2025 DOGE Fiyat Tahmini: Dogecoin’in Potansiyel Büyüme ve Piyasa Trendlerinin Analizi

Giriş: DOGE'nin Piyasa Konumu ve Yatırım Değeri

Dogecoin (DOGE), önde gelen bir meme tabanlı kripto para birimi olarak 2013'te piyasaya sürülmesinden bu yana dikkat çekici bir başarı elde etti. 2025 yılı itibarıyla Dogecoin’in piyasa değeri 31.044.635.504 dolar seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 151.333.896.384 coin ve fiyatı yaklaşık 0,20514 dolar civarında seyrediyor. "Halkın kriptosu" olarak anılan bu varlık, dijital ödemeler ve çevrim içi bahşişlerde giderek daha önemli bir rol üstleniyor.

Bu makalede, Dogecoin’in 2025’ten 2030’a kadar olan fiyat eğilimleri; tarihsel hareketler, piyasa arz-talebi, ekosistem gelişimi ve makroekonomik etkenlerle birlikte kapsamlı olarak analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunuluyor.

I. DOGE Fiyat Geçmişi ve Mevcut Piyasa Durumu

DOGE Fiyatının Tarihsel Gelişimi

- 2013: Dogecoin 8 Aralık'ta piyasaya sürüldü, başlangıç fiyatı yaklaşık 0,000559 dolar

- 2021: 8 Mayıs’ta sosyal medya etkisiyle tüm zamanların en yüksek seviyesi olan 0,731578 dolara ulaştı

- 2022-2023: Piyasa düzeltme dönemi, fiyat 0,05 ile 0,15 dolar arasında dalgalandı

DOGE Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla Dogecoin (DOGE) 0,20514 dolar seviyesinden işlem görüyor ve küresel kripto para piyasasında 10. sırada yer alıyor. Mevcut fiyat, tüm zamanların en yüksek seviyesinden %71,96 daha düşük olsa da, en düşük seviyesi olan 0,0000869 dolardan oldukça yukarıda bulunuyor.

Son 24 saatte DOGE %1,77 oranında hafif bir düşüş yaşadı, işlem hacmi ise 71.351.377 dolar olarak gerçekleşti. Piyasa değeri 31.044.635.504 dolar olup, toplam kripto para piyasasının %0,76’sını oluşturuyor.

Kısa vadeli fiyat hareketleri karma sinyaller veriyor:

- 1 saatlik değişim: +%0,69

- 7 günlük değişim: -%17,71

- 30 günlük değişim: -%26,29

Son dönemde yaşanan düşüşlere karşın, DOGE son bir yılda %76,13 artış göstererek meme tabanlı kripto paraya olan uzun vadeli ilginin sürdüğünü ortaya koyuyor.

Güncel DOGE piyasa fiyatını görüntülemek için tıklayın

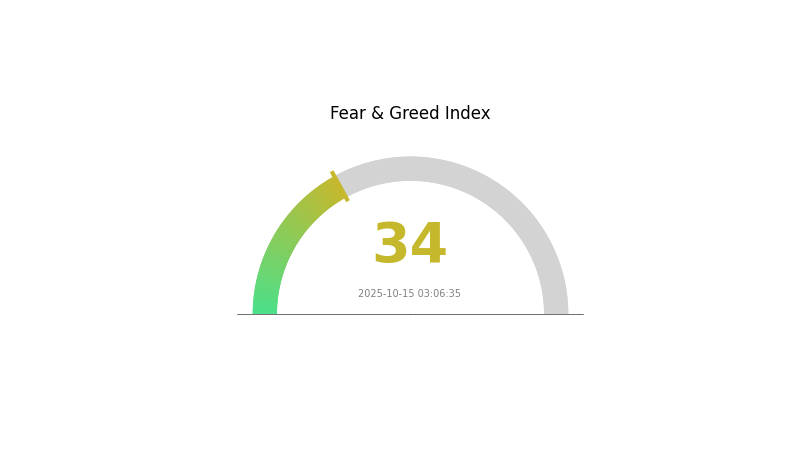

DOGE Piyasa Duyarlılığı Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku ve Açgözlülük Endeksini görüntülemek için tıklayın

