2025 WEETH Fiyat Tahmini: Kurumsal Benimsemenin Artmasıyla 5.000 Dolar Seviyesine Potansiyel Sıçrama

Giriş: WEETH’nin Piyasa Pozisyonu ve Yatırım Değeri

Wrapped eETH (WEETH), Likit Stake Token (LST) pazarında öne çıkan bir varlık olarak piyasaya sürüldüğünden bu yana çarpıcı bir gelişim göstermiştir. 2025 yılı itibarıyla WEETH’nin piyasa değeri 11,04 milyar dolara ulaşmış, dolaşımdaki arzı yaklaşık 2.481.364 token olup fiyatı 4.447,73 dolar civarındadır. Sıkça “staking türevi” olarak anılan bu varlık, Ethereum staking ekosisteminde giderek daha kritik bir konumda yer almaktadır.

Bu makalede, WEETH’nin 2025-2030 dönemi fiyat hareketleri; geçmiş eğilimler, arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik unsurlar ışığında tüm yönleriyle incelenecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. WEETH Fiyat Geçmişi ve Güncel Piyasa Durumu

WEETH Tarihsel Fiyat Seyri

- 2025: WEETH piyasaya sürüldü, fiyatı 1.461,44 dolar (7 Mart) ile 5.379,82 dolar (24 Ağustos) arasında dalgalandı

WEETH Güncel Piyasa Görünümü

15 Ekim 2025 itibarıyla WEETH 4.447,73 dolardan işlem görüyor. Token son 24 saatte %1,12 düşüş kaydederken, işlem hacmi 19.083.103 dolar. WEETH’nin piyasa değeri ise 11.036.438.428 dolar olup genel kripto para sıralamasında 17. sırada bulunuyor.

Kısa vadede, WEETH farklı zaman dilimlerinde karmaşık bir performans sergiledi. Son bir saatte %0,8 yükselirken, son bir haftada %7,85 ve son bir ayda %6,80 geriledi. Uzun vadede ise son bir yılda %63,89’luk önemli bir artışla güçlü bir performans ortaya koydu.

Mevcut fiyat, 24 Ağustos 2025’teki 5.379,82 dolarlık zirveden düşük; 7 Mart 2025’teki 1.461,44 dolarlık dipten ise oldukça yüksek. Bu fiyat aralığı, WEETH için yüksek volatilite ve büyüme potansiyeline işaret ediyor.

Dolaşımdaki WEETH token sayısı 2.481.364, toplam arz ise 2.528.741. Dolaşım oranı %101,23. Tam seyreltilmiş piyasa değeri 10.902.769.474 dolar olarak hesaplanmaktadır.

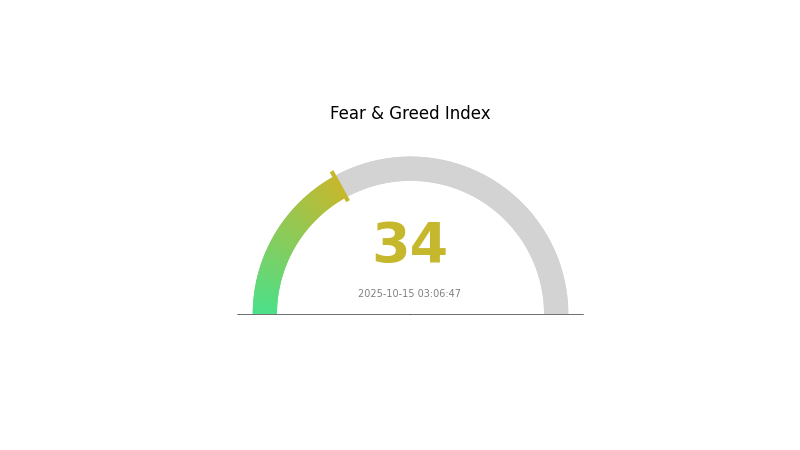

Piyasa duyarlılığı, 34 seviyesindeki VIX endeksiyle “Korku” durumunda; bu durum kısa vadede işlem eğilimlerini ve fiyat hareketlerini etkileyebilir.

