Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

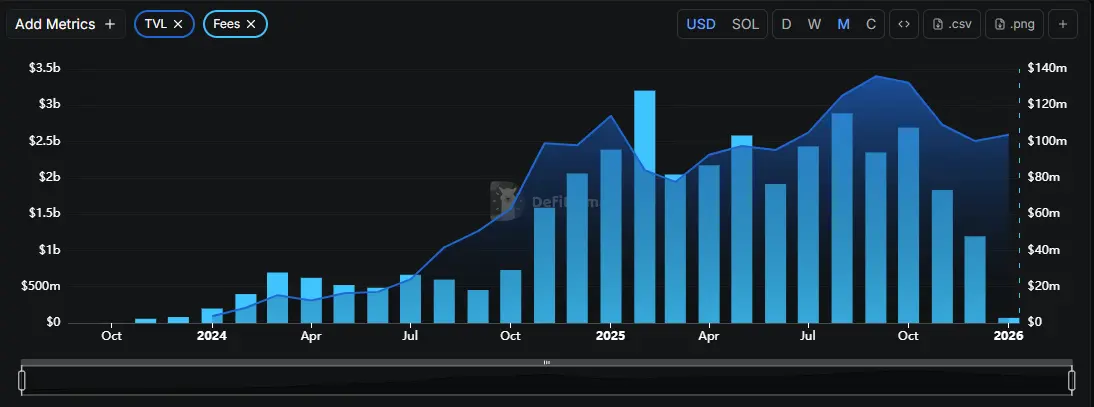

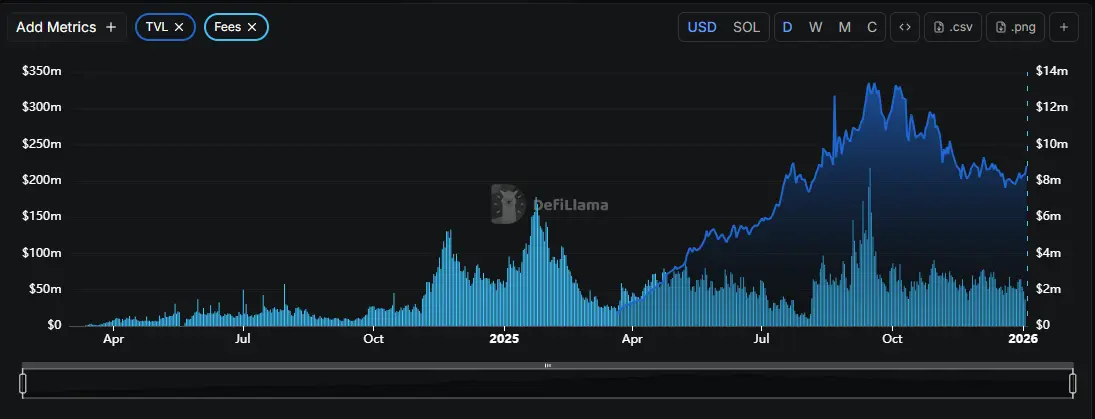

Perform of Sol Eco

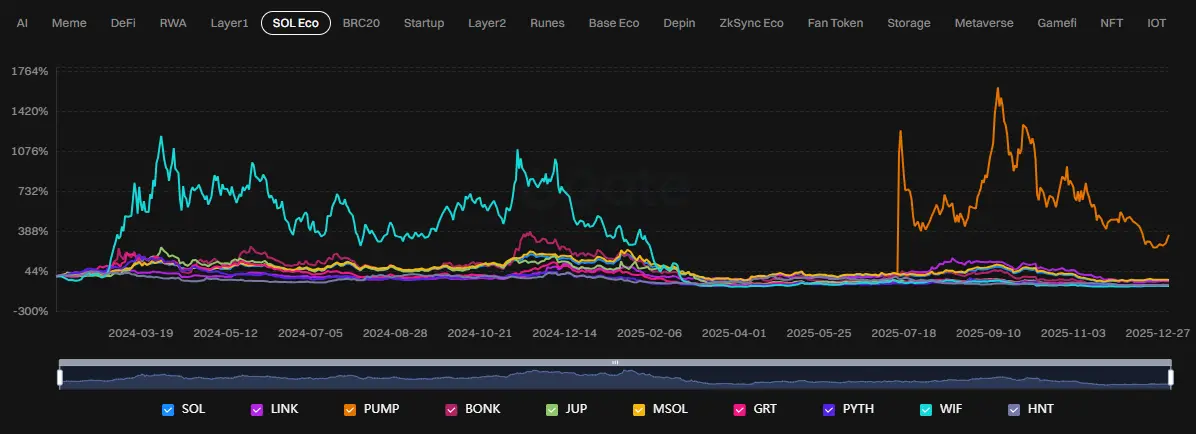

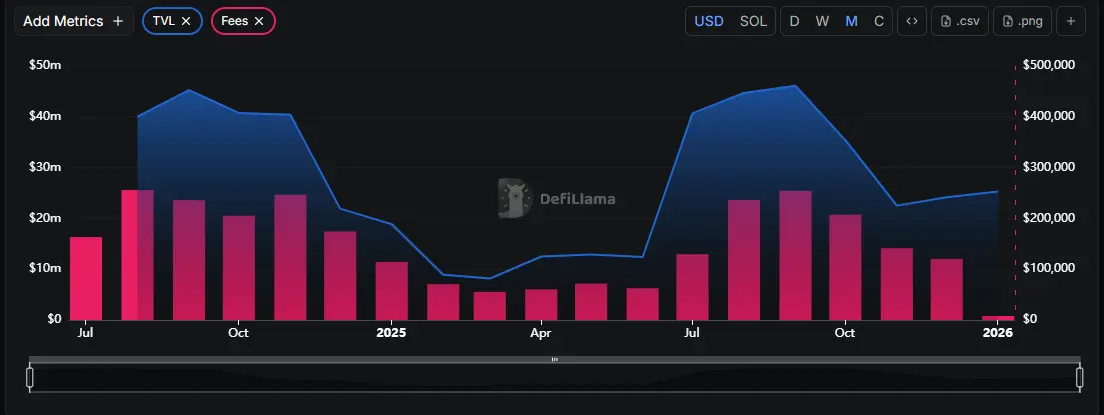

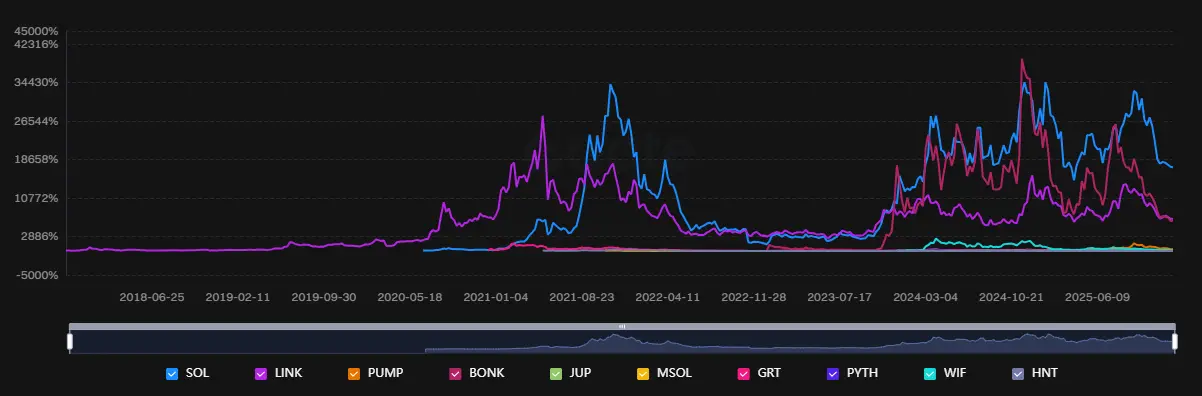

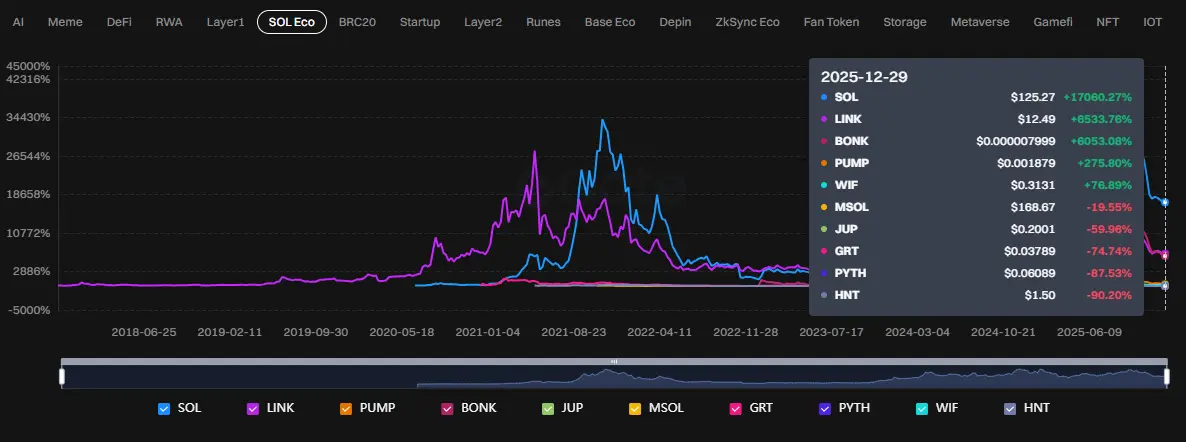

From a one-year perspective, the Solana Ecosystem presents a very representative picture of a fast-growing but highly cyclical ecosystem, where returns are driven primarily by short, explosive phases rather than by steady and sustainable accumulation.Over the past twelve months, performance within Sol Eco has not been driven exclusively by SOL itself, but has instead rotated into higher-beta satellite assets. SOL has functioned as the liquidity pivot: when SOL strengthens and the Solana narrative comes back into focus, capital rapidly disperses across ecosystem tokens. Conversely, when SOL weakens or the market shifts into a risk-off regime, much of those gains is quickly retraced. This behavior suggests that Sol Eco is still operating more under a tactical rotation framework than under a compound growth model. Chart behavior reinforces this view. Most ecosystem tokens share a common characteristic: sharp upside moves are typically followed by deep drawdowns. Major rallies tend to cluster around very specific windows, usually tied to clear catalysts such as meme explosions, consumer-app narratives, or highly viral community events within Solana. Once those catalysts fade, prices revert toward lower equilibrium levels, reflecting the reality that inflows into this group are predominantly momentum-driven rather than supported by durable cash flows or revenues.