DOGE için kripto piyasa duyarlılığı şu anda "Korku" bölgesinde ve Korku ve Açgözlülük Endeksi 34 seviyesinde bulunuyor. Bu durum, yatırımcılar arasında temkinli bir havaya işaret ederek kalabalığın tersine hareket etmek isteyenler için alım fırsatları sunabilir. Ancak piyasa duyarlılığının hızla değişebileceğini göz ardı etmeyin. Yatırım kararı almadan önce mutlaka detaylı araştırma yapmalı ve risk toleransınızı dikkate almalısınız. Gate.com, piyasa koşullarında etkin şekilde yol almanız için kapsamlı araçlar ve veriler sunar.

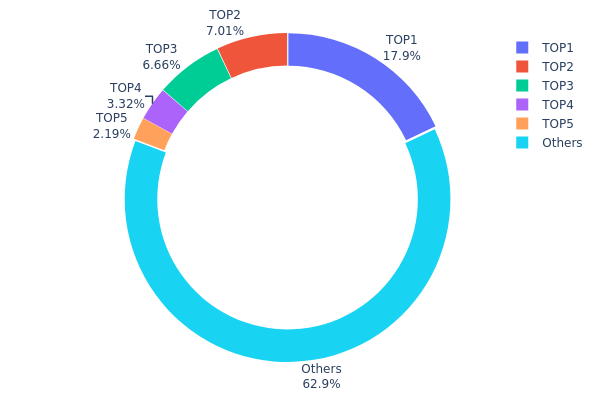

DOGE Varlık Dağılımı

Adres bazında varlık dağılımı grafiği, DOGE sahipliğinin farklı cüzdan adreslerine ne kadar yoğunlaştığını gösteriyor. Verilere göre, DOGE’de yüksek bir yoğunlaşma söz konusu: En büyük 5 adres, toplam arzın %37,13’ünü elinde bulunduruyor. En büyük tek adres ise tüm DOGE tokenlarının %17,95’ini kontrol ederek ciddi bir servet yoğunlaşmasına işaret ediyor.

Bu derece bir yoğunlaşma, piyasa dinamiklerinde etkili olabilir. "Balina" olarak anılan büyük sahiplerin önemli miktarda DOGE hareket ettirmesi, fiyat oynaklığını artırabilir. Ayrıca, büyük sahiplerin büyük ölçekli alım-satım işlemleriyle fiyat hareketlerini etkileme potansiyeli, piyasa manipülasyonu endişelerini de beraberinde getiriyor.

Yukarıdaki yoğunlaşmaya rağmen, DOGE’nin %62,87’sinin "Diğerleri" arasında dağılması, küçük yatırımcılar arasında merkezsizliğin de mevcut olduğunu gösteriyor. Bu dağılım modeli, merkezi büyük sahiplerle daha çeşitli küçük yatırımcı tabanının dengelendiği karma bir piyasa yapısına işaret ederek DOGE ekosisteminin istikrarına katkı sağlayabilir.

Güncel DOGE Varlık Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | DEgDVF...s1pMke | 27.164.003,43K | 17,95% |

| 2 | DE5opa...X6EToX | 10.614.629,63K | 7,01% |

| 3 | D8ZEVb...bd66TX | 10.086.993,21K | 6,66% |

| 4 | DDTtqn...iXYdGG | 5.031.001,97K | 3,32% |

| 5 | AC8azE...gmP5hQ | 3.311.716,60K | 2,19% |

| - | Diğerleri | 95.143.261,56K | 62,87% |

II. DOGE’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Enflasyonist Model: DOGE, sabit yıllık ihraç oranıyla sınırsız arza sahiptir ve bu, uzun vadede fiyatı seyreltebilir.

- Tarihsel Eğilim: Geçmiş arz artışları genellikle kısa vadeli fiyat oynaklığına yol açsa da, uzun vadeli büyüme üzerinde belirgin bir etki yaratmamıştır.

- Güncel Etki: Sürekli enflasyonist arz fiyat üzerinde baskı oluşturabilir; ancak topluluk talebi bu etkiyi dengeleyebilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: CleanCore Solutions gibi büyük şirketler, rezervlerine önemli miktarda DOGE ekleyerek kurumsal ilgiyi göstermektedir.

- Kurumsal Benimseme: Tesla ve SpaceX gibi şirketler, belirli ürün ve hizmetler için DOGE’yi ödeme yöntemi olarak kabul ederek destek vermektedir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özellikleri: DOGE, enflasyona karşı bir koruma aracı olarak potansiyel göstermekte; ancak bu etkinlik, geleneksel kripto paralara kıyasla daha az belirgindir.

- Jeopolitik Etkenler: Küresel ekonomik belirsizlikler ve jeopolitik gerginlikler, yatırımcıları kripto paralara yönlendirebilir ve DOGE’ye avantaj sağlayabilir.

Teknik Gelişim ve Ekosistem İnşası

- Ağ Yükseltmesi: Dogecoin ağı, 500 milisaniye indeksleme hızına yükseltilerek UTXO zinciri hızında ve programlanabilirlikte önemli artış sağlıyor.

- Ekosistem Uygulamaları: Dogecoin Foundation’ın kurumsal kolu House of Doge, NASDAQ’ta listelenmeyi ve ticari hizmetler, ödeme altyapısı ile DOGE tabanlı uygulamalar geliştirmeyi planlıyor.

III. 2025-2030 İçin DOGE Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,17789 - 0,19000 dolar

- Nötr tahmin: 0,20447 - 0,21000 dolar

- İyimser tahmin: 0,21500 - 0,21878 dolar (sürekli piyasa ivmesi gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan oynaklıkla birlikte potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,21848 - 0,33141 dolar

- 2028: 0,27979 - 0,29998 dolar

- Temel tetikleyiciler: Dijital ödemelerde yaygın benimseme, kripto piyasasında olumlu gelişmeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,29000 - 0,33393 dolar (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,33393 - 0,40000 dolar (ana akımda yaygın benimseme ile)

- Dönüştürücü senaryo: 0,40000 - 0,46751 dolar (teknolojik atılımlar ve yaygın entegrasyon ile)

- 2030-12-31: DOGE 0,46751 dolar (olumlu piyasa koşullarında potansiyel zirve)

| 年份 | Öngörülen En Yüksek Fiyat | Öngörülen Ortalama Fiyat | Öngörülen En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,21878 | 0,20447 | 0,17789 | 0 |

| 2026 | 0,27935 | 0,21163 | 0,10793 | 3 |

| 2027 | 0,33141 | 0,24549 | 0,21848 | 19 |

| 2028 | 0,29998 | 0,28845 | 0,27979 | 40 |

| 2029 | 0,37365 | 0,29422 | 0,17653 | 43 |

| 2030 | 0,46751 | 0,33393 | 0,17699 | 62 |

IV. DOGE Profesyonel Yatırım Stratejileri ve Risk Yönetimi

DOGE Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Yüksek risk toleransına sahip sabırlı yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde DOGE biriktirin

- Fiyat hedefleri belirleyip kısmi kâr alın

- Varlıklarınızı güvenli soğuk cüzdanlarda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri, destek ve direnç seviyelerini belirleyin

- RSI: Aşırı alım/aşırı satım koşullarını analiz edin

- Swing trade için temel noktalar:

- Sosyal medya duyarlılığını takip edin

- Ünlü destek açıklamalarını izleyin

DOGE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Aggresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımlarınızı birden fazla kripto varlık arasında dağıtın

- Zarar-durdur emirler: Potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Büyük tutarlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, ortak Wi-Fi’dan kaçının