Güncel WEETH piyasa fiyatını görüntüleyin

WEETH Piyasa Duyarlılık Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni inceleyin

Kripto para piyasasında Korku ve Açgözlülük Endeksi 34 seviyesinde olup piyasanın belirsizlik içinde olduğunu gösteriyor. Bu “Korku” seviyesi, yatırımcıların volatilite veya dışsal ekonomik nedenlerle temkinli hareket ettiğini gösterir. Böyle dönemlerde yatırımcıların dikkatli olması ve karar öncesi kapsamlı araştırma yapması önemlidir. Korku ortamı bazı yatırımcılar için fırsat sunabilir; ancak riskleri yönetmek ve portföyü çeşitlendirmek gereklidir.

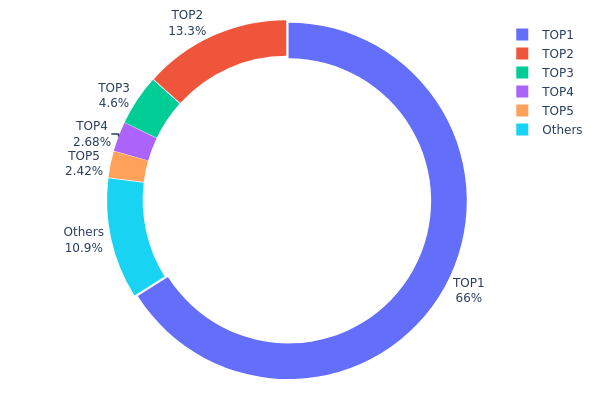

WEETH Varlık Dağılımı

Adres dağılımı verileri, WEETH’de sahipliğin son derece yoğun olduğunu gösteriyor. En büyük adres toplam arzın %66,04’üne sahipken, ilk 5 adres toplamda %89,04’ünü elinde tutuyor. Bu yüksek yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı konusunda ciddi riskler barındırıyor.

Bu kadar merkeziyetçi bir dağılım, büyük yatırımcıların piyasayı kolayca etkileyebileceği anlamına gelir ve istikrarsızlığı artırır. Az sayıda adresin hakimiyeti, merkeziyetsizlik düzeyini düşürerek tokenin dışsal baskılara karşı direncini ve piyasa dengesi kurma gücünü zayıflatır.

Böyle bir dağılım, WEETH piyasasını ani dalgalanmalara ve büyük yatırımcılar tarafından manipülasyona açık hale getirir. Bu yoğunlaşma küçük yatırımcıları caydırabilir ve ekosistemin daha çeşitli ve sağlam olmasını engelleyebilir.

Güncel WEETH Varlık Dağılımı'nı görüntüleyin

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xbdfa...275129 | 1.638,45K | 66,04% |

| 2 | 0xcd2e...cdca63 | 330,89K | 13,33% |

| 3 | 0xa3a7...d60eec | 113,99K | 4,59% |

| 4 | 0xf047...aeafa6 | 66,43K | 2,67% |

| 5 | 0x3cfd...76b008 | 59,94K | 2,41% |

| - | Diğerleri | 270,96K | 10,96% |

II. WEETH Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Proof of Stake: Ethereum’un Proof of Stake’e geçişi, ETH’yi daha kıt ve potansiyel olarak deflasyonist kıldı.

- Tarihsel Eğilimler: Arzda geçmişte yaşanan değişiklikler kıtlığı artırdı ve fiyatta değerlenmeye yol açtı.

- Mevcut Etki: Azalan ihraç oranı ve deflasyon potansiyeli, fiyatta yukarı yönlü baskı yaratıyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: BlackRock gibi büyük kurumlar ETF’ler aracılığıyla ETH arzının yaklaşık %2’sini elinde tutuyor.

