Publique conteúdos e ganhe rendimentos da extração de conteúdos

placeholder

HighAmbition

#CLARITYBillDelayed

Outro revés importante para a regulamentação de criptomoedas nos EUA: a Lei CLARITY (Lei de Clareza do Mercado de Ativos Digitais) — o projeto de lei tão aguardado que finalmente traria regras claras para os mercados de criptomoedas, stablecoins, DeFi e a divisão de supervisão entre SEC e CFTC — foi novamente adiado no Senado.

Para a indústria de criptomoedas, isto é frustrante, mas altamente consequential, não só para DeFi e stablecoins, mas também para o Bitcoin (BTC), que está intimamente ligado ao sentimento do mercado dos EUA, liquidez e clareza regulatória.

Atualizaç

Ver originalOutro revés importante para a regulamentação de criptomoedas nos EUA: a Lei CLARITY (Lei de Clareza do Mercado de Ativos Digitais) — o projeto de lei tão aguardado que finalmente traria regras claras para os mercados de criptomoedas, stablecoins, DeFi e a divisão de supervisão entre SEC e CFTC — foi novamente adiado no Senado.

Para a indústria de criptomoedas, isto é frustrante, mas altamente consequential, não só para DeFi e stablecoins, mas também para o Bitcoin (BTC), que está intimamente ligado ao sentimento do mercado dos EUA, liquidez e clareza regulatória.

Atualizaç

- Recompensa

- 5

- 9

- Republicar

- Partilhar

repanzal :

:

Comprar Para Ganhar 💎Ver mais

Este China, faz-me muito triste! Todos estão muito tristes! Se você é apenas um apostador especulador no mundo das criptomoedas, não entenderá o peso das duas palavras "China" no meu coração, essas duas palavras são mais pesadas do que montanhas na maioria das pessoas, por isso eu compro, mantenho firmemente.

Ver original

LM:$6.52KTitulares:825

0.00%

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

A seguir, opiniões puramente entediantes, longas e malcheirosas

Perspetivas do mercado de criptomoedas no fim de semana: volatilidade, estrutura e zonas de oportunidade

Este fim de semana, o mercado de criptomoedas está a entrar numa fase crucial de estabilidade e consolidação. A pressão de venda está a diminuir gradualmente, a volatilidade ainda existe, mas o mercado está a digerir, a reequilibrar-se e a preparar-se para uma potencial recuperação. A questão-chave é se as moedas principais podem estabilizar-se e atrair volume de negociação. Sem isso, o espaço de subida ainda é temporário, e o

Ver originalPerspetivas do mercado de criptomoedas no fim de semana: volatilidade, estrutura e zonas de oportunidade

Este fim de semana, o mercado de criptomoedas está a entrar numa fase crucial de estabilidade e consolidação. A pressão de venda está a diminuir gradualmente, a volatilidade ainda existe, mas o mercado está a digerir, a reequilibrar-se e a preparar-se para uma potencial recuperação. A questão-chave é se as moedas principais podem estabilizar-se e atrair volume de negociação. Sem isso, o espaço de subida ainda é temporário, e o

- Recompensa

- gostar

- 1

- Republicar

- Partilhar

鎏年似水 :

:

Sente-se confortavelmente, a decolagem é iminente 🛫芝麻传奇

芝麻传奇之路

Criado por@gatefunuser_e111

Progresso da listagem

100.00%

LM:

$7.38K

Criar o meu token

$FARTCOIN $FARTCOIN /USDT — Quebra de alta em observação 🚀

Ação de preço:

FARTCOIN defendeu a zona de procura de 0.352 e rebotou de forma acentuada, agora consolidando acima da resistência de faixa média — uma configuração construtiva para continuação.

Níveis-chave:

Zona de suporte: 0.365 – 0.360

Pivô atual: 0.375

Resistência à quebra: 0.385 – 0.395

Configuração de negociação (Bias de compra):

Entrada: 0.370 – 0.378 na retração e manutenção

ou quebra confirmada acima de 0.395

Alvos:

🎯 T1: 0.395

🎯 T2: 0.420

🎯 T3: 0.450

Stop Loss: 0.352 (abaixo da invalidação da estrutura)

Sentimento de merc

Ação de preço:

FARTCOIN defendeu a zona de procura de 0.352 e rebotou de forma acentuada, agora consolidando acima da resistência de faixa média — uma configuração construtiva para continuação.

Níveis-chave:

Zona de suporte: 0.365 – 0.360

Pivô atual: 0.375

Resistência à quebra: 0.385 – 0.395

Configuração de negociação (Bias de compra):

Entrada: 0.370 – 0.378 na retração e manutenção

ou quebra confirmada acima de 0.395

Alvos:

🎯 T1: 0.395

🎯 T2: 0.420

🎯 T3: 0.450

Stop Loss: 0.352 (abaixo da invalidação da estrutura)

Sentimento de merc

FARTCOIN1,89%

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

✨豆豆BTC · Relatório de batalha do 41º dia ✨

✅ Capital inicial: 500U → 1413U(+182,68%)

✅ Ativos totais sob gestão: 220.312,80U

✅ Lucro/prejuízo total de seguidores: +50.702,84U

✅ Taxa de sucesso: 90% | Máximo de retração: 7,76%

✅ Retorno dos seguidores existentes: 182,68%

🔥 Limitado a 400 pessoas, poucas vagas restantes!

📌 Objetivo claro: alcançar 3000U antes do Ano Novo, vamos passar o Ano Novo juntos!

🔗 Seguir com proporção fixa, buscar vitória com estabilidade!!!

#豆豆社区 #跟单 #Reiniciar o portfólio $#豆豆军团

✅ Capital inicial: 500U → 1413U(+182,68%)

✅ Ativos totais sob gestão: 220.312,80U

✅ Lucro/prejuízo total de seguidores: +50.702,84U

✅ Taxa de sucesso: 90% | Máximo de retração: 7,76%

✅ Retorno dos seguidores existentes: 182,68%

🔥 Limitado a 400 pessoas, poucas vagas restantes!

📌 Objetivo claro: alcançar 3000U antes do Ano Novo, vamos passar o Ano Novo juntos!

🔗 Seguir com proporção fixa, buscar vitória com estabilidade!!!

#豆豆社区 #跟单 #Reiniciar o portfólio $#豆豆军团

BTC-0,1%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Visão Geral do Mercado de Criptomoedas no Fim de Semana 🚦

O mercado de criptomoedas está a entrar numa fase de estabilização e consolidação neste fim de semana.

A pressão de venda diminuiu, a volatilidade permanece, e a ação dos preços está a digerir em vez de a tendência.

🔑 Foco Principal:

O BTC e ETH conseguem manter a estrutura e atrair volume real?

Sem volume, os movimentos de alta permanecem temporários.

Abordagem de Mercado

Estou a priorizar recuperações baseadas em oscilações, não impulsos de fim de semana: • Estrutura > hype

• Níveis > emoções

• Gestão de risco > agressividade

Perspe

Ver originalO mercado de criptomoedas está a entrar numa fase de estabilização e consolidação neste fim de semana.

A pressão de venda diminuiu, a volatilidade permanece, e a ação dos preços está a digerir em vez de a tendência.

🔑 Foco Principal:

O BTC e ETH conseguem manter a estrutura e atrair volume real?

Sem volume, os movimentos de alta permanecem temporários.

Abordagem de Mercado

Estou a priorizar recuperações baseadas em oscilações, não impulsos de fim de semana: • Estrutura > hype

• Níveis > emoções

• Gestão de risco > agressividade

Perspe

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

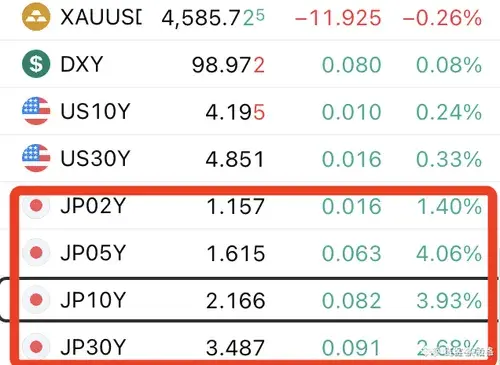

O Banco do Japão continua a subir as taxas de juros! A taxa atual de 0,75% atingiu o nível mais alto em 30 anos e pode ser aumentada novamente já em abril. O objetivo é controlar a inflação e estabilizar o iene, mas isso está a fazer com que os fundos globais retornem ao Japão, afetando tanto as ações dos EUA quanto os títulos do governo dos EUA~

Ver original

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

#Gate 2025 年终社区盛典#

Prémios de Melhor Streamer & Criador de Conteúdo do Ano

Quem será o Melhor Streamer do Ano? Quem conquistará o topo da lista de Criadores de Conteúdo? Venha votar comigo, apoie o seu streamer e criador favorito, e testemunhe o nascimento das estrelas da comunidade!

https://www.gate.com/activities/community-vote-2025?ref=VLMXVQWOVA&refType=1&refUid=19664557&ref_type=165&utm_cmp=xjdtmcgP

Ver originalPrémios de Melhor Streamer & Criador de Conteúdo do Ano

Quem será o Melhor Streamer do Ano? Quem conquistará o topo da lista de Criadores de Conteúdo? Venha votar comigo, apoie o seu streamer e criador favorito, e testemunhe o nascimento das estrelas da comunidade!

https://www.gate.com/activities/community-vote-2025?ref=VLMXVQWOVA&refType=1&refUid=19664557&ref_type=165&utm_cmp=xjdtmcgP

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Que tipo de lanche da tarde de fim de semana vocês costumam comer?

Eu começo: uma chaleira de chá Pu-erh envelhecido + as folhas de gergelim feitas pela minha mãe.

Por falar nisso, vocês já comeram folhas de gergelim?

Ver originalEu começo: uma chaleira de chá Pu-erh envelhecido + as folhas de gergelim feitas pela minha mãe.

Por falar nisso, vocês já comeram folhas de gergelim?

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Goldman Sachs Explora o Potencial Crescente dos Mercados de Previsão: Pesquisa Institucional, Narrativas Emergentes de Web3 Financeiro e Oportunidades Estratégicas para Traders e Investidores em Finanças Orientadas por Eventos

Introdução: O Foco Institucional Brilha nos Mercados de Previsão

A pesquisa recente do Goldman Sachs sobre mercados de previsão indica uma mudança notável na atenção institucional para este setor emergente de Web3. Plataformas de mercados de previsão, onde os participantes negociam contratos sobre o resultado de eventos futuros, têm sido historicamente nichos, experiment

Ver originalIntrodução: O Foco Institucional Brilha nos Mercados de Previsão

A pesquisa recente do Goldman Sachs sobre mercados de previsão indica uma mudança notável na atenção institucional para este setor emergente de Web3. Plataformas de mercados de previsão, onde os participantes negociam contratos sobre o resultado de eventos futuros, têm sido historicamente nichos, experiment

- Recompensa

- 4

- 2

- Republicar

- Partilhar

CryptoVortex :

:

boa informação que partilhouVer mais

Depois de o Bitcoin atingir os 100 mil, começará um mercado em baixa. Veja se a minha previsão está certa, para provar, hoje é 17 de janeiro de 2026.

BTC-0,1%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

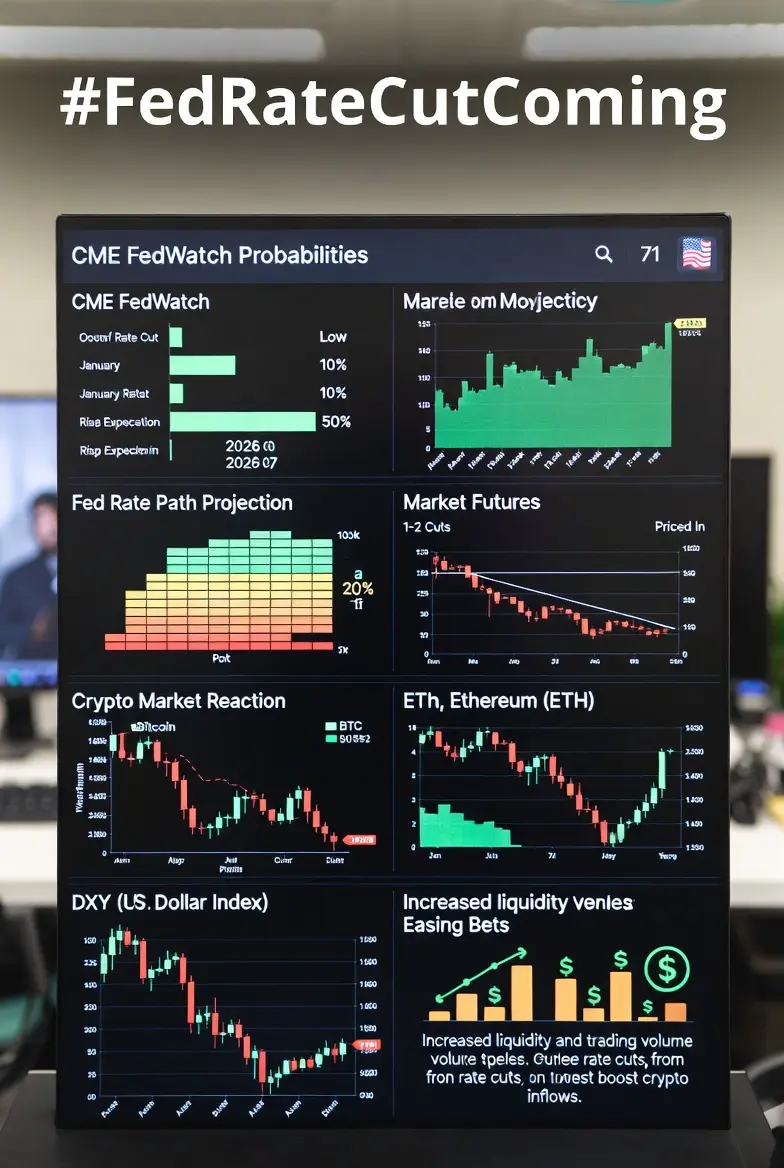

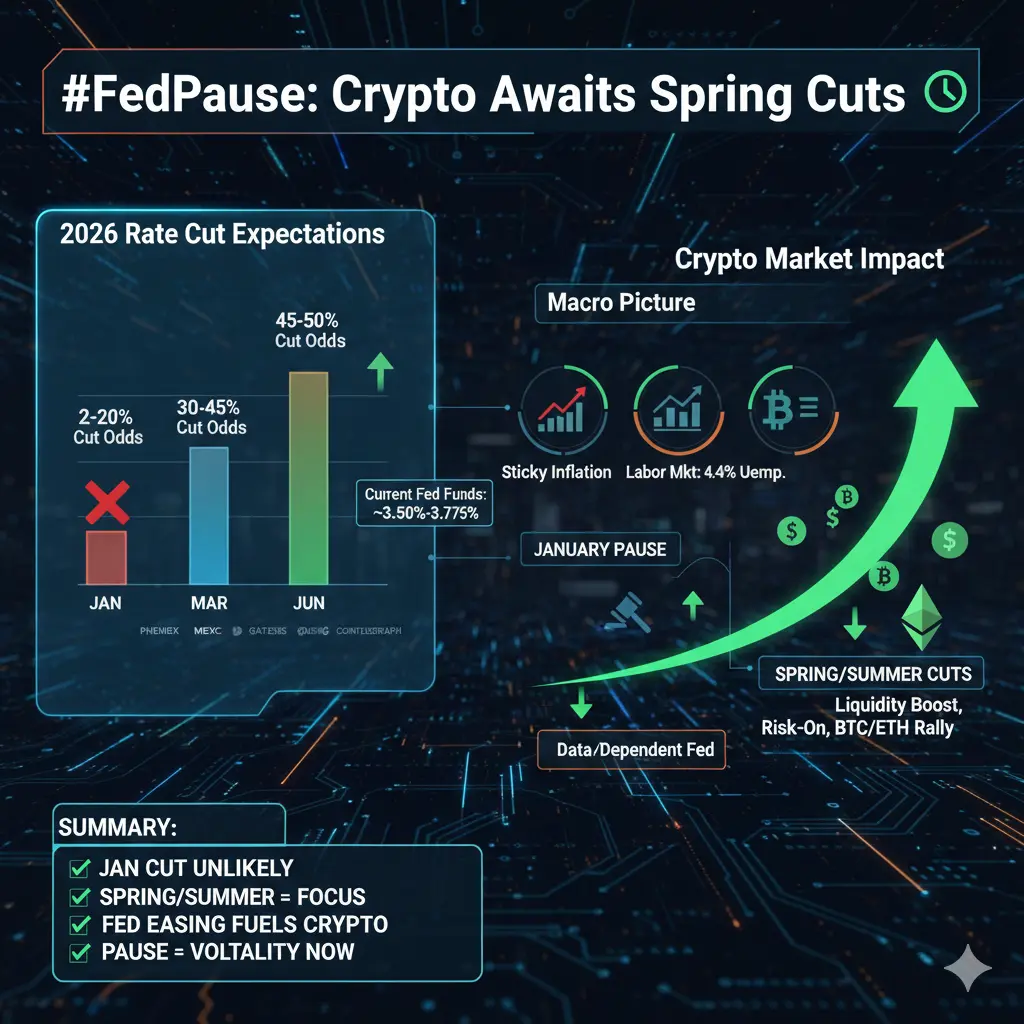

#FedRateCutComing

Taxa de Juros dos Fundos Federais Atual & Perspetiva de Curto Prazo

Após três cortes na taxa de juros pelo Fed no final de 2025, a taxa de referência dos Fundos Federais encontra-se atualmente em ~3.50%–3.75%.

Reunião do FOMC de 27–28 de janeiro: Os mercados estão a precificar esmagadoramente nenhuma redução de taxa — com apenas ~2–20% de probabilidades de um corte de 25 bp e ~80–97% de probabilidades de manter as taxas estáveis.

O Fed está a digerir uma inflação persistente (acima de 2%) e um mercado de trabalho resiliente, mas a arrefecer — desemprego estável em torno de

Ver originalTaxa de Juros dos Fundos Federais Atual & Perspetiva de Curto Prazo

Após três cortes na taxa de juros pelo Fed no final de 2025, a taxa de referência dos Fundos Federais encontra-se atualmente em ~3.50%–3.75%.

Reunião do FOMC de 27–28 de janeiro: Os mercados estão a precificar esmagadoramente nenhuma redução de taxa — com apenas ~2–20% de probabilidades de um corte de 25 bp e ~80–97% de probabilidades de manter as taxas estáveis.

O Fed está a digerir uma inflação persistente (acima de 2%) e um mercado de trabalho resiliente, mas a arrefecer — desemprego estável em torno de

- Recompensa

- 3

- 5

- Republicar

- Partilhar

repanzal :

:

GOGOGO 2026 👊Ver mais

Bom dia, Chads

Tenham um dia maravilhoso

Ver originalTenham um dia maravilhoso

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

马年财神

马年财神

Criado por@ScorpioMan

Progresso da listagem

0.09%

LM:

$3.64K

Criar o meu token

Desta vez, vou reivindicar o meu nome.

📍Alatau · Montanha do General

Ver original📍Alatau · Montanha do General

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

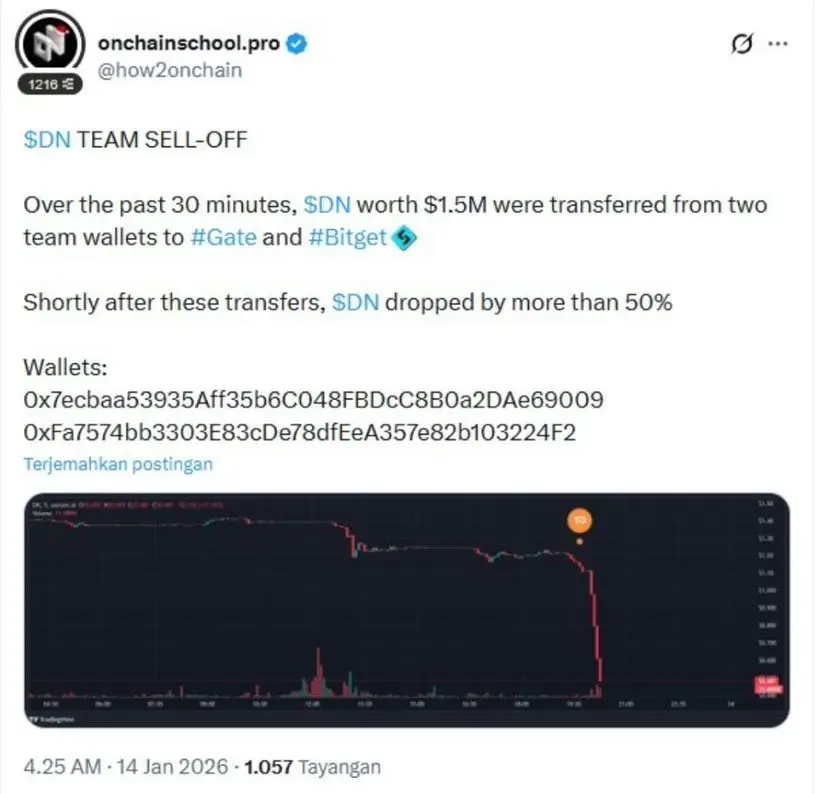

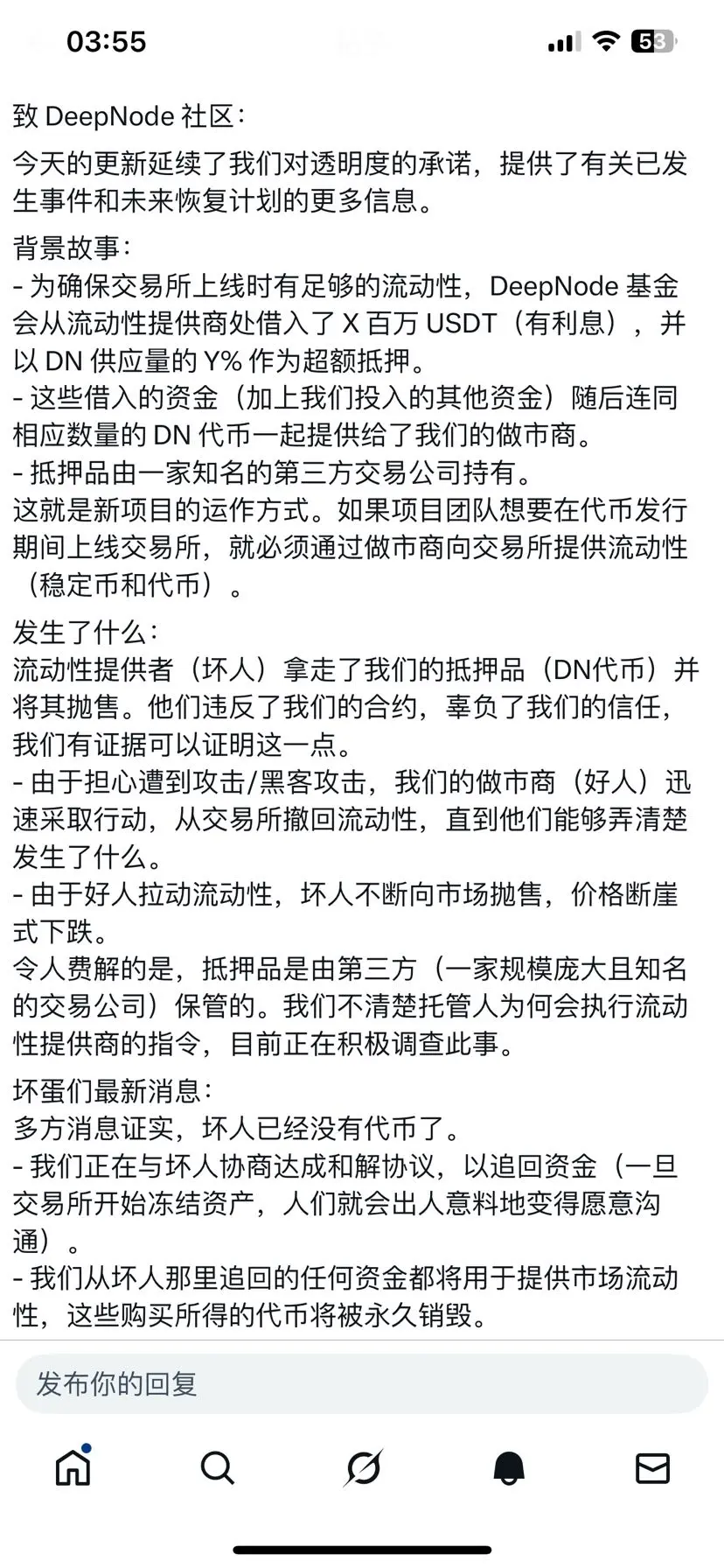

$DN ● Incoerência entre palavras e ações: o governo afirma que terceiros estão vendendo, enquanto os dados na cadeia mostram que a equipe está vendendo.

● Venda por insiders: tokens no valor de 150 mil dólares foram transferidos da carteira da equipe e despejados na exchange, um comportamento típico de insiders realizando lucros.

● Narrativa complexa: aquela declaração longa é confusa, tentando usar termos financeiros complicados (hipoteca, provedores de liquidez, market makers) para esconder o fato de que a equipe está vendendo.

Sugestões para todos:

1. Não crie ilusões: não con

● Venda por insiders: tokens no valor de 150 mil dólares foram transferidos da carteira da equipe e despejados na exchange, um comportamento típico de insiders realizando lucros.

