Post content & earn content mining yield

placeholder

Sarikoze

Don't forget to hold BTC until it reaches $200K. Make sure it definitely won't drop further. It's going much higher, just retest it again.

BTC-0.93%

- Reward

- like

- Comment

- Repost

- Share

🎮 Sandbox ( $SAND ): Is the Metaverse Waking Up?

Market capitalization: $400M.

The Sandbox is a decentralized gaming platform where users create, own, and monetize their gaming experiences.

🟡 The SAND token is used for transactions, governance, and ecosystem access.

What's happening now❔

💬 Early 2026 brought an unexpected surge of interest in the NFT sector. SAND broke out of a months-long downtrend with an impressive trading volume spike of over 400%. The price jumped from the support zone around $0.11 to the current $0.15–0.16.

Why does this matter❔

💬 The Sandbox team is actively imple

Market capitalization: $400M.

The Sandbox is a decentralized gaming platform where users create, own, and monetize their gaming experiences.

🟡 The SAND token is used for transactions, governance, and ecosystem access.

What's happening now❔

💬 Early 2026 brought an unexpected surge of interest in the NFT sector. SAND broke out of a months-long downtrend with an impressive trading volume spike of over 400%. The price jumped from the support zone around $0.11 to the current $0.15–0.16.

Why does this matter❔

💬 The Sandbox team is actively imple

SAND-0.31%

- Reward

- like

- Comment

- Repost

- Share

#ETHTrendWatch

TH Trend Watch: Deep Dive Into Recent Price Action and Strategic Positioning

Ethereum (ETH), the world’s second‑largest cryptocurrency, has been through an intriguing phase of consolidation and volatility as traders and investors digest both technical signals and macro drivers. As of the latest market data, ETH is trading near $2,970–$3,200, having retraced from earlier highs and testing key support zones after weeks of choppy price action.

Over the past month, ETH has seen its price oscillate between approximately $2,950 and $3,260, with immediate support clustered around $3,2

TH Trend Watch: Deep Dive Into Recent Price Action and Strategic Positioning

Ethereum (ETH), the world’s second‑largest cryptocurrency, has been through an intriguing phase of consolidation and volatility as traders and investors digest both technical signals and macro drivers. As of the latest market data, ETH is trading near $2,970–$3,200, having retraced from earlier highs and testing key support zones after weeks of choppy price action.

Over the past month, ETH has seen its price oscillate between approximately $2,950 and $3,260, with immediate support clustered around $3,2

- Reward

- 6

- 6

- Repost

- Share

GateUser-a646ad8c :

:

gogogogo 2026 strongView More

basedrunk

basedrunk

Created By@Bitcointod

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- like

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats

Big shift in global trade sentiment today.

When tariff threats ease, markets breathe. 🌍

The withdrawal of EU tariff pressure changes more than headlines — it impacts risk appetite, capital flow, and global liquidity expectations.

For crypto, this matters.

Less trade tension =

✔️ Stronger risk-on sentiment

✔️ Potential dollar stabilization

✔️ Relief rally potential in equities and BTC

But here’s the real question:

Is this a short-term relief move… or the beginning of a broader policy pivot?

Bitcoin and Gold often react differently t

Big shift in global trade sentiment today.

When tariff threats ease, markets breathe. 🌍

The withdrawal of EU tariff pressure changes more than headlines — it impacts risk appetite, capital flow, and global liquidity expectations.

For crypto, this matters.

Less trade tension =

✔️ Stronger risk-on sentiment

✔️ Potential dollar stabilization

✔️ Relief rally potential in equities and BTC

But here’s the real question:

Is this a short-term relief move… or the beginning of a broader policy pivot?

