2025 PIZZA Price Prediction: Analyzing Market Trends and Factors Influencing the Future of Cryptocurrency

Introduction: PIZZA's Market Position and Investment Value

PIZZA (PIZZA), as a BRC-20 token celebrating Bitcoin Pizza Day, has made significant strides since its distribution by UniSat on May 22, 2025. As of 2025, PIZZA's market capitalization stands at $2,299,500, with a circulating supply of 21,000,000 tokens and a price hovering around $0.1095. This asset, dubbed the "Bitcoin Pizza Day Commemorative Token," is playing an increasingly important role in the BRC-20 ecosystem and Bitcoin-related celebrations.

This article will provide a comprehensive analysis of PIZZA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PIZZA Price History Review and Current Market Status

PIZZA Historical Price Evolution

- 2024: Launch of PIZZA token, price reached all-time high of $8.8 on June 9

- 2025: Market downturn, price dropped to all-time low of $0.08502 on October 10

PIZZA Current Market Situation

As of October 15, 2025, PIZZA is trading at $0.1095, with a market capitalization of $2,299,500. The token has experienced significant volatility over the past year, with a 96.77% decrease in value. In the last 24 hours, PIZZA has seen a 3.55% decline, while the 7-day and 30-day price changes show drops of 23.08% and 35.08% respectively. The current price is 98.76% below its all-time high and 28.79% above its all-time low. With a circulating supply equal to its total supply of 21,000,000 PIZZA, the token has a fully diluted market cap of $2,299,500. Trading volume in the last 24 hours stands at $51,082.56, indicating moderate market activity.

Click to view the current PIZZA market price

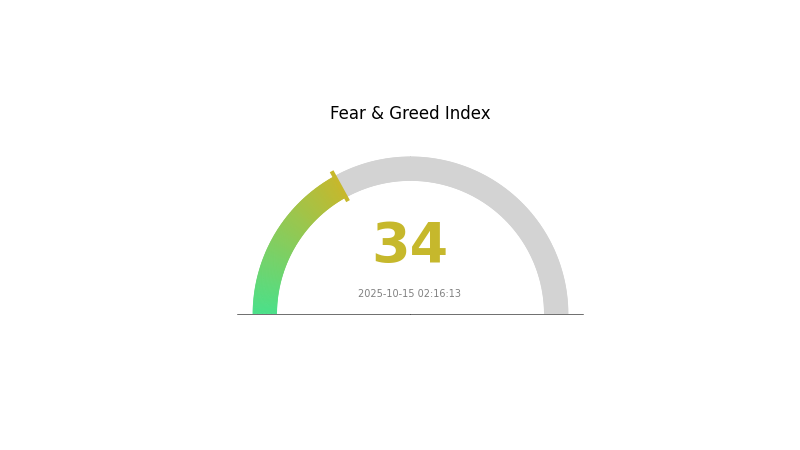

PIZZA Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index standing at 34. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Gate.com offers a range of tools to help you navigate these market conditions effectively.

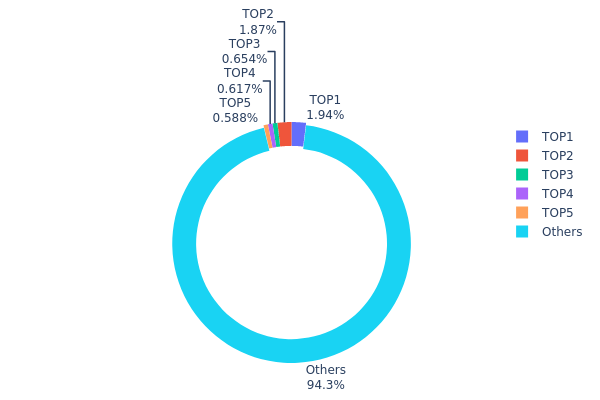

PIZZA Holdings Distribution

The address holdings distribution data provides valuable insights into the concentration of PIZZA tokens among different wallet addresses. According to the data, the top 5 addresses collectively hold approximately 5.65% of the total PIZZA supply, with the largest single address holding 1.94%. This distribution pattern suggests a relatively low level of concentration, as the majority of tokens (94.35%) are distributed among numerous other addresses.

This decentralized holding structure indicates a healthy market dynamic for PIZZA. The absence of significant whale wallets controlling large portions of the supply reduces the risk of market manipulation and sudden price swings caused by individual large holders. Furthermore, the widespread distribution among many addresses suggests a diverse user base, which is often associated with greater network stability and organic growth potential.

The current address distribution reflects a market with a high degree of decentralization and on-chain structural stability. This characteristic aligns well with the principles of decentralized finance and may contribute to increased investor confidence in PIZZA's long-term prospects.

