Post content & earn content mining yield

placeholder

EagleEye

#MiddleEastTensionsEscalate

Gold Hits $5,000 as Geopolitical Risk Spikes, Bitcoin Pulls Back: Where Are You Allocating Now?

Rising U.S.–Iran tensions are rattling markets. Gold has surged above $5,000/oz, reflecting a classic flight-to-safety, while Bitcoin and other risk assets are pulling back as traders digest uncertainty. This is one of those rare moments where macro events intersect directly with crypto and traditional markets, creating both risk and opportunity.

Gold as the Safe Haven

Gold’s move above $5,000 is no coincidence. Investors are flocking to safety amid geopolitical uncerta

Gold Hits $5,000 as Geopolitical Risk Spikes, Bitcoin Pulls Back: Where Are You Allocating Now?

Rising U.S.–Iran tensions are rattling markets. Gold has surged above $5,000/oz, reflecting a classic flight-to-safety, while Bitcoin and other risk assets are pulling back as traders digest uncertainty. This is one of those rare moments where macro events intersect directly with crypto and traditional markets, creating both risk and opportunity.

Gold as the Safe Haven

Gold’s move above $5,000 is no coincidence. Investors are flocking to safety amid geopolitical uncerta

BTC0.42%

- Reward

- 4

- 3

- Repost

- Share

marcosurf15 :

:

perfectView More

Check out Gate and join me in the hottest event! https://www.gate.com/ar/campaigns/3913?ref=VQRFXQTXBW&ref_type=132&utm_cmp=ApbojVO9

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

星星之火

星星之火

Created By@gatefunuser_936d

Listing Progress

100.00%

MC:

$3.74K

Create My Token

【$OP Signal】Empty position, waiting for selling pressure confirmation

$OP Price decline accompanied by high open interest, caution is needed for main players to offload. The current market lacks clear buy-in absorption signals, and the market logic points to a bearish dominance.

🎯 Direction: Empty position

Wait for the price to show clear signs of stabilization or volume breakout at key support zones (such as around 0.255) before making further decisions. Currently, the risk outweighs the opportunity; prioritize observation.

Trade 👇 $OP

here

---

Follow me: Get more real-time analysis and

$OP Price decline accompanied by high open interest, caution is needed for main players to offload. The current market lacks clear buy-in absorption signals, and the market logic points to a bearish dominance.

🎯 Direction: Empty position

Wait for the price to show clear signs of stabilization or volume breakout at key support zones (such as around 0.255) before making further decisions. Currently, the risk outweighs the opportunity; prioritize observation.

Trade 👇 $OP

here

---

Follow me: Get more real-time analysis and

OP-3.63%

- Reward

- like

- Comment

- Repost

- Share

Metal market bloodbath: Silver prices drop from $121 to $74. Why am I not planning to buy long-term at the moment?

View Original- Reward

- like

- Comment

- Repost

- Share

【$KAS Signal】Empty position, wait for selling pressure to be exhausted and confirmed

$KAS Price decline accompanied by high open interest, market logic suggests caution against long liquidation or main force distribution risks. Currently, there are no clear signals of selling pressure exhaustion, indicating a disorderly decline phase, and it is not advisable to buy the dip on the left side.

🎯 Direction: Short

Be patient and wait for the price action to show clear accumulation structures or signs of selling pressure exhaustion. The current market sentiment is leaning towards panic, with weak

$KAS Price decline accompanied by high open interest, market logic suggests caution against long liquidation or main force distribution risks. Currently, there are no clear signals of selling pressure exhaustion, indicating a disorderly decline phase, and it is not advisable to buy the dip on the left side.

