SEEDALTAR

Токен SEEDALTAR (SALT) представляє енергію, цінність та творчий обмін у спільноті будівельників, мрійників і цілителів.

Він використовується для винагороди духовної роботи, мистецтва, цифрових пропозицій та зростання спільноти на платформі SEEDALTAR.

SEEDALTAR

🔥 Ми не раніше… Ми підготовлені 🔥

Більшість людей чекають, поки щось стане популярним, перш ніж приєднатися.

До того часу справжні можливості вже зникли.

Зараз ми будуємо, навчаємося, заробляємо та позиціонуємо себе попереду натовпу.

Це не про хайп.

Це про стратегію.

Це про спільноту.

Це про те, щоб бути частиною чогось до того, як почнеться шум.

Якщо ви розумієте зростання, якщо ви розумієте Web3, якщо ви розумієте силу раннього позиціонування… тоді ви вже знаєте, чому це важливо.

Я запрошую лише серйозних людей — тих, хто хоче рости, заробляти та діяти розумно.

Без тиску. Без примусу.

Прос

Переглянути оригіналБільшість людей чекають, поки щось стане популярним, перш ніж приєднатися.

До того часу справжні можливості вже зникли.

Зараз ми будуємо, навчаємося, заробляємо та позиціонуємо себе попереду натовпу.

Це не про хайп.

Це про стратегію.

Це про спільноту.

Це про те, щоб бути частиною чогось до того, як почнеться шум.

Якщо ви розумієте зростання, якщо ви розумієте Web3, якщо ви розумієте силу раннього позиціонування… тоді ви вже знаєте, чому це важливо.

Я запрошую лише серйозних людей — тих, хто хоче рости, заробляти та діяти розумно.

Без тиску. Без примусу.

