2025 BTC Price Prediction: Bull Run or Bear Market - Analyzing Crypto's Future Trajectory

Introduction: BTC's Market Position and Investment Value

Bitcoin (BTC), as the pioneer and leader of the cryptocurrency market, has achieved remarkable success since its inception in 2008. As of 2025, Bitcoin's market capitalization has reached $2.25 trillion, with a circulating supply of approximately 19,934,406 coins, and a price hovering around $113,055. This asset, often hailed as "digital gold," is playing an increasingly crucial role in the global financial system and digital economy.

This article will comprehensively analyze Bitcoin's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. BTC Price History Review and Current Market Status

BTC Historical Price Evolution

- 2009: Bitcoin launched, price effectively $0

- 2010: First real-world transaction, Bitcoin Pizza Day, price around $0.0025

- 2013: First major bull run, price peaked at $1,242 before crashing

- 2017: Massive bull market, price reached $19,783 before sharp correction

- 2020: COVID-19 crash and recovery, price dropped to $3,800 then surged

- 2021: All-time high of $69,000 reached in November

BTC Current Market Situation

As of October 15, 2025, Bitcoin is trading at $113,055. The cryptocurrency has seen a slight decline of 0.67% in the last 24 hours, with a trading volume of $2,640,836,374. Bitcoin's market capitalization stands at $2,253,684,270,330, maintaining its position as the largest cryptocurrency with a market dominance of 55.24%.

Bitcoin recently set a new all-time high of $126,080 on October 7, 2025, but has since experienced a minor pullback. The current price represents a 10.33% decrease from this peak. Despite this short-term correction, Bitcoin has shown strong performance over the past year, with a 71.09% increase.

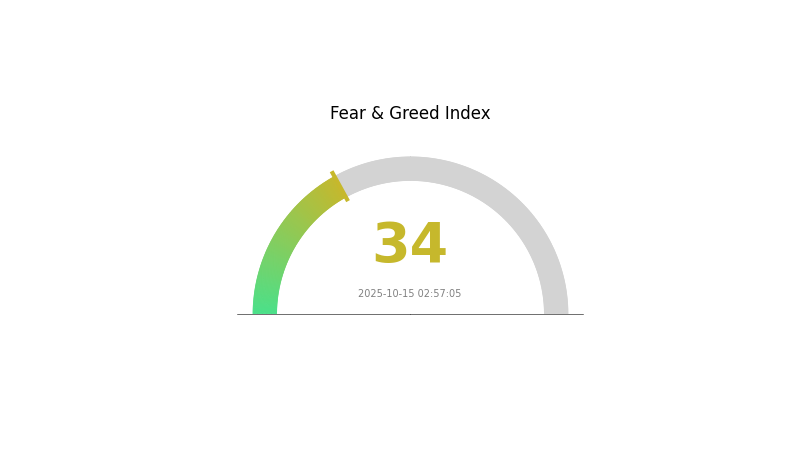

The market sentiment, as indicated by the Fear and Greed Index, currently stands at 34, suggesting a "Fear" state. This could indicate potential buying opportunities for long-term investors, although caution is advised given the recent price volatility.

Click to view the current BTC market price

BTC Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a wave of fear, with the Fear and Greed Index at 34. This suggests investors are cautious and uncertain about market conditions. During such periods, some view it as an opportunity to accumulate assets at potentially discounted prices. However, it's crucial to conduct thorough research and manage risks carefully. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and trade wisely on Gate.com.

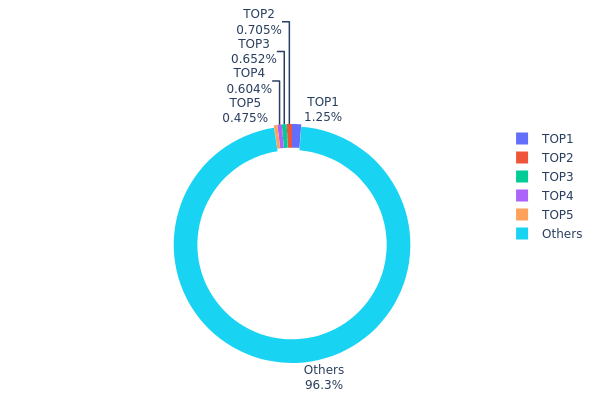

BTC Holdings Distribution

The Bitcoin address holdings distribution provides insight into the concentration of BTC ownership across different wallet addresses. Analysis of the provided data reveals that the top 5 addresses collectively hold approximately 3.68% of the total BTC supply, with the largest single address containing 1.25% of all bitcoins. This distribution suggests a relatively decentralized ownership structure, as the majority of BTC (96.32%) is spread among numerous smaller holders.

The current distribution pattern indicates a healthy level of decentralization in Bitcoin ownership. While there are some large individual holders, their influence is not overwhelmingly dominant. This structure contributes to market stability and reduces the risk of price manipulation by any single entity. The absence of extreme concentration also aligns with Bitcoin's ethos of decentralization and suggests a maturing ecosystem where ownership is becoming more widely distributed over time.

However, it's important to note that these large addresses could represent exchanges, institutional investors, or long-term holders. Their actions, such as sudden large transfers or liquidations, could still impact market sentiment and potentially lead to short-term price volatility. Overall, the current holdings distribution reflects a resilient on-chain structure and a diverse user base, which are positive indicators for Bitcoin's long-term stability and adoption.

