2025 ROSE Price Prediction: Expert Analysis and Market Forecast for Oasis Network's Native Token

Introduction: ROSE Market Position and Investment Value

Oasis Network (ROSE) serves as a decentralized blockchain network dedicated to building a privacy-focused cloud computing platform that combines privacy protection, security, and performance. Since its launch in November 2020, the project has pioneered the implementation of compute-intensive applications such as artificial intelligence on the blockchain through its innovative software and hardware integration technology. As of December 2025, ROSE maintains a market capitalization of approximately $85.79 million with a circulating supply of around 7.49 billion tokens, currently trading at $0.01146 per token. This asset, recognized for its unique approach to enabling privacy-preserving computation, is playing an increasingly important role in advancing decentralized AI and confidential computing applications within the blockchain ecosystem.

This article will comprehensively analyze ROSE's price trends from 2025 through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

Oasis Network (ROSE) Market Analysis Report

I. ROSE Price History Review and Current Market Status

ROSE Historical Price Evolution Trajectory

- 2021: Project launched with initial trading price of $0.02, marking the beginning of Oasis Network's market presence as a decentralized blockchain platform.

- January 2022: Reached all-time high (ATH) of $0.597347 on January 15, 2022, representing a significant appreciation from the initial launch price.

- 2022-2025: Extended bear market period, with price declining substantially from the peak, contracting approximately 81.2% from ATH to current levels.

ROSE Current Market Status

As of December 17, 2025, ROSE is trading at $0.01146, reflecting severe depreciation from its historical peaks. The token exhibits the following characteristics:

Price Performance Metrics:

- 24-hour change: -1.63% (down $0.000189893)

- 7-day change: -11.69% (down $0.001517013)

- 30-day change: -40.82% (down $0.007904650)

- 1-year change: -89.34% (down $0.096044690)

Market Capitalization and Supply:

- Current market capitalization: $85,792,705.56

- Fully diluted valuation: $114,600,000.00

- Circulating supply: 7,486,274,482 ROSE (74.86% of total supply)

- Total supply: 10,000,000,000 ROSE

- Market dominance: 0.0036%

Trading Activity:

- 24-hour trading volume: $112,550.95

- Number of active trading pairs: 19 exchanges

- Token holders: 309,801

Historical Price Range:

- All-time high: $0.597347 (January 15, 2022)

- All-time low: $0.01115333 (December 16, 2025)

- 24-hour range: $0.01146 - $0.01185

The token has reached fresh all-time lows recently, indicating continued downward pressure. Market sentiment remains negative with extreme fear conditions prevailing in the broader cryptocurrency market.

Click to view current ROSE market price

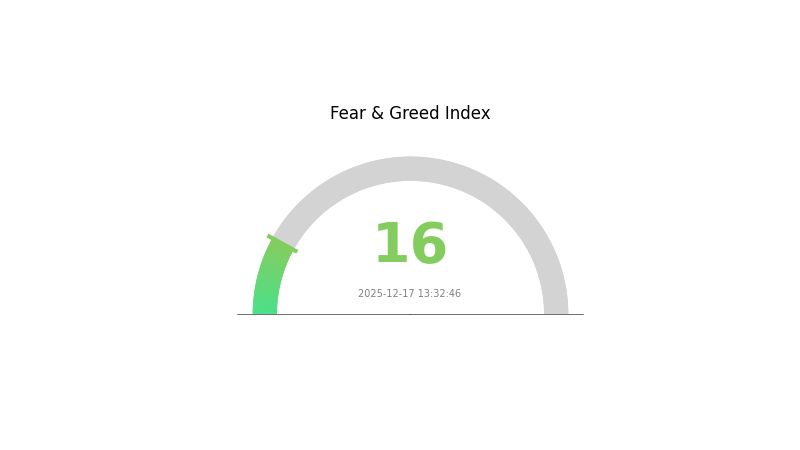

ROSE Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 16. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, panic selling often intensifies as participants rush to exit positions. However, extreme fear historically presents potential opportunities for contrarian investors. Market volatility remains elevated, and prudent risk management is essential. Monitor key support levels closely on Gate.com and consider your risk tolerance before making trading decisions in this uncertain environment.

ROSE Holdings Distribution

The holdings distribution chart illustrates the concentration of ROSE tokens across different wallet addresses on the blockchain, serving as a critical indicator for assessing market structure and decentralization levels. By analyzing the percentage allocation among top holders, this metric reveals the degree of token concentration, potential governance risks, and the resilience of the network against coordinated market movements.

Currently, the ROSE token distribution presents a fragmented ownership structure that suggests a relatively healthy degree of decentralization. The absence of extreme concentration among top-tier addresses indicates that no single entity maintains overwhelming control over the token supply, which is favorable for long-term market stability and reduces the systemic risk associated with potential large-scale liquidations or coordinated price manipulation. This distributed model supports a more robust market microstructure where individual whale movements are less likely to trigger severe price volatility or create cascading forced selling pressures.

