Post content & earn content mining yield

placeholder

MAB350

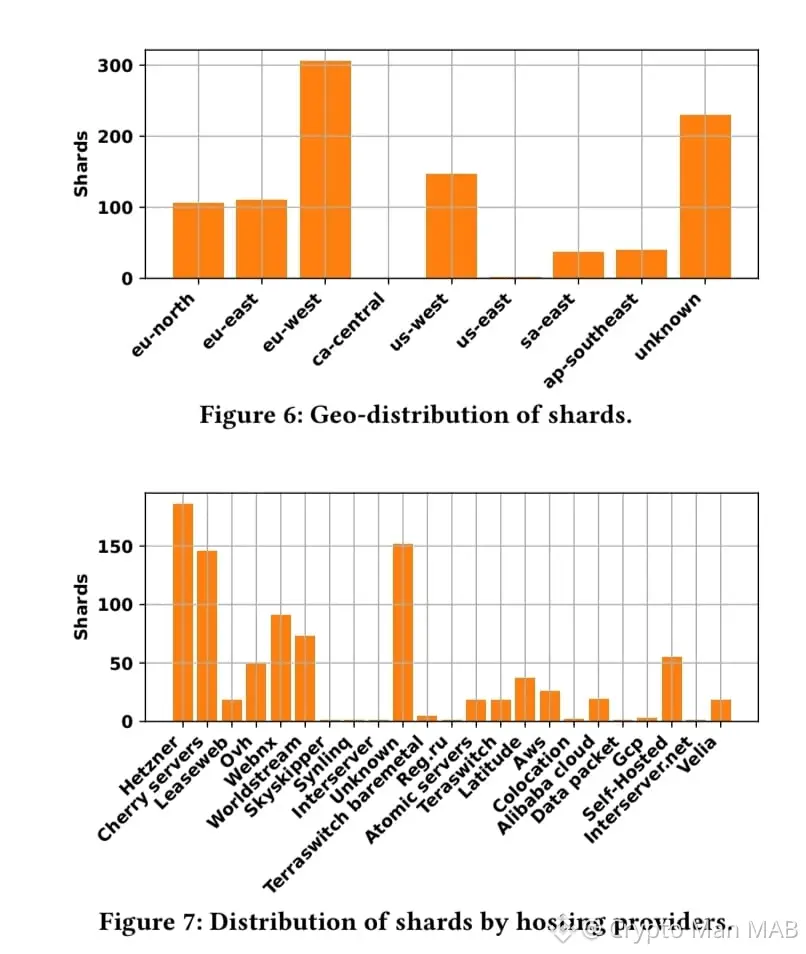

fixed-price model delivers two major advantages of walrus

Commitment enforcement Users cannot exit early without forfeiting payments, giving nodes confidence to lower future prices without risking mass cancellations of existing contracts.

Overall, Walrus's pricing and payment system balances competition among nodes with system-wide coordination, delivering predictable costs, strong availability guarantees, and incentives aligned toward long-term reliability in a decentralized storage ecosystem.

Commitment enforcement Users cannot exit early without forfeiting payments, giving nodes confidence to lower future prices without risking mass cancellations of existing contracts.

Overall, Walrus's pricing and payment system balances competition among nodes with system-wide coordination, delivering predictable costs, strong availability guarantees, and incentives aligned toward long-term reliability in a decentralized storage ecosystem.

- Reward

- like

- Comment

- Repost

- Share

Good luck and prosperity in the Year of the Horse! Just released, bottom chips, about to go public. Still hesitating? The consensus in the Year of the Horse is a money-making market! Keep up with the rhythm, and you'll be on the fast track to wealth and prosperity in the crypto world. No more nonsense, just do it. Financial freedom in the crypto space has always belonged to those who dare to take action. This time, don't miss out again.

#fogo

#fogo

FOGO2.75%

MC:$9.1KHolders:2

23.75%

- Reward

- 1

- Comment

- Repost

- Share

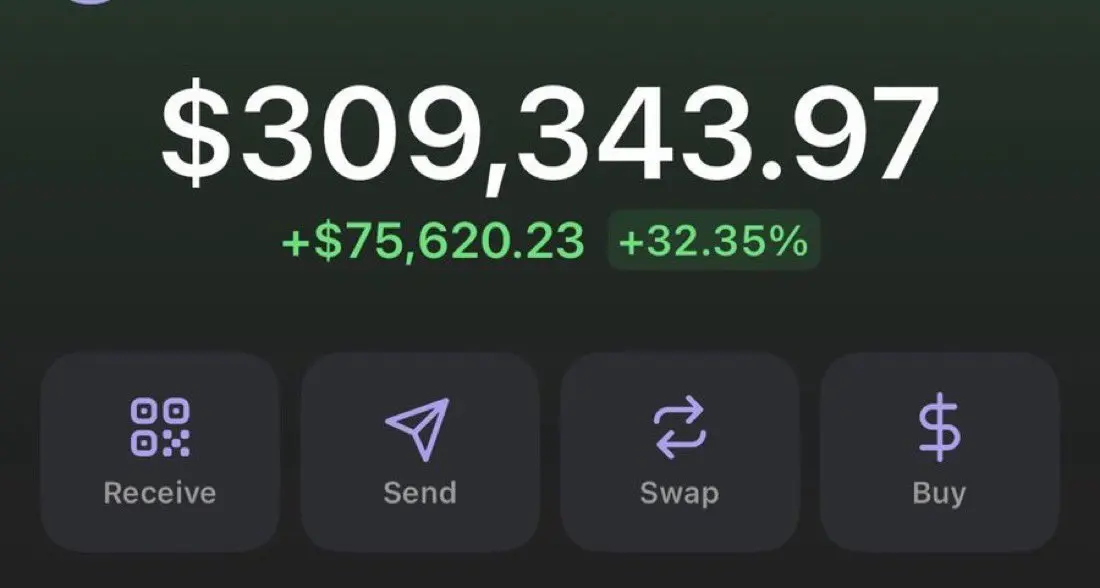

This was $2700 just 4 days ago

Lock in mode

I am going to make millionaires tomorrow!

Who's ready?

Lock in mode

I am going to make millionaires tomorrow!

Who's ready?

- Reward

- 1

- Comment

- Repost

- Share

马勒戈币

马勒戈币

Created By@LittlePonyGogo

Listing Progress

100.00%

MC:

$50.92K

Create My Token

- Reward

- like

- Comment

- Repost

- Share

My timeline seems to have reverted to the era of readers and Yilin...

Especially in the English-speaking community, are there everywhere feel-good articles?

View OriginalEspecially in the English-speaking community, are there everywhere feel-good articles?

- Reward

- like

- Comment

- Repost

- Share

They got Venezuelan baseball league on TV again already? You’re welcome, from America

- Reward

- like

- Comment

- Repost

- Share

Good luck and great fortune in the Year of the Horse! Coming soon to the market, don't miss the bottom chip prices. The consensus in the Year of the Horse is the ultimate engine to ignite wealth! Now, immediately, right away—seize this raging wave and create a legendary fortune in the crypto world. Financial freedom in the crypto space is within reach. On the cusp of opportunity, even pigs can fly, and you are destined to be the dragon riding the wind!

#SOL

#SOL

SOL-5.09%

MC:$9.1KHolders:2

23.75%

- Reward

- 1

- Comment

- Repost

- Share

GameStop Bitcoin Transfers Stir Market Amid Tariff Concerns - - #cryptocurrency #bitcoin #altcoins

BTC-3.17%

- Reward

- like

- Comment

- Repost

- Share

International Crude Oil Market Analysis: Supply and Demand Easing Dominates, Geopolitical Disruptions Add Volatility

Currently, the international crude oil market remains in a sideways and weak pattern, with WTI crude oil fluctuating around $59.5 per barrel. The market is caught in a tug-of-war between "supply and demand easing" and "geopolitical risk support," highlighting short-term volatility, while medium- to long-term downward pressure persists.

1. Supply and Demand Imbalance as the Main Contradiction

Global crude oil supply remains ample, with OPEC+’s pause on production increases in Q1

View OriginalCurrently, the international crude oil market remains in a sideways and weak pattern, with WTI crude oil fluctuating around $59.5 per barrel. The market is caught in a tug-of-war between "supply and demand easing" and "geopolitical risk support," highlighting short-term volatility, while medium- to long-term downward pressure persists.

1. Supply and Demand Imbalance as the Main Contradiction

Global crude oil supply remains ample, with OPEC+’s pause on production increases in Q1

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

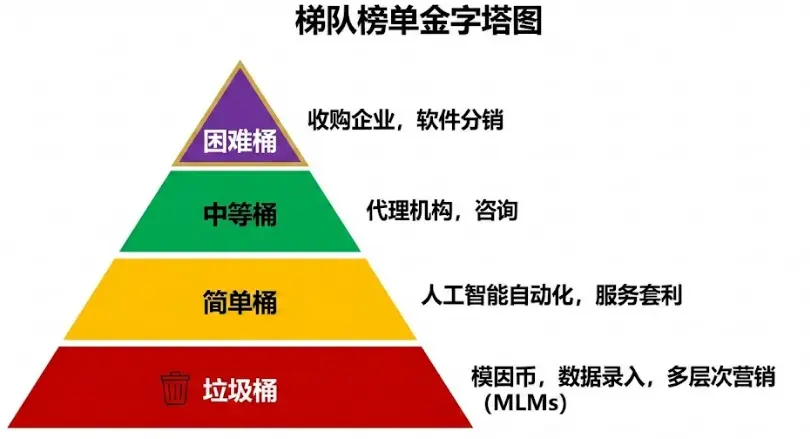

99% of "side jobs" will only be an accelerator to bankruptcy by 2026.

Most people think they are starting a business, but in reality, they are just picking up coins while a steamroller approaches from behind.

Dan Martell categorizes all the money-making methods in 2026 into 4 levels. The scariest thing is not "hard mode," but being trapped in "trash mode" and mistaking it for opportunity.

This is the brutal truth about wealth distribution over the next 3 years.

1. Trash Bin

The projects here are very obvious: extremely low difficulty, negative returns. Essentially, it's fighting Moore's Law wi

View OriginalMost people think they are starting a business, but in reality, they are just picking up coins while a steamroller approaches from behind.

Dan Martell categorizes all the money-making methods in 2026 into 4 levels. The scariest thing is not "hard mode," but being trapped in "trash mode" and mistaking it for opportunity.

This is the brutal truth about wealth distribution over the next 3 years.

1. Trash Bin

The projects here are very obvious: extremely low difficulty, negative returns. Essentially, it's fighting Moore's Law wi

- Reward

- like

- Comment

- Repost

- Share

马年大富大贵

马年大富大贵

Created By@YearOfTheHorseMemeGlobal

Listing Progress

0.00%

MC:

$3.36K

Create My Token

Tariff threats resurface! Crypto market flashed down overnight – can BTC hold?

- Reward

- like

- Comment

- Repost

- Share

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$23.31KHolders:355

100.00%

- Reward

- like

- Comment

- Repost

- Share

#CryptoMarketPullback ONE TRUMP MOVE JUST NUKED THE CRYPTO MARKET 🚨

Bitcoin didn't crash because of bad technicals or weak on-chain data. It dumped hard on pure politics. Trump's 10% EU tariff announcement triggered a brutal selloff—BTC dropped nearly $5,800 in days.

The damage? $215 BILLION in crypto market cap erased. This wasn't a slow bleed—it was an instant market-wide cascade. Altcoins followed BTC straight down.

Why? Markets didn't care about Greenland drama. They heard: trade war escalation, macro uncertainty, geopolitical risk. Crypto = high-beta risk asset, so it got hammered first.

Bitcoin didn't crash because of bad technicals or weak on-chain data. It dumped hard on pure politics. Trump's 10% EU tariff announcement triggered a brutal selloff—BTC dropped nearly $5,800 in days.

The damage? $215 BILLION in crypto market cap erased. This wasn't a slow bleed—it was an instant market-wide cascade. Altcoins followed BTC straight down.

Why? Markets didn't care about Greenland drama. They heard: trade war escalation, macro uncertainty, geopolitical risk. Crypto = high-beta risk asset, so it got hammered first.

BTC-3.17%

- Reward

- 2

- 1

- Repost

- Share

Unoshi :

:

Thanks for informationETH Trading Strategy

Go long at 2856. Stop loss at 2820. Take profit at 2918.

Short at 3000 to 3020. Stop loss at 3037. Take profit at 2945.

BTC Trading Strategy

Short at 90000 to 90300. Take profit at 90400. Stop loss at 93100.

Go long at 87890. Stop loss at 87500. Take profit at 88700.

View OriginalGo long at 2856. Stop loss at 2820. Take profit at 2918.

Short at 3000 to 3020. Stop loss at 3037. Take profit at 2945.

BTC Trading Strategy

Short at 90000 to 90300. Take profit at 90400. Stop loss at 93100.

Go long at 87890. Stop loss at 87500. Take profit at 88700.

- Reward

- like

- Comment

- Repost

- Share

After blowing up the bulls, get ready to blow up the bears.

View Original

- Reward

- 2

- 3

- Repost

- Share

CryptoVortex :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More19.08K Popularity

188 Popularity

55.51K Popularity

43.36K Popularity

339.78K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.41KHolders:20.00%

- MC:$3.36KHolders:10.00%

- MC:$9.1KHolders:223.75%

- MC:$3.36KHolders:10.00%

News

View MoreSnap Store experiences domain hijacking attack, tampering with wallet applications to steal cryptocurrency assets

6 m

Snap Store security vulnerability allows hackers to steal users' crypto assets by hijacking expired domains

7 m

Data: If Bitcoin rebounds and breaks through $97,000, the total liquidation strength of long positions on mainstream CEXs will reach 1.489 billion.

11 m

Data: If BTC breaks through $93,803, the total liquidation strength of short positions on mainstream CEXs will reach $2.616 billion.

13 m

Data: If ETH breaks through $3,128, the total liquidation strength of mainstream CEX short positions will reach $1.464 billion.

13 m

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889