Trending Topics

View More21.44K Popularity

6.86K Popularity

5.73K Popularity

3.47K Popularity

89.85K Popularity

Hot Gate Fun

View More- MC:$3.63KHolders:10.00%

- MC:$3.94KHolders:21.33%

- MC:$3.65KHolders:10.00%

- MC:$3.72KHolders:30.11%

- MC:$3.67KHolders:10.00%

Pin

Have Fun With A Quiz in Gate Chat Group & Unlock Big Rewards!

Venue: Gate Chat Group

Time: Jan. 7, 04:00 AM (UTC)

💡 Rules:

‣ The quiz has 5 easy questions about Gate

‣ 2 lucky winners will be picked for each question with a $5 Position Voucher each

➜ How:

Open Gate App » Click at the bottom of "Home"-"Chat" » Enter Gate Chat Group or

➜ Click the Link to Enter: https://gate.onelink.me/Hls0/group?chatroom=groupGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693

Bitcoin drops to $88,000, major altcoins also weaken together

Source: DecenterKorea Original Title: Bitcoin at $88,000… Major Altcoins Also Downtrend [Decenter Market] Original Link:

Market Overview

Bitcoin(BTC) has fallen to the $88,000 level. The decline is influenced by cautious investor sentiment ahead of major macroeconomic events.

As of the 15th, at 8 a.m. according to global cryptocurrency market data, BTC was trading at $82,417.18, down 1.41% from 24 hours earlier. Major altcoins also showed a similar weakness:

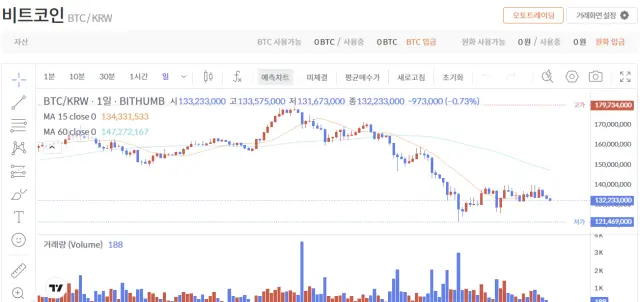

The domestic market is showing a similar trend. At the same time, BTC on domestic exchanges declined 0.64% from the previous day to 133,223,000 KRW. ETH is trading at 4,607,000 KRW, down 0.19%, and XRP has slightly increased by 0.03% to 2,983 KRW.

Reasons for Weakness

Market analysts suggest that position adjustments are ongoing ahead of the scheduled major macroeconomic indicators this week. In the U.S., November employment data will be released on the 16th, and the November Consumer Price Index(CPI) is scheduled for the 18th. Depending on the results, expectations regarding the baseline interest rate may be readjusted, which could impact the cryptocurrency market.

Overseas central bank policies are also considered variables. Ahead of the Bank of Japan(BOJ) monetary policy meeting, discussions about possible rate hikes are underway, raising concerns about a reduction in yen carry trades. Yen carry trades involve borrowing Japanese yen at ultra-low interest rates and investing in higher-yield assets such as dollars, stocks, or cryptocurrencies. If Japan raises interest rates, borrowing costs and exchange losses could increase, leading to a potential withdrawal of carry trade funds. This could increase overall volatility in global risk assets.

Market Sentiment

Cryptocurrency investment sentiment remains in an ‘extreme fear’ state. The fear and greed index from a data analytics firm indicates a level of 21 points, reflecting considerable investor apprehension.