Post content & earn content mining yield

placeholder

laniakea

hffdbbbvvfddfhjnmmmntttfrrrghnnnnmhgfffhnnbbhgfgbbggffffghjhhggtrrrthhjjjhjjjugffffggggggtrfffggggggfff#GateSquare$50KRedPacketGiveaway

- Reward

- 2

- 9

- Repost

- Share

GateUser-b4b88d3c :

:

Bull Run 🐂View More

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLURAQPZVQ

View Original

- Reward

- like

- Comment

- Repost

- Share

PS

PowerShell

Created By@Kp_dollar

Subscription Progress

0.00%

MC:

$0

More Tokens

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=A1ZAU1Fa

View Original

- Reward

- 1

- 2

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 7

- 11

- Repost

- Share

MagpieBridgeJungle :

:

Then why isn't it increasing?View More

Start the Year of the Horse with a win! Gate Plaza's $50,000 Red Envelope Rain is waiting for you to post and throw https://www.gate.com/campaigns/4044?ref=VFNFAFoL&ref_type=132

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVKXV1EMVG

View Original

- Reward

- like

- Comment

- Repost

- Share

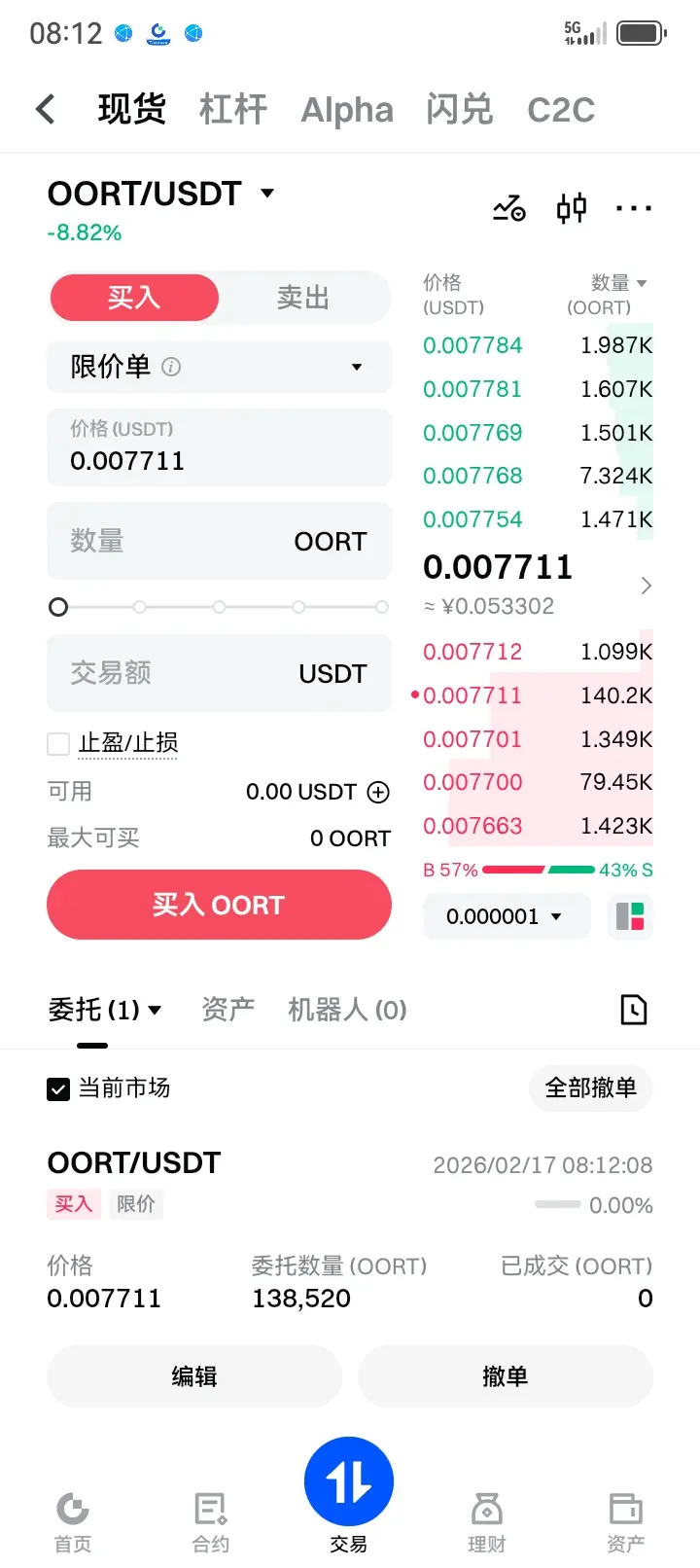

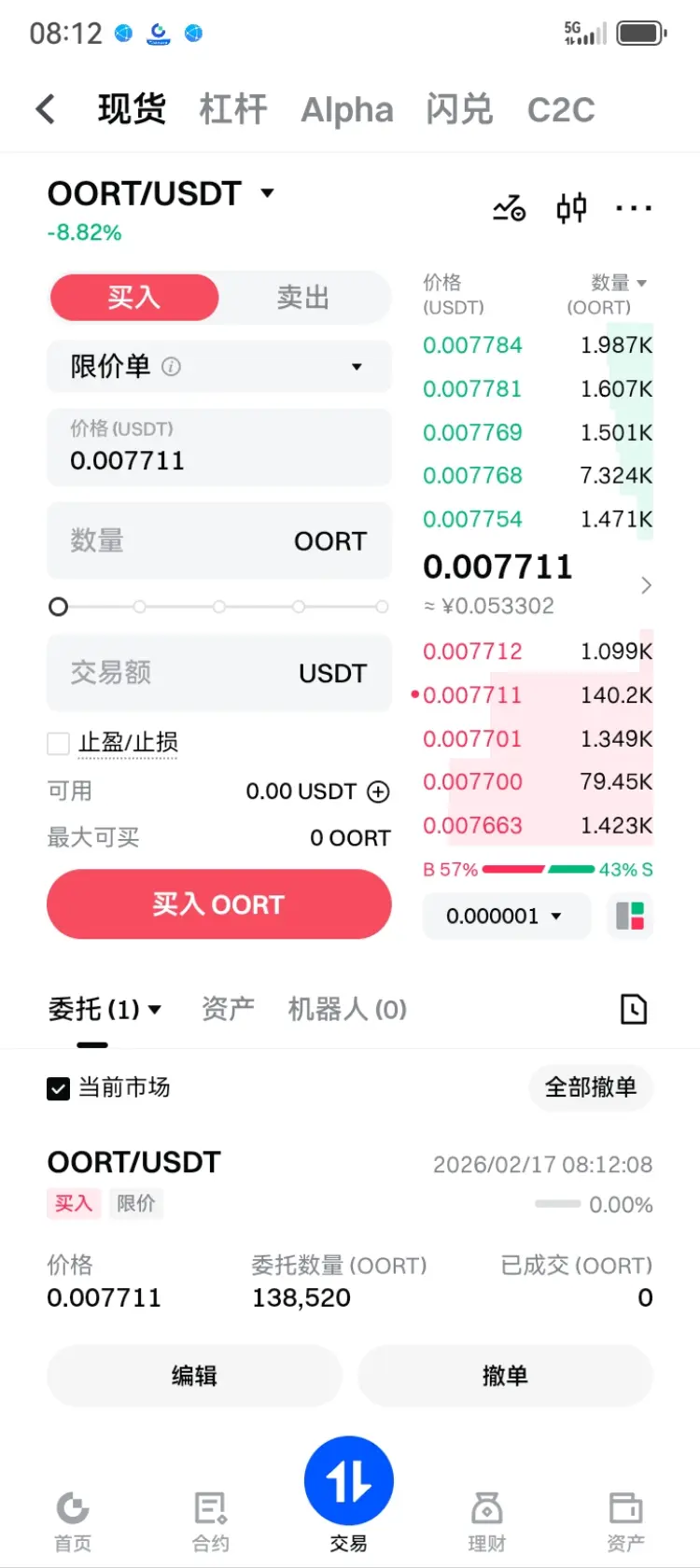

There's no way out now; I can only persevere to the end and complete the last order.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

Musk666 :

:

Completely without a bottom line, are you still buying?BML

白龙马

Created By@LittleWhiteDragon

Subscription Progress

0.00%

MC:

$0

More Tokens

Many personalities in the stock world have subscription channels for recommendations, consultations, instructions, or news analysis—"even Trump's kids."

Most foreigners' channels focus solely on Bitcoin analysis, charging a monthly or annual fee, with thousands of subscribers.

Michael Perry, a technical analyst and "multi-millionaire" who owns $300 million in the American stock market, has a recommendation channel with over 200,000 subscribers and an annual income of $133 million from subscriptions alone.

️ Why does he have a recommendation channel if he's a millionaire and makes money from tr

View OriginalMost foreigners' channels focus solely on Bitcoin analysis, charging a monthly or annual fee, with thousands of subscribers.

Michael Perry, a technical analyst and "multi-millionaire" who owns $300 million in the American stock market, has a recommendation channel with over 200,000 subscribers and an annual income of $133 million from subscriptions alone.

