2025 BNB Price Prediction: Bullish Outlook as DeFi and NFT Sectors Fuel Growth

Introduction: BNB's Market Position and Investment Value

Binance Coin (BNB), as a leading cryptocurrency in the global market, has achieved remarkable success since its inception in 2017. As of 2025, BNB's market capitalization has reached $169.73 billion, with a circulating supply of approximately 139.18 million coins, and a price hovering around $1,219.5. This asset, often referred to as the "Exchange Token Pioneer," is playing an increasingly crucial role in decentralized finance and exchange ecosystems.

This article will provide a comprehensive analysis of BNB's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. BNB Price History Review and Current Market Status

BNB Historical Price Evolution

- 2017: Initial Coin Offering (ICO) at $0.15, price surged to $2.80 by year-end

- 2021: Bull market peak, BNB reached all-time high of $686.31

- 2022: Crypto winter, price dropped from $529.27 to $220.13

BNB Current Market Situation

As of October 15, 2025, BNB is trading at $1,219.5, ranking 4th in the global cryptocurrency market with a market capitalization of $169.73 billion. The current price represents a -5.25% decrease in the last 24 hours, but a significant 31.61% increase over the past 30 days. BNB has shown strong performance over the past year, with a 107.2% price increase. The token's all-time high of $1,369.99 was recently achieved on October 13, 2025, indicating a bullish trend in the short term. However, the current market sentiment index (VIX) stands at 34, suggesting a "Fear" sentiment among investors.

Click to view the current BNB market price

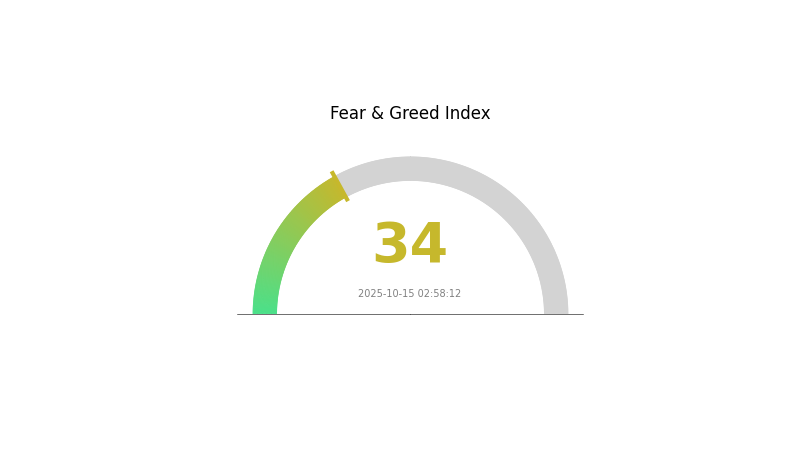

BNB Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 34. This suggests that investors are cautious and uncertain about the market's direction. During such times, it's crucial to remain vigilant and avoid making impulsive decisions. Remember, market sentiment can shift quickly, and periods of fear often present opportunities for those who have done their research and are prepared to invest strategically. As always, it's advisable to diversify your portfolio and only invest what you can afford to lose.

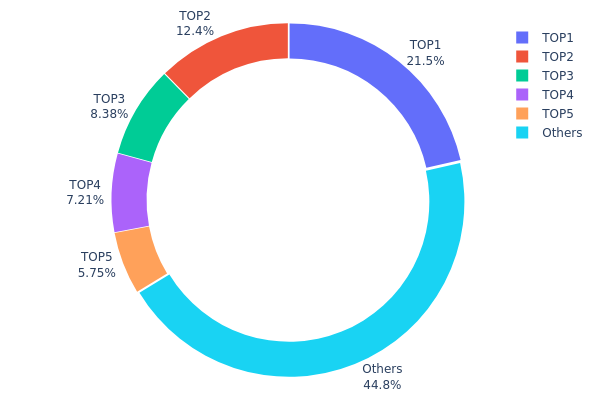

BNB Holdings Distribution

The address holdings distribution data for BNB reveals a relatively concentrated ownership structure. The top 5 addresses collectively hold 55.14% of the total BNB supply, with the largest holder possessing 21.47% of all tokens. This level of concentration raises concerns about potential market manipulation and centralization risks.

The significant holdings by a few addresses could lead to increased price volatility if large transactions occur. Moreover, this concentration may impact the overall market structure, as decisions made by these major holders could have outsized effects on BNB's price and liquidity. The current distribution suggests a less than ideal level of decentralization, which is a core principle of many blockchain projects.

However, it's worth noting that 44.86% of BNB tokens are held by addresses outside the top 5, indicating some degree of distribution among smaller holders. This balance between major players and a broader base of smaller holders will be crucial to monitor for assessing the long-term stability and decentralization of the BNB ecosystem.

Click to view the current BNB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xff3f...8ac4d3 | 29888.00K | 21.47% |

| 2 | 0xbe0e...4d33e8 | 17195.73K | 12.35% |

| 3 | 0xd37c...aa07ca | 11666.89K | 8.38% |

| 4 | 0xf977...41acec | 10034.70K | 7.20% |

| 5 | 0x771f...a9a23e | 8000.56K | 5.74% |

| - | Others | 62395.63K | 44.86% |

II. Key Factors Influencing BNB's Future Price

Supply Mechanism

- Quarterly Token Burn: BNB implements a deflationary model through regular token burns, reducing the circulating supply.