Bitcoin and Gold often react differently t

BTC-0.93%

- Reward

- 7

- 9

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

If Bitcoin loses $88,000, it could trigger $638 million in cascading long liquidations

- Reward

- like

- Comment

- Repost

- Share

The game of life on PENGUIN MODE

- Reward

- like

- Comment

- Repost

- Share

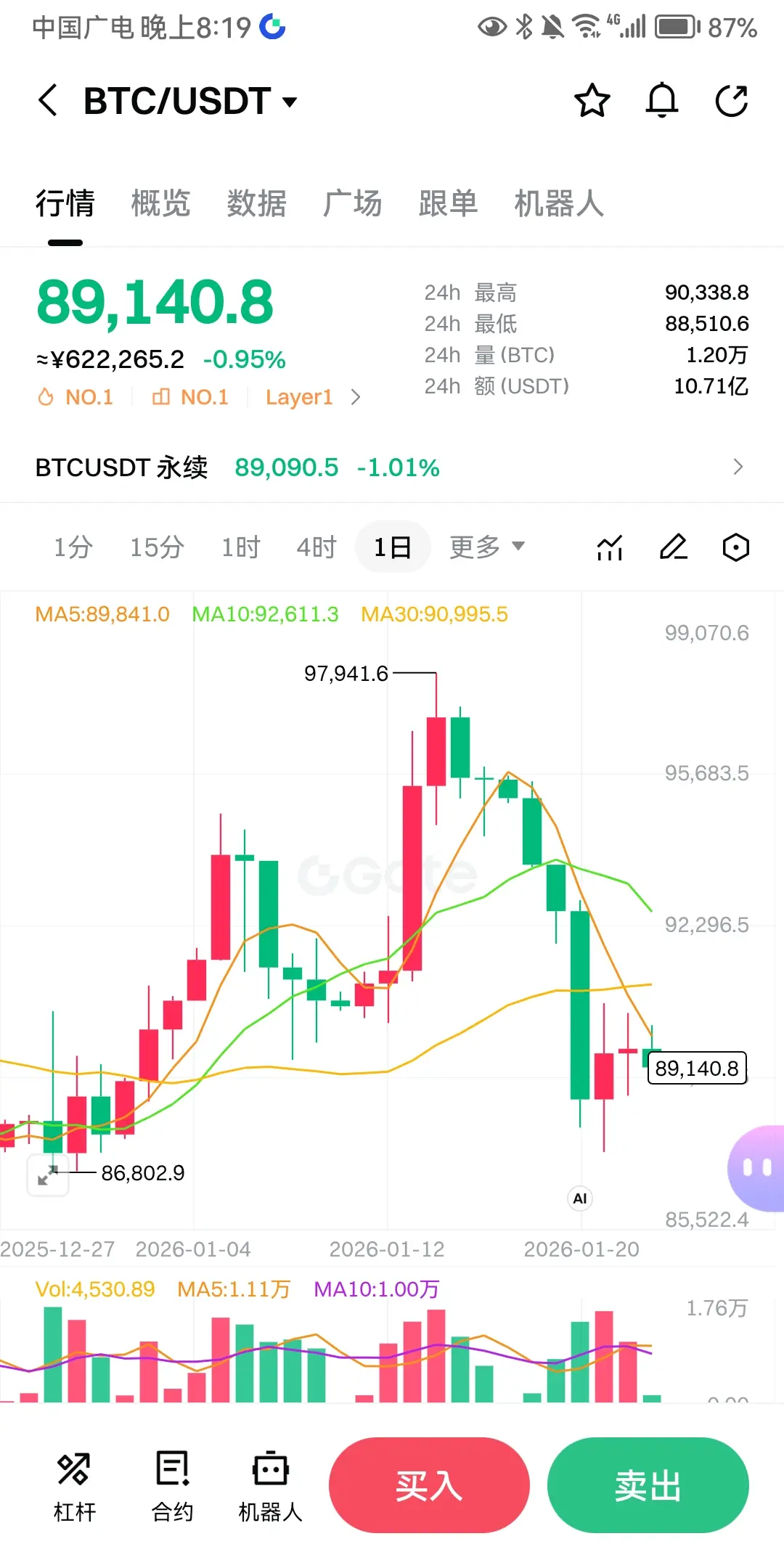

Here is the core market analysis and causes of BTC on January 22, 2026 (yesterday), with data sourced from public market statistics:

Core Price and Volatility

- Opened at $89,455, high of $90,360, low of $87,209, close at $89,560, with slight intra-day fluctuations, a deep dip at one point, and ultimately nearly flat, with the $90,000 level repeatedly contested.

- During the day, it briefly fell below $88k, reaching a recent low, then quickly rebounded amid macro easing news (cancellation of EU tariff threats), showing a V-shaped recovery but failing to break through the $91k resistance zone.