🎯 Direction: Short

Be patient and wait for the price action to show clear accumulation structures or signs of selling pressure exhaustion. The current market sentiment is leaning towards panic, with weak

KAS-2.83%

- Reward

- 2

- 1

- Repost

- Share

I'mLost,I'mLost. :

:

New Year Wealth Explosion 🤑- Reward

- 4

- 4

- Repost

- Share

WallStreetTrendResearch :

:

As of now, Pi Coin is still better than mainstream cryptocurrencies including Bitcoin. The 4-hour chart has already broken through the downward trend, while mainstream cryptocurrencies are still in a downward channel on the 4-hour chart. A period that is too short has no reference value.View More

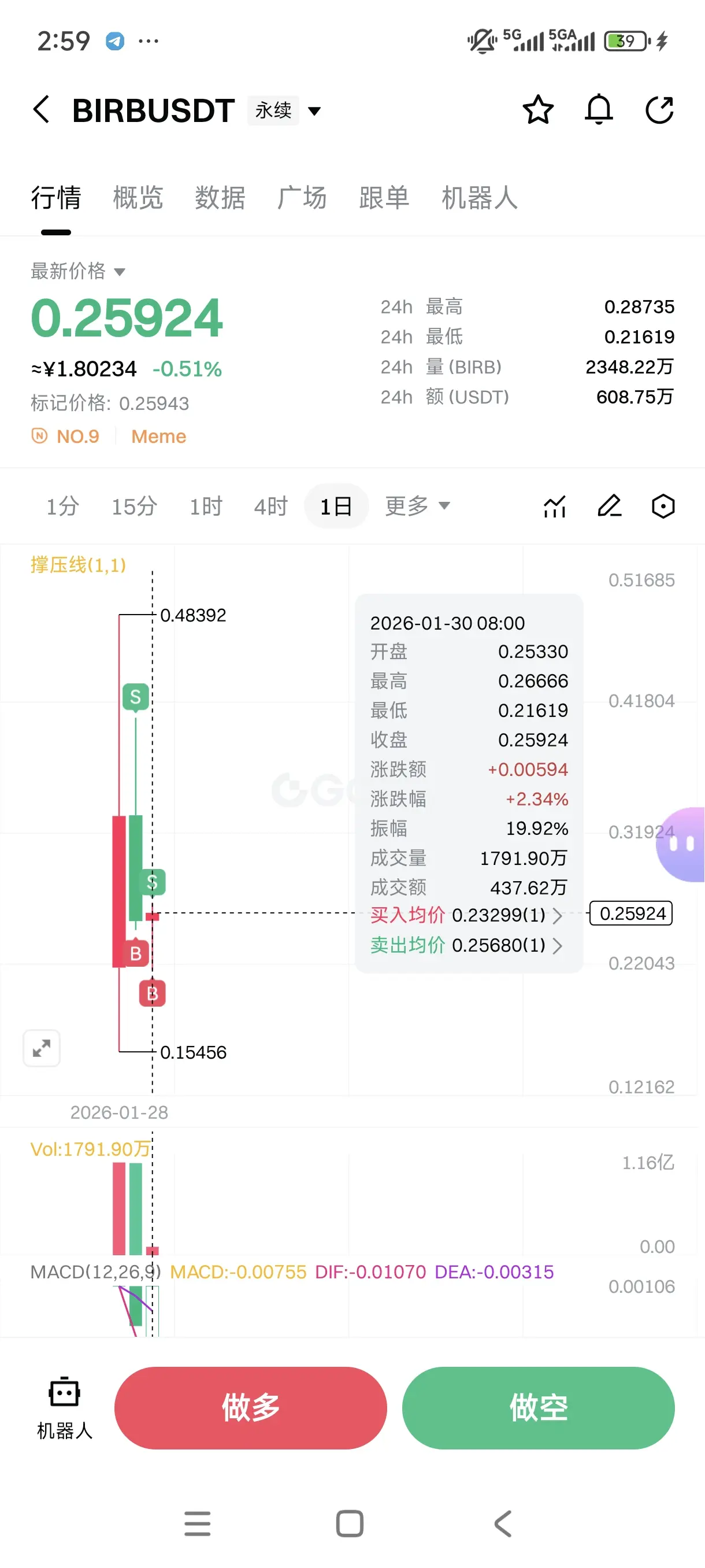

$BIRB Subscription is urgent, add around 0.22, with only about a 0.04 deviation. Click the link to enter and select the subscription: https://www.gate.com/zh/profile/Fang Han's Crypto Diary

View Original

- Reward

- 1

- 1

- Repost

- Share

CoolMomsWhoDon'tDanceInThe :

:

The cow is good. The analysis is spot on.#GoldBreaksAbove$5,500 What if I told you that maybe you’re looking in the wrong place ⁉️

For years, we’ve been taught that gold is "the safe haven" and cryptos are the roulette: a promise of fortune or ruin. But today I ask you bluntly: what if cryptos rise so much that, truly, they leave gold behind?

I’m not stating it, I’m opening the debate.

I won’t say gold is fixed nor that Bitcoin is salvation. What I want is to put on the table two realities that coexist and are sometimes ignored: the emotional function of gold (peace, tangibility) and the narrative function of cryptos (betting on gr

For years, we’ve been taught that gold is "the safe haven" and cryptos are the roulette: a promise of fortune or ruin. But today I ask you bluntly: what if cryptos rise so much that, truly, they leave gold behind?

I’m not stating it, I’m opening the debate.

I won’t say gold is fixed nor that Bitcoin is salvation. What I want is to put on the table two realities that coexist and are sometimes ignored: the emotional function of gold (peace, tangibility) and the narrative function of cryptos (betting on gr

BTC0.42%

- Reward

- 2

- Comment

- Repost

- Share

$STX The price has gently risen by 0.66%, but the key is that open interest and trading volume are expanding simultaneously. This is not retail investors chasing highs, but a clear signal of main capital entering the market or shorts being forced to cover. Market logic suggests that open interest should be considered alongside volume; the current volume-price structure is healthy, indicating that buying pressure is absorbing supply.

🎯Direction: Long

🎯Entry: 0.2860 - 0.2920

🛑Stop Loss: 0.2780 (Rigid Stop Loss)

🚀Target 1: 0.3050

🚀Target 2: 0.3180

The price is gradually rising with a signifi

🎯Direction: Long

🎯Entry: 0.2860 - 0.2920

🛑Stop Loss: 0.2780 (Rigid Stop Loss)

🚀Target 1: 0.3050

🚀Target 2: 0.3180

The price is gradually rising with a signifi

STX1.67%

- Reward

- like

- Comment

- Repost

- Share

℉

℉

Created By@ListeningToOthers'Stories

Listing Progress

0.00%

MC:

$3.22K

Create My Token

#GateLiveMiningProgramPublicBeta

#GateLiveMiningProgramPublicBeta is NOW OPEN!

Step into the future of crypto mining with Gat, the visionary hub leading the way! Experience mining like never before through the Gate Live Mining Program, and enjoy the world-class facilities at Gate Square and Gate Plaza—where innovation meets excellence.

💎 Why this is unmissable:

Live mining experience with complete transparency

Exclusive early access to advanced tools and updates

Exciting rewards, bonuses, and surprises for beta participants

Operate in a world-class environment at Gate Square—a landmark of cu

#GateLiveMiningProgramPublicBeta is NOW OPEN!

Step into the future of crypto mining with Gat, the visionary hub leading the way! Experience mining like never before through the Gate Live Mining Program, and enjoy the world-class facilities at Gate Square and Gate Plaza—where innovation meets excellence.

💎 Why this is unmissable:

Live mining experience with complete transparency

Exclusive early access to advanced tools and updates

Exciting rewards, bonuses, and surprises for beta participants

Operate in a world-class environment at Gate Square—a landmark of cu

GAT-2.42%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊Here, we have compiled different styles of motivational quotes in the crypto world, balancing emotional reassurance, investment cognition, and inspirational motivation, while also including risk warnings. You can choose according to your needs. Yesterday, we adopted a high-position trading strategy, and the market once again moved as expected. In the afternoon, Bitcoin and Ethereum surged to around 83,300 and 2,760 respectively for entry. Overnight, the market fluctuated downward, with the lowest reaching around 81,800 and 2,640.

The direct cause of this market crash was a sudden shift in Fe

View OriginalThe direct cause of this market crash was a sudden shift in Fe

- Reward

- like

- Comment

- Repost

- Share

this is a monthly chartwhat we thinking? up or down?

- Reward

- like

- Comment

- Repost

- Share

#CryptoRegulationNewProgress

Global crypto markets are witnessing significant regulatory advancements in 2026, reflecting governments’ efforts to balance innovation with investor protection. These developments are shaping trading behavior, market transparency, and institutional participation.