️ Why does he have a recommendation channel if he's a millionaire and makes money from tr

- Reward

- like

- Comment

- Repost

- Share

AIBT Protecting Cross-Border Freelancers. AI acts as a digital supervisor, automatically comparing code submissions or design results to ensure they meet contractual standards; blockchain uses multi-signature vaults and smart contracts to automatically release payments upon acceptance, eliminating high cross-border remittance fees and the risk of chargebacks, while establishing an immutable professional reputation score. $AIBT #AIBT

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Alpha Score Speedrun Graduation Day Welcome

- Reward

- like

- Comment

- Repost

- Share

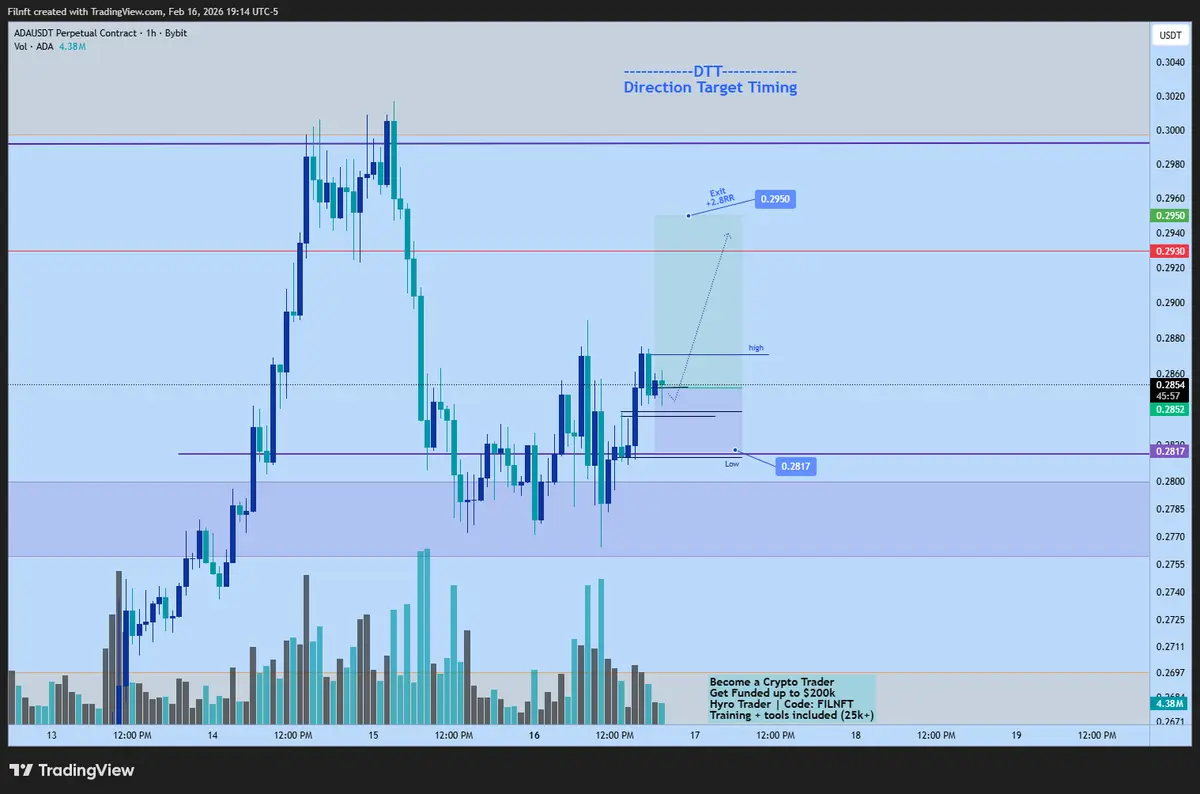

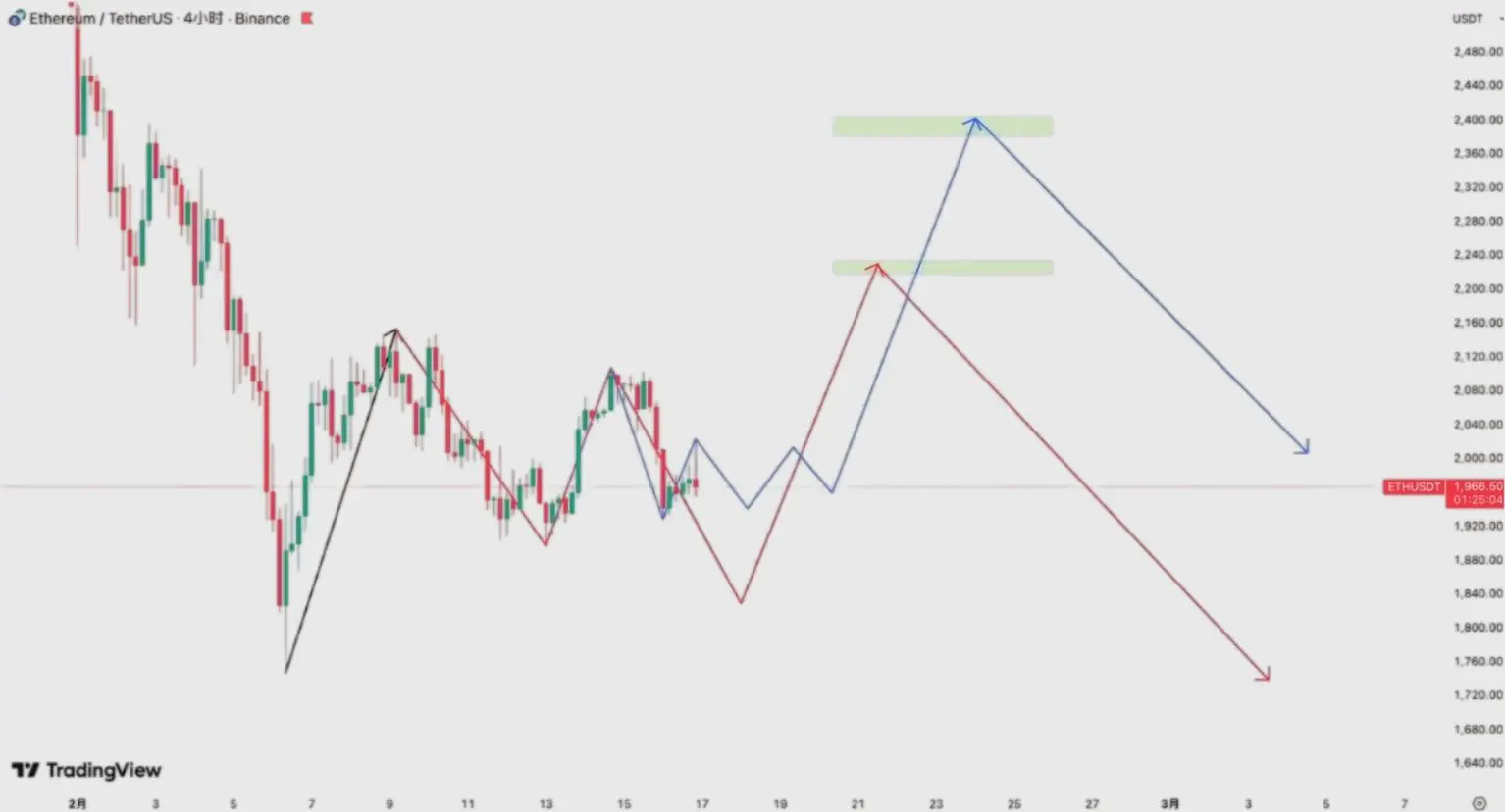

Since the evening of February 5th, when ETH's decline appeared to be ending and a rebound began, ETH has risen from 1748 to around 2152, an increase of over 23%. This segment of the market is marked by the black line in the chart. The decline starting at 2152 is still viewed as an adjustment structure rather than a new downtrend.

Currently, I will maintain the Sunday video approach and refine it further—there are two possible future trajectories for ETH:

Red: ETH may undergo a deep adjustment this week, with the correction ending below 1897 but above 1747. Under this scenario, the subsequent u

Currently, I will maintain the Sunday video approach and refine it further—there are two possible future trajectories for ETH:

Red: ETH may undergo a deep adjustment this week, with the correction ending below 1897 but above 1747. Under this scenario, the subsequent u

ETH1,06%

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AlESVVld

View Original

- Reward

- like

- Comment

- Repost

- Share

#GateSquare$50KRedPacketGiveaway mkjjjjjjjjjjjjjjhjjlişşjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjjkkklşşkhhjjjjjjjjjjjjjjjjjjjjjjjjhfffggggg

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More160.71K Popularity

31.59K Popularity

28.08K Popularity

74.07K Popularity

13.83K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.53KHolders:20.00%

- MC:$2.5KHolders:10.00%

- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

News

View MoreAlchemy Pay plans to launch the Alchemy Chain L1 public chain testnet on February 23.

3 m

Spot gold and silver continue to decline in the early trading session, with gold falling below $4950 per ounce

8 m

F2Pool co-founder Wang Chun insists on bullish Bitcoin and names multiple quantum concept stocks as bearish.

11 m

BTC Breaks Through 69,000 USDT

23 m

SPACE increased by 50.80% after launching Alpha, current price 0.01146912541655347 USDT

40 m

Pin