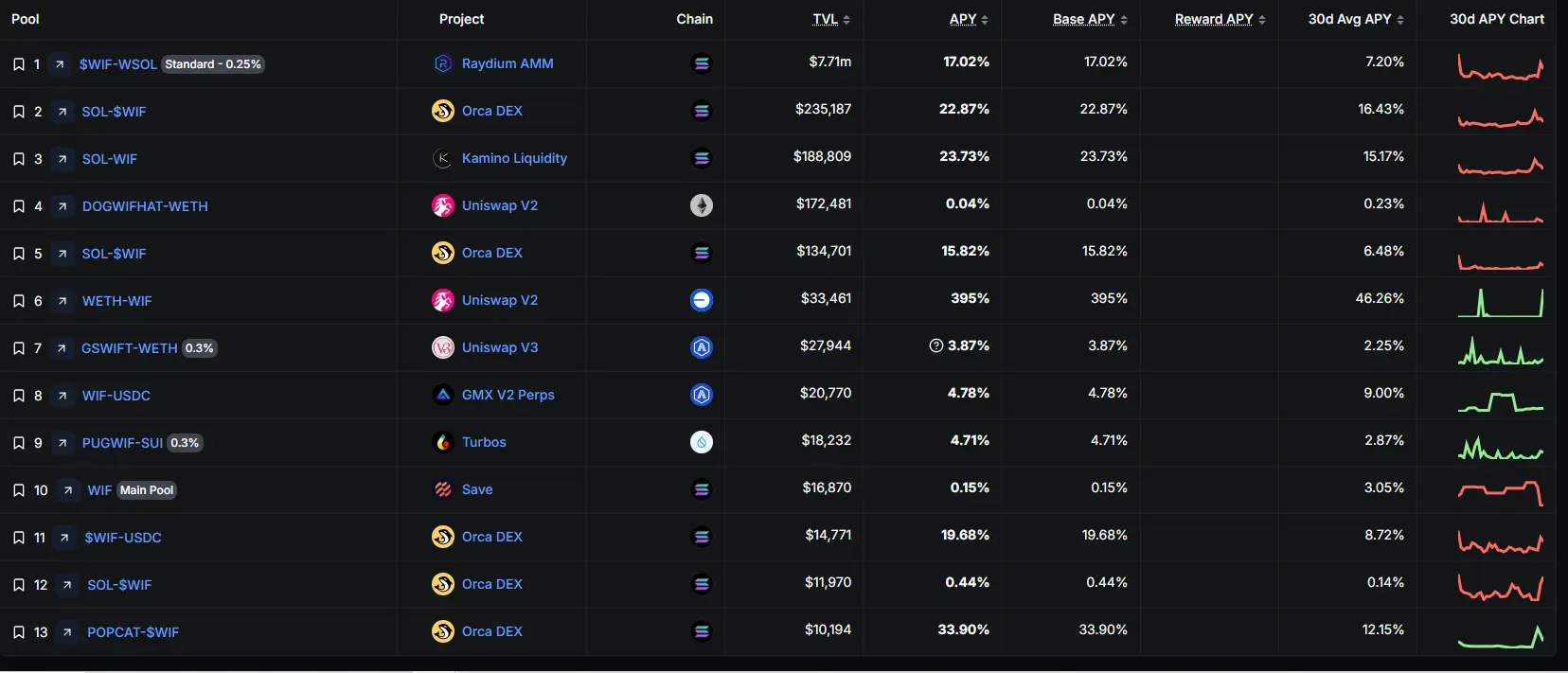

Chart behavior reinforces this view. Most ecosystem tokens share a common characteristic: sharp upside moves are typically followed by deep drawdowns. Major rallies tend to cluster around very specific windows, usually tied to clear catalysts such as meme explosions, consumer-app narratives, or highly viral community events within Solana. Once those catalysts fade, prices revert toward lower equilibrium levels, reflecting the reality that inflows into this group are predominantly momentum-driven rather than supported by durable cash flows or revenues. $WIF is a textbook example of this dynamic. The token delivered exceptional outperformance over the past year, but the majority of those gains were concentrated in a relatively short period, followed by an extended correction. This does not diminish the appeal of memes within Sol Eco, but it clearly highlights that such returns are highly time-dependent and difficult to sustain without a constant influx of new narratives.

$WIF is a textbook example of this dynamic. The token delivered exceptional outperformance over the past year, but the majority of those gains were concentrated in a relatively short period, followed by an extended correction. This does not diminish the appeal of memes within Sol Eco, but it clearly highlights that such returns are highly time-dependent and difficult to sustain without a constant influx of new narratives. $BONK exhibits a similar pattern, albeit with more muted amplitude.

$BONK exhibits a similar pattern, albeit with more muted amplitude. Within the more infrastructure-oriented segment, $JUP and

Within the more infrastructure-oriented segment, $JUP and $PYTH have shown relatively more stable performance compared to the broader ecosystem, yet they have not escaped the broader tendency toward sideways movement or post-rally weakness. This implies that while these projects play meaningful roles within Solana, the market is still reluctant to assign a significant long-term premium to their value-capture potential. Growth expectations remain narrative-driven rather than grounded in proven, recurring economic flows.

$PYTH have shown relatively more stable performance compared to the broader ecosystem, yet they have not escaped the broader tendency toward sideways movement or post-rally weakness. This implies that while these projects play meaningful roles within Solana, the market is still reluctant to assign a significant long-term premium to their value-capture potential. Growth expectations remain narrative-driven rather than grounded in proven, recurring economic flows. LINK and

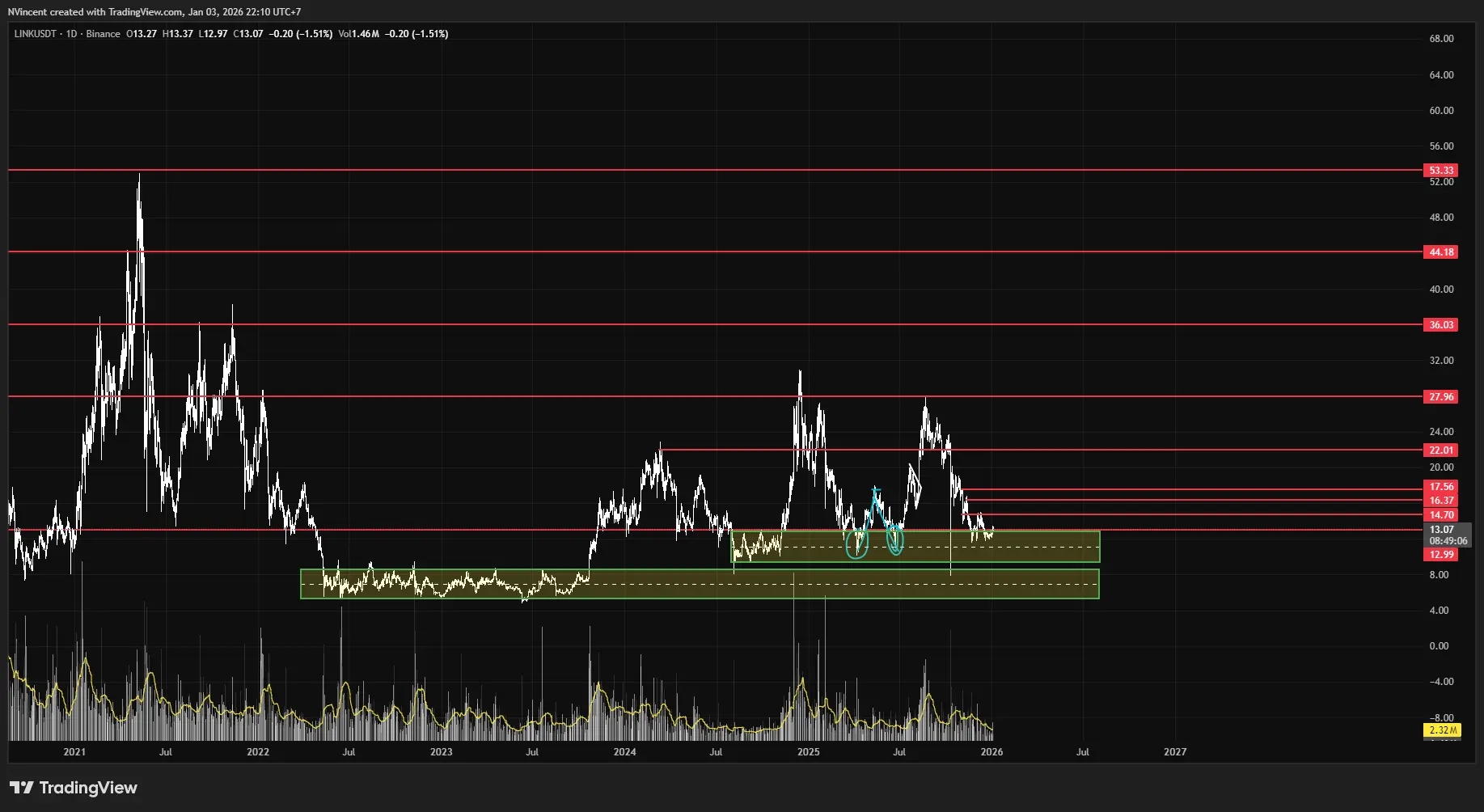

LINK and GRT, despite appearing on Sol Eco charts, point to a broader structural issue: cross-ecosystem infrastructure tokens do not fully benefit from the rotation of any single ecosystem. Their one-year performance suggests they are not direct beneficiaries of Solana-specific flows, but are instead more heavily influenced by broader, market-wide narratives.

GRT, despite appearing on Sol Eco charts, point to a broader structural issue: cross-ecosystem infrastructure tokens do not fully benefit from the rotation of any single ecosystem. Their one-year performance suggests they are not direct beneficiaries of Solana-specific flows, but are instead more heavily influenced by broader, market-wide narratives. One notable feature is the emergence of outliers such as PUMP in the later stages of the period, showing sharp, isolated price appreciation detached from the rest of the ecosystem. This is a classic sign of late-cycle behavior, where capital seeks rapid gains in extremely high-volatility assets rather than rotating back into core tokens. From an analytical standpoint, such moves tend to function more as warning signals than as indicators of sustainable strength.

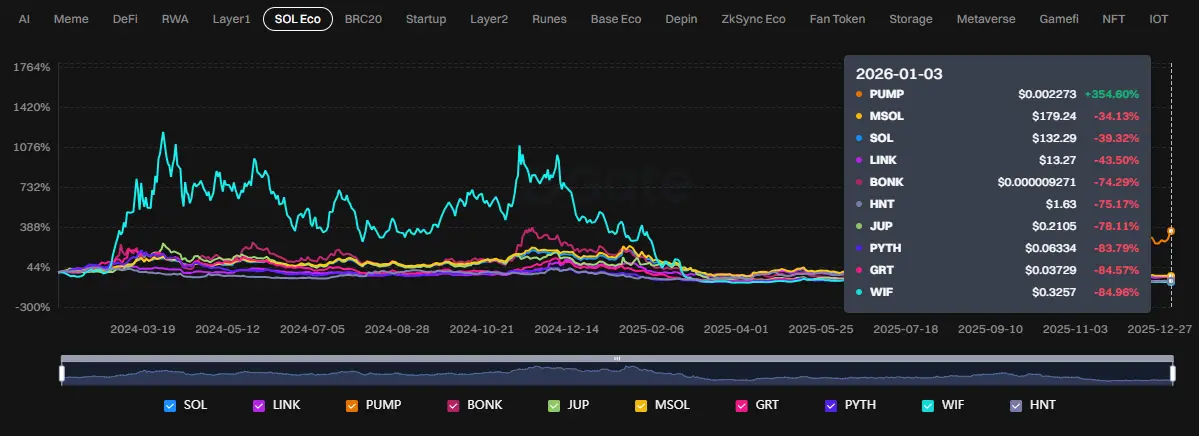

One notable feature is the emergence of outliers such as PUMP in the later stages of the period, showing sharp, isolated price appreciation detached from the rest of the ecosystem. This is a classic sign of late-cycle behavior, where capital seeks rapid gains in extremely high-volatility assets rather than rotating back into core tokens. From an analytical standpoint, such moves tend to function more as warning signals than as indicators of sustainable strength. Taken together, the Solana Ecosystem over the past year exhibits three clear characteristics. First, returns are highly dispersed and heavily timing-dependent. Second, most tokens behave as high-beta satellites around SOL, making them more suitable for trading than for long-term holding. Third, while the Solana narrative remains strong in terms of community engagement and user experience, its ability to translate narrative momentum into durable economic value for tokens is still limited.In terms of assets to watch, SOL remains the core asset of the entire Sol Eco, acting as the primary coordinator of capital flows and the most suitable vehicle for both medium- and long-term strategies within the ecosystem. JUP and PYTH are worth monitoring from an infrastructure and adoption perspective, but require clearer evidence of value capture before transitioning from trading instruments to long-term holdings. WIF and BONK are better approached tactically, leveraging narrative and volatility, but carry significant risk if treated as long-duration investments. Tokens such as LINK and GRT should be evaluated within a broader market context rather than as pure Solana Ecosystem exposures.From an all-time perspective, the Solana ecosystem (Sol Eco) presents a very different picture compared with the one-year view. It is an ecosystem capable of generating explosive, cycle-driven returns, but it also exhibits extremely strong mean reversion and a high degree of dispersion across tokens.

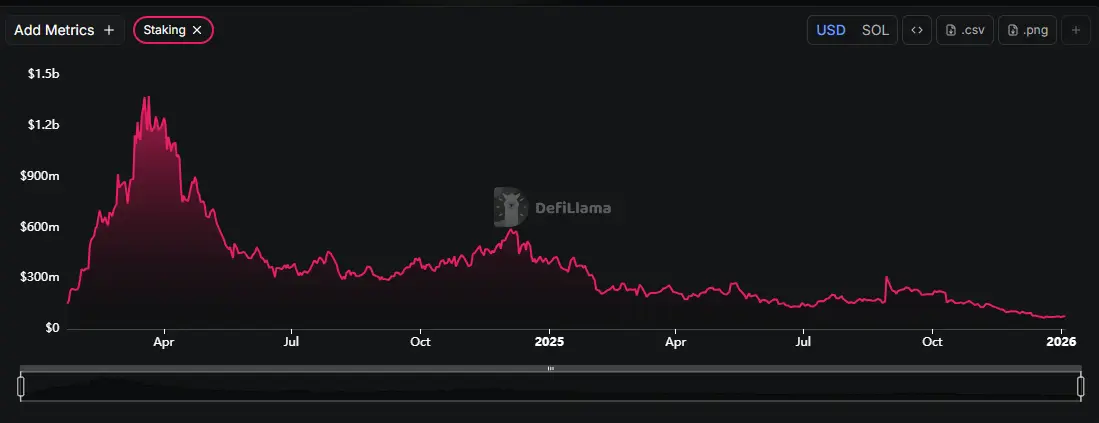

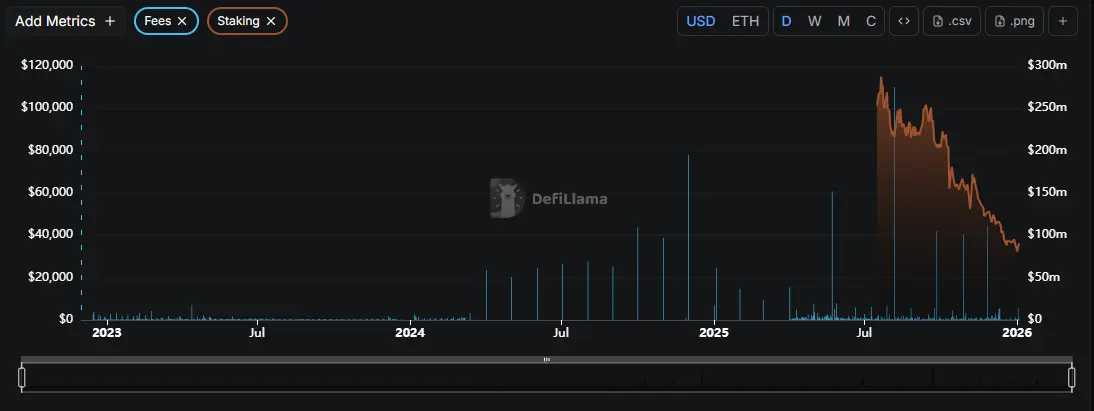

Taken together, the Solana Ecosystem over the past year exhibits three clear characteristics. First, returns are highly dispersed and heavily timing-dependent. Second, most tokens behave as high-beta satellites around SOL, making them more suitable for trading than for long-term holding. Third, while the Solana narrative remains strong in terms of community engagement and user experience, its ability to translate narrative momentum into durable economic value for tokens is still limited.In terms of assets to watch, SOL remains the core asset of the entire Sol Eco, acting as the primary coordinator of capital flows and the most suitable vehicle for both medium- and long-term strategies within the ecosystem. JUP and PYTH are worth monitoring from an infrastructure and adoption perspective, but require clearer evidence of value capture before transitioning from trading instruments to long-term holdings. WIF and BONK are better approached tactically, leveraging narrative and volatility, but carry significant risk if treated as long-duration investments. Tokens such as LINK and GRT should be evaluated within a broader market context rather than as pure Solana Ecosystem exposures.From an all-time perspective, the Solana ecosystem (Sol Eco) presents a very different picture compared with the one-year view. It is an ecosystem capable of generating explosive, cycle-driven returns, but it also exhibits extremely strong mean reversion and a high degree of dispersion across tokens. Looking at the full timeline from 2018 to the present, SOL is the unquestionable backbone of the entire Sol Eco. The 2020–2021 cycle propelled SOL into the ranks of emblematic high-growth assets, driven by the convergence of the “high-performance L1” narrative, strong VC inflows, rising developer activity, and expectations that Solana could challenge Ethereum at the infrastructure layer. However, the 2022 collapse made one reality very clear: $SOL is not a defensive asset, but rather a high-beta core asset, heavily dependent on liquidity cycles and ecosystem confidence. That said, unlike many other L1s, SOL demonstrated an ability to survive and recover, re-establishing itself as a central asset in the subsequent cycle. This resilience is the key reason SOL is still viewed as a “conditional core holding” rather than being removed from long-term consideration.

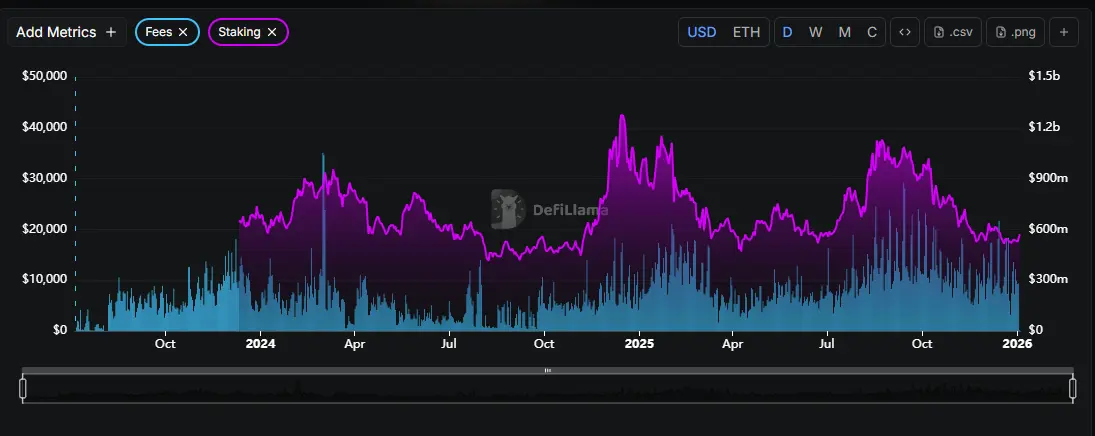

Looking at the full timeline from 2018 to the present, SOL is the unquestionable backbone of the entire Sol Eco. The 2020–2021 cycle propelled SOL into the ranks of emblematic high-growth assets, driven by the convergence of the “high-performance L1” narrative, strong VC inflows, rising developer activity, and expectations that Solana could challenge Ethereum at the infrastructure layer. However, the 2022 collapse made one reality very clear: $SOL is not a defensive asset, but rather a high-beta core asset, heavily dependent on liquidity cycles and ecosystem confidence. That said, unlike many other L1s, SOL demonstrated an ability to survive and recover, re-establishing itself as a central asset in the subsequent cycle. This resilience is the key reason SOL is still viewed as a “conditional core holding” rather than being removed from long-term consideration. Turning to infrastructure and middleware tokens, LINK stands out as a special case. Although not natively tied to Solana, LINK’s all-time performance within Sol Eco charts shows superior long-term value accumulation relative to most other tokens in the ecosystem. This reflects the fact that LINK is anchored to cross-chain demand and oracle infrastructure, making it less dependent on any single ecosystem. Within a Sol Eco context, LINK functions as a “semi-defensive asset,” helping to dampen portfolio volatility when allocated appropriately.

Turning to infrastructure and middleware tokens, LINK stands out as a special case. Although not natively tied to Solana, LINK’s all-time performance within Sol Eco charts shows superior long-term value accumulation relative to most other tokens in the ecosystem. This reflects the fact that LINK is anchored to cross-chain demand and oracle infrastructure, making it less dependent on any single ecosystem. Within a Sol Eco context, LINK functions as a “semi-defensive asset,” helping to dampen portfolio volatility when allocated appropriately. In contrast, most other tokens in Sol Eco display the classic characteristics of short-lived hype cycles. BONK, WIF, and other meme coins have delivered exponential gains during periods of peak liquidity, but have struggled to retain those gains once the cycle turns. This is not a negative judgment on their tradability; rather, it underscores that memes in Sol Eco are optimal vehicles for momentum trading, not for long-term value storage.

In contrast, most other tokens in Sol Eco display the classic characteristics of short-lived hype cycles. BONK, WIF, and other meme coins have delivered exponential gains during periods of peak liquidity, but have struggled to retain those gains once the cycle turns. This is not a negative judgment on their tradability; rather, it underscores that memes in Sol Eco are optimal vehicles for momentum trading, not for long-term value storage.

The internal DeFi and infrastructure cohort—such as JUP, MSOL, PYTH, and GRT (in an integrated context)—highlights a core structural challenge for Sol Eco: protocol-level value capture remains insufficiently durable. While adoption and usage have surged at times, token prices have generally failed to sustain long-term accumulation trends, repeatedly reverting to equilibrium levels after each speculative upswing. This suggests that capital flowing into this segment is still largely speculative, rather than driven by stable, recurring cash flows.

Notably, when comparing the cycle peaks of 2021 and 2024–2025, Sol Eco appears to be forming lower-quality distribution of returns. Capital is increasingly concentrated in a small subset of tokens (primarily SOL and leading memes), while the broader ecosystem no longer commands the same premium it did in earlier phases. This is a hallmark of an ecosystem entering a more mature stage, where markets become more selective and no longer price the entire Sol Eco as a bundled trade.

In summary, the all-time view of Sol Eco can be characterized as follows: it is an ecosystem capable of generating significant cyclical alpha, particularly during periods of expanding market liquidity, but it is not well suited to a broad, buy-and-hold approach across many tokens. The most effective strategy is a clear role-based allocation: SOL as the high-beta core, LINK (and certain cross-chain infrastructure assets) as more stable satellites, and memes or internal DeFi tokens as tactical positions aligned with narrative and momentum.

In other words, Sol Eco does not reward blind patience. It rewards the ability to read cycles, select the right asset classes, and exit at the appropriate time. This is the defining difference between a strategic long-term investor and someone who is merely “present in the ecosystem.”