2025 ZRX Price Prediction: Navigating the Future of Decentralized Exchange Tokens

Introduction: ZRX's Market Position and Investment Value

0xProject (ZRX), as an open-source protocol for decentralized exchange on the Ethereum blockchain, has made significant strides since its inception in 2017. As of 2025, 0xProject's market capitalization has reached $167,218,962, with a circulating supply of approximately 848,396,562 tokens, and a price hovering around $0.1971. This asset, often referred to as the "DEX enabler," is playing an increasingly crucial role in facilitating decentralized trading of ERC20 tokens.

This article will provide a comprehensive analysis of 0xProject's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ZRX Price History Review and Current Market Status

ZRX Historical Price Evolution

- 2017: Initial launch, price opened at $0.05

- 2018: Bull market peak, price reached all-time high of $2.5 on January 13

- 2020: Market downturn, price hit all-time low of $0.120667 on March 13

ZRX Current Market Situation

As of October 19, 2025, ZRX is trading at $0.1971, with a market cap of $167,218,962. The token has experienced a 1.45% decrease in the last 24 hours and a 3.58% increase over the past week. However, it shows a significant decline of 27.88% in the last 30 days and 41.78% over the past year. The current price is 92.12% below its all-time high and 63.34% above its all-time low. With a circulating supply of 848,396,562 ZRX out of a total supply of 1 billion, the token has a market dominance of 0.0051%.

Click to view the current ZRX market price

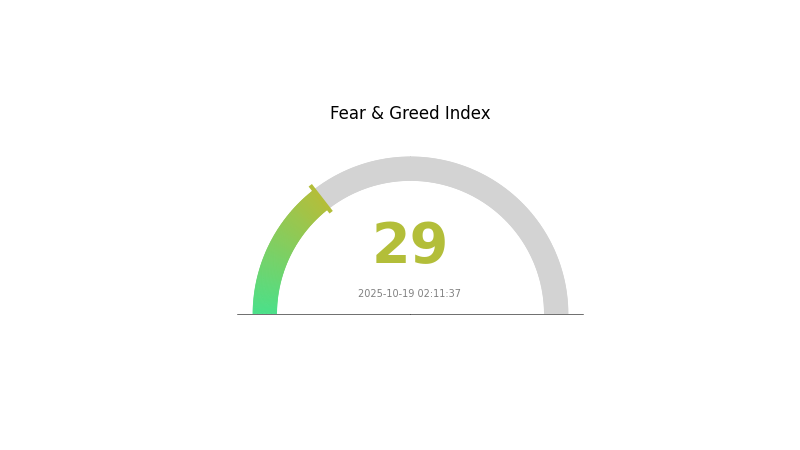

ZRX Market Sentiment Indicator

2025-10-19 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 29. This sentiment suggests that investors are cautious and potentially looking for buying opportunities. During such times, it's crucial to stay informed and make rational decisions. Remember, market cycles are natural, and periods of fear often precede potential rebounds. As always, conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto market.

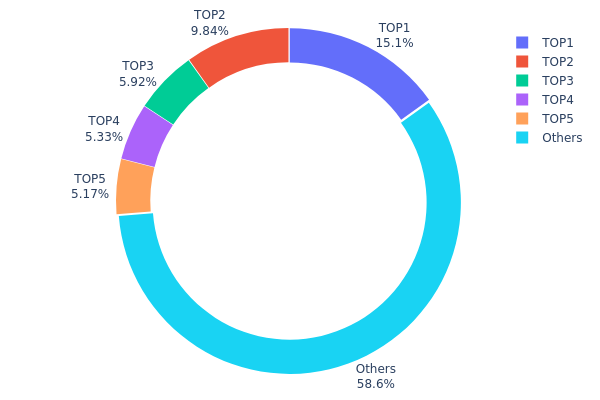

ZRX Holdings Distribution

The address holdings distribution data for ZRX reveals a moderately concentrated ownership structure. The top five addresses collectively hold 41.32% of the total ZRX supply, with the largest holder possessing 15.10%. This level of concentration suggests a significant influence from a small number of major stakeholders.

While not excessively centralized, this distribution raises some concerns about potential market manipulation. The top holders could potentially impact price movements through large transactions. However, with 58.68% of tokens held by other addresses, there is still a considerable degree of distribution among smaller holders, which can help mitigate some of the risks associated with high concentration.

This current distribution reflects a market structure that balances between centralized influence and wider participation. It indicates a moderate level of decentralization, which is crucial for the long-term stability and fairness of the ZRX ecosystem. However, investors should remain vigilant of potential actions by major holders that could affect market dynamics.

Click to view the current ZRX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1743...f27440 | 151061.91K | 15.10% |

| 2 | 0x2063...e0fd43 | 98350.94K | 9.83% |

| 3 | 0xf977...41acec | 59191.09K | 5.91% |

| 4 | 0xdb63...d97303 | 53252.50K | 5.32% |

| 5 | 0xba7f...7a5eaf | 51657.98K | 5.16% |

| - | Others | 586485.58K | 58.68% |

II. Key Factors Affecting ZRX's Future Price

Technical Development and Ecosystem Building

-

Protocol Upgrades: ZRX has been continuously improving its protocol to enhance efficiency and functionality, which could positively impact its adoption and value.

