2025 POKT Price Prediction: Analyzing Market Trends and Growth Potential for Pocket Network's Native Token

Introduction: POKT's Market Position and Investment Value

Pocket Network (POKT) as a decentralized Web3 infrastructure middleware protocol, has made significant strides since its inception in 2021. As of 2025, Pocket Network's market capitalization has reached $47,334,833, with a circulating supply of approximately 2,011,680,128 POKT tokens, and a price hovering around $0.02353. This asset, often referred to as the "Web3 API backbone," is playing an increasingly crucial role in providing RPC relay services for dapps running on various blockchains.

This article will comprehensively analyze POKT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. POKT Price History Review and Current Market Status

POKT Historical Price Evolution

- 2022: POKT reached its all-time high of $3.11 on January 16, 2022

- 2025: POKT hit its all-time low of $0.00883573 on April 17, 2025

- 2025: Current market cycle, price has declined from its peak to $0.02353

POKT Current Market Situation

As of September 30, 2025, POKT is trading at $0.02353, with a market capitalization of $47,334,833. The token has experienced significant volatility in recent periods:

- In the past 24 hours, POKT has seen a 6.51% decrease in price

- Over the last 7 days, the price has dropped by 17.99%

- The 30-day change shows a substantial decline of 33.22%

- Year-to-date, POKT has fallen by 38.14%

The current price represents a 99.24% decrease from its all-time high and a 166.31% increase from its all-time low. With a circulating supply of 2,011,680,128 POKT and a total supply of 2,351,355,446 POKT, the token has a circulating supply ratio of 85.55%.

POKT's 24-hour trading volume stands at $142,364, indicating moderate market activity. The token's market dominance is currently at 0.0013%, suggesting a relatively small presence in the overall cryptocurrency market.

Click to view the current POKT market price

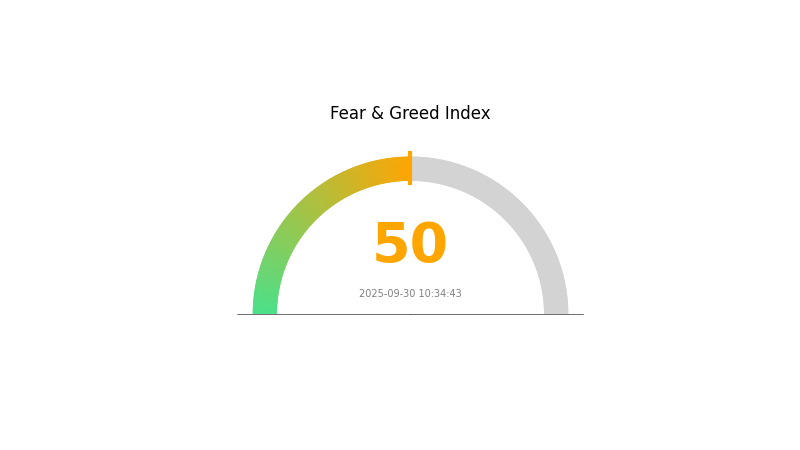

POKT Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The POKT market sentiment remains balanced today, with the Fear and Greed Index at 50, indicating a neutral stance among investors. This equilibrium suggests a stable market environment, where neither extreme fear nor excessive optimism dominates. Traders and investors should remain vigilant, as this neutral sentiment could potentially shift in either direction based on upcoming market developments or external factors. It's an opportune time to reassess investment strategies and consider diversifying portfolios while keeping a close eye on market trends.

POKT Holdings Distribution

The address holdings distribution data for POKT reveals an interesting pattern in token concentration. While the provided table lacks specific data points, we can still draw some general conclusions about the current state of POKT's market structure.

The absence of highly concentrated holdings in the top addresses suggests a relatively decentralized distribution of POKT tokens. This distribution pattern typically indicates a healthier market structure, as it reduces the risk of price manipulation by large token holders. A more evenly spread token distribution can contribute to increased market stability and potentially lower volatility in price movements.

However, without specific percentages, it's challenging to definitively assess the level of decentralization. A truly decentralized network would ideally show a gradual decrease in holdings percentages across a wide range of addresses. The current distribution appears to support a more robust and resilient network structure for POKT, potentially fostering greater community participation and reducing systemic risks associated with token concentration.

Click to view the current POKT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting POKT's Future Price

Macroeconomic Environment

- Impact of Monetary Policy: Central bank policies and macroeconomic trends play a significant role in influencing POKT's price.

