2025 XYO Price Prediction: Expert Analysis and Market Forecast for the Geospatial Data Network Token

Introduction: XYO's Market Position and Investment Value

XYO Network (XYO) stands as the original and largest Decentralized Physical Infrastructure Network (DePIN), with millions of nodes globally. Since its inception in 2018, XYO has established itself as a pioneering force in bridging Web3 and Web2 through real-world data collection and validation. As of 2025, XYO's market capitalization has reached approximately $70.38 million USD, with a circulating supply of approximately 13.93 billion XYO tokens, currently trading at around $0.005052. This innovative asset, recognized for its "Proof of Location" and "Proof of Origin" technologies, is playing an increasingly critical role in real-world asset (RWA) management, DePIN tracking, and real-world gaming applications.

This article will provide a comprehensive analysis of XYO's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for investors seeking exposure to the DePIN sector.

XYO Network (XYO) Market Analysis Report

I. XYO Price History Review and Market Status

XYO Historical Price Evolution

-

March 2020: Project launch phase, XYO reached its all-time low of $0.00009672 on March 13, 2020, marking the early stage of the protocol's development.

-

November 2021: Peak performance period, XYO achieved its all-time high of $0.081391 on November 6, 2021, representing a peak market valuation during the DePIN sector's early expansion phase.

-

2021-2025: Sustained correction phase, XYO experienced a significant 80.21% decline over the one-year period, reflecting broader market adjustments and sector-wide consolidation in the decentralized physical infrastructure network space.

XYO Current Market Position

As of December 18, 2025, XYO is trading at $0.005052, with a 24-hour trading volume of $98,683.26. The token demonstrates the following market characteristics:

Price Performance:

- 1-hour change: +0.26%

- 24-hour change: -4.71%

- 7-day change: -13.55%

- 30-day change: -10.97%

- 52-week change: -80.21%

Market Capitalization Metrics:

- Market cap: $70.38 million

- Fully diluted valuation: $70.38 million

- Circulating supply: 13.93 billion XYO tokens

- Total supply: 13.93 billion XYO tokens

- Market cap dominance: 0.0022%

Trading and Holder Information:

- Current 24-hour high: $0.005522

- Current 24-hour low: $0.005012

- Listed on 13 major exchanges

- Total active holders: 93,684

- Token listed on Coinbase and other major platforms

View current XYO market price

XYO Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index dropping to 16. This exceptionally low reading signals significant market pessimism and panic selling pressure. During periods of extreme fear, assets often reach capitulation levels, presenting potential contrarian opportunities for long-term investors. However, heightened volatility and downside risks remain prevalent. Traders should exercise caution and employ strict risk management strategies. Monitor market fundamentals closely before making investment decisions, as extreme fear typically precedes potential market reversals or stabilization phases.

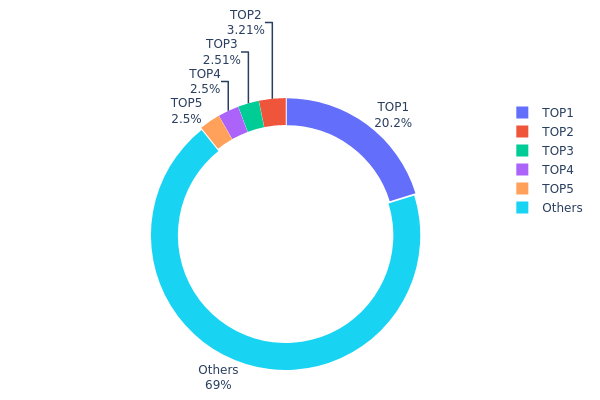

XYO Holdings Distribution

The address holdings distribution chart illustrates the concentration of XYO tokens across blockchain addresses, revealing the tokenomics structure and decentralization characteristics of the network. This metric is fundamental for assessing market concentration risk, potential price manipulation concerns, and the overall health of token distribution within the XYO ecosystem.

Current analysis of XYO's address holdings demonstrates a moderately concentrated distribution pattern. The top address holds approximately 20.23% of total tokens (2.82 million K), while the top five addresses collectively control approximately 31.73% of the circulating supply. The remaining 69.07% of tokens are dispersed among other addresses, indicating that while significant holdings are concentrated in a relatively small number of wallets, the majority of tokens remain distributed across a broader base of holders. This distribution structure suggests neither extreme centralization nor optimal decentralization, positioning XYO within a transitional phase typical of projects with established institutional or early investor positions.