From a market structural perspective, the current holdings distribution reflects a mature token ecosystem characterized by diversified stakeholder participation. The balance between institutional adoption and community distribution suggests that ROSE maintains sufficient decentralization to preserve its protocol's integrity while facilitating sufficient liquidity for trading activities. This equilibrium is essential for sustaining confidence in the network's governance mechanisms and reducing concerns about centralized control that could undermine the fundamental value proposition of the blockchain infrastructure.

View current ROSE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing ROSE's Future Price

Supply Mechanism

- Supply and Demand Dynamics: ROSE price is primarily influenced by supply-demand relationships. When demand exceeds supply, prices rise; conversely, prices fall when supply exceeds demand.

- Historical Patterns: Supply adjustments have historically caused significant price fluctuations for ROSE.

- Current Impact: The ecosystem and strategic partnership expansion are key factors driving price growth.

Ecosystem Growth and Strategic Development

- Project Ecosystem Expansion: Ecosystem development and partner expansion are significant drivers of ROSE price appreciation. As of October 2025, ROSE traded at $0.85 USD, representing a 150% increase compared to 2023.

- Privacy-Focused Innovation: As a privacy-centric blockchain project, ROSE's innovative technology and strong mainstream application prospects have garnered substantial market attention.

III. ROSE Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.00791 - $0.01147

- Neutral Forecast: $0.01147

- Optimistic Forecast: $0.01594 (requiring sustained ecosystem development and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual growth phase with increasing market confidence and protocol maturation. The token is expected to experience steady appreciation as the Oasis Network ecosystem expands and use cases proliferate.

- Price Range Forecasts:

- 2026: $0.01138 - $0.01796 (19% upside potential)

- 2027: $0.01282 - $0.02106 (38% upside potential)

- 2028: $0.01309 - $0.02674 (60% upside potential)

- Key Catalysts: Layer 1 protocol upgrades, expansion of privacy-preserving applications, growing enterprise partnerships, increased mainstream adoption of decentralized confidentiality solutions, and overall market maturation of the privacy-focused blockchain sector.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02079 - $0.02485 (97% gain potential by 2029, reflecting sustained network growth and moderate market conditions)

- Optimistic Scenario: $0.02135 - $0.03037 (107% gain potential by 2030, assuming accelerated enterprise adoption and broader blockchain integration)

- Transformational Scenario: Extended upside potential beyond $0.03037 if major technological breakthroughs occur, mainstream regulatory clarity emerges globally, and Oasis Network becomes a primary infrastructure solution for confidential computing applications across multiple industries.

Note: These forecasts represent market analysis based on historical data and trends. Investors should conduct thorough due diligence and monitor developments on Gate.com and other reliable sources before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01594 | 0.01147 | 0.00791 | 0 |

| 2026 | 0.01796 | 0.01371 | 0.01138 | 19 |

| 2027 | 0.02106 | 0.01583 | 0.01282 | 38 |

| 2028 | 0.02674 | 0.01844 | 0.01309 | 60 |

| 2029 | 0.02485 | 0.02259 | 0.02079 | 97 |

| 2030 | 0.03037 | 0.02372 | 0.02135 | 107 |

Oasis Network (ROSE) Professional Investment Strategy and Risk Management Report

IV. ROSE Professional Investment Strategy and Risk Management

ROSE Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in privacy-focused blockchain infrastructure and enterprise-grade computing solutions

- Operational Recommendations:

- Accumulate ROSE tokens during market downturns, as the project is in early infrastructure development stages

- Hold for 2-3 years minimum to allow the ecosystem to mature and AI/ML computing applications to gain adoption

- Reinvest any ecosystem rewards or staking benefits to compound holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the critical support at $0.01115 (historical low) and resistance at $0.01185 (24-hour high)

- Volume Analysis: Track the 24-hour trading volume of approximately $112,550 to identify breakout opportunities and trend reversals

- Wave Trading Key Points:

- Execute buys near support levels when volume spikes alongside positive ecosystem announcements

- Set profit targets at 15-25% gains given the token's extreme volatility (89.34% down year-over-year)

ROSE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Dollar-Cost Averaging: Execute equal-sized purchases monthly over 6-12 months to reduce timing risk and average entry price

- Portfolio Diversification: Balance ROSE holdings with established layer-1 networks and stablecoins to mitigate single-asset risk

(3) Secure Storage Solutions

- Hot Wallet Approach: Use Gate.com Web3 Wallet for active trading and smaller holdings requiring frequent transactions

- Cold Storage Option: For long-term holdings exceeding 6 months, consider offline storage solutions to minimize exchange counterparty risk