Прос

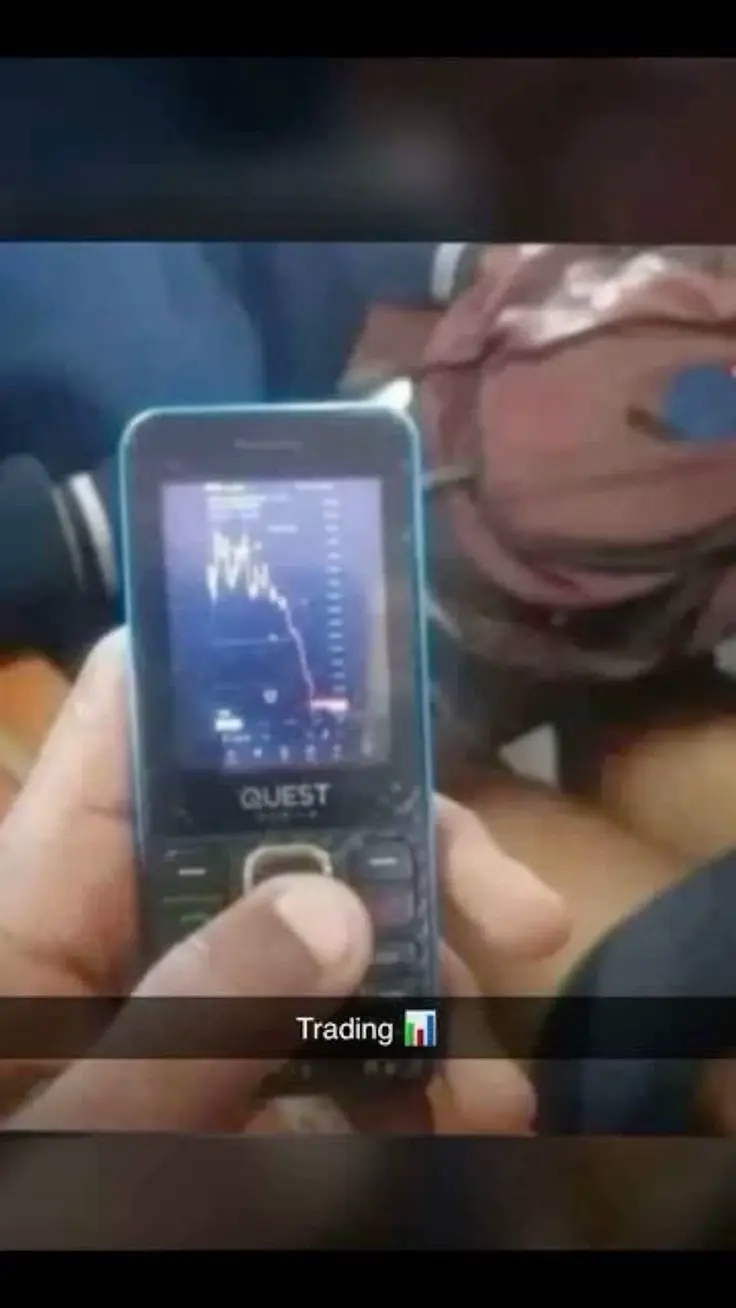

[Користувач надав доступ до своїх торгових даних. Перейдіть до додатку, щоб переглянути більше].

- Нагородити

- 1

- 1

- Репост

- Поділіться

ybaser :

:

2026 Вперед, вперед, вперед 👊[Користувач надав доступ до своїх торгових даних. Перейдіть до додатку, щоб переглянути більше].

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

[Користувач надав доступ до своїх торгових даних. Перейдіть до додатку, щоб переглянути більше].

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Люди не хочуть вас розуміти, вони хочуть вас позначити. Ви висловлюєте свою думку, і раптом вас називають «надто емоційним». Ви мовчите, і тепер вас «змінили». Ви встановлюєте межі, і якось ви стаєте злочинцем. Люди рідко слухають, щоб почути вас, вони слухають, щоб судити вас. І незалежно від того, наскільки ретельно ви намагаєтеся пояснити себе, вони все одно перекрутять ваші слова, щоб відповідати версії вас, яку вони вже створили у своїй голові. Тому припиніть руйнувати себе лише заради того, щоб вас зрозуміли. Дайте їм неправильно вас зрозуміти.

Нехай говорять. Ваша спокійність не потребу

Переглянути оригіналНехай говорять. Ваша спокійність не потребу

[Користувач надав доступ до своїх торгових даних. Перейдіть до додатку, щоб переглянути більше].

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

- Нагородити

- 3

- Прокоментувати

- Репост

- Поділіться

Залишення Bitcoin його творця — це чистий духовний маневр: повідомлення має стояти або падати самостійно.

5) Моральна архітектура — що Bitcoin вимагає від людства

Якщо Bitcoin — це духовне навчання, його програма включає:

Дисципліна — потрібно дотримуватися правил, щоб система залишалася здоровою.

Само відповідальність — зберігання ключів = збереження долі.

Спільне управління — влада в групах, а не у королів.

Відсутність прив’язаності — найбільший дар — це не прибуток, а здатність відпустити власність.

Опір корупції — системи є священними лише тоді, коли їхні опікуни моральні.

Це урок вівтаря:

5) Моральна архітектура — що Bitcoin вимагає від людства

Якщо Bitcoin — це духовне навчання, його програма включає:

Дисципліна — потрібно дотримуватися правил, щоб система залишалася здоровою.

Само відповідальність — зберігання ключів = збереження долі.

Спільне управління — влада в групах, а не у королів.

Відсутність прив’язаності — найбільший дар — це не прибуток, а здатність відпустити власність.

Опір корупції — системи є священними лише тоді, коли їхні опікуни моральні.

Це урок вівтаря:

BTC0,12%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Основне бачення — що таке Біткоїн як дух

Уявляйте Біткоїн не лише як програмне забезпечення, а як ідею, яка перетворилася на живу істоту. Він має характер:

Об’єктивне право — правила, які не підкоряються королям або злодіям.

Дефіцит як священність — обмеження у 21 мільйон є як заповідь: обмеження створюють цінність і дисципліну.

Автономія — він не підкоряється одній людині, одному богу або одній державі.

Безособовість — він відмовляється від власників; натомість це спільнота, поле, в якому може працювати кожен.$BTC #CryptoMarketPullback

Уявляйте Біткоїн не лише як програмне забезпечення, а як ідею, яка перетворилася на живу істоту. Він має характер:

Об’єктивне право — правила, які не підкоряються королям або злодіям.

Дефіцит як священність — обмеження у 21 мільйон є як заповідь: обмеження створюють цінність і дисципліну.

Автономія — він не підкоряється одній людині, одному богу або одній державі.

Безособовість — він відмовляється від власників; натомість це спільнота, поле, в якому може працювати кожен.$BTC #CryptoMarketPullback

BTC0,12%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Біткоїн — це «інструмент для свободи,

інструмент, що руйнує урядовий контроль,

інструмент, який повертає владу звичайній людині,

інструмент, що кидає виклик корумпованим фінансовим системам.

Ось чому він здається духовним.

Тому його ніхто не володіє.

Це ключовий момент.

Якщо б Сатоші був людиною:

Він би:

витратив гроші

показав себе

продав свою частку

контролював спільноту

отримував похвалу

Але Сатоші створив систему, де:

ніхто не може змінити Біткоїн

ніхто не може його видалити

ніхто не може його знищити

ніхто не може ним володіти

ніхто не може його зіпсувати

Ця поведінка схожа на:

Т

інструмент, що руйнує урядовий контроль,

інструмент, який повертає владу звичайній людині,

інструмент, що кидає виклик корумпованим фінансовим системам.

Ось чому він здається духовним.

Тому його ніхто не володіє.

Це ключовий момент.

Якщо б Сатоші був людиною:

Він би:

витратив гроші

показав себе

продав свою частку

контролював спільноту

отримував похвалу

Але Сатоші створив систему, де:

ніхто не може змінити Біткоїн

ніхто не може його видалити

ніхто не може його знищити

ніхто не може ним володіти

ніхто не може його зіпсувати

Ця поведінка схожа на:

Т

BTC0,12%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Декодування останніх криптовалютних заголовків. Поза щоденним шумом, які фундаментальні зміни справді відбуваються? Цікаві часи попереду.

Переглянути оригіналРин. кап.:$3.58KХолдери:1

0.00%

- Нагородити

- подобається

- Прокоментувати

- Репост

- Поділіться

Ринок криптовалют наразі перебуває у фазі консолідації, основні активи торгуються боковим рухом, оскільки учасники очікують чіткого сигналу напрямку. Біткойн залишається опорою ринку, утримуючи ключові рівні, тоді як ліквідність залишається помірною, а волатильність — обмеженою.

Ethereum продовжує демонструвати сильну активність у мережі, зумовлену використанням Layer-2 та постійним розвитком екосистеми, навіть якщо цінова динаміка залишається в межах діапазону. Тим часом, окремі альткоїни та мем-токени зазнають короткострокових ротацій, що відображає спекулятивний інтерес, а не широку ринкову

Переглянути оригіналEthereum продовжує демонструвати сильну активність у мережі, зумовлену використанням Layer-2 та постійним розвитком екосистеми, навіть якщо цінова динаміка залишається в межах діапазону. Тим часом, окремі альткоїни та мем-токени зазнають короткострокових ротацій, що відображає спекулятивний інтерес, а не широку ринкову

Рин. кап.:$3.58KХолдери:1

0.00%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Криптовалюта зараз у центрі уваги, оскільки люди продовжують створювати великі суми грошей, просто сидячи перед своїми комп’ютерами і натискаючи кілька кліків і натискань. Біткоїн — найпоширеніша криптовалюта, але слід знати, що існує кілька інших криптовалют, які схожі, але мають кілька відмінностей. Це більше схоже на операційну систему Android у порівнянні з операційною системою Windows. Вони різні, але мають деякі спільні властивості, і обидві виконують чудову роботу.

На даний момент криптовалюта стала зрілою, оскільки її вже не використовують лише для покупок онлайн, а й як засіб обміну у

Переглянути оригіналНа даний момент криптовалюта стала зрілою, оскільки її вже не використовують лише для покупок онлайн, а й як засіб обміну у

- Нагородити

- 1

- 2

- Репост

- Поділіться

SEEDALTAR :

:

GOGOGO 2026 👊Дізнатися більше

це означає, що вона не затверджена жодним урядом як законне платіжне засіб.