The concentration profile presents moderate implications for market dynamics and structural stability. With the top holder commanding over one-fifth of total supply, any substantial liquidation activity from these major wallets could exert meaningful downward pressure on price discovery mechanisms. However, the relatively diverse distribution among the remaining holders—with no additional single address exceeding 3.50%—suggests that coordinated manipulation becomes increasingly difficult beyond the tier-one addresses. This structure indicates a market environment where price volatility may be influenced by institutional or large holder movements, while maintaining sufficient distribution breadth to prevent complete oligopolistic control. The current holdings landscape reflects a level of decentralization appropriate for an established token project, balancing between concentrated early investor positions and sufficient community participation to support network resilience.

Click to view current XYO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1e9b...18b5b0 | 2818637.03K | 20.23% |

| 2 | 0xb225...d8e7c2 | 446717.16K | 3.20% |

| 3 | 0x5043...7db715 | 349219.25K | 2.50% |

| 4 | 0x414f...2396f1 | 348976.13K | 2.50% |

| 5 | 0x0d6c...c4ce38 | 348976.13K | 2.50% |

| - | Others | 9618691.24K | 69.07% |

II. Core Factors Affecting XYO's Future Price

Supply Mechanism

-

Fixed Supply with XYO Token: XYO maintains a fixed supply, serving as the governance core of the ecosystem and enhancing token scarcity.

-

XL1 Deflationary Mechanism: XL1 functions as the transaction fuel with no supply cap. Each transaction automatically burns XL1 tokens, creating a deflationary mechanism that controls inflation while enabling cross-chain bridging capabilities.

-

staking and Scarcity Enhancement: Users can stake XYO tokens to earn XL1 rewards, which increases overall token scarcity and creates a self-reinforcing economic cycle within the ecosystem.

Technology Development and Ecosystem Building

-

XYO Layer One Launch: XYO introduced XYO Layer One, the first scalable blockchain specifically designed for data applications. This infrastructure supports AI, DePIN, Real World Assets (RWA), gaming, and high-precision data services, providing a new foundation for multiple emerging sectors.

-

Market Sentiment and Adoption: XYO's future price is influenced by market sentiment, technological development progress, user adoption rates, and macroeconomic events. Traders utilize various technical indicators to analyze historical XYO trading patterns to anticipate future price movements.

III. 2025-2030 XYO Price Forecast

2025 Outlook

- Conservative Estimate: $0.0049 - $0.00576

- Base Case: Average of $0.00505

- Bullish Scenario: Consolidation near $0.00576 (pending market stabilization)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth trajectory, supported by improving market sentiment and potential protocol developments

- Price Range Forecast:

- 2026: $0.0033 - $0.00616 (7% upside potential)

- 2027: $0.0048 - $0.00717 (14% upside potential)

- 2028: $0.00408 - $0.00706 (28% upside potential)

- Key Catalysts: Enhanced network adoption, ecosystem expansion, technological improvements, and strengthening macroeconomic conditions for risk assets

2029-2030 Long-term Outlook

- Base Case: $0.00562 - $0.01009 (2029) and $0.00523 - $0.01011 (2030), assuming steady adoption and stable market conditions

- Bullish Scenario: $0.01009 average (2029) and $0.01011 average (2030), contingent upon accelerated protocol adoption and institutional interest

- Transformative Scenario: Sustained price appreciation above $0.01011 (2030), driven by breakthrough use cases, mainstream recognition, and significant ecosystem partnerships

- 2030-12-31: XYO trading near long-term resistance levels (cumulative 66% appreciation from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00576 | 0.00505 | 0.0049 | 0 |

| 2026 | 0.00616 | 0.00541 | 0.0033 | 7 |

| 2027 | 0.00717 | 0.00578 | 0.0048 | 14 |

| 2028 | 0.00706 | 0.00648 | 0.00408 | 28 |

| 2029 | 0.01009 | 0.00677 | 0.00562 | 33 |

| 2030 | 0.01011 | 0.00843 | 0.00523 | 66 |

XYO Network Professional Investment Strategy and Risk Management Report

I. Executive Summary

XYO Network (XYO) is the original and largest Decentralized Physical Infrastructure Network (DePIN), operating millions of nodes globally. As of December 18, 2025, XYO is trading at $0.005052, with a market capitalization of approximately $70.38 million and ranking #414 in the cryptocurrency market. The token is listed on major exchanges including Gate.com and Coinbase, with 13,931,216,938 tokens in circulation.