Core Price and Volatility

- Opened at $89,455, high of $90,360, low of $87,209, close at $89,560, with slight intra-day fluctuations, a deep dip at one point, and ultimately nearly flat, with the $90,000 level repeatedly contested.

- During the day, it briefly fell below $88k, reaching a recent low, then quickly rebounded amid macro easing news (cancellation of EU tariff threats), showing a V-shaped recovery but failing to break through the $91k resistance zone.

BTC-0.93%

- Reward

- like

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats

As of January 22, 2026, global markets are reacting to a notable shift in trade rhetoric as former U.S. President Donald Trump has stepped back from previously signaled tariff threats against the European Union, easing fears of an imminent transatlantic trade confrontation. The move has been interpreted by investors and policymakers as a de-escalation signal at a time when global markets are already navigating heightened volatility, slowing growth expectations, and sensitive geopolitical dynamics. Trade tensions between the U.S. and EU have historically carried

As of January 22, 2026, global markets are reacting to a notable shift in trade rhetoric as former U.S. President Donald Trump has stepped back from previously signaled tariff threats against the European Union, easing fears of an imminent transatlantic trade confrontation. The move has been interpreted by investors and policymakers as a de-escalation signal at a time when global markets are already navigating heightened volatility, slowing growth expectations, and sensitive geopolitical dynamics. Trade tensions between the U.S. and EU have historically carried

- Reward

- 2

- 2

- Repost

- Share

CryptoVortex :

:

Buy To Earn 💎View More

🚨 Gamestop $BTC exposure just flashed a structural breakdown and it matters for the broader #Bitcoin macro flow

Gamestop’s unrealized PnL flipped from a months long profit zone into a deepening loss cluster as BTC slid under the psychological range. This shift shows a complete sentiment reversal from strong hands sitting on gains to holders trapped in underwater positions. The red expansion reflects accelerating stress that historically pressures entities to reduce exposure.

Their on chain balance change confirms it. After months of accumulation, the address stopped adding and began printing

Gamestop’s unrealized PnL flipped from a months long profit zone into a deepening loss cluster as BTC slid under the psychological range. This shift shows a complete sentiment reversal from strong hands sitting on gains to holders trapped in underwater positions. The red expansion reflects accelerating stress that historically pressures entities to reduce exposure.

Their on chain balance change confirms it. After months of accumulation, the address stopped adding and began printing

BTC-0.93%

- Reward

- 2

- 1

- Repost

- Share

DragonFlyOfficial :

:

Buy To Earn 💎黑8

黑8

Created By@ThousandsOfHeart-PoundingCast

Subscription Progress

0.00%

MC:

$0

Create My Token

Gate Annual Report is out! Let's take a look at my yearly performance.

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQVABWOLBA&ref_type=126&shareUid=U1ZAXF9bAAcO0O0O.

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQVABWOLBA&ref_type=126&shareUid=U1ZAXF9bAAcO0O0O.

- Reward

- like

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats 🌍

Global trade sentiment just flipped risk-on.

The withdrawal of EU tariff threats isn’t just a political headline — it’s a macro liquidity signal.

When trade pressure eases:

✔️ Risk appetite improves

✔️ Dollar pressure can stabilize

✔️ Capital rotates back into growth & high-beta assets

Why this matters for crypto 👇

Lower geopolitical friction often unlocks sidelined liquidity. Equities breathe first — BTC usually follows if volume confirms.

Now the key divergence to watch:

🔹 Bitcoin vs Gold

– Falling uncertainty → rotation into BTC & equities

– Persistent ca

Global trade sentiment just flipped risk-on.

The withdrawal of EU tariff threats isn’t just a political headline — it’s a macro liquidity signal.

When trade pressure eases:

✔️ Risk appetite improves

✔️ Dollar pressure can stabilize

✔️ Capital rotates back into growth & high-beta assets

Why this matters for crypto 👇

Lower geopolitical friction often unlocks sidelined liquidity. Equities breathe first — BTC usually follows if volume confirms.

Now the key divergence to watch:

🔹 Bitcoin vs Gold

– Falling uncertainty → rotation into BTC & equities

– Persistent ca

BTC-0.93%

- Reward

- 3

- 5

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

#MyFirstPostOnTheSquare

January 23, 2026 🚀

Every journey starts with a single post.

Today isn’t just about sharing content — it’s about showing up, building consistency, and becoming part of something bigger. Gate Square isn’t just a feed… it’s where ideas turn into opportunities.