- Security Precautions: Enable two-factor authentication on Gate.com, use strong passwords with 16+ characters, never share private keys, and regularly audit wallet activity

V. ROSE Potential Risks and Challenges

ROSE Market Risks

- Severe Valuation Decline: Token has experienced an 89.34% loss over the past year and is trading 98.08% below its all-time high of $0.597347 (reached January 15, 2022), indicating substantial investor skepticism

- Liquidity Constraints: With only $112,550 in 24-hour trading volume across 19 exchanges, ROSE faces significant liquidity challenges that could result in slippage on large trades

- Market Sentiment Deterioration: Current market position ranks 373rd by market cap with a dominance of only 0.0036%, suggesting limited institutional adoption and retail interest

ROSE Regulatory Risks

- Compliance Uncertainty: Privacy-focused blockchain features for computation may face regulatory scrutiny from governments concerned with data protection and illicit activity prevention

- Enterprise Adoption Barriers: Regulatory frameworks around AI/ML applications on blockchain remain undefined in most jurisdictions, potentially limiting business implementation

- Geopolitical Restrictions: Different regulatory approaches across jurisdictions could fragment the Oasis Network user base and reduce network effects

ROSE Technical Risks

- Network Maturity: As a project still developing core infrastructure, Oasis Network faces risks related to smart contract vulnerabilities, consensus mechanism stability, and scalability bottlenecks

- Competition in Privacy Infrastructure: Multiple competing platforms (such as other privacy-centric blockchains) are developing similar capabilities, creating technology obsolescence risk

- AI Integration Complexity: Implementing computationally intensive AI/ML applications on-chain requires breakthrough improvements in blockchain throughput and cost efficiency

VI. Conclusion and Action Recommendations

ROSE Investment Value Assessment

Oasis Network presents a specialized opportunity within the privacy and enterprise-grade computation segment of blockchain infrastructure. The project's focus on solving the privacy-performance-security trilemma through hardware-software integration addresses a genuine market need. However, the token's 89.34% year-over-year decline and current position near historical lows reflect significant market skepticism regarding execution timeline, adoption rates, and competitive positioning. The project appeals primarily to investors with high risk tolerance seeking exposure to emerging infrastructure themes rather than those seeking near-term returns.

ROSE Investment Recommendations

✅ Beginners: Start with a minimal position of 0.5-1% portfolio allocation through gate.com, using dollar-cost averaging over 12 months. Focus on understanding the project roadmap before increasing exposure.

✅ Experienced Investors: Consider a 2-5% allocation as a speculative holding aligned with your thesis on enterprise blockchain adoption and privacy infrastructure growth. Implement strict stop-loss orders at 20% below your average entry price.

✅ Institutional Investors: Evaluate ROSE as part of broader blockchain infrastructure exposure (5-10% of dedicated crypto allocation), but only after conducting extensive due diligence on team execution, partnerships with enterprises, and technology differentiation.

ROSE Trading Participation Methods

- Direct Purchase on Gate.com: Create an account, complete KYC verification, fund your account via bank transfer or stablecoins, and execute ROSE trades against USDT pairs

- Spot Trading: Use Gate.com's spot trading interface for direct purchases and sales with full custody of private keys

- On-Chain Participation: Bridge ROSE to the Oasis Network mainnet to participate in staking, governance, and ecosystem applications directly

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their risk tolerance and financial situation. Always consult with a professional financial advisor before investing. Never invest funds you cannot afford to lose completely.

FAQ

Can rose coins reach $1 dollar?

Yes, ROSE has potential to reach $1. With strategic development, increased adoption, and favorable market conditions, ROSE could appreciate significantly from its current price of around $0.01168, making $1 a realistic long-term target for investors.

Is rose an AI coin?

Yes, ROSE is an AI-focused cryptocurrency associated with the Oasis Network. It leverages AI technology and AI agents as its main proposition, positioning itself at the forefront of AI-driven crypto trends.

How much is rose crypto coin worth?

As of December 17, 2025, ROSE (Oasis Network) is trading at approximately $0.0134 USD. The price fluctuates based on market conditions and trading volume across major crypto platforms.

How much will 1 pi be worth in 2025?

Based on current market analysis and trends, 1 Pi Coin is projected to reach approximately $0.26 in 2025. However, market conditions and adoption rates may influence actual values.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is VTHO: Understanding VeThor Token and Its Role in the VeChainThor Blockchain Ecosystem

What is SC: A Comprehensive Guide to Supply Chain Management in Modern Business

What is VANA: A Comprehensive Guide to the Revolutionary Decentralized AI Data Network

2025 SUSHI Price Prediction: Expert Analysis and Market Forecast for the Leading DeFi Token

2025 ALEO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year