- Historical Pattern: Past burns have generally led to positive price movements due to reduced supply.

- Current Impact: The ongoing burn mechanism is expected to continue supporting BNB's value by maintaining scarcity.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions like BNB Network Company have been increasing their BNB holdings, with recent purchases of over $160 million worth of BNB.

- Corporate Adoption: BNB Chain is witnessing increased adoption in GameFi and SocialFi sectors.

Macroeconomic Environment

- Inflation Hedge Properties: BNB has shown potential as a hedge against inflation, attracting investors during periods of economic uncertainty.

- Geopolitical Factors: Global regulatory developments, especially in regions like UAE, France, and Hong Kong, impact BNB's adoption and value.

Technological Development and Ecosystem Building

- Block Confirmation Time Reduction: BNB Chain has reduced block confirmation time to 0.75 seconds, enhancing network efficiency.

- Gas Limit Increase: Plans to increase the Gas limit by 10x by year-end, improving DeFi and NFT experiences.

- Ecosystem Applications: The BNB ecosystem boasts over 2.2 million daily active users and 90 million on-chain transactions, indicating robust ecosystem growth.

III. BNB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $742.31 - $1,000

- Neutral prediction: $1,000 - $1,216.90

- Optimistic prediction: $1,216.90 - $1,338.59 (requires strong market recovery and increased BNB adoption)

2027-2028 Outlook

- Market stage expectation: Potential bull market phase

- Price range forecast:

- 2027: $957.03 - $1,421.87

- 2028: $976.17 - $1,729.22

- Key catalysts: BNB ecosystem expansion, increased DeFi and NFT activity on BNB Chain

2029-2030 Long-term Outlook

- Base scenario: $1,561.87 - $1,585.30 (assuming steady growth in BNB utility and adoption)

- Optimistic scenario: $1,608.73 - $1,648.71 (assuming significant BNB Chain technological advancements)

- Transformative scenario: $1,700 - $2,000 (extremely favorable market conditions and major BNB Chain breakthroughs)

- 2030-12-31: BNB $1,585.30 (potential year-end price based on average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1338.59 | 1216.9 | 742.31 | 0 |

| 2026 | 1456.63 | 1277.75 | 983.86 | 4 |

| 2027 | 1421.87 | 1367.19 | 957.03 | 12 |

| 2028 | 1729.22 | 1394.53 | 976.17 | 14 |

| 2029 | 1608.73 | 1561.87 | 1483.78 | 28 |

| 2030 | 1648.71 | 1585.3 | 1220.68 | 29 |

IV. Professional BNB Investment Strategies and Risk Management

BNB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors seeking exposure to the crypto ecosystem

- Operation suggestions:

- Accumulate BNB during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend direction

- RSI: Use overbought/oversold levels for entry and exit points

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor BNB's correlation with Bitcoin price movements

BNB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable multi-signature wallets

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BNB

BNB Market Risks

- High volatility: Significant price fluctuations can lead to substantial losses

- Market sentiment: BNB price heavily influenced by overall crypto market trends

- Competition: Emerging blockchain platforms may challenge BNB's market position

BNB Regulatory Risks

- Increased scrutiny: Potential for stricter regulations on centralized exchanges

- Cross-border compliance: Varying regulatory approaches in different jurisdictions

- Tax implications: Evolving tax laws may impact BNB transactions and holdings

BNB Technical Risks

- Smart contract vulnerabilities: Potential for exploits in BNB Chain ecosystem

- Network congestion: High transaction volumes may lead to increased fees

- Technological obsolescence: Rapid advancements in blockchain technology

VI. Conclusion and Action Recommendations

BNB Investment Value Assessment

BNB offers long-term potential as a key asset in the crypto ecosystem, but faces short-term volatility and regulatory uncertainties. Its value proposition is tied to the success of the BNB Chain and associated projects.

BNB Investment Recommendations

✅ Beginners: Start with small positions, focus on education and understanding the BNB ecosystem

✅ Experienced investors: Consider allocating a portion of crypto portfolio to BNB, use dollar-cost averaging

✅ Institutional investors: Evaluate BNB as part of a diversified crypto strategy, monitor regulatory developments closely

BNB Trading Participation Methods

- Spot trading: Buy and hold BNB on reputable exchanges like Gate.com

- Staking: Participate in BNB staking programs for passive income

- DeFi: Explore decentralized finance applications built on BNB Chain

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will BNB reach $10,000?

Reaching $10,000 for BNB is highly unlikely. Current market trends don't support such a dramatic increase. A more realistic target would be in the $500-$1000 range by 2025.

How much will 1 BNB be worth in 2025?

Based on current market trends and analysis, 1 BNB is projected to be worth approximately $660 to $675 in 2025.

How much will BNB be worth in 2030?

Based on market analysis, BNB could be worth between $880 and $950 in 2030. However, cryptocurrency prices are highly volatile and unpredictable.

Can BNB reach $1000 USD?

Yes, BNB could potentially reach $1000 by early 2025, driven by bullish market trends and increased adoption of the BNB ecosystem.

Share

Content