2025 COAI Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: COAI'nin Piyasa Konumu ve Yatırım Değeri

ChainOpera AI (COAI), blokzincir tabanlı eksiksiz bir yapay zeka platformu olarak kuruluşundan bu yana önemli kilometre taşlarına ulaşmıştır. 2025 yılı itibarıyla, COAI'nin piyasa değeri 2,77 milyar dolara yükselmiş, dolaşımdaki arzı yaklaşık 196.479.267 token seviyesine ulaşmış ve fiyatı 14,104 dolar civarında seyretmektedir. “Yapay Zeka İş Birliği Sağlayıcısı” olarak anılan bu varlık, yapay zeka ve merkeziyetsiz bilişim alanlarında gittikçe daha önemli bir rol üstlenmektedir.

Bu makalede, 2025-2030 yılları arasında COAI'nin fiyat eğilimleri, geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam birlikte değerlendirilerek kapsamlı şekilde analiz edilecek; yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. COAI Fiyat Geçmişi ve Mevcut Piyasa Durumu

COAI Tarihsel Fiyat Gelişimi

- 2025: Projenin başlatılması, fiyat 3,789 ile 47,978 dolar arasında dalgalandı

COAI Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla COAI, 14,104 dolardan işlem görmekte olup 24 saatlik işlem hacmi 18.230.534,45 dolara ulaşmıştır. Son günlerde önemli fiyat dalgalanmaları yaşanmış ve son 24 saatte %113,39 oranında güçlü bir yükseliş gözlenmiştir. COAI'nin piyasa değeri 2.771.143.581,77 dolar ile genel kripto para piyasasında 49. sırada yer almaktadır. Dolaşımdaki arzı 196.479.267 COAI olup, toplam arzın %19,65'ini (toplam arz: 1.000.000.000 COAI) oluşturmaktadır. Tam seyreltilmiş değer 14.104.000.000,00 dolar seviyesinde olup, tüm arzın dolaşıma girmesi halinde önemli bir büyüme potansiyeline işaret etmektedir. Farklı zaman dilimlerinde dikkat çekici performans gösteren token, son bir saatte %25,25, geçtiğimiz haftada %102.170.318,01 ve son bir ayda %455.258.773,33 artış sergilemiştir. COAI, tüm zamanların en yüksek seviyesine 12 Ekim 2025'te 47,978 dolar ile, en düşük seviyesine ise 11 Ekim 2025'te 3,789 dolar ile ulaşmıştır. Bu durum, yeni çıkan kripto varlıklara özgü yüksek volatiliteyi yansıtmaktadır.

Güncel COAI piyasa fiyatını görüntülemek için tıklayın

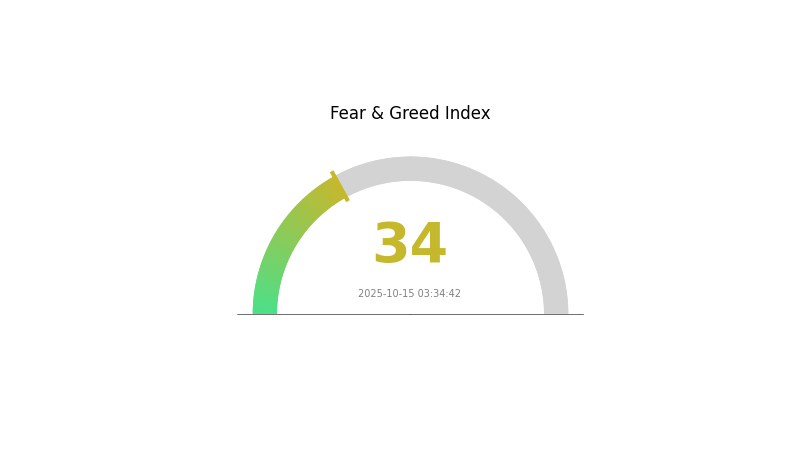

COAI Piyasa Duyarlılık Endeksi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasası şu anda korku ortamında seyrediyor ve Korku ve Açgözlülük Endeksi 34 seviyesinde bulunuyor. Bu durum, yatırımcılar arasında temkinli bir yaklaşım olduğunu gösterirken, karşıt işlem stratejisi uygulayanlar için potansiyel alım fırsatına işaret edebilir. Ancak, yatırım kararı vermeden önce dikkatli olmak ve kapsamlı araştırma yapmak önemlidir. Piyasa duyarlılığının hızla değişebileceğini unutmayın; bugün korku görülen ortam, yarın fırsata dönüşebilir. Güncel gelişmeleri takip edin ve Gate.com'da sorumlu şekilde işlem yapın.