II. Current Market Status of XYO

Price Performance Analysis

| Metric | Value |

|---|---|

| Current Price | $0.005052 |

| 24H Change | -4.71% |

| 7D Change | -13.55% |

| 30D Change | -10.97% |

| 1Y Change | -80.21% |

| All-Time High | $0.081391 (Nov 6, 2021) |

| All-Time Low | $0.00009672 (Mar 13, 2020) |

| 24H Trading Volume | $98,683.26 |

| 24H Price Range | $0.005012 - $0.005522 |

Market Position

- Market Capitalization: $70.38 million

- Fully Diluted Valuation: $70.38 million

- Market Dominance: 0.0022%

- Trading Pairs: Available on 13 exchanges

- Holder Count: 93,684 addresses

III. XYO Network Fundamentals & Technology

Project Overview

XYO Network bridges Web3 and Web2 ecosystems through real-world data collection and verification. The network operates through millions of distributed nodes that collect and validate location and origin data, with applications across AI, geolocation, RWA (Real-World Assets) management, DePIN tracking, and real-world gaming.

Core Technologies

Proof of Location (PoL)

- Verifies physical location authenticity through network consensus

- Powers location-based applications and services

Proof of Origin (PoO)

- Validates the origin and authenticity of real-world data

- Supports supply chain verification and asset tracking

Network Infrastructure

XYO Layer One

- Native blockchain providing scalable and interoperable infrastructure

- Enables decentralized data validation with seamless integration

- Enhances privacy and improves roll-up efficiency

- Designed for efficient data verification and storage

Ecosystem Applications

COIN Application

- Mobile application driving significant network growth

- Enables users to participate in location data verification

- Incentivizes network participation through token rewards

Organizational Support

- XYO Foundation: Oversees protocol development and community initiatives

- XY Labs Inc.: U.S.-based for-profit company operating the network

- Tokenized Equity: XY Labs' tokenized shares ($XYLB) trade on tZERO ATS, positioning the project at the forefront of the Real-World Assets (RWA) movement

IV. XYO Professional Investment Strategy and Risk Management

XYO Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: DePIN believers, Web3 infrastructure investors, long-term crypto portfolio builders

-

Operational Recommendations:

- Accumulate XYO during market downturns when prices are below $0.006, as the token demonstrates fundamental utility in the DePIN sector

- Hold through market cycles (minimum 12-24 months) to benefit from potential network expansion and institutional adoption

- Utilize dollar-cost averaging (DCA) to reduce entry price volatility—invest fixed amounts monthly regardless of price fluctuations

-

Storage Solutions:

- For smaller holdings (<$1,000): Gate Web3 Wallet offers user-friendly custody with strong security features

- For larger holdings (>$1,000): Hardware wallet solutions with self-custody for maximum security control

- Enable two-factor authentication and backup seed phrases in secure offline locations

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor crossovers to identify momentum shifts; bullish signals emerge when MACD crosses above the signal line during uptrends

- Relative Strength Index (RSI): Trade range signals (RSI below 30 = oversold buying opportunity; RSI above 70 = overbought selling pressure)

- Support/Resistance Levels: Current support at $0.004800; resistance at $0.006000

-

Swing Trading Highlights:

- Enter positions when price approaches identified support levels ($0.0048) with RSI below 40

- Exit portions of holdings when resistance ($0.0060) is approached with RSI above 60

- Maintain strict stop-losses at 15% below entry prices to protect capital during rapid downturns

XYO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: XYO allocation maximum 2-3% of total crypto portfolio, combined with stablecoin holdings for stability

- Active Investors: XYO allocation 5-8% of crypto portfolio, with regular rebalancing quarterly

- Professional Investors: XYO allocation 10-15% of DePIN-focused portfolio, with hedging strategies and derivatives positioning

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance XYO holdings with established cryptocurrencies (Bitcoin, Ethereum) to reduce concentration risk

- Stablecoin Reserve: Maintain 20-30% of intended trading capital in stablecoins to capitalize on price dips and manage drawdowns

(3) Security Storage Solutions

- Hot Wallet (Gate Web3 Wallet) Recommendation: Ideal for active traders holding amounts under $5,000; enables quick transaction execution with convenient access

- Cold Storage Approach: For holdings exceeding $5,000, transfer XYO to self-custodial solutions with offline backup; hardware wallet integration ensures protection from exchange counterparty risk

- Critical Security Measures:

- Never share private keys or recovery phrases

- Enable IP address whitelisting on exchange accounts

- Use unique, complex passwords for all Web3 interaction platforms

- Verify smart contract addresses before token transfers to prevent phishing attacks

V. Potential Risks and Challenges for XYO

Market Risks

- Severe Price Volatility: XYO has experienced an 80.21% decline over 12 months and 13.55% decline over 7 days, indicating extreme price fluctuations typical of speculative DePIN tokens

- Low Trading Liquidity: Daily volume of $98,683 is relatively thin; large purchase or sale orders could cause significant price slippage

- Market Sentiment Dependency: DePIN sector sentiment shifts rapidly; negative news about competing projects could trigger portfolio exits from the entire sector

Regulatory Risks

- Uncertain Classification: Regulatory clarity remains unclear regarding whether DePIN tokens constitute securities; future classification could restrict trading accessibility