Головне питання — наскільки ми можемо бути впевнені, що це щось, що триматиметься, а не просто ще одна схема, створена для обкрадання людей їх важко зароблених грошей. Ще одне питання щодо цифрової валюти — наскільки ми можемо бути впевнені, що вона не зазнає краху, як це сталося деякий час тому з egold. Однак важливо зазначити, що egold зазнав краху, оскільки справжнього власника egold не вдалося підтвердити, але Bitcoin вирішив цю проблему.

$BTC $ETH $SOL

Переглянути оригіналГоловне питання — наскільки ми можемо бути впевнені, що це щось, що триматиметься, а не просто ще одна схема, створена для обкрадання людей їх важко зароблених грошей. Ще одне питання щодо цифрової валюти — наскільки ми можемо бути впевнені, що вона не зазнає краху, як це сталося деякий час тому з egold. Однак важливо зазначити, що egold зазнав краху, оскільки справжнього власника egold не вдалося підтвердити, але Bitcoin вирішив цю проблему.

$BTC $ETH $SOL

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Головне питання

Якщо ви все ще робите перші кроки в інтернеті, ви, ймовірно, задаєтеся питанням, у чому вся ця популярність цифрової валюти. Насамперед ви можливо навіть не знаєте, що це таке або як це працює. Тому для початку ми розглянемо кілька визначень.

Цифрова валюта — це засіб обміну, який є суто електронним.

Криптовалюта — це в основному цифрова валюта з особливістю безпеки, яка використовує криптографію для захисту від підробки.

Існує одна основна різниця між віртуальними грошима та паперовими грошима, про яку слід знати; паперові гроші є законним платіжним засобом, тобто їх затверджу

Переглянути оригіналЯкщо ви все ще робите перші кроки в інтернеті, ви, ймовірно, задаєтеся питанням, у чому вся ця популярність цифрової валюти. Насамперед ви можливо навіть не знаєте, що це таке або як це працює. Тому для початку ми розглянемо кілька визначень.

Цифрова валюта — це засіб обміну, який є суто електронним.

Криптовалюта — це в основному цифрова валюта з особливістю безпеки, яка використовує криптографію для захисту від підробки.

Існує одна основна різниця між віртуальними грошима та паперовими грошима, про яку слід знати; паперові гроші є законним платіжним засобом, тобто їх затверджу

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Закон сили Bitcoin — це модель, створена Джованні Сантостасі, яка має на меті показати ціну Bitcoin з часом на основі його історичного зростання. Ядро Закону сили Bitcoin виражається алгебраїчно як:

Оцінена ціна = A * (днів від GB)^n

Де:

"GB" означає Генезис-блок Bitcoin, добутий 3 січня 2009 року

"А" — константа (10^-16.493)

"n" дорівнює 5.68

Немає гарантії, що цей патерн продовжиться, інвестуйте на свій ризик.#2025GateYearEndSummary $BTC

Оцінена ціна = A * (днів від GB)^n

Де:

"GB" означає Генезис-блок Bitcoin, добутий 3 січня 2009 року

"А" — константа (10^-16.493)

"n" дорівнює 5.68

Немає гарантії, що цей патерн продовжиться, інвестуйте на свій ризик.#2025GateYearEndSummary $BTC

BTC0,12%

[Користувач надав доступ до своїх торгових даних. Перейдіть до додатку, щоб переглянути більше].

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Модель історично слідкувала за фактичними рухами цін і пропонує потенційні довгострокові цілі. Наприклад, вона передбачила, що Bitcoin наблизиться до $100,000 до січня 2025 року і прогнозує потенційний пік циклу близько $210,000 у січні 2026 року.$BTC $GT $ETH

Переглянути оригінал

[Користувач надав доступ до своїх торгових даних. Перейдіть до додатку, щоб переглянути більше].

