2025 ARCHAI Fiyat Tahmini: Yapay Zeka Destekli Kripto Paraların Geleceğinde Yolculuk

Giriş: ARCHAI’nin Piyasadaki Konumu ve Yatırım Potansiyeli

ARCH AI (ARCHAI), yapay zeka ajanları alanında öncü bir proje olarak, kuruluşundan bu yana sektörü dönüştürmeye devam ediyor. 2025 yılı itibarıyla ARCHAI’nin piyasa değeri 3.338.820 $’a ulaşmış olup, yaklaşık 900.000.000 token dolaşımda ve fiyatı 0,0037098 $ seviyelerinde dalgalanıyor. “Yapay zeka ekosisteminin yenilikçisi” unvanını taşıyan bu varlık, AI ajan modelleme ve tasarımında giderek daha kritik bir rol üstleniyor.

Bu yazıda, ARCHAI’nin 2025-2030 dönemine ait fiyat trendleri; tarihsel süreç, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar doğrultusunda kapsamlı şekilde analiz edilerek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. ARCHAI Fiyat Geçmişi ve Güncel Durum

ARCHAI Tarihsel Fiyat Gelişimi

- 2025: Proje başlatıldı, 20 Şubat’ta fiyat 0,08301 $ ile tüm zamanların en yüksek seviyesine (ATH) ulaştı

- 2025: Piyasa düzeltmesiyle fiyat 30 Ağustos’ta 0,0024147 $ ile tüm zamanların en düşük seviyesine (ATL) geriledi

- 2025: Kademeli toparlanma, mevcut fiyat 0,0037098 $ civarında sabitlendi

ARCHAI Güncel Piyasa Durumu

13 Ekim 2025 itibarıyla ARCHAI, 0,0037098 $ seviyesinden işlem görüyor ve piyasa değeri 3.338.820 $. 24 saatlik işlem hacmi 15.497,06 $. ARCHAI, son 24 saatte %4,07; son bir haftada ise %12,41 değer kaybetti. Dolaşımdaki arz 900.000.000 ARCHAI olup, toplam ve maksimum arz ile eşdeğer. Projenin tamamen seyreltilmiş değeri de piyasa değeriyle aynı (3.338.820 $), yani tüm token’lar dolaşımda. ARCHAI, küresel kripto piyasasında 2.022’nci sırada yer alıyor ve piyasa hakimiyeti %0,000080 düzeyinde.

Güncel ARCHAI piyasa fiyatını görmek için tıklayın

İstenen formatta çıktı aşağıda:

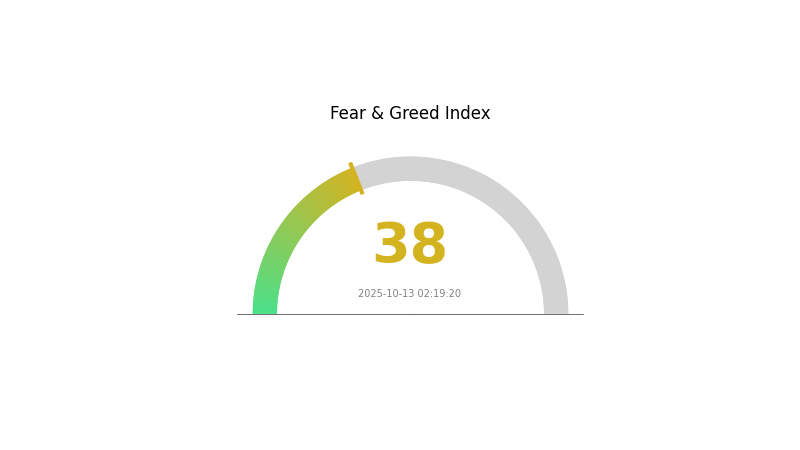

ARCHAI Piyasa Duyarlılığı Göstergesi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında, Korku ve Açgözlülük Endeksi’nin 38 seviyesinde olması endişeli bir atmosferi gösteriyor ve yatırımcılar temkinli davranıp fırsat arayışında. Bu dönemlerde bilgiye erişim ve rasyonel karar almak kritik önemde. Piyasa döngülerinin olağan olduğunu unutmayın; mevcut korku, uzun vadeli yatırımcıların stratejilerini dikkatli biçimde değerlendirmeleri için bir işaret olabilir. Her zaman kapsamlı araştırma yapın ve yatırım kararlarınızda profesyonel danışmanlardan destek alın.

