Post content & earn content mining yield

placeholder

NotJeromePowell

Elon all I need is that .2 bro

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- like

- Comment

- Repost

- Share

馬币火

Malaysian Ringgit

Created By@TIANDAO

Listing Progress

100.00%

MC:

$13.43K

Create My Token

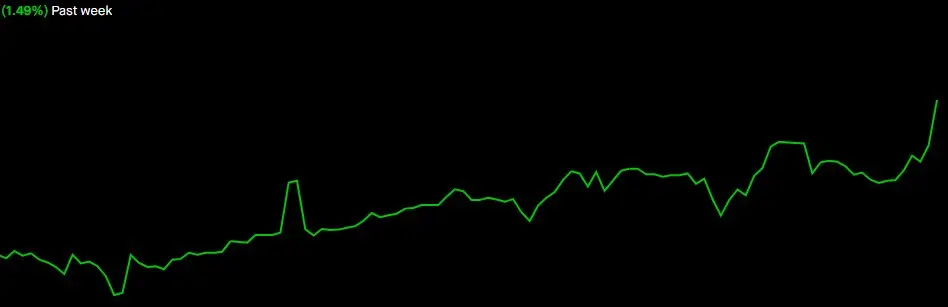

Choppy but solid week of trading. Still just grinding away not trying to make huge gains in a day and keeping risk management at the top of mind always.Annoyed about the markets though. Kind of depressing just watching everything nuke.