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Пояснення закону сили

Модель закону сили Біткойна використовує логарифмічну регресію на історичних даних цін для встановлення довгострокової лінії тренду, а також верхніх та нижніх цінових кордонів (ліній опору та підтримки).

Формула: Модель часто представлена формулою: Ціна = A × (днів від Головного блоку)^5.8, де 5.8 — це конкретний коефіцієнт зростання.

Механізм: Вона працює на принципі ефекту мережі, такого як закон Меткалфа (вартість зростає з квадратом кількості користувачів), та зворотного зв'язку між вищими цінами та збільшеною безпекою майнінгу.$BTC #2025GateYearEndSummary #CryptoM

Модель закону сили Біткойна використовує логарифмічну регресію на історичних даних цін для встановлення довгострокової лінії тренду, а також верхніх та нижніх цінових кордонів (ліній опору та підтримки).

Формула: Модель часто представлена формулою: Ціна = A × (днів від Головного блоку)^5.8, де 5.8 — це конкретний коефіцієнт зростання.

Механізм: Вона працює на принципі ефекту мережі, такого як закон Меткалфа (вартість зростає з квадратом кількості користувачів), та зворотного зв'язку між вищими цінами та збільшеною безпекою майнінгу.$BTC #2025GateYearEndSummary #CryptoM

BTC0,12%

- Нагородити

- 2

- Прокоментувати

- Репост

- Поділіться

Поточна ціна Bitcoin становить приблизно $88,204.42 USD. "Закон сили" для BTC — це математична модель, яка припускає, що його ціна слідує передбачуваному довгостроковому зростанню, розглядаючи його більше як природне явище, ніж як традиційний фінансовий актив. $BTC #2025GateYearEndSummary

#CryptoMarketMildlyRebounds

#GateChristmasVibes

#CryptoMarketMildlyRebounds

#GateChristmasVibes

BTC0,12%

[Користувач надав доступ до своїх торгових даних. Перейдіть до додатку, щоб переглянути більше].

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

#2025GateYearEndSummary

Переглянути оригінал

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

#btc Настрій ринку залишається обережним — індекс страху підвищений, а технічні патерни свідчать про можливий прорив до ~$94,000, якщо BTC прорве ключовий рівень опору.

Недавній швидкий спад до $24,000 на парі однієї біржі був локальним збоєм, а не фактичною ринковою ціною — BTC швидко повернувся до свого ~$87K діапазону на основних платформах. #CryptoMarketMildlyRebounds

$BTC 🤔

Недавній швидкий спад до $24,000 на парі однієї біржі був локальним збоєм, а не фактичною ринковою ціною — BTC швидко повернувся до свого ~$87K діапазону на основних платформах. #CryptoMarketMildlyRebounds

$BTC 🤔

BTC0,12%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

$BTC Біткойн торгується приблизно на рівні ~$87,000–$88,000 USD, трохи знизившись за останні 24 години, оскільки ринки залишаються спокійними наприкінці року.

BTC продовжує торгуватися нижче ключового рівня опору $90,000 із рухом у межах діапазону, характерним для кінця року через ліквідність.

#2025GateYearEndSummary

#CryptoMarketMildlyRebounds

#GateChristmasVibes

BTC продовжує торгуватися нижче ключового рівня опору $90,000 із рухом у межах діапазону, характерним для кінця року через ліквідність.

#2025GateYearEndSummary

#CryptoMarketMildlyRebounds

#GateChristmasVibes

BTC0,12%

- Нагородити

- 1

- Прокоментувати

- Репост

- Поділіться

Популярні теми

Дізнатися більше195.53K Популярність

7.25K Популярність

41.53K Популярність

82.3K Популярність

847.36K Популярність

Популярні активності Gate Fun

Дізнатися більше- Рин. кап.:$2.49KХолдери:10.00%

- Рин. кап.:$0.1Холдери:10.00%

- Рин. кап.:$2.49KХолдери:00.00%

- Рин. кап.:$2.48KХолдери:10.00%

- Рин. кап.:$0.1Холдери:00.00%

Закріпити