Click to view the current PIZZA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | bc1ps0...ss2vxa | 408.43K | 1.94% |

| 2 | bc1p3m...le3vla | 393.19K | 1.87% |

| 3 | bc1pqq...r4jj8g | 137.28K | 0.65% |

| 4 | bc1pyd...wykt7z | 129.55K | 0.61% |

| 5 | bc1pw7...86usp2 | 123.43K | 0.58% |

| - | Others | 19808.11K | 94.35% |

II. Core Factors Affecting PIZZA's Future Price

Supply Mechanism

- Market Supply and Demand: The price of PIZZA is primarily determined by market supply and demand, including investor demand and trading volume.

- Historical Pattern: Past supply changes have directly impacted PIZZA's price volatility.

- Current Impact: Current market supply and demand dynamics continue to be a key driver of PIZZA's price movements.

Institutional and Whale Dynamics

- National Policies: Regulatory policies and legal frameworks related to cryptocurrencies can significantly influence PIZZA's price.

Macroeconomic Environment

- Inflation Hedging Properties: PIZZA's performance in inflationary environments may affect its price as investors seek potential hedges against inflation.

- Geopolitical Factors: International geopolitical situations can impact PIZZA's price as a global cryptocurrency.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects built on or utilizing PIZZA can affect its price and adoption.

III. PIZZA Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.07938 - $0.11025

- Neutral forecast: $0.11025 - $0.13000

- Optimistic forecast: $0.13000 - $0.14774 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Growth phase with potential volatility

- Price range predictions:

- 2027: $0.1455 - $0.22135

- 2028: $0.09592 - $0.22945

- Key catalysts: Technological advancements, increased adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.20876 - $0.21711 (assuming steady growth and adoption)

- Optimistic scenario: $0.22546 - $0.24750 (assuming favorable market conditions and strong project performance)

- Transformative scenario: $0.25000 - $0.30000 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: PIZZA $0.21711 (potential 98% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14774 | 0.11025 | 0.07938 | 0 |

| 2026 | 0.18059 | 0.12899 | 0.09029 | 17 |

| 2027 | 0.22135 | 0.15479 | 0.1455 | 41 |

| 2028 | 0.22945 | 0.18807 | 0.09592 | 71 |

| 2029 | 0.22546 | 0.20876 | 0.14822 | 90 |

| 2030 | 0.2475 | 0.21711 | 0.19757 | 98 |

IV. Professional Investment Strategies and Risk Management for PIZZA

PIZZA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate PIZZA tokens during market dips

- Set price targets for partial profit-taking

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor BTC price movements as they may influence PIZZA

- Set stop-loss orders to limit potential losses

PIZZA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for PIZZA

PIZZA Market Risks

- High volatility: PIZZA price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Correlation with Bitcoin: PIZZA price may be influenced by BTC movements

PIZZA Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of BRC-20 tokens

- Legal status: Lack of clear classification for PIZZA tokens in many jurisdictions

- Compliance challenges: May face difficulties in adhering to evolving regulations

PIZZA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the BRC-20 protocol

- Scalability issues: Limitations of the Bitcoin network may affect PIZZA transactions

- Blockchain congestion: High network activity could lead to increased transaction fees

VI. Conclusion and Action Recommendations

PIZZA Investment Value Assessment

PIZZA presents a unique opportunity as a BRC-20 token, but carries significant risks due to its novelty and market volatility. Long-term potential exists, but investors should be prepared for high short-term volatility.

PIZZA Investment Recommendations

✅ Beginners: Limit exposure to a small portion of portfolio, focus on education ✅ Experienced investors: Consider small allocations as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence, implement robust risk management

PIZZA Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Dollar-cost averaging: Regular small purchases to mitigate price volatility

- Limit orders: Set buy and sell orders at predetermined price levels

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the food price prediction for 2025?

Food prices are expected to increase slightly in 2025, with a moderate rise from 2024 levels. Economic trends and supply chain factors suggest a stable but upward trajectory for food costs.

Why have pizza prices gone up?

Pizza prices have risen due to increased costs of ingredients, labor, and operational expenses in the food industry.

What is the stock price prediction for Dominos pizza?

As of 2025, Domino's stock is expected to reach $500, driven by global expansion and innovative delivery tech.

What is Pepe's price prediction for 2025?

Based on crypto experts' analysis, Pepe's price in 2025 is predicted to range between $0.00000528 and $0.00000761, with a maximum expected price of around $0.0000104.

Is SATS (SATS) a good investment?: Analyzing the Potential and Risks of the Lightning Network Token

2025 TRIO Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

Bitcoin Price Prediction 2030

2025 Guide for UK Traders on Bitcoin to Pound Exchange

Heikin-Ashi Charts Most Underrated Tool

Bitcoin price in GBP: 2025 UK market analysis and trading guide

Maximize Gains with Curve's Decentralized Liquidity Pools

Guide to Offering Liquidity in DeFi Platforms

Understanding Smart Contracts: A Comprehensive Guide

Understanding the Bear Flag Pattern in Digital Asset Trading

Top High-Yield Crypto Savings Options