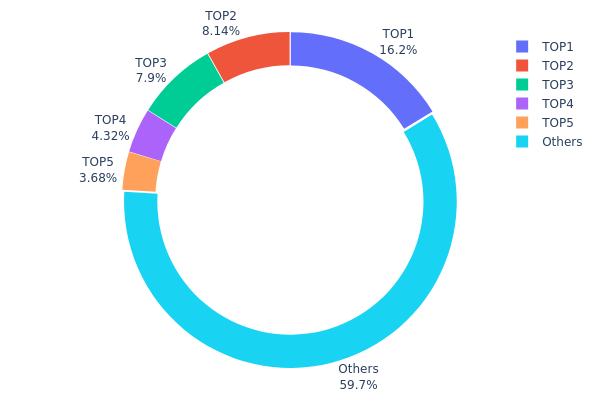

ARCHAI Token Dağılımı

ARCHAI’nin adres bazlı token dağılımı verileri, orta seviyede yoğunlaşmış bir sahiplik yapısını ortaya koyuyor. En büyük adres toplam arzın %16,22’sini elinde bulundururken, sonraki dört büyük adresin kontrol oranları sırasıyla %8,14, %7,90, %4,32 ve %3,68. İlk beş adres ARCHAI token’larının %40,26’sına sahipken, kalan %59,74 ise çeşitli adreslerde bulunuyor.

Bu yapı, büyük paydaşlar ile geniş bir dağılım arasında denge sağlıyor. En büyük sahipler etkili olsa da token’ların çoğunluğu hala çok sayıda farklı adreste. Bu dağılım, piyasada tek bir varlığın baskın olmadığı bir istikrar sunabilir; fakat büyük sahiplerin koordineli hareketleri fiyatı etkileyebilir.

Mevcut dağılım, ARCHAI için makul bir merkeziyetsizlik seviyesi gösteriyor. Tamamen dağılmasa da; sahiplik yapısı, etkili paydaşlar ile piyasaya erişim imkanı arasında bir denge sunuyor.

Güncel ARCHAI Token Dağılımı için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x7c97...07d424 | 133.462,00K | 16,22% |

| 2 | 0xd73e...0c4cc2 | 67.000,00K | 8,14% |

| 3 | 0xbb3e...b292a6 | 65.000,00K | 7,90% |

| 4 | 0x82d7...c96b46 | 35.574,89K | 4,32% |

| 5 | 0x17e9...814b94 | 30.278,62K | 3,68% |

| - | Diğerleri | 491.372,87K | 59,74% |

II. ARCHAI’nin Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Piyasa Duyarlılığı: Fiyat dalgalanmaları çoğunlukla genel piyasa algısından etkilenir.

- Tarihsel Model: Geçmiş fiyat hareketleri, haber akışı ve topluluk etkileşimiyle doğrudan ilişkilidir.

- Mevcut Etki: Kısa vadeli yatırımcılar piyasa tepkilerine odaklanırken, uzun vadeli sahipler (HODLer) temel faktörleri ön planda tutar.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Proje güncellemeleri ve teknolojik ilerlemeler, kurumsal ilgiyi çekmede belirleyici rol oynar.

Teknik Gelişim ve Ekosistem İnşası

- Proje Güncellemeleri: Sürekli gelişim ve teknolojik yenilikler fiyat üzerinde önemli etki yaratır.

- Ekosistem Uygulamaları: Topluluk katılımı ve ekosistem büyümesi ARCHAI’nin değerini artırır.

III. ARCHAI Fiyat Tahmini (2025-2030)

2025 Görünümü

- Temkinli tahmin: 0,00327 $ - 0,00371 $

- Tarafsız tahmin: 0,00371 $ - 0,00431 $

- İyimser tahmin: 0,00431 $ - 0,0049 $ (olumlu piyasa koşulları gerektirir)

2026-2027 Görünümü

- Piyasa aşaması: Kademeli büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,00327 $ - 0,00642 $

- 2027: 0,00381 $ - 0,00665 $

- Temel katalizörler: Artan benimsenme ve teknolojik ilerleme

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,006 $ - 0,00770 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00770 $ - 0,00862 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,00862 $ - 0,01 $ (çığır açan yenilikler ve yaygın benimsenme ile)

- 31 Aralık 2030: ARCHAI 0,00793 $ (yıl sonu düzeltme öncesi olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,0049 | 0,00371 | 0,00327 | 0 |

| 2026 | 0,00642 | 0,00431 | 0,00327 | 16 |

| 2027 | 0,00665 | 0,00536 | 0,00381 | 44 |

| 2028 | 0,00756 | 0,006 | 0,0042 | 61 |

| 2029 | 0,00862 | 0,00678 | 0,00427 | 82 |

| 2030 | 0,00793 | 0,0077 | 0,00678 | 107 |

IV. ARCHAI Profesyonel Yatırım Stratejisi ve Risk Yönetimi

ARCHAI Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli yatırımcılar ve AI teknolojisi meraklıları

- İşlem önerileri:

- Piyasa düşüşlerinde ARCHAI token biriktirin

- En az 2-3 yıl tutma hedefi belirleyin

- Token’ları donanım cüzdanlarında veya güvenilir saklama hizmetlerinde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım veya satım koşullarını tespit eder

- Dalgalı alım-satım için önemli noktalar:

- AI sektörü haberlerini ve ARCHAI proje gelişmelerini izleyin

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

ARCHAI Risk Yönetim Sistemi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı AI ve blockchain projelerine yaymak

- Zarar-durdur emirleri: Olası kayıpları sınırlamak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü şifreler kullanın ve yazılımı güncel tutun

V. ARCHAI için Olası Riskler ve Zorluklar

ARCHAI Piyasa Riskleri

- Volatilite: AI token piyasası oldukça dalgalı olabilir

- Rekabet: Yeni AI projeleri ARCHAI’nin piyasa payını etkileyebilir

- Piyasa algısı: AI sektörüne yönelik algı değişimleri token değerini etkileyebilir

ARCHAI Regülasyon Riskleri

- Belirsiz regülasyonlar: AI ve kripto düzenlemeleri gelişmekte olup ARCHAI’yi etkileyebilir

- Sınır ötesi uyumluluk: Farklı ülkelerde farklı regülasyon yaklaşımları

- Veri gizliliği: AI veri kullanımı konusunda olası düzenleyici denetimler

ARCHAI Teknik Riskleri

- Akıllı kontrat açıkları: Token kontratında olası açıklar ve hatalar

- Ölçeklenebilirlik: Ağ yükünü yönetmede sınırlamalar yaşanabilir

- Teknolojik eskime: AI’daki hızlı gelişmeler ARCHAI’nin teknolojisini geride bırakabilir

VI. Sonuç ve Eylem Önerileri

ARCHAI Yatırım Değeri Analizi

ARCHAI, AI ve blockchain kesişiminde uzun vadeli büyüme potansiyeline sahip benzersiz bir fırsat sunuyor. Ancak, yatırımcıların kısa vadeli oynaklık ve AI sektörünün dinamik yapısına dikkat etmesi gerekiyor.

ARCHAI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük ve düzenli yatırımlar yapın ✅ Deneyimli yatırımcılar: Uzun vadeli tutum ile stratejik alım-satımı bir arada değerlendirin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yaparak ARCHAI’yi çeşitlendirilmiş AI odaklı portföyde ele alın

ARCHAI Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden ARCHAI token alıp satın alın

- Staking: Varsa staking programlarına katılarak pasif gelir elde edin

- DeFi entegrasyonu: ARCHAI token ile ilişkili merkeziyetsiz finans çözümlerini inceleyin

Kripto para yatırımları yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alacağınızdan fazlasını yatırmayın.

Sıkça Sorulan Sorular

2025’te hangi meme coin yükselişe geçecek?

Shiba Inu’nun, güçlü topluluk desteği ve viral trendler sayesinde 2025’te önemli bir fiyat artışı yaşaması bekleniyor. Piyasa dinamikleri ve ilgi sayesinde popülaritesi sürüyor.

En yüksek fiyat tahmini hangi kripto parada?

Bitcoin, en yüksek fiyat tahminine sahip olup 2025’te 122.937 $ seviyelerine ulaşması öngörülüyor. Chainlink ise 59,67 $’a kadar kayda değer bir artışla takip ediyor.

Axie coin için tahmin nedir?

Axie Infinity (AXS), Ekim 2025’te 2,62 $ seviyesine ulaşabilir. Mevcut eğilim tarafsız olup, Eylül 2026’ya kadar 10.000 $’lık bir yatırımdan anlamlı bir kazanç beklenmiyor.

XRP 2030’da ne olur, fiyat tahmini nedir?

Küresel varlıkların %10’u XRP Ledger üzerinde tokenleştirilirse, XRP 2030’da 473.000 $ seviyesine ulaşabilir; bu, teknolojinin yaygın olarak benimsenmesi varsayımına bağlıdır.

2025 CHATAI Fiyat Tahmini: Piyasa Eğilimleri ve Yapay Zekâ Destekli Token’ın Olası Büyüme Faktörlerinin Analizi

GG3 Proje Analizi: Beyaz Kağıt Mantığı, Kullanım Senaryoları ve Teknik Yenilik

2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

2025 AI16Z Fiyat Tahmini: Devrim Yaratan Yapay Zekâ Teknolojisinin Piyasa Trendlerinin ve Gelecek Değerinin Analizi

2025 QUBIC Fiyat Tahmini: Gelişen Kripto Para Sektöründe Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 AITECH Fiyat Tahmini: Makine öğrenimi modelleri, teknoloji sektöründe piyasa eğilimlerini ve yatırım fırsatlarını öngörüyor

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması