Market Flash Crash: How On-Chain Capital Is Chasing Yield Across Perp DEXs

Last Friday evening saw the largest liquidation event on record, with $19 billion in leveraged positions wiped out in one sweep—most of this volume came from just three centralized exchanges. This event highlights an ongoing risk: the crypto industry is still far too centralized, with power and risk heavily concentrated among a few major players. It’s not simply a financial reckoning. It’s a serious test of the core principles of the crypto sector. This turmoil has set the stage for DEXs to shine. Hyperliquid has made a bold statement, positioning itself as “The House of All Finance,” which aligns with its current strategic direction. Grvt has also publicly declared its long-term goal—to become the highest-yielding exchange—establishing a unique strategic position in the perpetual contract DEX market, currently untargeted by competitors.

DEX Overview

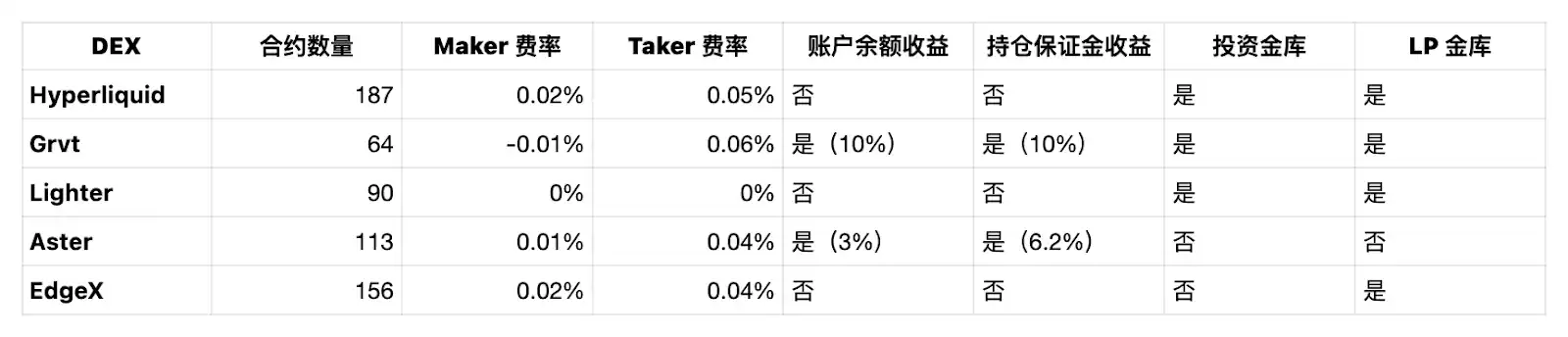

As of October 15, 2025, here’s a comparison of the base fee rates and yield features for several leading perpetual contract DEXs:

Hyperliquid currently offers the most perpetual trading pairs, while Grvt has the fewest.

However, Grvt applies a negative fee rate to Maker volume, so traders not only receive airdrop rewards for placing limit orders, but also earn USDT directly.

By comparison, even though Grvt’s Taker fee (market order fee) is the highest, it’s more valuable during points farming, since it directly affects future Grvt airdrop rewards.

For yield on balance, Grvt and Aster stand out:

· Grvt offers users a 10% annual yield (APY) on USDT trading accounts, paid in USDT;

· Aster provides a 3% APY on USDF balances, with rewards paid in USDF.

For yield on margin, Grvt and Aster also lead:

· Grvt gives users 10% APY on USDT whether it’s idle or used as margin;

· Aster rewards users with an additional 3.2% APY when USDF is used as margin, totaling 6.2% APY.

In terms of investment vaults, all platforms except Aster and EdgeX allow users to invest in internal vaults for potential returns beyond regular trading. Except for Aster, nearly every platform also provides LP (liquidity provider) vaults.

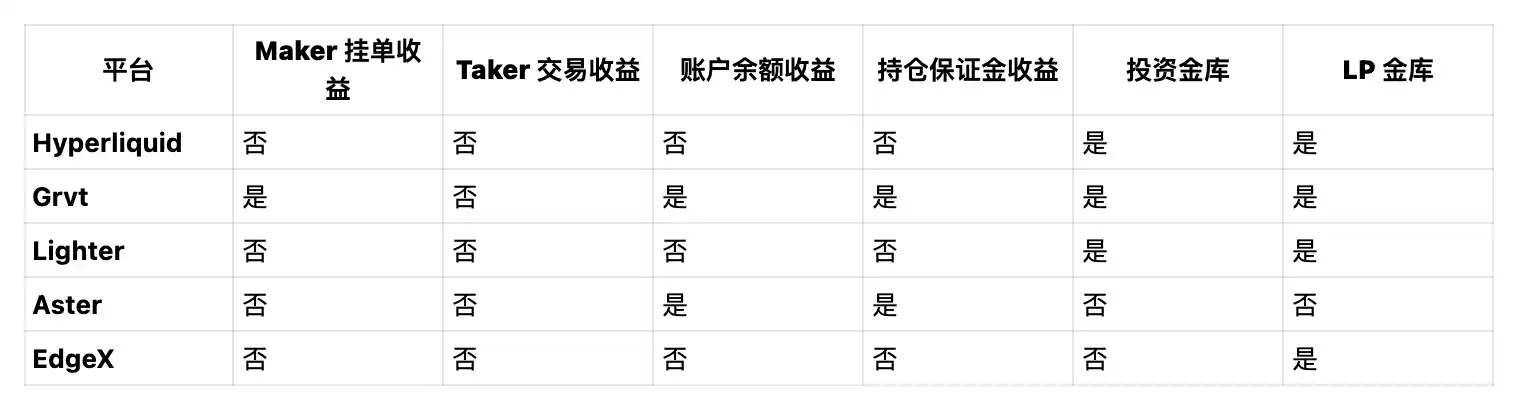

How to Earn on These DEXs (Beyond Trading and Airdrops)?

The table above shows that Grvt is currently the only perpetual DEX offering multiple yield paths beyond trading and points farming.

While Aster distinguishes itself with its unique account balance and margin yield features, it falls behind competitors in standard investment vault and LP vault offerings.

Conclusion

Grvt offers negative fee rate rewards on limit orders and top annual yields on both account balances and margin. The platform is steadily fulfilling its vision as the “highest yield trading platform.” As competition among perpetual DEXs intensifies, we can expect to see more innovative products and yield structures in the future. The outlook for decentralized perpetual contracts is increasingly promising.

Statement:

- This article is republished from [BlockBeats]. Copyright belongs to the original author [BlockBeats]. If you have concerns about this republication, please contact the Gate Learn team. We will handle your request promptly according to the relevant procedures.

- Disclaimer: The opinions and views expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Do not copy, distribute, or plagiarize these translations without referencing Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?