Key Drivers:

Regulatory Clarity: Clearer guidelines reduce legal uncertainty for exchanges and traders, enabling smoother onboarding of institutional investors.

Enhanced Compliance: New standards for KYC, AML, and token listing improve market integrity and reduce fraudulent activity.

Cross-Border Coopera

Global crypto markets are witnessing significant regulatory advancements in 2026, reflecting governments’ efforts to balance innovation with investor protection. These developments are shaping trading behavior, market transparency, and institutional participation.

Key Drivers:

Regulatory Clarity: Clearer guidelines reduce legal uncertainty for exchanges and traders, enabling smoother onboarding of institutional investors.

Enhanced Compliance: New standards for KYC, AML, and token listing improve market integrity and reduce fraudulent activity.

Cross-Border Coopera

DEFI-3.58%

- Reward

- 3

- 2

- Repost

- Share

SheenCrypto :

:

2026 GOGOGO 👊View More

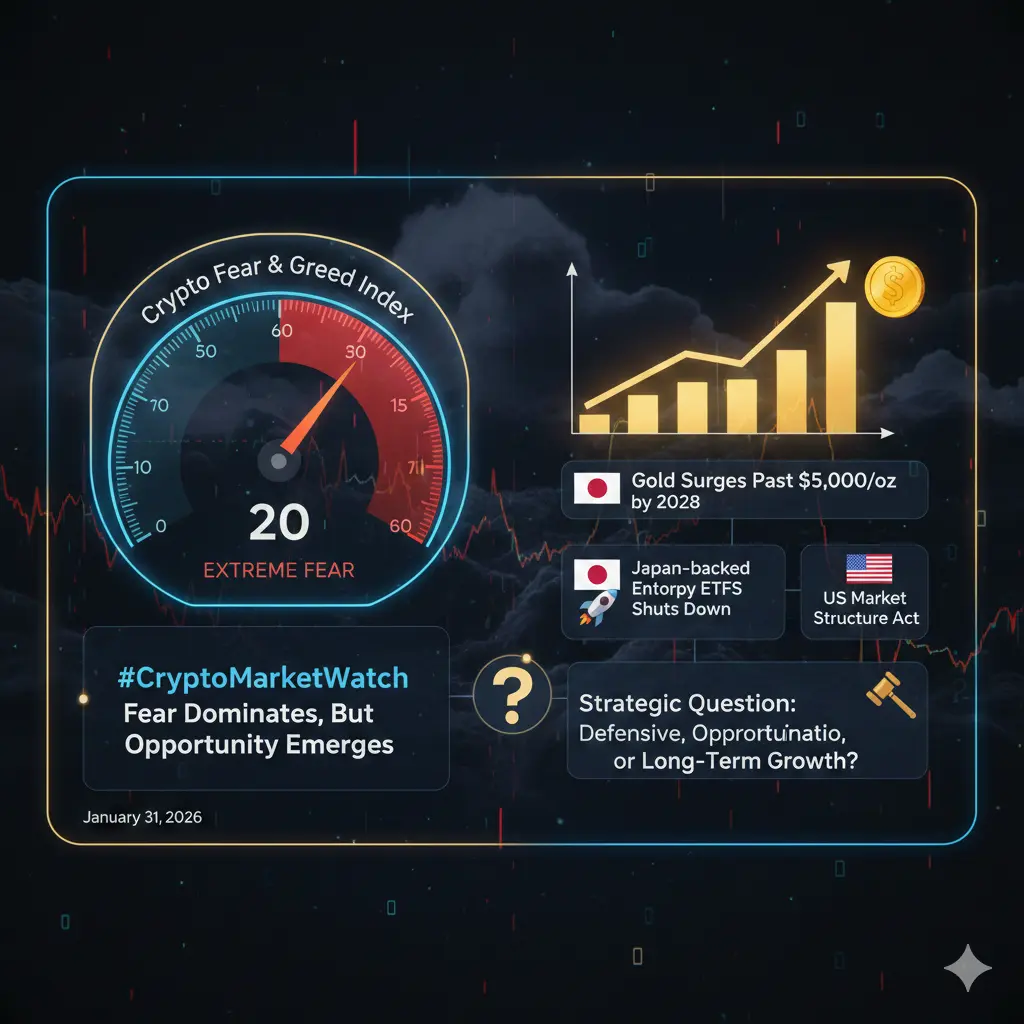

#CryptoMarketWatch Fear Dominates, But Opportunity Emerges

Global crypto markets are signaling heightened caution as the Crypto Fear & Greed Index plunges to 20, reflecting deep risk aversion among investors. Volatility remains elevated, and traders are carefully weighing their next moves amid uncertainty.