-

Ecosystem Applications: 0x Protocol supports various decentralized exchanges and DeFi applications, contributing to its utility and potential price growth.

III. ZRX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.15595 - $0.1974

- Neutral prediction: $0.1974 - $0.22701

- Optimistic prediction: $0.22701 - $0.25662 (requires sustained market growth and increased adoption of decentralized exchanges)

2027-2028 Outlook

- Market stage expectation: Potential consolidation phase with gradual upward trend

- Price range forecast:

- 2027: $0.16655 - $0.28835

- 2028: $0.19061 - $0.30068

- Key catalysts: Expansion of DeFi ecosystem, improvements in Ethereum scalability, and broader institutional acceptance of decentralized protocols

2029-2030 Long-term Outlook

- Base scenario: $0.28457 - $0.35287 (assuming steady growth in DeFi adoption and continued development of the 0x protocol)

- Optimistic scenario: $0.35287 - $0.42116 (assuming rapid expansion of decentralized finance and significant upgrades to the 0x ecosystem)

- Transformative scenario: $0.42116 - $0.45167 (assuming widespread mainstream adoption of DeFi and 0x becoming a dominant protocol in the space)

- 2030-12-31: ZRX $0.45167 (potential peak based on highly favorable market conditions and technological advancements)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.25662 | 0.1974 | 0.15595 | 0 |

| 2026 | 0.27014 | 0.22701 | 0.17707 | 15 |

| 2027 | 0.28835 | 0.24858 | 0.16655 | 26 |

| 2028 | 0.30068 | 0.26846 | 0.19061 | 36 |

| 2029 | 0.42116 | 0.28457 | 0.23335 | 44 |

| 2030 | 0.45167 | 0.35287 | 0.21525 | 79 |

IV. ZRX Professional Investment Strategy and Risk Management

ZRX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and blockchain technology enthusiasts

- Operation suggestions:

- Accumulate ZRX during market dips

- Set a target holding period of 3-5 years

- Store tokens in a secure hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor 0x protocol adoption and ecosystem growth

- Stay informed about Ethereum upgrades that may impact 0x

ZRX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi protocols

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Software wallet option: Official 0x wallet or Gate Web3 wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ZRX

ZRX Market Risks

- Volatility: Crypto market fluctuations can impact ZRX price

- Competition: Emerging DEX protocols may challenge 0x's market share

- Liquidity: Low trading volumes could affect price stability

ZRX Regulatory Risks

- DEX regulations: Potential regulatory crackdowns on decentralized exchanges

- Token classification: Uncertainty regarding ZRX's legal status as a utility token

- Cross-border restrictions: Varying regulations across jurisdictions

ZRX Technical Risks

- Smart contract vulnerabilities: Potential exploits in the 0x protocol

- Scalability issues: Ethereum network congestion affecting 0x performance

- Upgrade challenges: Complications during protocol updates or governance changes

VI. Conclusion and Action Recommendations

ZRX Investment Value Assessment

ZRX offers long-term potential as a key infrastructure token for decentralized exchange protocols. However, short-term volatility and regulatory uncertainties pose significant risks.

ZRX Investment Recommendations

✅ Beginners: Start with small, long-term positions and focus on education ✅ Experienced investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional investors: Explore market-making opportunities and governance participation

ZRX Participation Methods

- Spot trading: Purchase ZRX on Gate.com

- DeFi staking: Participate in liquidity provision on 0x protocol

- Governance: Engage in 0x Improvement Proposals (ZEIPs) using ZRX tokens

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will ZRX go?

ZRX could potentially reach $3-$5 by 2026, driven by increased DeFi adoption and protocol upgrades. However, crypto markets are highly volatile and unpredictable.

Is zrx a good crypto?

ZRX is a promising crypto with strong potential. It powers the 0x protocol, enabling decentralized exchange of tokens. With increasing DeFi adoption, ZRX's utility and value are likely to grow in the coming years.

Is ox a good crypto?

Yes, 0x (ZRX) is a promising crypto. It's a key player in decentralized exchanges, offering efficient token swaps. With growing DeFi adoption, 0x's potential for value increase looks strong.

What are the risks of using ZRX?

Key risks include market volatility, regulatory changes, smart contract vulnerabilities, and potential liquidity issues in the 0x protocol ecosystem.

Will Crypto Recover in 2025?

2025 ETCPrice Prediction: Analyzing Key Factors and Market Trends for Ethereum Classic's Future Value

Discover Top Decentralized Exchange Platforms for Crypto Traders

The Future of Decentralized Finance Platforms: Exploring DeFi Exchanges

Innovative Approaches to Decentralized Trading Systems

Explore Velodrome Finance: Everything You Need to Know About the Velodrome Token

Guide to Participating and Claiming SEI Airdrop Rewards

Effective Strategies for Algorithmic Trading in Cryptocurrency

Understanding Bitcoin Valuation with the Stock-to-Flow Model

Understanding How Transaction Speed Impacts Blockchain Efficiency

Web3 Identity Management with ENS Domains