- Kurum Benimsemesi: JPMorgan gibi şirketler Ethereum üzerinde projeler geliştirerek değerini pekiştiriyor.

- Devlet Politikaları: Kripto paraların 401(k) emeklilik planlarına dahil edilmesiyle yeni talep oluşabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: FED’in faiz kararları, özellikle olası indirimler, ETH fiyatını etkileyebilir.

- Enflasyon Korumalı Özellikler: ETH, Bitcoin gibi enflasyona karşı koruma aracı olarak görülüyor.

- Jeopolitik Etkenler: Küresel ekonomik belirsizlikler, yatırımcıları ETH gibi kripto paralara yönlendirebilir.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Layer 2 Ölçekleme: Arbitrum ve Optimism gibi çözümler, Ethereum’un işlem kapasitesini artırıp maliyetleri düşürüyor.

- Dencun Yükseltmesi: Layer 2 işlem maliyetlerini daha da azaltması ve 2026 başında devreye alınması bekleniyor.

- Ekosistem Uygulamaları: DeFi, NFT ve kurumsal blockchain çözümlerindeki büyüme, ETH’ye talep ve kullanımını artırıyor.

III. WEETH 2025-2030 Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 3.545,50 - 4.431,88 dolar

- Tarafsız tahmin: 4.431,88 - 4.875,07 dolar

- İyimser tahmin: 4.875,07 - 5.318,26 dolar (olumlu piyasa koşullarında)

2026-2027 Görünümü

- Piyasa fazı: Yükselen volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 3.120,04 - 5.070,07 dolar

- 2027: 3.530,52 - 6.663,24 dolar

- Kilit katalizörler: Benimseme artışı, teknolojik gelişmeler ve piyasa duyarlılığında değişim

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 5.817,91 - 7.239,80 dolar (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 7.239,80 - 8.545,34 dolar (güçlü boğa piyasasıyla)

- Dönüştürücü senaryo: 8.545,34 - 9.918,53 dolar (istisnai piyasa koşulları ve yaygın benimsemeyle)

- 2030-12-31: WEETH 9.918,53 dolar (iyimser öngörülere göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 5.318,26 | 4.431,88 | 3.545,5 | 0 |

| 2026 | 5.070,07 | 4.875,07 | 3.120,04 | 9 |

| 2027 | 6.663,24 | 4.972,57 | 3.530,52 | 11 |

| 2028 | 6.050,62 | 5.817,91 | 5.177,94 | 30 |

| 2029 | 8.545,34 | 5.934,26 | 4.391,36 | 33 |

| 2030 | 9.918,53 | 7.239,8 | 6.588,22 | 62 |

IV. WEETH Profesyonel Yatırım Stratejileri ve Risk Yönetimi

WEETH Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun: Ethereum staking’e maruz kalmak isteyen temkinli yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde WEETH biriktirin

- En az bir tam piyasa döngüsü (3-4 yıl) tutun

- Güvenli, saklama gerektirmeyen cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalar ile trendleri takip edin

- RSI: Aşırı alım/satım sinyallerini izleyin

- Swing trade için ana noktalar:

- Zarar-durdur seviyeleriyle potansiyel kayıpları sınırlayın

- Belirlenen fiyat hedeflerinde kar alın

WEETH Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Orta riskli: %3-7

- Agresif: %7-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: WEETH’yi diğer varlıklarla dengeleyin

- Zarar-durdur emirleriyle potansiyel kayıpları sınırlayın

(3) Güvenli Saklama

- Sıcak cüzdan: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama, güçlü şifre kullanımı