Click to view the current BTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 34xp4v...4Twseo | 248.60K | 1.25% |

| 2 | bc1ql4...8859v2 | 140.57K | 0.71% |

| 3 | bc1qgd...jwvw97 | 130.01K | 0.65% |

| 4 | 3M219K...DjxRP6 | 120.35K | 0.60% |

| 5 | bc1qaz...uxwczt | 94.64K | 0.47% |

| - | Others | 19200.50K | 96.32% |

II. Key Factors Influencing BTC's Future Price

Supply Mechanism

- Halving: Bitcoin's block reward halves approximately every four years, reducing new supply.

- Historical Pattern: Previous halvings have led to significant price increases in the following years.

- Current Impact: The 2024 halving reduced block rewards to 3.125 BTC, potentially driving up prices due to increased scarcity.

Institutional and Whale Dynamics

- Institutional Holdings: Major companies like MicroStrategy continue to accumulate Bitcoin.

- Corporate Adoption: Growing acceptance of Bitcoin as a treasury reserve asset by corporations.

- Government Policies: Regulatory developments, particularly in the U.S., impact market sentiment.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve's interest rate decisions significantly affect Bitcoin's price.

- Inflation Hedging Properties: Bitcoin is increasingly viewed as a hedge against inflation.

- Geopolitical Factors: Global economic uncertainties drive interest in Bitcoin as a safe-haven asset.

Technological Development and Ecosystem Building

- ETF Approvals: The introduction of Bitcoin ETFs has increased accessibility for traditional investors.

- Layer 2 Solutions: Development of scaling solutions to improve Bitcoin's transaction capacity.

- Ecosystem Applications: Growing integration of Bitcoin in DeFi platforms and other blockchain applications.

III. BTC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $102,843 - $113,014

- Neutral prediction: $113,014 - $136,182

- Optimistic prediction: $136,182 - $159,350 (requires continued institutional adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market continuation

- Price range forecast:

- 2027: $138,701 - $211,627

- 2028: $117,024 - $262,418

- Key catalysts: Halving event, increased global adoption, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $219,864 - $255,042 (assuming steady market growth)

- Optimistic scenario: $255,042 - $290,220 (assuming widespread institutional adoption)

- Transformative scenario: $290,220 - $300,000+ (assuming Bitcoin becomes a global reserve asset)

- 2030-12-31: BTC $275,445 (potential peak of the cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 159350.59 | 113014.6 | 102843.29 | 0 |

| 2026 | 149800.85 | 136182.59 | 78985.9 | 20 |

| 2027 | 211627.75 | 142991.72 | 138701.97 | 26 |

| 2028 | 262418.41 | 177309.74 | 117024.43 | 56 |

| 2029 | 290220.58 | 219864.07 | 211069.51 | 94 |

| 2030 | 275445.71 | 255042.32 | 137722.86 | 125 |

IV. Professional BTC Investment Strategies and Risk Management

BTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Dollar-cost averaging (DCA) to reduce entry price volatility

- Hold for at least one market cycle (4 years)

- Store in secure cold storage solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend directions and potential reversal points

- Relative Strength Index (RSI): Determine overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

BTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-5%

- Aggressive investors: 5-15%

- Professional investors: 15-30%

(2) Risk Hedging Solutions

- Diversification: Allocate investments across different asset classes

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for BTC

BTC Market Risks

- High volatility: Significant price swings can lead to substantial losses

- Market manipulation: Potential for large holders to influence prices

- Liquidity risk: Difficulty in exiting large positions during market stress

BTC Regulatory Risks

- Regulatory crackdowns: Potential for governments to restrict or ban BTC

- Tax implications: Evolving tax laws may impact BTC holdings and transactions

- AML/KYC requirements: Stricter regulations may affect BTC's pseudonymous nature

BTC Technical Risks

- Network attacks: Potential for 51% attacks or other vulnerabilities

- Scaling issues: Challenges in handling increased transaction volumes

- Quantum computing threat: Future quantum computers could potentially break BTC's encryption

VI. Conclusion and Action Recommendations

BTC Investment Value Assessment

Bitcoin remains a high-risk, high-reward investment with potential for long-term growth but significant short-term volatility. Its limited supply and growing institutional adoption support its value proposition, but regulatory and technical challenges persist.

BTC Investment Recommendations

✅ Beginners: Start with small, regular investments using DCA strategy ✅ Experienced investors: Consider a core holding with active trading around the edges ✅ Institutional investors: Explore BTC as a potential inflation hedge and portfolio diversifier

BTC Trading Participation Methods

- Spot trading: Direct purchase and sale of BTC on exchanges like Gate.com

- Futures trading: Leverage opportunities for experienced traders

- BTC-backed ETFs: Indirect exposure through regulated financial products

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 Bitcoin be worth in 2025?

Based on current projections, 1 Bitcoin is expected to be worth approximately $123,000 in 2025. This represents a significant increase from current levels, driven by growing adoption and institutional interest.

What will 1 Bitcoin be worth in 2030?

By 2030, 1 Bitcoin could be worth between $250,000 and $1 million, based on long-term projections. The exact value remains uncertain.

Is Bitcoin expected to reach $100,000?

Yes, Bitcoin is expected to reach $100,000 by 2025, with some predictions suggesting it could hit $130,000 by 2030.

Why is BTC crashing?

BTC crashes due to market speculation, regulatory news, and macroeconomic factors. Large trades by whales can influence sentiment and temporarily halt declines.

Share

Content