Key Market Highlights:

1️⃣ Gold Surges:

Gold has surpassed $5,000 per ounce, reaffirming its role as a safe-haven asset. Investors are rotating capital into tangible stores of value as macro and geopolitical uncertainty grips markets.

2️⃣ Japan Plans Spot Crypto ETFs:

Regulatory discussions

Global crypto markets are signaling heightened caution as the Crypto Fear & Greed Index plunges to 20, reflecting deep risk aversion among investors. Volatility remains elevated, and traders are carefully weighing their next moves amid uncertainty.

Key Market Highlights:

1️⃣ Gold Surges:

Gold has surpassed $5,000 per ounce, reaffirming its role as a safe-haven asset. Investors are rotating capital into tangible stores of value as macro and geopolitical uncertainty grips markets.

2️⃣ Japan Plans Spot Crypto ETFs:

Regulatory discussions

- Reward

- 6

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Late-night gold plunge, silver crashes 26%, US stocks fall across the board, Yipeng Energy soars over 3000%, the US announces new sanctions on Iran

On January 31, the three major US stock indices closed lower,

Dow Jones down 0.36%, with a 1.73% increase in January;

Nasdaq down 0.94%, with a 0.95% increase in January;

S&P 500 index closed down 29.98 points, a 0.43% decline.

In the early hours of January 31, panic selling swept across the global precious metals market, with spot silver plunging over 36% intraday. Gold prices fell below the $5000 mark, with spot gold intraday decline expanding to

View OriginalOn January 31, the three major US stock indices closed lower,

Dow Jones down 0.36%, with a 1.73% increase in January;

Nasdaq down 0.94%, with a 0.95% increase in January;

S&P 500 index closed down 29.98 points, a 0.43% decline.

In the early hours of January 31, panic selling swept across the global precious metals market, with spot silver plunging over 36% intraday. Gold prices fell below the $5000 mark, with spot gold intraday decline expanding to

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

【$RNDR Signal】Empty position, wait for the downward momentum to be confirmed as exhausted

$RNDR Price decline accompanied by increased trading volume, observe changes in open interest to distinguish between long liquidation or main force distribution. The current market logic suggests a potential bearish dominance, and it is not advisable to blindly buy the dip.

🎯 Direction: Empty position

Wait for the price to show clear buy absorption signals in key support areas (such as $1.55-$1.60) (e.g., long lower shadows, shrinking volume, rising open interest), or to re-establish above $1.75 and st

$RNDR Price decline accompanied by increased trading volume, observe changes in open interest to distinguish between long liquidation or main force distribution. The current market logic suggests a potential bearish dominance, and it is not advisable to blindly buy the dip.

🎯 Direction: Empty position

Wait for the price to show clear buy absorption signals in key support areas (such as $1.55-$1.60) (e.g., long lower shadows, shrinking volume, rising open interest), or to re-establish above $1.75 and st

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More24.44K Popularity

37.78K Popularity

357.64K Popularity

35.11K Popularity

52.5K Popularity

News

View MoreNomura's European Business Division has turned to losses due to the decline in crypto assets and has tightened management of holdings and risk exposure.

4 m

Jupiter "CatLumpurr 2026" event officially opens

14 m

Trump announces nomination of Brett Sampson as the new director of the Bureau of Labor Statistics

17 m

Data: In the past 24 hours, the entire network has liquidated 1.382 billion USD, with long positions liquidated at 1.226 billion USD and short positions at 157 million USD.

18 m

JPMorgan: Bitcoin futures are oversold, while silver has turned overbought. The long-term target price for gold is $8,500.

38 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889