V. WEETH Potansiyel Riskler ve Zorluklar

WEETH Piyasa Riskleri

- Fiyat oynaklığı: WEETH fiyatında ciddi dalgalanmalar yaşanabilir

- Likitide riski: Sınırlı işlem çiftleri çıkışları zorlaştırabilir

- ETH ile korelasyon: Ethereum fiyat hareketleriyle yüksek bağlantı

WEETH Regülasyon Riskleri

- Bilinmeyen regülasyon ortamı: Staking türevlerinde denetim artabilir

- Uyum zorlukları: Gelişen regülasyonlar WEETH’nin işleyişini etkileyebilir

- Vergisel belirsizlik: Bazı ülkelerde vergi uygulamaları net değil

WEETH Teknik Riskler

- Akıllı sözleşme açıkları: Temel protokolde potansiyel güvenlik riskleri

- Ethereum ağ riskleri: Ethereum’un başarılı PoS geçişine bağlılık

- Oracle arızaları: Fiyat beslemesi doğruluğunda sorun riski

VI. Sonuç ve Eylem Önerileri

WEETH Yatırım Değeri Değerlendirmesi

WEETH, Ethereum staking ödüllerine yüksek likiditeyle erişim sunar. Uzun vadeli değeri Ethereum’un başarısına bağlıdır; kısa vadeli riskler ise piyasa dalgalanması ve düzenleyici belirsizliktir.

WEETH Yatırım Önerileri

✅ Yeni başlayanlar: Çeşitlendirilmiş portföyde küçük, uzun vadeli pozisyonlar değerlendirebilir ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayabilir ✅ Kurumsal yatırımcılar: WEETH’yi Ethereum ekosistemi yatırımlarında değerlendirebilir

WEETH Katılım Yöntemleri

- Spot işlem: Gate.com’dan WEETH alın

- Staking: Ether.Fi staking protokolüne katılarak WEETH elde edin

- DeFi entegrasyonu: Uyumlu DeFi protokollerinde WEETH ile ek getiri fırsatları

Kripto para yatırımları yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarını göz önünde bulundurmalı ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

SSS

2025’te kripto fiyat tahmini nedir?

Bitcoin’in 60.000 dolara, Ethereum’un 4.000 dolara, Solana’nın 100 dolara ulaşması bekleniyor. Diğer kripto varlıklarında da kayda değer büyüme öngörülüyor.

2030’da XRP fiyat tahmini nedir?

2030’da, XRP’nin mevcut piyasa eğilimleri ve finans sektöründe potansiyel benimsemeyle 90-120 dolar aralığında olması bekleniyor.

En yüksek fiyat tahmini hangi kripto varlık için?

2025’te en yüksek fiyat tahmini Bitcoin (BTC) içindir; ardından Ethereum (ETH) ve Solana (SOL) gelmektedir.

2030’da kripto fiyat tahmini nedir?

Kripto fiyatları 2030’a kadar on binlerce doları bulabilir. Uzmanlar önemli bir büyüme beklerken tahminler değişkendir. Gelecekteki değerlemeler büyük ölçüde piyasa dinamiklerine bağlıdır.

GTETH (GTETH) iyi bir yatırım mı?: Bu yeni ortaya çıkan kripto paranın potansiyeli ve riskleri üzerine analiz

2025'te ETH Staking: Zincir Üstü Seçenekler ve En İyi Platformlar

ETH stake yatırımı: Gate milyon dolarlık ödül programı %5 yıllık getiri ile

ETH'nizi maksimize edin: Gate'in on-chain Staking'i 2025'te %5.82 yıllık getirisi sunuyor.

2025 WEETH Fiyat Tahmini: Gelişen DeFi Ekosisteminde Piyasa Trendlerini ve Büyüme Potansiyelini Analiz Etmek

2025 ETH Mining ve Staking Karşılaştırması: Gate Esnek Getiri Programı Analizi

Polygon Ağına Varlık Transferi Kılavuzu

Polygon Ağını Kripto Cüzdanınıza Entegre Etme Kılavuzu

BEP2 ile Dijital Varlıkların Güvenli Saklanmasına Yönelik Yeni Başlayanlar İçin Rehber

Polygon PoS Ağı’na Varlık Aktarma Kılavuzu

Blokzincir teknolojisinde Utility Token’ların kullanım alanlarını keşfetmek