- Inflation Hedging Properties: As a cryptocurrency, POKT may be seen as a potential hedge against inflation in certain economic environments.

- Geopolitical Factors: International situations and geopolitical events can impact the overall crypto market, including POKT.

Technological Development and Ecosystem Building

- Infrastructure Improvements: As a decentralized infrastructure provider, any upgrades or improvements to Pocket Network's technology could significantly impact POKT's value.

- Ecosystem Applications: The growth of DApps and projects utilizing Pocket Network's infrastructure could drive demand for POKT tokens.

III. POKT Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01885 - $0.02356

- Neutral forecast: $0.02356 - $0.03000

- Optimistic forecast: $0.03000 - $0.03487 (requires strong market recovery and increased POKT adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2027: $0.01906 - $0.04118

- 2028: $0.02181 - $0.04475

- Key catalysts: Expansion of POKT network usage, broader crypto market trends, and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.04118 - $0.04962 (assuming steady growth in POKT ecosystem)

- Optimistic scenario: $0.05807 - $0.07245 (assuming rapid adoption and favorable market conditions)

- Transformative scenario: $0.07500 - $0.09000 (assuming breakthrough partnerships and mainstream integration)

- 2030-12-31: POKT $0.07245 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03487 | 0.02356 | 0.01885 | 0 |

| 2026 | 0.03886 | 0.02921 | 0.02775 | 24 |

| 2027 | 0.04118 | 0.03403 | 0.01906 | 44 |

| 2028 | 0.04475 | 0.03761 | 0.02181 | 59 |

| 2029 | 0.05807 | 0.04118 | 0.02718 | 75 |

| 2030 | 0.07245 | 0.04962 | 0.0258 | 110 |

IV. POKT Professional Investment Strategies and Risk Management

POKT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate POKT during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Swing trading tips:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

POKT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for POKT

POKT Market Risks

- Price volatility: POKT may experience significant price swings

- Liquidity risk: Limited trading volume may affect ability to exit positions

- Competition: Other blockchain API providers may gain market share

POKT Regulatory Risks

- Uncertain regulatory landscape: Potential for unfavorable regulations

- Compliance challenges: Changing legal requirements may impact operations

- Taxation issues: Evolving tax laws may affect investor returns

POKT Technical Risks

- Network security: Potential for hacks or exploits

- Scalability challenges: May face issues as network usage grows

- Smart contract vulnerabilities: Bugs in code could lead to losses

VI. Conclusion and Action Recommendations

POKT Investment Value Assessment

POKT offers long-term potential as a decentralized Web3 infrastructure provider, but faces short-term risks due to market volatility and competition.

POKT Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the project ✅ Experienced investors: Consider dollar-cost averaging into POKT ✅ Institutional investors: Conduct thorough due diligence before large allocations

POKT Trading Participation Methods

- Spot trading: Buy and hold POKT on Gate.com

- Staking: Participate in POKT network validation for potential rewards

- DeFi: Explore liquidity provision opportunities if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is the Pokt token worth?

As of 2025-09-30, the Pokt token is worth $0.024050. This price reflects the latest market valuation based on current trading activity.

What is the price prediction for Trump in 2030?

Based on current forecasts, Trump's price is expected to reach a maximum of $73.56 and a minimum of $68.82 in 2030.

How much is TapSwap token worth in 2025?

Based on current market trends, TapSwap token is predicted to be worth $0.000557 by October 2025.

What is pokt crypto?

POKT is the native token of Pocket Network, a decentralized blockchain data platform. It's earned through staking and used for network governance.

2025 XL1 Price Prediction: Analyzing Market Trends and Potential Growth for the Next-Gen Electric Vehicle

2025 NKN Price Prediction: Analyzing Market Trends and Growth Potential for the New Kind of Network Token

2025 MOBILEPrice Prediction: Analyzing Market Trends and Technological Factors Shaping Future Smartphone Costs

2025 BZZPrice Prediction: Analyzing Swarm's Native Token Potential in the Web3 Storage Ecosystem

2025 FIL Price Prediction: Analyzing Market Trends and Expert Forecasts for Filecoin's Future Value

2025 MSN Price Prediction: Navigating the Future of Decentralized Storage in a Digital Economy

Exploring Top ZK Rollup Solutions for Enhanced Blockchain Scalability

Understanding Blockchain Nodes: A Comprehensive Explanation

Exploring Purchases You Can Make Using Cryptocurrency

Guide to Using ERC-20 Compatible Wallets

Guide to Maximizing Benefits with Velodrome Finance Platform