From market insights 📊 to gold events 🟡 and crypto discussions ₿ — this space is full of energy, strategy, and ambition.

I’m here to learn, share, grow, and connect with serious traders and long-term thinkers.

2026 is not about noise.

It’s about discipline, smart positioning, and strong community.

Let’s build mome

January 23, 2026 🚀

Every journey starts with a single post.

Today isn’t just about sharing content — it’s about showing up, building consistency, and becoming part of something bigger. Gate Square isn’t just a feed… it’s where ideas turn into opportunities.

From market insights 📊 to gold events 🟡 and crypto discussions ₿ — this space is full of energy, strategy, and ambition.

I’m here to learn, share, grow, and connect with serious traders and long-term thinkers.

2026 is not about noise.

It’s about discipline, smart positioning, and strong community.

Let’s build mome

- Reward

- 8

- 13

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

$SPX500 So disgusting, the platform's slippage is so severe.

Clearly saw a profit of 2u to close the position, but looking at the history record, I actually lost 0.4.

It ruined my 100% win rate!!

View OriginalClearly saw a profit of 2u to close the position, but looking at the history record, I actually lost 0.4.

It ruined my 100% win rate!!

- Reward

- 1

- 1

- Repost

- Share

CryptoCircleCeo :

:

Small tokens have extremely severe slippage. Setting take-profit, fee, and funding rate deductions leave only 1U profit, then exit the position. It shows a loss of 0.5U. I have also encountered this before.【$MMT Signal】Long + Volume and Price Breakout

$MMT Strong breakout after a 27% increase in volume, combined with a simultaneous rise in open interest, is a typical signal of institutional entry rather than a short squeeze.

🎯 Direction: Long

🎯 Entry: 0.238 - 0.242

🛑 Stop Loss: 0.225 ( Rigid Stop Loss )

🚀 Target 1: 0.265

🚀 Target 2: 0.285

Price action shows buying pressure continuously absorbing at the breakout level, indicating healthy high-level consolidation. The increase in both volume and open interest confirms bullish momentum, and no panic selling occurred during the LTF pullback.

$MMT Strong breakout after a 27% increase in volume, combined with a simultaneous rise in open interest, is a typical signal of institutional entry rather than a short squeeze.

🎯 Direction: Long

🎯 Entry: 0.238 - 0.242

🛑 Stop Loss: 0.225 ( Rigid Stop Loss )

🚀 Target 1: 0.265

🚀 Target 2: 0.285

Price action shows buying pressure continuously absorbing at the breakout level, indicating healthy high-level consolidation. The increase in both volume and open interest confirms bullish momentum, and no panic selling occurred during the LTF pullback.

MMT21.74%

- Reward

- like

- 6

- Repost

- Share

UnstoppableOk :

:

Hold on tight, we're about to take off 🛫View More

🔥 BULLISH: The SEC and CFTC will hold a joint event next Tuesday on making the US the “crypto capital of the world.”

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.23K Popularity

7.8K Popularity

4.33K Popularity

1.97K Popularity

3.07K Popularity

Hot Gate Fun

View More- MC:$3.39KHolders:10.00%

- MC:$3.38KHolders:10.00%

- MC:$3.38KHolders:10.00%

- MC:$3.39KHolders:10.00%

- MC:$3.39KHolders:10.00%

News

View MoreAnalysis: Ethereum mainnet activity has surpassed multiple L2s, but this may be related to the rise of address poisoning attacks.

12 m

A whale deposited 1.53 million USDC into Hyperliquid and then purchased XAUT

21 m

Data: 1340.06 PAXG transferred from an anonymous address, worth approximately $6.62 million

33 m

11 Wall Street analysts predict that Strategy's stock target price could exceed $440 within the year

34 m

A certain whale bought 566.8 XAUT from CEX in the past 2 days, worth nearly $2.8 million.

39 m

Pin

Gate ELSA Futures Trading Challenge is Now Live!

Share a 200,000 USDT Prize Pool

💰 Get 20 USDT for your first futures trade

🏆 Trade to share 160,000 USDT!

join now: https://www.gate.com/campaigns/3911

Announcement link: https://www.gate.com/announcements/article/49432

#ELSA #FuturesTrading #GateStrike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889