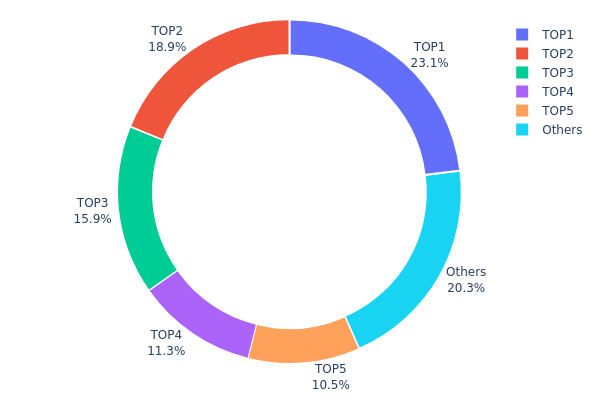

COAI Token Dağılımı

COAI'nin adres bazlı token dağılımı, sahipliğin büyük ölçüde birkaç adreste toplandığını göstermektedir. En büyük beş adres toplam arzın %79,69'una sahip olup, en büyük tek adres %23,06'lık paya sahiptir. Bu yoğunlaşma, merkeziyet riski ile birlikte piyasa manipülasyonu endişelerini gündeme getirmektedir.

Böyle bir dağılım, fiyat volatilitesini artırabilir ve büyük ölçekli satışlara karşı kırılganlık yaratabilir. Az sayıda büyük sahibin hakimiyeti, token tabanlı bir oylama mekanizması mevcutsa yönetişim süreçlerini de etkileyebilir. Ayrıca, bu konsantrasyon kripto projelerin temel merkeziyetsizlik ilkesiyle de çelişmektedir.

Bazı durumlarda büyük sahipler istikrar sağlayabilse de, mevcut durum piyasada çeşitliliğin artırılması ve sistematik risklerin azaltılması gerekliliğini ortaya koymaktadır. Potansiyel yatırımcılar, COAI'nin uzun vadeli beklentilerini ve piyasa davranışlarını değerlendirirken bu sahiplik yapısını dikkatle analiz etmelidir.

Güncel COAI Token Dağılımını görüntülemek için tıklayın

| Top | Adres | Tutar | Yüzde (%) |

|---|---|---|---|

| 1 | 0x8348...322974 | 230.690,40K | 23,06% |

| 2 | 0x38cd...bf2d62 | 188.500,00K | 18,85% |

| 3 | 0xa5e4...c8320f | 159.309,50K | 15,93% |

| 4 | 0x24c6...243c30 | 113.500,00K | 11,35% |

| 5 | 0x1b0d...da4f8a | 105.000,00K | 10,50% |

| - | Diğerleri | 203.000,10K | 20,31% |

II. COAI'nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Kurumsal ve Balina Hareketleri

- Kurumsal Benimseme: Bazı büyük şirketlerin COAI'yi kullanmaya başlaması, fiyat üzerinde olumlu etki yaratabilir.

Makroekonomik Faktörler

- Enflasyona Karşı Koruma: COAI'nin enflasyona karşı koruma potansiyeli, özellikle enflasyonist dönemlerde performansını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

-

Ekosistem Uygulamaları: COAI ekosistemi gelişmekte ve çeşitli DApp ile projeler ortaya çıkmaktadır. Bu uygulamalardaki ilerleme, COAI'nin fiyatında belirleyici olabilir.

-

"Proof of Wisdom" Mekanizması: COAI'nin kendine has “Proof of Wisdom” mekanizması, yatırımcı ilgisini çeken temel bir unsur olup fiyatın gidişatını etkileyebilir.

III. 2025-2030 Dönemi COAI Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 11,90 - 14,00 dolar

- Tarafsız tahmin: 14,00 - 16,00 dolar

- İyimser tahmin: 16,00 - 19,89 dolar (güçlü piyasa ivmesi gerektirir)

2027-2028 Beklentisi

- Piyasa evresi beklentisi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 16,33 - 26,35 dolar

- 2028: 12,12 - 31,21 dolar

- Ana katalizörler: Artan benimseme, teknolojik ilerlemeler

2030 Uzun Vadeli Beklenti

- Temel senaryo: 19,16 - 27,77 dolar (istikrarlı piyasa büyümesi varsayımında)

- İyimser senaryo: 27,77 - 41,10 dolar (hızlı benimseme durumunda)

- Dönüştürücü senaryo: 41,10 dolar üzeri (oldukça elverişli koşullarda)

- 31 Aralık 2030: COAI 27,77 dolar (2025'e göre %96 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı (%) |

|---|---|---|---|---|

| 2025 | 19,88568 | 14,004 | 11,9034 | 0 |

| 2026 | 20,16436 | 16,94484 | 9,48911 | 20 |

| 2027 | 26,34753 | 18,5546 | 16,32805 | 31 |

| 2028 | 31,20698 | 22,45107 | 12,12358 | 59 |

| 2029 | 28,70706 | 26,82902 | 23,07296 | 90 |

| 2030 | 41,0967 | 27,76804 | 19,15995 | 96 |

IV. COAI İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

COAI Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli yatırımcılar ve AI teknolojisi ilgilileri

- Uygulama önerileri:

- Piyasa geri çekilmelerinde COAI token biriktirin

- En az 2-3 yıl hedef tutma süresi belirleyin

- Tokenlerinizi güvenli bir Gate Web3 cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük hareketli ortalamaları trend tespiti için izleyin