● Narrativa complexa: aquela declaração longa é confusa, tentando usar termos financeiros complicados (hipoteca, provedores de liquidez, market makers) para esconder o fato de que a equipe está vendendo.

Sugestões para todos:

1. Não crie ilusões: não con

DN-15,66%

- Recompensa

- 1

- 4

- Republicar

- Partilhar

诺先生 :

:

A equipa tem pessoas a vender, outras a comprarVer mais

天天国人在这里意淫

1. 越是年轻越对于中国好奇(tiktok打开了白女的眼界) - Isso é verdade

2. 白女配偶区域鄙视链(英国 > 德国 + 北欧>其他欧洲> 大洋洲日韩 > 南美 > 本土黑人 > 中东 > 东南亚+中国

3. 留子群体分两类(炫富恋爱花钱撕逼类/校园nerd打工节俭类)基本都是自己圈子在玩,没什么自信也不会和本地人接触

4. 通过做饭找到一个好的室友没问题,找到一个伴侣有点难,得忽悠红州的红脖子二代,想要左翼的蓝州典型白女有点难

5. 如果tiktok上有这个trend,我倒是不奇怪,毕竟斩杀线都传到美国了,美国学贷一直都是一个问题,我见过有的人毕业了7年以上才还完学贷

Ver original1. 越是年轻越对于中国好奇(tiktok打开了白女的眼界) - Isso é verdade

2. 白女配偶区域鄙视链(英国 > 德国 + 北欧>其他欧洲> 大洋洲日韩 > 南美 > 本土黑人 > 中东 > 东南亚+中国

3. 留子群体分两类(炫富恋爱花钱撕逼类/校园nerd打工节俭类)基本都是自己圈子在玩,没什么自信也不会和本地人接触

4. 通过做饭找到一个好的室友没问题,找到一个伴侣有点难,得忽悠红州的红脖子二代,想要左翼的蓝州典型白女有点难

5. 如果tiktok上有这个trend,我倒是不奇怪,毕竟斩杀线都传到美国了,美国学贷一直都是一个问题,我见过有的人毕业了7年以上才还完学贷

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

O jackpot está ativo, estás pronto para ganhar o maior dinheiro da tua vida? Posiciona-te na Trojan e aproveita a oportunidade de ganhar o jackpot da tua vida

Ver original- Recompensa

- gostar

- 1

- Republicar

- Partilhar

LittleQueen :

:

GOGOGO 2026 👊Não estamos a acender cavalos, mas sim a encontrar uma forma concreta de consenso. No deserto da criptografia, somos como uma chama que nunca se apaga. Irmãos, mantenham-se firmes, apoiem alguns U.#周末行情分析

Ver original

[O utilizador partilhou os seus dados de negociação. Aceda à App para ver mais].

LM:$20.31KTitulares:8

51.21%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Se houver alguém que goste, pode ir brincar, o General Ma é uma figura de destaque no exército. Treinador rigoroso, os soldados são bons de batalha. Durante a guerra, lidera pelo exemplo, com olhar penetrante e comando eficaz, conquistando muitas glórias. Ele tem um coração dedicado à pátria, disposto a sacrificar a vida, sendo altamente respeitado. “patient”!.

Ver original

[O utilizador partilhou os seus dados de negociação. Aceda à App para ver mais].

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Carregar mais

Junte-se a 40M utilizadores na nossa comunidade em crescimento

⚡️ Junte-se a 40M utilizadores na discussão sobre a tendência das criptomoedas

💬 Interaja com os seus criadores favoritos

👍 Descubra o que lhe interessa

Tópicos em destaque

Ver mais2.64K Popularidade

35.06K Popularidade

21.44K Popularidade

5.44K Popularidade

4.49K Popularidade

Notícias

Ver maisProteger os desenvolvedores ou enfraquecer a regulamentação? O artigo 604 da Lei CLARITY enfrenta forte oposição do Comitê Judiciário

4 m

Ontem, o ETF de Solana à vista nos EUA teve uma saída líquida de 2,2 milhões de dólares

16 m

Bitdeer vendeu 146.8 BTC esta semana, a quantidade de Bitcoin em posse caiu para cerca de 1502 moedas

16 m

CEO do Goldman Sachs: espera-se que a Lei CLARITY ainda tenha um longo caminho a percorrer antes de fazer progressos

27 m

A cadeia de restaurantes americana Steak n' Shake investiu 10 milhões de dólares em Bitcoin, para fins de reserva estratégica

28 m

Fixar