- Geopolitical Restrictions: XYO may face delisting from exchanges in jurisdictions imposing stricter crypto regulations

- Compliance Evolution: The RWA (Real-World Assets) sector faces increasing regulatory scrutiny; XY Labs tokenized shares could trigger additional regulatory requirements

Technology Risks

- Network Adoption Challenges: Millions of nodes require sustained incentivization; reduced rewards could cause network participation decline

- Data Validation Accuracy: Proof of Location and Proof of Origin mechanisms must maintain accuracy as real-world applications scale; consensus failures could undermine platform credibility

- Smart Contract Vulnerabilities: XYO Layer One blockchain could face security exploits; unforeseen code vulnerabilities could result in fund loss

VI. Conclusion and Action Recommendations

XYO Investment Value Assessment

XYO Network represents a high-risk, high-potential-upside investment opportunity in the emerging DePIN infrastructure sector. The project demonstrates genuine utility through its Proof of Location and Proof of Origin technologies, with real-world applications in location verification, RWA management, and decentralized data collection.

Strengths: Established network with millions of operational nodes, major exchange listings (Gate.com, Coinbase), tokenized equity backing through XY Labs, and clear technological differentiation in the DePIN space.

Weaknesses: Significant price decline (-80% annually), thin trading liquidity, regulatory uncertainty, and competition from emerging location-based infrastructure projects.

Short-Term Outlook: Downward pressure likely continues through market cycles; technical indicators suggest further consolidation.

Long-Term Potential: If XYO Layer One achieves enterprise adoption and tokenized equity ($XYLB) drives institutional participation, XYO could experience substantial appreciation.

XYO Investment Recommendations

✅ For Beginners: Start with a small position (0.5-1% of crypto allocation) through Gate.com's accessible interface; use Gate Web3 Wallet for custody; focus on understanding DePIN fundamentals before scaling investment

✅ For Experienced Investors: Implement dollar-cost averaging strategy over 6-12 months; use technical analysis for swing trading during 20-30% price drawdowns; maintain 5-8% portfolio allocation as a speculative position

✅ For Institutional Investors: Consider XYO as a satellite holding within DePIN infrastructure funds; monitor XY Labs' tokenized equity performance on tZERO ATS for correlation opportunities; implement hedging through derivatives on major exchanges

XYO Trading Participation Methods

- Direct Token Trading: Purchase XYO on Gate.com using multiple trading pairs with fiat and crypto entry points; suitable for active portfolio management

- Spot Holdings: Accumulate and hold XYO on Gate.com with withdrawal to Gate Web3 Wallet for self-custody; aligned with long-term infrastructure investment thesis

- DePIN Fund Exposure: Participate through cryptocurrency investment funds incorporating DePIN allocations; reduces direct token management responsibility

Critical Disclaimer: Cryptocurrency investment carries extreme risk, including potential total capital loss. This report does not constitute financial, investment, or legal advice. Investors must conduct independent research and consult with qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely. XYO Network remains a speculative asset suitable only for risk-tolerant investors with multi-year investment horizons. Past performance does not guarantee future results.

Report Generated: December 18, 2025

Data Source: Gate.com Market Data

XYO Contract Address (Ethereum): 0x55296f69f40ea6d20e478533c15a6b08b654e758

FAQ

Does XYO coin have a future?

Yes, XYO coin has strong potential. With projected price reaching $0.0783 by 2030, supported by growing market value and trading volume, XYO demonstrates solid future prospects in the location data ecosystem.

Is XYO coin worth anything?

Yes, XYO coin has measurable market value. Currently trading at $0.005343, XYO maintains active market liquidity and utility within the XYO Network ecosystem. Its value derives from real-world location verification applications and network functionality, making it genuinely worth holding for network participants.

Why is XYO tanking?

XYO faces potential delisting risks from major exchanges and is under regulatory review. Reduced trading volume and market sentiment pressures have contributed to recent price declines.

What crypto will 1000x prediction?

XYO Network has strong fundamentals with its location oracle technology and growing ecosystem adoption. Early-stage positioning and expanding real-world use cases position it for significant upside potential in the coming market cycles.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What Are Crypto Derivatives Market Signals: Analyzing PENGU's Open Interest, Funding Rates, and Liquidation Data?

LON vs ARB: A Comprehensive Comparison of Two Leading Layer 2 Solutions in the Ethereum Ecosystem

How Does AAVE Price Volatility Impact DeFi Trading in 2025?

How to Use MACD, RSI, and Bollinger Bands for Technical Indicator Analysis in Crypto Trading?

What is AERGO: Enterprise Blockchain Fundamentals, Team Background, and Roadmap Progress Explained