 | 0.02026 | 0.01369 | 0.01259 | 2 |

| 2027 | 0.01782 | 0.01697 | 0.01494 | 26 |

| 2028 | 0.02227 | 0.0174 | 0.00992 | 29 |

| 2029 | 0.02955 | 0.01983 | 0.0123 | 47 |

| 2030 | 0.0321 | 0.02469 | 0.02222 | 84 |

IV. PACK Professional Investment Strategy and Risk Management

PACK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate PACK tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

PACK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Never share private keys, use two-factor authentication

V. Potential Risks and Challenges for PACK

PACK Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited liquidity: Potential difficulties in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

PACK Regulatory Risks

- Regulatory uncertainty: Potential for new regulations affecting PACK

- Compliance challenges: Evolving regulatory landscape may impact adoption

- Cross-border restrictions: Varying regulations across jurisdictions

PACK Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Possible transaction delays on the Hedera network

- Integration issues: Challenges in maintaining compatibility with dApps

VI. Conclusion and Action Recommendations

PACK Investment Value Assessment

PACK offers potential long-term value as a leading wallet on Hedera Hashgraph, but faces short-term risks due to market volatility and regulatory uncertainties.

PACK Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and integrate PACK into a diversified crypto portfolio

PACK Trading Participation Methods

- Spot trading: Buy and sell PACK tokens on Gate.com

- DeFi participation: Explore liquidity provision or yield farming opportunities

- Dollar-cost averaging: Set up recurring purchases to accumulate PACK over time

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is pack stock price prediction for 2025?

Based on market analysis, PACK stock price is predicted to average $5.38 in 2025, with potential highs of $10.75 and lows of $0.02.

Is pack a buy, sell, or hold?

Based on current market analysis, PACK is considered a buy. Analysts' consensus suggests positive growth potential for the token in the near future.

What is Pepe's price prediction for 2025?

Based on current trends, Pepe's price prediction for 2025 is bearish. Market sentiment is negative, and historical data suggests it may not be a profitable investment.

What is the NVDA price target?

The NVDA price target ranges from $100.00 to $389.73, with an average of $220.90. The current price is $192.57.

The next-generation DEX vision of Aster

2025 KAR Price Prediction: Analyzing Market Trends and Potential Growth for Karura

2025 HOT Price Prediction: Analyzing Market Trends and Potential Growth Factors for Holo's Native Token

What is DFYN: A Comprehensive Guide to the Multi-Chain DEX Protocol

2025 KIM Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 STND Price Prediction: Bullish Trends and Key Factors Shaping the Future of Standard Protocol

What Is a Ponzi Scheme? How Ponzi Scams Work and How to Identify Them

DRK: Understanding the Controversial Cryptocurrency and Its Market Impact

Infrared Finance LSD: How IR Token Works in DeFi Yield Farming and Liquid Staking

How to Invest in Tokenized US Stocks on Solana With Ondo Finance ETFs

Theoriq (THQ): AI-Driven DeFi Infrastructure for Web3