V. DOGE’nin Potansiyel Riskleri ve Zorlukları

DOGE Piyasa Riskleri

- Yüksek oynaklık: Büyük fiyat dalgalanmaları

- Meme kaynaklı talep: Sosyal medya trendlerine duyarlılık

- Piyasa manipülasyonu: Pump-and-dump girişimleri olasılığı

DOGE Regülasyon Riskleri

- Belirsiz düzenlemeler: Daha sıkı devlet denetimi ihtimali

- Vergisel etkiler: Değişen kripto para vergi düzenlemeleri

- Banka kısıtlamaları: Kripto işlemlerine yönelik olası sınırlamalar

DOGE Teknik Riskler

- Ağ tıkanıklığı: Yüksek talepte yavaş işlemler

- Güvenlik açıkları: Saldırı veya açık riski

- Ölçeklenebilirlik sorunları: Artan işlem hacmini yönetme zorlukları

VI. Sonuç ve Eylem Önerileri

DOGE Yatırım Değeri Değerlendirmesi

DOGE, spekülatif potansiyele sahip olsa da meme odaklı yapısı ve piyasa oynaklığı nedeniyle yüksek risk taşır. Uzun vadeli değer, topluluk desteği ve potansiyel kullanım alanlarına bağlıdır.

DOGE Yatırım Önerileri

✅ Yeni başlayanlar: Kripto piyasalarını öğrenmek amacıyla küçük tutarlarla yatırım yapabilir

✅ Deneyimli yatırımcılar: DOGE’yi yüksek risk-yüksek getiri potansiyeliyle portföyünüzde değerlendirebilir

✅ Kurumsal yatırımcılar: Dikkatli yaklaşarak kısa vadeli al-sat fırsatlarına odaklanabilir

DOGE Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com’da DOGE alım-satımı

- Vadeli işlemler: Kaldıraçlı DOGE türevleriyle işlem

- Staking: Uygun ise DOGE staking programlarına katılım

Kripto para yatırımları son derece risklidir ve bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatlice vermeli ve profesyonel finansal danışmanlardan görüş almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırım yapmayın.

SSS

2025’te 1 Dogecoin Kaç Dolar Olur?

Piyasa eğilimleri ve topluluk katılımına göre, 2025’te 1 Dogecoin’in yaklaşık 0,10 dolar olması bekleniyor. Ancak fiyat, farklı faktörlere bağlı olarak değişebilir.

DOGE 1 Dolar Olacak mı?

Tahminlere göre, işlem hacmi artarsa DOGE 2025 sonunda 1,07 dolara ulaşabilir. Uzun vadeli projeksiyonlar ise piyasa koşulları ve benimseme oranına göre ileride 1 doları görebileceğini öngörüyor.

DOGE 10 Doları Görür mü?

Mevcut eğilimler göz önüne alındığında, DOGE’nin 2025’e kadar 10 dolara ulaşması olası değil. Analistler, fayda artışı ve piyasa koşullarına bağlı olarak daha gerçekçi bir aralığın 0,80 – 1,10 dolar olduğunu belirtiyor.

2030’da DOGE Ne Kadar Olacak?

Mevcut eğilimler ve piyasa analizine göre, DOGE’nin 2030’da 0,269549 dolara ulaşması öngörülüyor. Bu öngörü, önümüzdeki yıllarda potansiyel bir değer artışına işaret ediyor.

Milyarder Patırtısı: Musk vs. Trump Kripto'yu Sarsıyor

DOGE 10 $'a Ulaşabilir Mi

2025 SPX Fiyat Tahmini: S&P 500’ü Yeni Zirvelere Taşıyabilecek Temel Faktörler

2025 DOGE Fiyat Tahmini: Olgunlaşan Kripto Piyasasında Dogecoin’in Gelecekteki Konumunu Değerlendirmek

Doge Günü 2025: Dogecoin Fiyatı ve Ticaret Fırsatları Üzerindeki Etkisi

2025 MPrice Tahmini: Gelecekte Dijital Varlıkların Değerlemesini Etkileyen Makroekonomik Faktörler ile Piyasa Trendlerinin Analizi

Dropee Günlük Kombinasyonu 9 Aralık 2025

Tomarket Günlük Kombinasyonu 9 Aralık 2025

Web3 Dünyasında Gerçek Varlıkların Tokenleştirilmesi Fırsatlarını Keşfedin

Lüks tutkunlarına özel, yat konseptli NFT koleksiyonlarını keşfedin

Verimli Kripto Musluk Yönetimi İçin En İyi Araçlar