Plasma: High-Performance Layer-1 Blockchain for Stablecoin Payments

Plasma Design Philosophy

(Source: Plasma)

With the stablecoin payments market rapidly expanding, Plasma is positioned as a Layer 1 blockchain dedicated to high-efficiency settlement. Its core architecture integrates speed, security, and programmability. Leveraging EVM compatibility and Bitcoin sidechain anchoring, Plasma brings everyday payment scenarios on-chain, embedding blockchain technology into routine financial activities.

Core Technical Features

- PlasmaBFT Consensus

Plasma has independently developed PlasmaBFT, building on HotStuff consensus to deliver sub-second finality and throughput exceeding 2,000 transactions per second. Its streamlined consensus process and parallel transaction architecture are engineered for high-frequency payment and settlement demands. - EVM Compatibility & UTXO Model

Plasma’s execution environment utilizes the Reth client, providing full support for Solidity smart contracts and seamless integration with toolchains like MetaMask and Hardhat. It preserves Bitcoin’s UTXO model, enabling BTC payments for gas and balancing programmability with robust security. - Native Bitcoin Bridge

Plasma features a secure Bitcoin Bridge that anchors on-chain states to the Bitcoin mainnet, merging Bitcoin’s decentralization strengths with EVM smart contracts to ensure transactional security and transparency. - Flexible Gas Model

Plasma delivers a zero-fee stablecoin payment channel ideal for routine USDT transfers, while maintaining a fee-based channel for time-sensitive transactions to accommodate diverse user requirements. - Privacy & Compliance

Plasma is developing a privacy payment module that allows users to conceal transaction data, while also supporting selective disclosure to meet regulatory standards—balancing privacy and compliance.

Application Scenario Analysis

- Zero-Fee Payments: Everyday purchases and merchant settlements can be completed with USDT at zero cost, reducing barriers to adoption.

- Cross-Border Remittance: Offers efficient, low-cost transactions, ideal for regions with unstable currencies or under sanctions.

- Compliant Digital Finance: Banks and payment platforms can rapidly integrate stablecoin settlement solutions.

- Merchant & Micropayments: Supports subscriptions, installment plans, and microtransactions, and is already in use by Yellow Card in Africa.

- Stablecoin DeFi Integration: Collaborating with projects like Curve, Maker, and Aave to build a diversified DeFi ecosystem.

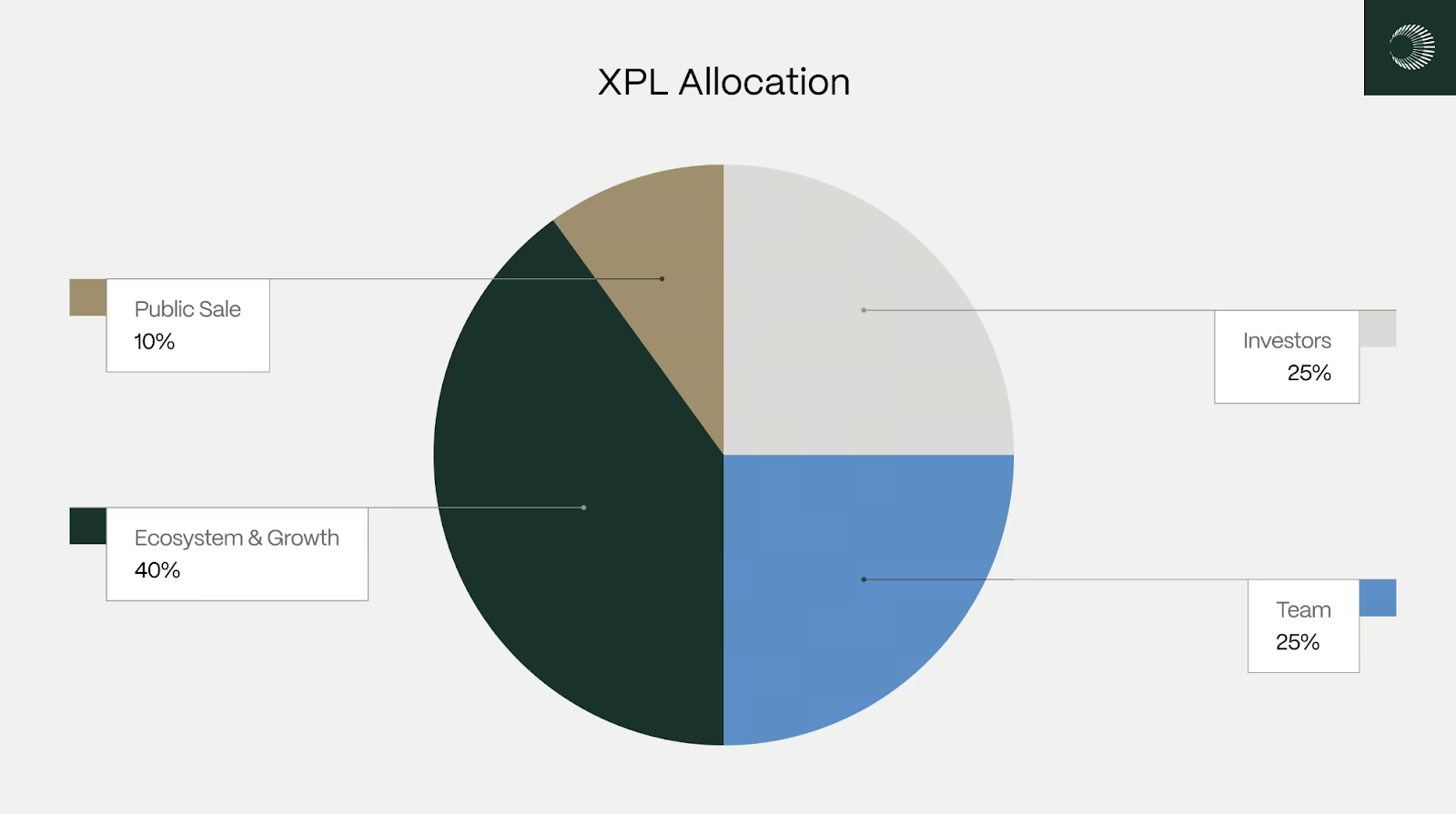

XPL Tokenomics

XPL serves as Plasma’s core asset, with an initial supply of 10 billion tokens. The allocation model prioritizes long-term incentives and ecosystem sustainability:

- Public Sale – 10%: Designed to encourage early user participation; non-US users have immediate access, while US users are subject to a 12-month lock-up period.

- Ecosystem & Growth – 40%: Allocated for DeFi incentives, liquidity support, and ecosystem expansion, released monthly on a linear schedule and unlocked over three years.

- Team – 25%: Structured as a long-term incentive, with one-third locked for one year and the remainder released monthly over a three-year period.

- Investors – 25%: Includes Founder’s Fund, Framework, Bitfinex, and others, following the same vesting schedule as the team to align long-term interests.

(Source: docs.plasma)

XPL is used for gas payments, staking to secure the network, and governance voting, delivering dual utility in payments and governance.

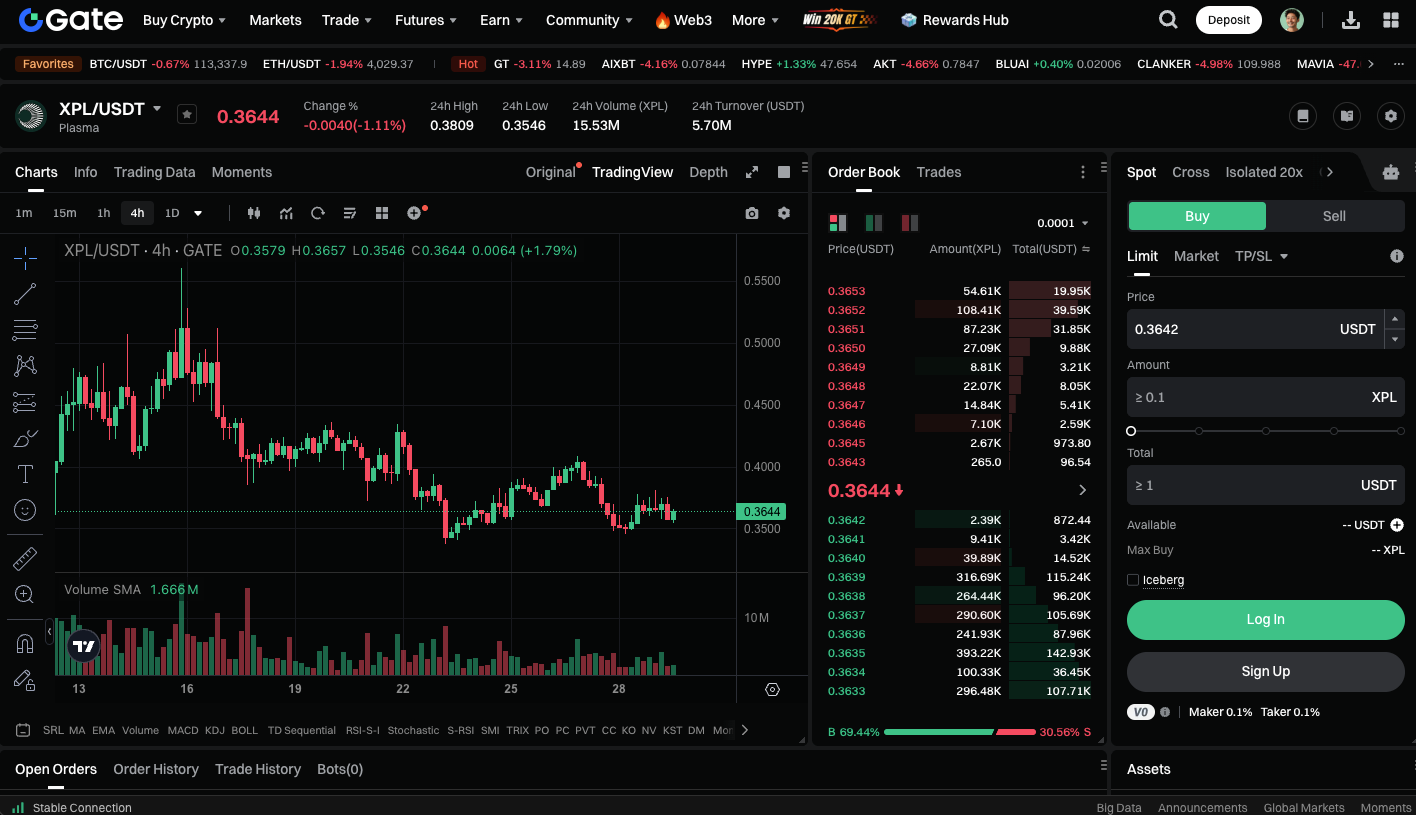

Start trading XPL spot now: https://www.gate.com/trade/XPL_USDT

Summary

Plasma stands out by combining zero-fee stablecoin payments with Bitcoin-anchored security, focusing on the distinct use case of stablecoin payments. Supported by strategic partnerships and capital investment, Plasma is building an efficient, low-cost, and compliant stablecoin settlement network. As global demand for stablecoins rises, whether Plasma can generate network effects and become a mainstream blockchain will be a key trend to watch.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

What is N2: An AI-Driven Layer 2 Solution

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article