2025 DAI Price Prediction: Will Stablecoin Maintain Its Peg Amidst Market Volatility?

Introduction: DAI's Market Position and Investment Value

Dai (DAI), as the largest decentralized stablecoin on Ethereum, has become a cornerstone of decentralized finance (DeFi) since its inception in 2017. As of 2025, Dai's market capitalization has reached $4.54 billion, with a circulating supply of approximately 4.53 billion tokens, maintaining a price close to $0.99862. This asset, hailed as the "DeFi backbone," is playing an increasingly crucial role in providing economic freedom and opportunities in the cryptocurrency ecosystem.

This article will comprehensively analyze Dai's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. DAI Price History Review and Current Market Status

DAI Historical Price Evolution Trajectory

- 2017: DAI launched, price stabilized around $1

- 2020: COVID-19 market crash, DAI briefly spiked to $1.22 (all-time high)

- 2023: Crypto market volatility, DAI dropped to $0.88196 (all-time low)

DAI Current Market Situation

As of October 15, 2025, DAI is trading at $0.99862, maintaining its peg close to $1. The 24-hour trading volume stands at $576,304, indicating moderate market activity. DAI's market capitalization is $4.53 billion, ranking it 34th among all cryptocurrencies. The circulating supply is 4,532,220,195 DAI, which is 99.77% of the total supply. Despite slight fluctuations, DAI has shown resilience in maintaining its stability, with minimal price changes over various timeframes: -0.13% in the past hour, -0.02% in the last 24 hours, and -0.06% over the past week and month.

Click to view the current DAI market price

DAI Market Sentiment Indicator

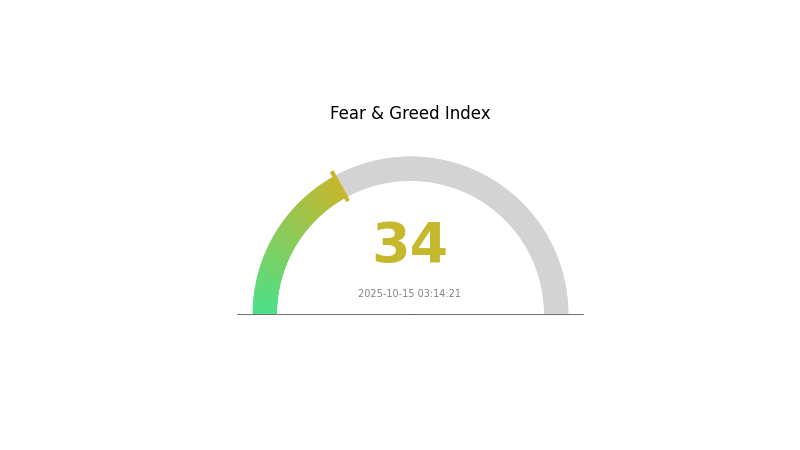

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 34, indicating a state of fear. This suggests investors are wary and potentially seeking safer assets. During such periods, it's crucial to stay informed and consider diversifying your portfolio. Remember, market cycles are normal, and periods of fear can present opportunities for long-term investors. Keep an eye on market trends and always conduct thorough research before making investment decisions.

DAI Holdings Distribution

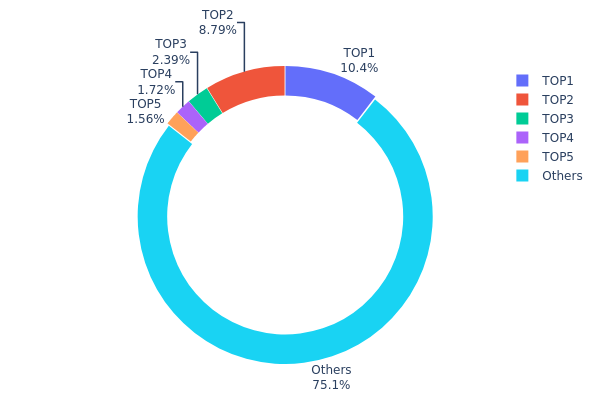

The address holdings distribution data for DAI reveals a moderate level of concentration among top holders. The top address holds 10.42% of the total supply, while the top 5 addresses collectively account for 24.87% of DAI tokens. This distribution suggests a relatively decentralized structure, as the majority of tokens (75.13%) are held by addresses outside the top 5.

The current distribution pattern indicates a balanced market structure for DAI. While there is some concentration among top holders, it is not excessive to the point of raising immediate concerns about market manipulation. The presence of multiple large holders, rather than a single dominant entity, contributes to a more stable ecosystem. This distribution may help mitigate extreme price volatility and reduce the risk of single-actor market manipulation.

Overall, the DAI holdings distribution reflects a moderately decentralized market with a healthy balance between major stakeholders and smaller holders. This structure supports the stablecoin's intended function as a decentralized, stable asset within the cryptocurrency ecosystem.

Click to view the current DAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 474746.82K | 10.42% |

| 2 | 0xf6e7...853042 | 400187.36K | 8.78% |

| 3 | 0x4ded...b05b8b | 108877.90K | 2.39% |

| 4 | 0xbebc...2ff1c7 | 78451.72K | 1.72% |

| 5 | 0x7378...4c1ca6 | 71081.60K | 1.56% |

| - | Others | 3420140.93K | 75.13% |

II. Key Factors Influencing DAI's Future Price

Supply Mechanism

- Algorithmic Stability: DAI's supply is algorithmically controlled to maintain its peg to the US dollar.

- Historical Pattern: Past supply changes have generally had minimal impact on price due to the stability mechanism.

- Current Impact: Expected supply changes should continue to have limited effect on price, barring extreme market conditions.

Macroeconomic Environment

- Monetary Policy Impact: Major central bank policies, particularly those of the Federal Reserve, can influence DAI's demand as a stable store of value.

- Inflation Hedging Properties: In inflationary environments, DAI may see increased demand as a dollar-pegged asset.

- Geopolitical Factors: International tensions and economic uncertainties can drive demand for stable digital assets like DAI.

Technological Development and Ecosystem Building

- Ethereum Upgrades: Improvements to the Ethereum network, on which DAI operates, can affect transaction costs and efficiency.

- DeFi Integration: Expansion of DAI's use in decentralized finance applications can drive demand and liquidity.

- Ecosystem Applications: Key DApps and projects utilizing DAI, such as lending platforms and decentralized exchanges, contribute to its utility and demand.

III. DAI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.95 - $1.00

- Neutral prediction: $0.98 - $1.02

- Optimistic prediction: $1.00 - $1.05 (requires increased DeFi adoption)

2027-2028 Outlook

- Market phase expectation: Stable growth with potential volatility

- Price range forecast:

- 2027: $0.97 - $1.03

- 2028: $0.98 - $1.04

- Key catalysts: Ethereum ecosystem expansion, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.99 - $1.01 (assuming continued stability in the crypto market)

- Optimistic scenario: $1.00 - $1.03 (assuming widespread institutional adoption)

- Transformative scenario: $1.00 - $1.05 (assuming DAI becomes a global standard for stablecoins)

- 2030-12-31: DAI $1.00 (maintaining its peg with enhanced stability mechanisms)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. Professional Investment Strategies and Risk Management for DAI

DAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operation suggestions:

- Allocate a portion of portfolio to DAI as a stable asset

- Use DAI for yield farming in DeFi protocols

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price trends

- RSI: Identify overbought/oversold conditions

- Key points for swing trading:

- Watch for deviations from the $1 peg

- Monitor supply and demand in DeFi ecosystems

DAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Balance DAI with other crypto assets

- Staking: Earn yield to offset potential risks

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage option: Hardware wallet for large holdings

- Security precautions: Enable 2FA, use strong passwords

V. Potential Risks and Challenges for DAI

DAI Market Risks

- Peg stability: Fluctuations in collateral value

- Liquidity risk: Potential issues in extreme market conditions

- Competition: Emergence of new stablecoins

DAI Regulatory Risks

- Stablecoin regulations: Potential impact on DAI's operations

- Cross-border restrictions: Limitations on use in certain jurisdictions

- Collateral scrutiny: Regulatory focus on backing assets

DAI Technical Risks

- Smart contract vulnerabilities: Potential for exploits

- Oracle failures: Inaccurate price feeds affecting stability

- Scalability issues: Network congestion on Ethereum

VI. Conclusion and Action Recommendations

DAI Investment Value Assessment

DAI offers stability in the volatile crypto market but faces challenges from regulatory scrutiny and potential technical risks. Its long-term value proposition remains strong as a decentralized stablecoin, while short-term risks are primarily tied to regulatory developments and market conditions.

DAI Investment Recommendations

✅ Beginners: Use DAI as an entry point to DeFi, start with small allocations ✅ Experienced investors: Incorporate DAI in yield farming strategies ✅ Institutional investors: Consider DAI for treasury management and as a trading pair

Ways to Participate in DAI Trading

- Spot trading: Buy and sell DAI on Gate.com

- DeFi participation: Use DAI in lending and borrowing protocols

- Yield farming: Stake DAI in liquidity pools for potential returns

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is DAI a good investment?

DAI is a stable and liquid asset, useful for trading and preserving value. However, it's not designed for significant price appreciation like other cryptocurrencies.

What is the future of DAI coin?

DAI's future remains stable as a reliable stablecoin. It will continue to play a key role in decentralized finance, with no plans for shutdown.

What is the future price of DAI?

The future price of DAI is projected to be $1.05 in 2026, based on current market trends and institutional involvement.

What is the price prediction for dent coin in 2025?

Based on current market analysis, the price of Dent coin is predicted to reach $0.0004934 by November 2025, showing no significant growth from its current value.

Share

Content