- RSI: Aşırı alım/aşırı satım seviyeleriyle giriş-çıkış zamanlaması yapın

- Dalgalı işlemde dikkat edilecek noktalar:

- Destek ve direnç seviyelerini belirleyin

- AI sektörü haberlerini ve COAI proje gelişmelerini takip edin

COAI Risk Yönetimi Yaklaşımı

(1) Varlık Dağılımı Prensipleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Stratejileri

- Çeşitlendirme: Birden fazla AI ve blokzincir projesine yatırım yapın

- Zarar durdur: Potansiyel kayıpları sınırlamak için zarar durdur emirleri kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki adımlı doğrulama etkinleştirin, güçlü şifreler kullanın

V. COAI İçin Potansiyel Riskler ve Zorluklar

COAI Piyasa Riskleri

- Yüksek oynaklık: AI token piyasası ani fiyat hareketlerine açıktır

- Rekabet: Yeni AI projeleri COAI'nin pazar payını etkileyebilir

- Piyasa duyarlılığı: Kripto piyasasının genel eğilimi COAI'nin performansını etkileyebilir

COAI Regülasyon Riskleri

- Belirsiz mevzuat: AI ve kriptoyla ilgili regülasyonlar küresel çapta değişmektedir

- Uyum güçlükleri: Sınır ötesi AI operasyonlarında olası zorluklar

- Veri gizliliği kaygıları: Sıkılaşan düzenlemeler AI model geliştirmeyi etkileyebilir

COAI Teknik Riskleri

- Akıllı sözleşme açıkları: Token sözleşmesinde potansiyel güvenlik riskleri

- Ölçeklenebilirlik sorunları: Benimseme arttıkça ağ yükünün yönetimi

- AI modeli doğruluğu: AI ajanlarının ve modellerinin tutarlılığının sağlanması

VI. Sonuç ve Eylem Önerileri

COAI Yatırım Değeri Analizi

COAI, yapay zeka ve blokzincir kesişiminde uzun vadede umut vadeden bir değer sunarken, kısa vadede piyasa oynaklığı ve regülasyon belirsizliklerinden kaynaklı risklerle karşı karşıyadır.

COAI Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, eğitime ve uzun vadeli potansiyele odaklanın ✅ Deneyimli yatırımcılar: Hem uzun vadeli tutma hem de aktif alım-satım ile dengeli bir strateji izleyin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve stratejik ortaklıkları değerlendirin

COAI İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com’da COAI token alım-satımı yapın

- Stake etme: Uygunsa stake programlarına katılın

- DeFi entegrasyonu: COAI token ile merkeziyetsiz finans olanaklarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatle vermeli ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

En yüksek fiyat tahmini hangi kripto parada?

2025’te en yüksek fiyat tahminine sahip kripto para Bitcoin (BTC)’dir; ardından Ethereum (ETH) ve Solana (SOL) gelir.

2030 için XRP fiyat tahmini nedir?

Mevcut piyasa trendleri ve kripto sektöründeki büyüme potansiyeline göre, XRP’nin 2030’da 90 ile 120 dolar arasında bir değere ulaşması beklenmektedir.

COTI kripto fiyat tahmini nedir?

COTI’nin 2027 fiyat tahminleri genellikle yükseliş yönünde iken, 2025-2030 arası öngörüler karışık seyretmektedir. Ekim 2025’te yapılan son analiz kısa vadede düşüş eğilimine işaret etmektedir.

Secret Coin’in 2030 fiyat tahmini nedir?

Güncel trendler ve piyasa duyarlılığına göre Secret (SCRT)’ın 2030’da 50-100 dolar aralığına ulaşması ve uzun vadeli yatırımcılar için ciddi getiri potansiyeli sunması beklenmektedir.

Kuantum Finansal Sistemi: Bankacılıktaki Zaman Çizelgesi ve Uygulama

Proje Omega: Elon Musk'ın Kripto Girişimi 2025'te Açıklandı

Mira Kripto: Nedir ve MIRA Token Nasıl Çalışır

Proje Omega Elon Musk: Gerçek mi, Efsane mi?

2025 BAND Fiyat Tahmini: Band Protocol için Piyasa Analizi ve Potansiyel Büyüme Etkenleri

2025 AIA Fiyat Tahmini: Yapay Zeka Destekli Varlık Yönetiminde Geleceğe Yön Vermek

Tomarket Günlük Kombinasyonu 10 Aralık 2025

Talus Network: Web3’e Yönelik Yapay Zekâ Destekli Layer 1 Altyapı

SEC Başkanı Paul Atkins’in ICO Düzenlemesi Üzerine Değerlendirmeleri: Kripto Projeleri İçin Bilinmesi Gerekenler

Responsible Financial Innovation Act’in Temelleri: ABD Kongresi Kripto Düzenleme Rehberi

Bitcoin 94.000 Dolar Seviyesine Yükseldi: Fed’in Faiz İndirimleri Kripto Rallisinde Nasıl Rol Oynuyor?