- Reward

- like

- Comment

- Repost

- Share

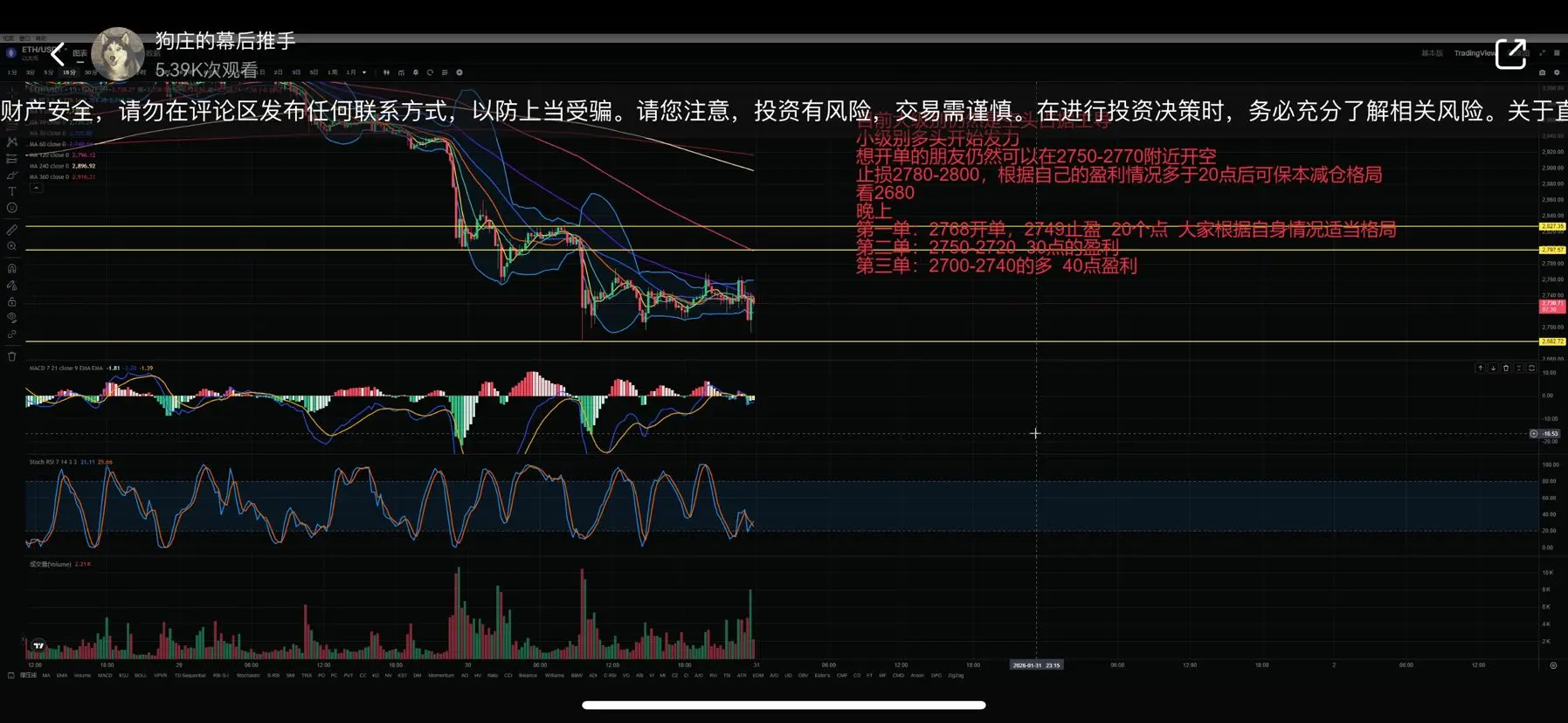

After providing a continued bearish operation suggestion in the morning, Bitcoin has generally been consolidating within a range with a slight downward trend. The market has sharply declined from recent highs to fluctuate between approximately 82,000 and 85,000, with the lowest point reaching 81,000, hitting multi-month lows. Market sentiment has become cautious in the short term. Currently, the contract funding rates are low or even slightly negative, indicating weakened bullish momentum and converging risk appetite. Ethereum is also under pressure, trading around 2,700 with decreased trading

BTC-2.01%

- Reward

- 1

- Comment

- Repost

- Share

$MON | USDT is rebounding from solid support at 0.0192, with controlled buying evident in the recent green volume spike. Momentum is neutral but MACD flattening suggests reduced selling pressure—breakout risk above 0.0216 could ignite the next leg up.

Entry Zone: 0.0200-0.0205

TP1: 0.0215

TP2: 0.0225

TP3: 0.0235

Stop-Loss: 0.0190

#Monad #CryptoTrading #Altcoins #BullMarket

Entry Zone: 0.0200-0.0205

TP1: 0.0215

TP2: 0.0225

TP3: 0.0235

Stop-Loss: 0.0190

#Monad #CryptoTrading #Altcoins #BullMarket

MON1.28%

- Reward

- like

- 3

- Repost

- Share

GateUser-44c397ee :

:

Happy New Year! 🤑View More

- Reward

- like

- Comment

- Repost

- Share

WARREN BUFFETT: “The natural course of government is to make the currency worth less over time.” "They devalue it at rates that are breathtaking. In the end, if you\'ve got people that control the currency, you can issue paper money.""Fiscal policy is what scares me in the United States."

- Reward

- like

- Comment

- Repost

- Share

Huge Regular Bullish Divergence on $ETH!These type of patterns hints that bears can be weakening and that bulls can be getting ready to regain dominance/control over the market!A reversal may be in the works for Ethereum.

ETH-3.84%

- Reward

- like

- 1

- Repost

- Share

RoundCabbage :

:

You see, you're just a little rookie, talking nonsense all day long.Eat meat, eat meat, support STTW more along with the profit-making brothers

View Original

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$LITEreached the 1.618 fibo of the 2021 peak

- Reward

- like

- Comment

- Repost

- Share

COCA-COLA

COCA-COLA .

Created By@Valival66666

Listing Progress

0.00%

MC:

$3.19K

Create My Token

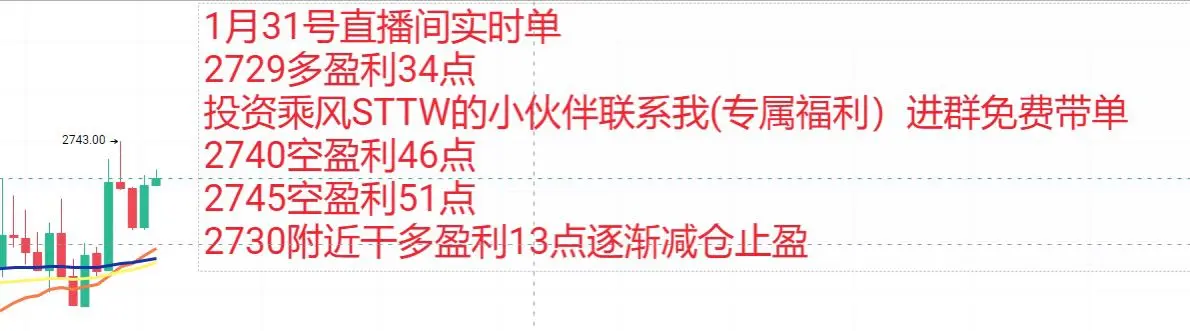

Evening signal call, audience gains once again netted 90 points

View Original

- Reward

- like

- Comment

- Repost

- Share

The Tokenized Stocks First Trade Bonus event is officially live. Newly registered users and first-time Tokenized Stocks traders can earn stacked airdrops by completing low-threshold trades... https://www.gate.com/campaigns/3927?ref=VLARBF1YAG&ref_type=132

- Reward

- 4

- 2

- Repost

- Share

CryptoDaisy :

:

Watching Closely 🔍️View More

Hello guys, I just joined Gate and I think Gate is very interesting, it's really a fun investment, and there are also many airdrop events.

View Original

- Reward

- like

- Comment

- Repost

- Share

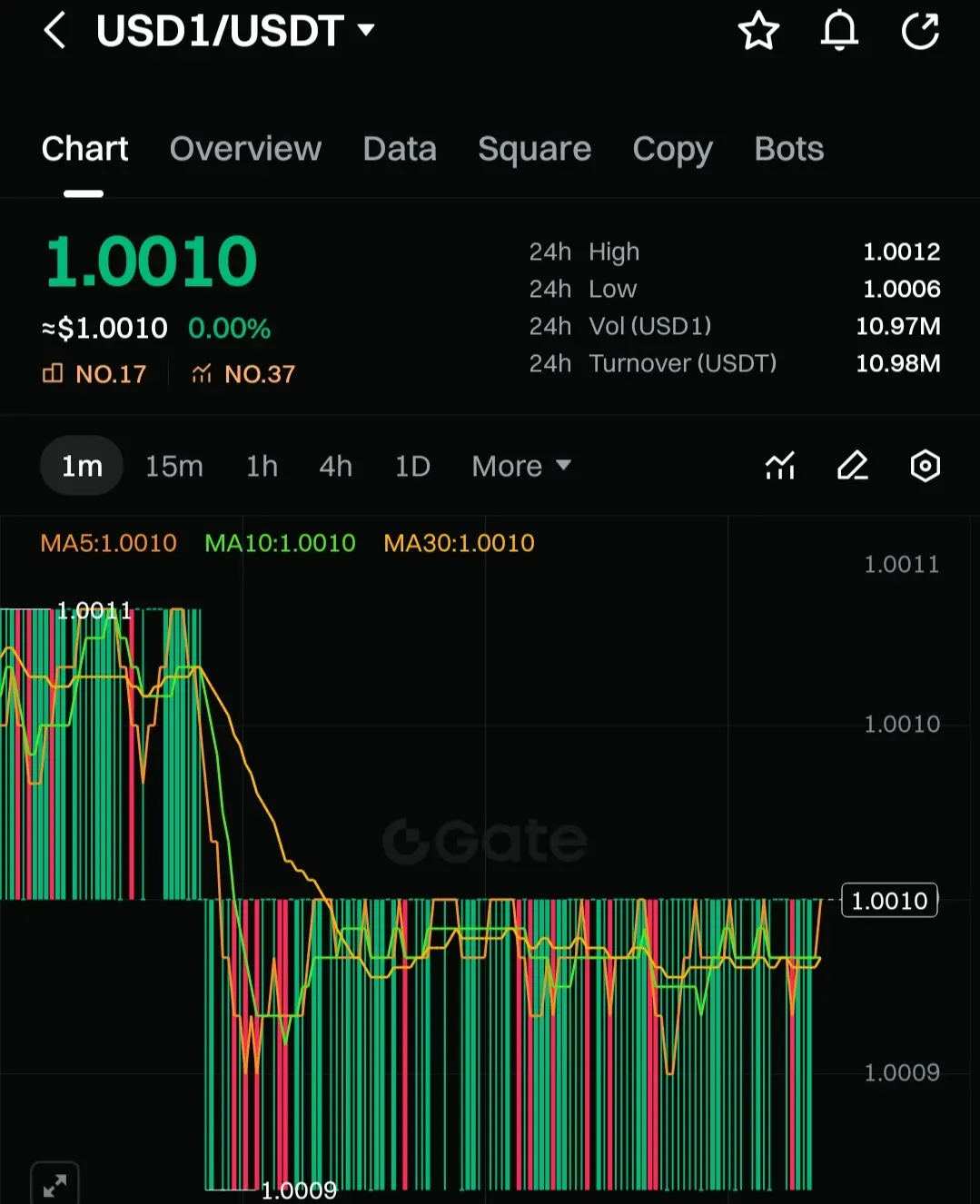

$USD1 is positioned at 1.0010, and the current zone appears to be a potential bounce area where price could rebound if market momentum turns bullish.

Entry Zone: 1.0006 – 1.0012

Target 1: 1.0020

Target 2: 1.0030

Target 3: 1.0040

Stop Loss: 0.9990

Simple setup: watch the price action unfold inside the range for a possible upward swing.

#USD1 #Rmj-Trades

Entry Zone: 1.0006 – 1.0012

Target 1: 1.0020

Target 2: 1.0030

Target 3: 1.0040

Stop Loss: 0.9990

Simple setup: watch the price action unfold inside the range for a possible upward swing.

#USD1 #Rmj-Trades

- Reward

- like

- 1

- Repost

- Share

Praveen07 :

:

gghhhjjbjjkjjkkkkkklkbhjhjjjjknbhjhjnhgjjjhjAlthough sesame seeds are small, they harbor ambitions as vast as the clouds.

Even if one has not yet entered the trading hall, their heart can shine like the sun and moon, and their will can shake mountains and seas.

The crypto world has always been turbulent and unpredictable; a single brave heart cannot determine the universe.

The cry of "killing the heavens" from the masses is a surge of ideals, but it also requires rationality as an anchor—

Respect the cycles of the market, honor the laws of technological evolution.

History has never favored reckless fools; only those who revere can see t

View OriginalEven if one has not yet entered the trading hall, their heart can shine like the sun and moon, and their will can shake mountains and seas.

The crypto world has always been turbulent and unpredictable; a single brave heart cannot determine the universe.

The cry of "killing the heavens" from the masses is a surge of ideals, but it also requires rationality as an anchor—

Respect the cycles of the market, honor the laws of technological evolution.

History has never favored reckless fools; only those who revere can see t

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 6

- 5

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

⚠️ #تحذير

Markets in the United States may experience some volatility if the US Senate approves the nomination of Kevin Warsh as Chair of the Federal Reserve, as investors adjust to his leadership style, according to Chief Investment Officer Richard Sabershtein.

🔸 Sabershtein says: "Markets may see fluctuations as investors get used to the new president's speech and message to the markets. It is natural to see volatility during a transitional period in the Federal Reserve chairmanship."

🔸 Sabershtein indicates that the appointment of Donald Trump as US President to Warsh does not change his

View OriginalMarkets in the United States may experience some volatility if the US Senate approves the nomination of Kevin Warsh as Chair of the Federal Reserve, as investors adjust to his leadership style, according to Chief Investment Officer Richard Sabershtein.

🔸 Sabershtein says: "Markets may see fluctuations as investors get used to the new president's speech and message to the markets. It is natural to see volatility during a transitional period in the Federal Reserve chairmanship."

🔸 Sabershtein indicates that the appointment of Donald Trump as US President to Warsh does not change his

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More15.83K Popularity

30.61K Popularity

354.45K Popularity

33.34K Popularity

50.4K Popularity

Hot Gate Fun

View More- MC:$3.23KHolders:10.00%

- MC:$3.2KHolders:10.00%

- MC:$3.21KHolders:00.00%

- MC:$3.19KHolders:10.00%

- MC:$3.19KHolders:10.00%

News

View MoreSpot gold falls below $4900, spot silver plunges 20% intraday

28 m

Total data: A total of 2,955,700 TON tokens transferred into the TON platform, with an approximate value of $4,285,700 USD.

35 m

U.S. stock indices generally declined, with the Dow Jones Industrial Average down 1% and the Nasdaq down over 0.9%

41 m

Trump: Will send more ships to Iran. If they don't reach an agreement, let's see what happens.

42 m

U.S. President Trump praises the S&P 500 Index for reaching a record high

44 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889